Question: Case 11: SMITH & NEPHEW: The Philippines 2014 (pg. 405) Questions 1. Were the two territories equal in their sales potential? Why or why not?

Case 11:

SMITH & NEPHEW: The Philippines 2014 (pg. 405)

Questions

1. Were the two territories equal in their sales potential? Why or why not?

2. What are the advantages and disadvantages of allowing ELC to represent S&Ns WCS products as opposed to company salespersons?

3. Give two reasons Teddy Tulalip appeared to perform at a higher level than Marites Garca?

4. How adequate was the two-week training program? Please elaborate.

5. Should sales representatives know the profit margin of each product line? Why?

6. Do you agree that the projected sales levels presented by the marketing manager are feasible? Why or why not?

7. Compute the gross profit, based upon the projected sales, projected gross profit, and cost per salesperson. If sales forecasts are accurate, what would the expected profit per salesperson be after six months?

8. Based upon the available information, what course of action would you recommend S&N to take? More important, why?

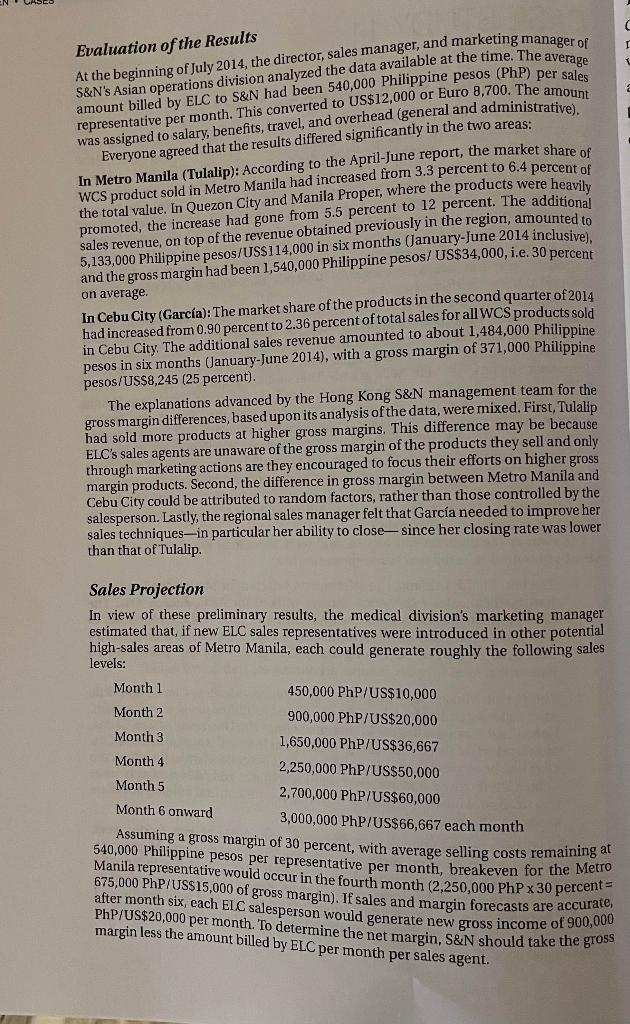

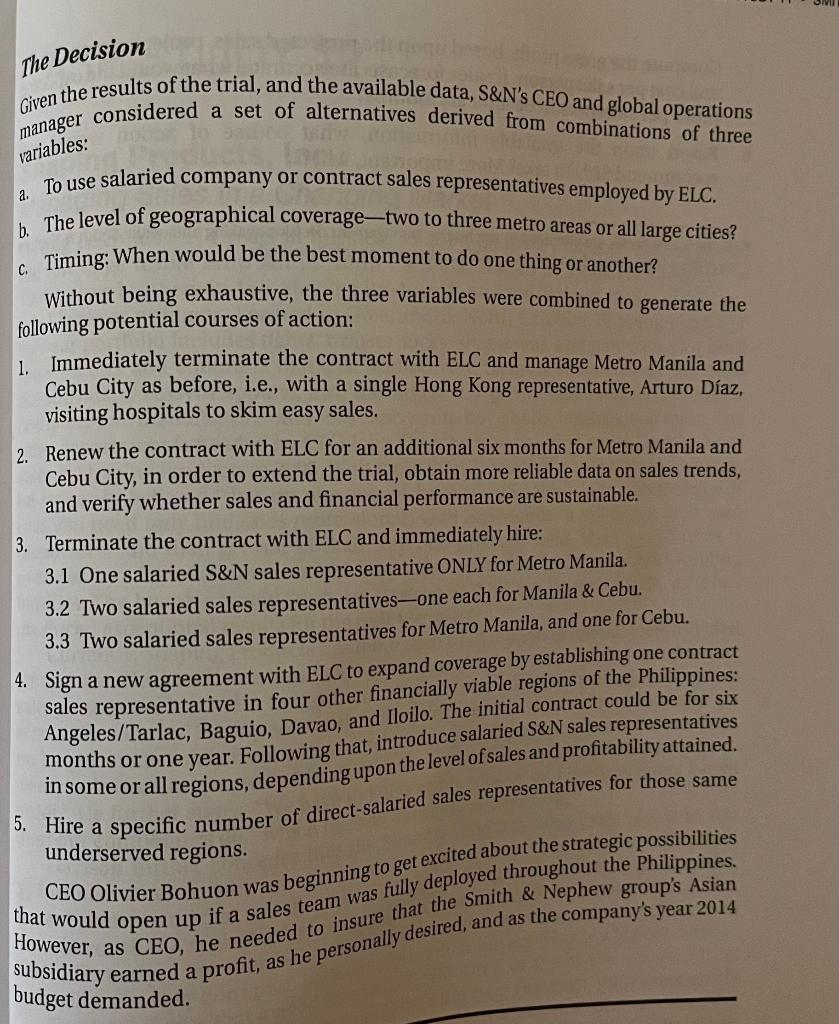

CASE STUDY 11 CASE STUDE der Center an e-mail ning that istraught July. She way he ion to ther ndler y to Ons SMITH & NEPHEW: The Philippines 2014 In mid-July 2014, Olivier Bohuon, CEO of Smith & Nephew, S.A. (S&N), met over lunch with Gordon Howe, President of Global Operations. Six months earlier, S&N had signed an agency contract with East Lane Corporation (ELC), located in Metro Manila, the Philippines, whereby ELC employees would promote S&N's wound-care solutions products in two major metropolitan areas: Manila and Cebu City. Wound care solutions (WCS) management can be complex since this includes chronic, acute, and surgical wounds that have their own characteristics. And wounds, much like the people affected by them, need to be treated on an individual basis. S&N offers WCS products in the areas of infection management, negative pressure wound therapy, bio-actives, and innovation dressings. An in-depth discussion of S&N products can be found at www.smith-nephew.com. It was the first time S&N had used the services of a contract sales partner in the Philippines. S&N often utilizes contract sales partners in new markets where sales levels are not sufficient to support full-time S&N sales staff. The Philippines is an island nation located in Southeast Asia, with a population of about 100 million citizens occupying more than 7,000 islands. That said, the population is concentrated on 30 of the larger islands, and the principal island of Luzon contains Metro Manila and surrounding areas that account for 20 million citizens. The second largest metropolitan area is Cebu City, with a highly dense population of approximately one million. The islands of Bohol, Cebu, Leyte, Negros, and Samar are all located within easy traveling distance of Cebu City, with a combined population for this area of 12 million. Both Metro Manila and Metro Cebu report the highest incomes in the country, welcome millions of tourists annually, and are home to a large number of expatriates from Australia, Europe, Japan, Korea, and the U.S. who work or live in retirement in each respective region As soon as the contract was signed, and with S&N Hong Kong's