Question: Case 13-2 Stern Aerospace 1. How much work do you think is required to keep the proposed scorecard up-to-date? Does this investment in time provide

Case 13-2 Stern Aerospace

1. How much work do you think is required to keep the proposed scorecard up-to-date? Does this investment in time provide value?

2. How would you use the scorecard proposed by Ryan? Can it be used to improve the performance of Sterns supply chain? Would you use it to award new business or to take business away from suppliers?

3. What are the problems with the original scorecard? What is Jessica Frischs concern? Does the proposed scorecard address her concerns adequately? What is different between the current scorecard and the proposed scorecard?

4. What criteria should Ryan use to decide which suppliers should be included on the scorecard?

5. Who is really getting measured by the scorecard the suppliers or Ryan Berry and the Stern supply function?

6. How do you think the suppliers will react to the proposed scorecard? How will the scorecard change the dynamics of the buyer-supplier relationship?

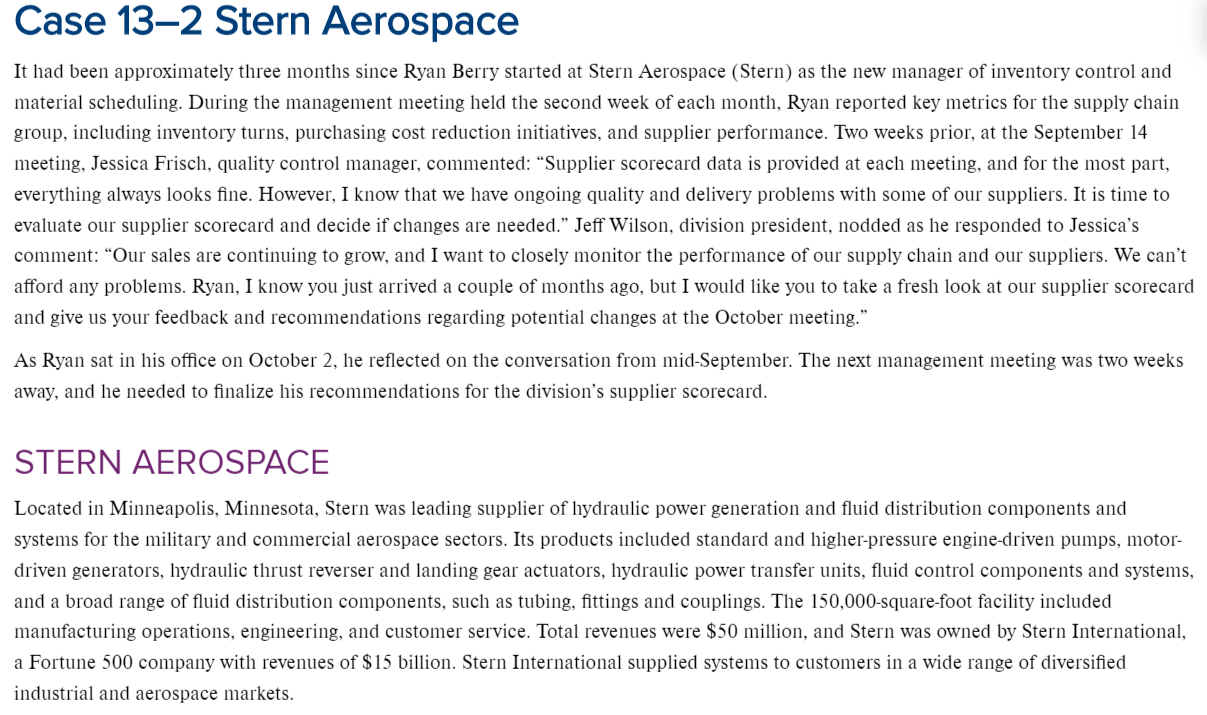