approval, East Lane Corporation selected two sales representatives: Teodoro (Teddy) Tulalip, the salesperson selected for Metro Manila, already had medical sales experience, having worked for Astra-Zeneca Asia. The S&N products he will promote were known and used in the area, thanks to two years of hospital work performed by Arturo Daz, a local representative under the employ of S&N Hong Kong. This also meant that Tulalip would have initial local support as some accounts were transferred to ELC. The person chosen for Cebu City, Maria Teresa (Marites) Garca, had little sales experience, but had the right profile and exhibited loads of enthusiasm. Garca had earned a degree in pharmacy from the University of San Carlos, then worked for three years as a pharmacist at Doctors' Hospital in Cebu City. Daz had been overtaxed, calling on hospitals in Metro Manila; therefore, the Cebu City territory had received scant attention, and S&N products were practically unknown at the major private, government, and military hospitals located in this multi-island region. Both ELC sales representatives took two weeks' training in Manila. During week one, they received three days' instruction on the products they would promote (provided by S&N Hong Kong) and two days on buyer relationships/sales techniques given by ELC). The second week was devoted to on-the-job training, supervised by Two S&N regional sales managers from Hong Kong who traveled with Tulalip and Garca on sales calls. Both sales representatives required about two months to adapt to the normal pace of work. . Evaluation of the Results or S&N's Asian operations division analyzed the data available at the time. The average representative per month. This converted to US$12,000 or Euro 8,700. The amount was assigned to salary, benefits, travel, and overhead (general and administrative). Everyone agreed that the results differed significantly in the two areas: WCS product sold in Metro Manila had increased from 3.3 percent to 6.4 percent of In Metro Manila (Tulalip): According to the April-June report, the market share of the total value. In Quezon City and Manila Proper, where the products were heavily promoted, the increase had gone from 5.5 percent to 12 percent. The additional sales revenue, on top of the revenue obtained previously in the region, amounted to 5,133,000 Philippine pesos/US$114,000 in six months (January-June 2014 inclusive) and the gross margin had been 1,540,000 Philippine pesos/ US$34,000, i.e. 30 percent on average. In Cebu City (Garca): The market share of the products in the second quarter of 2014 had increased from 0.90 percent to 2.36 percent of total sales for all WCS products sold in Cebu City. The additional sales revenue amounted to about 1,484,000 Philippine pesos in six months (January-June 2014), with a gross margin of 371,000 Philippine pesos/US$8,245 (25 percent). The explanations advanced by the Hong Kong S&N management team for the gross margin differences, based upon its analysis of the data were mixed. First, Tulalip had sold more products at higher gross margins. This difference may be because ELC's sales agents are unaware of the gross margin of the products they sell and only through marketing actions are they encouraged to focus their efforts on higher gross margin products. Second, the difference in gross margin between Metro Manila and Cebu City could be attributed to random factors, rather than those controlled by the salesperson. Lastly, the regional sales manager felt that Garca needed to improve her sales techniquesin particular her ability to close-since her closing rate was lower than that of Tulalip. Sales Projection In view of these preliminary results, the medical division's marketing manager estimated that, if new ELC sales representatives were introduced in other potential high-sales areas of Metro Manila, each could generate roughly the following sales levels: Month 1 Month 2 Month 3 Month 4 Month 5 450,000 PhP/US$10,000 900,000 PHP/US$20,000 1,650,000 PhP/US$36,667 2,250,000 PhP/US$50,000 2,700,000 PhP/US$60,000 Month 6 onward 3,000,000 PhP/US$66,667 each month 540,000 Philippine pesos per representative per month, breakeven for the Metro Assuming a gross margin of 30 percent, with average selling costs remaining at Manila representative would occur in the fourth month (2,250,000 PhP x 30 percent after month six , each ElC salesperson would generate new gross income of 900,00 675,000 PhP/US$15,000 of gross margin). If sales and margin forecasts are accurate PhP/US$20,000 per month. To determine the net margin, S&N should take the gross margin less the amount billed by ELC per month per sales agent. The Decision Given the results of the trial, and the available data, S&N's CEO and global operations manager considered a set of alternatives derived from combinations of three variables: To use salaried company or contract sales representatives employed by ELC. b. The level of geographical coverage-two to three metro areas or all large cities? 6 Timing: When would be the best moment to do one thing or another? Without being exhaustive, the three variables were combined to generate the following potential courses of action: 1. Immediately terminate the contract with ELC and manage Metro Manila and Cebu City as before, i.e., with a single Hong Kong representative, Arturo Daz, visiting hospitals to skim easy sales. 2. Renew the contract with ELC for an additional six months for Metro Manila and Cebu City, in order to extend the trial, obtain more reliable data on sales trends, and verify whether sales and financial performance are sustainable. 3. Terminate the contract with ELC and immediately hire: 3.1 One salaried S&N sales representative ONLY for Metro Manila. 3.2 Two salaried sales representatives-one each for Manila & Cebu. 3.3 Two salaried sales representatives for Metro Manila, and one for Cebu. 4. Sign a new agreement with ELC to expand coverage by establishing one contract sales representative in four other financially viable regions of the Philippines: Angeles/Tarlac, Baguio, Davao, and Iloilo. The initial contract could be for six months or one year. Following that, introduce salaried S&N sales representatives in some or all regions, depending upon the level of sales and profitability attained. 5. Hire a specific number of direct-salaried sales representatives for those same underserved regions. CEO Olivier Bohuon was beginning to get excited about the strategic possibilities that would open up if a sales team was fully deployed throughout the Philippines. However, as CEO, he needed to insure that the Smith & Nephew group's Asian subsidiary earned a profit, budget demanded. as he personally desired, and as the company's year 2014