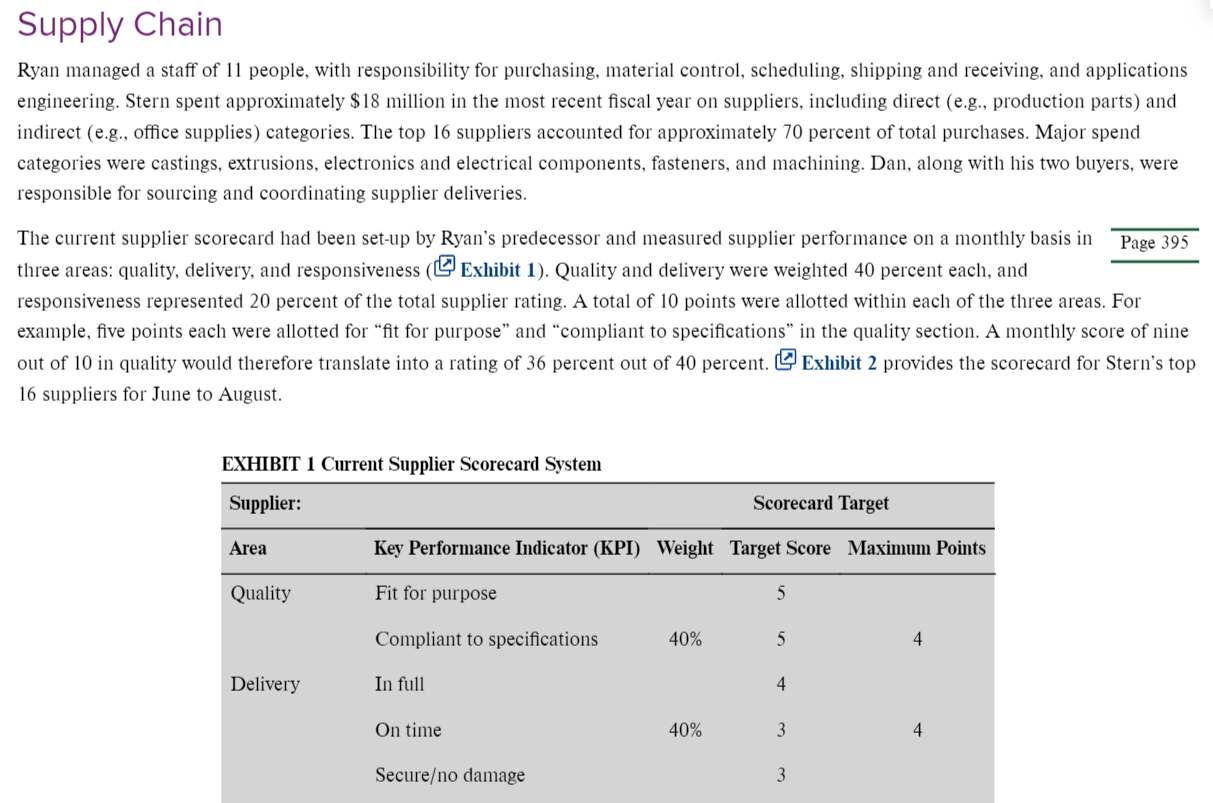

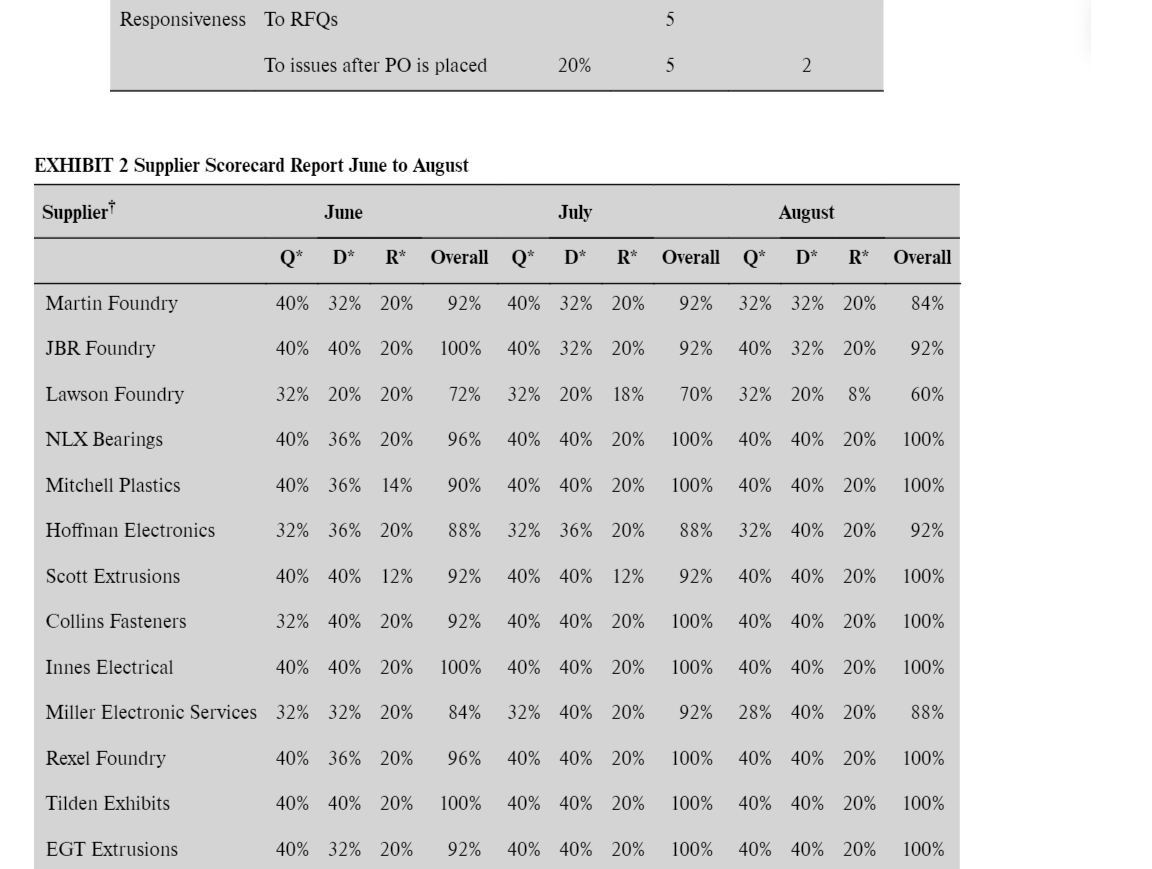

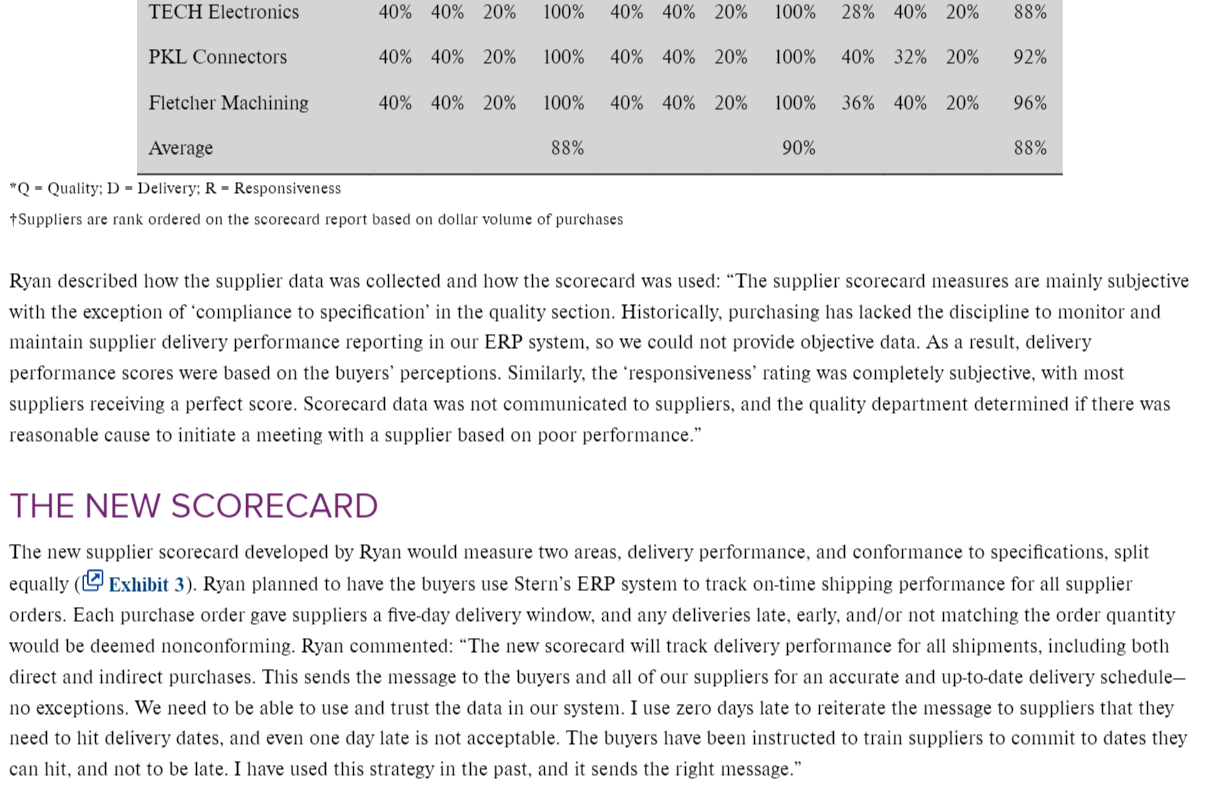

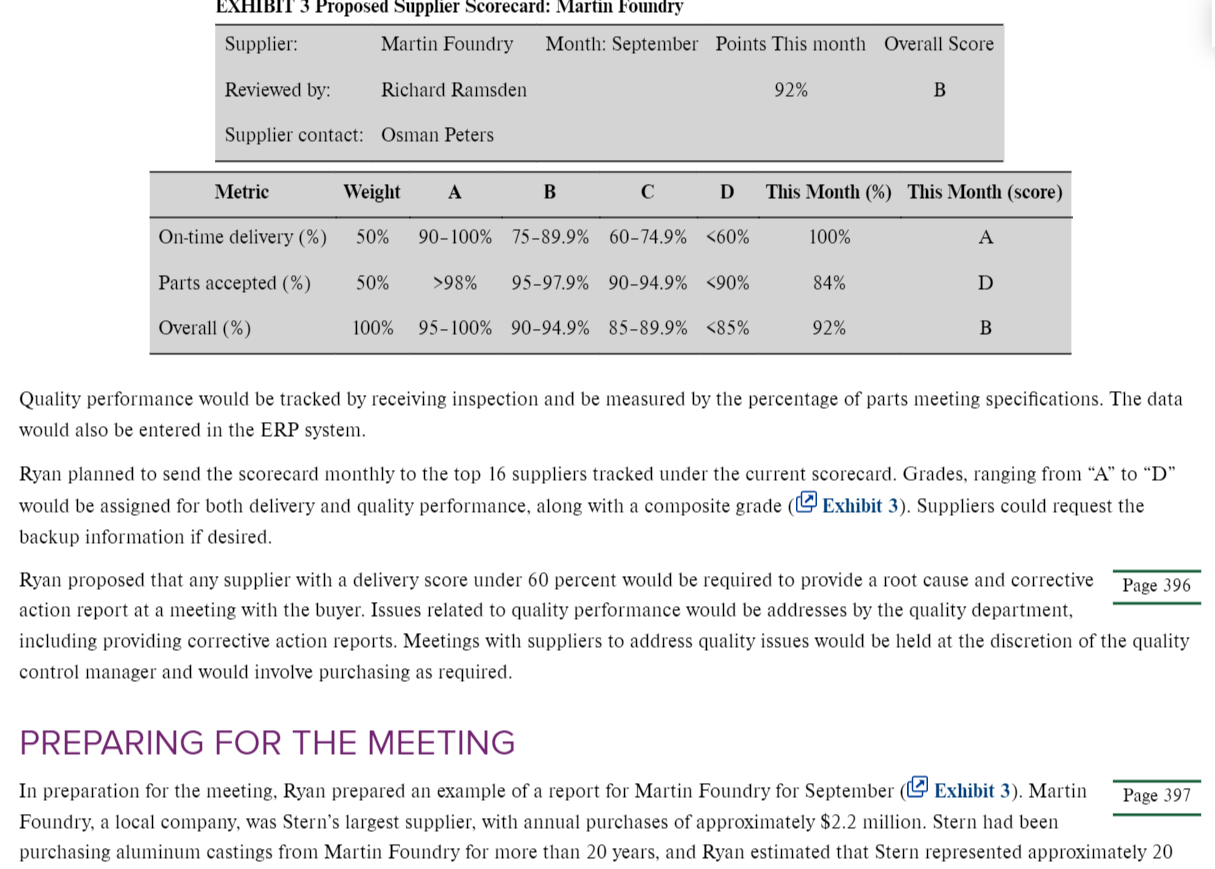

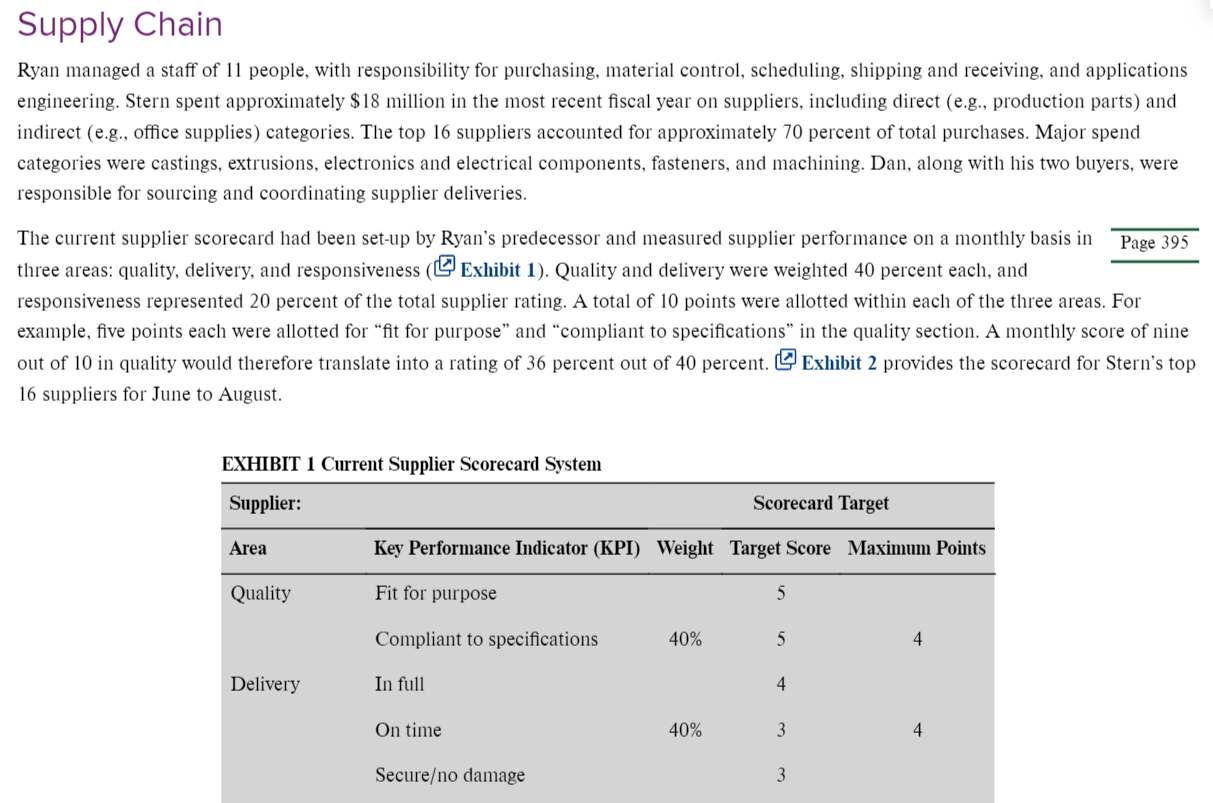

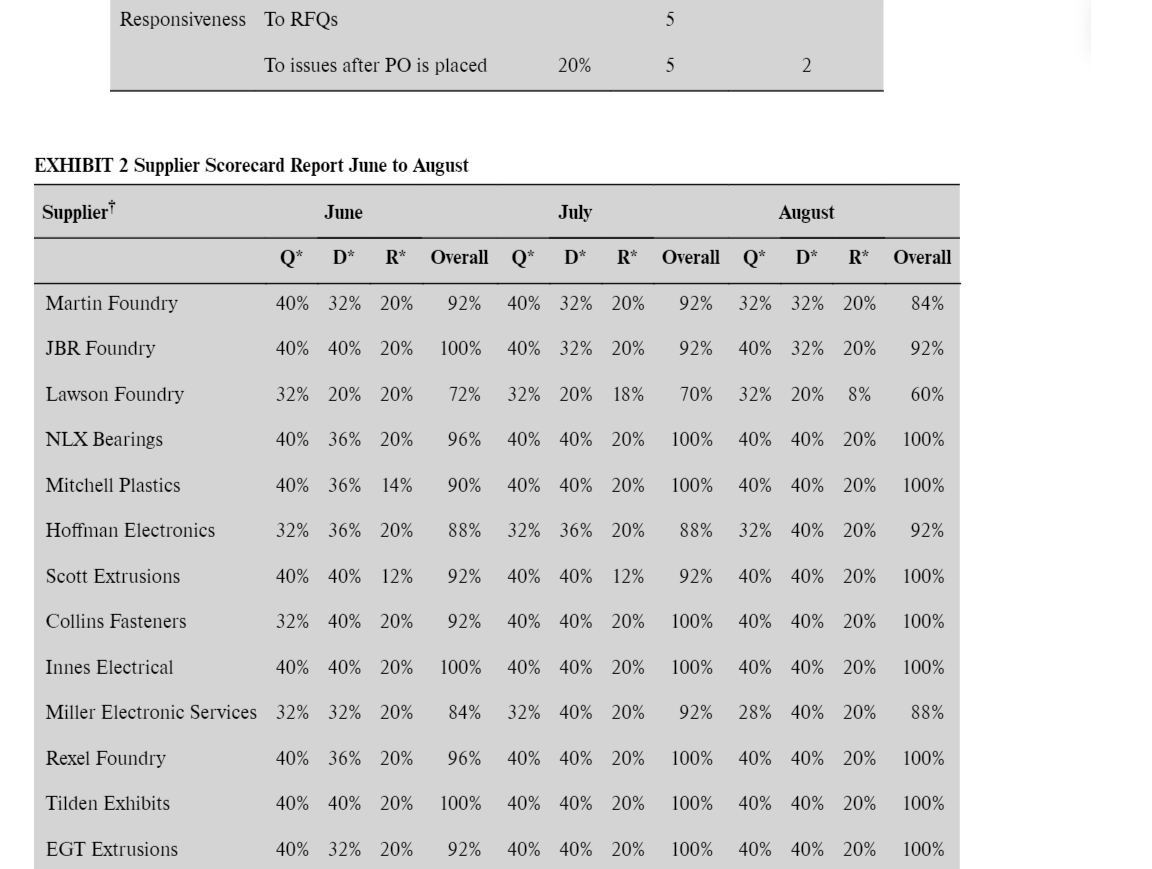

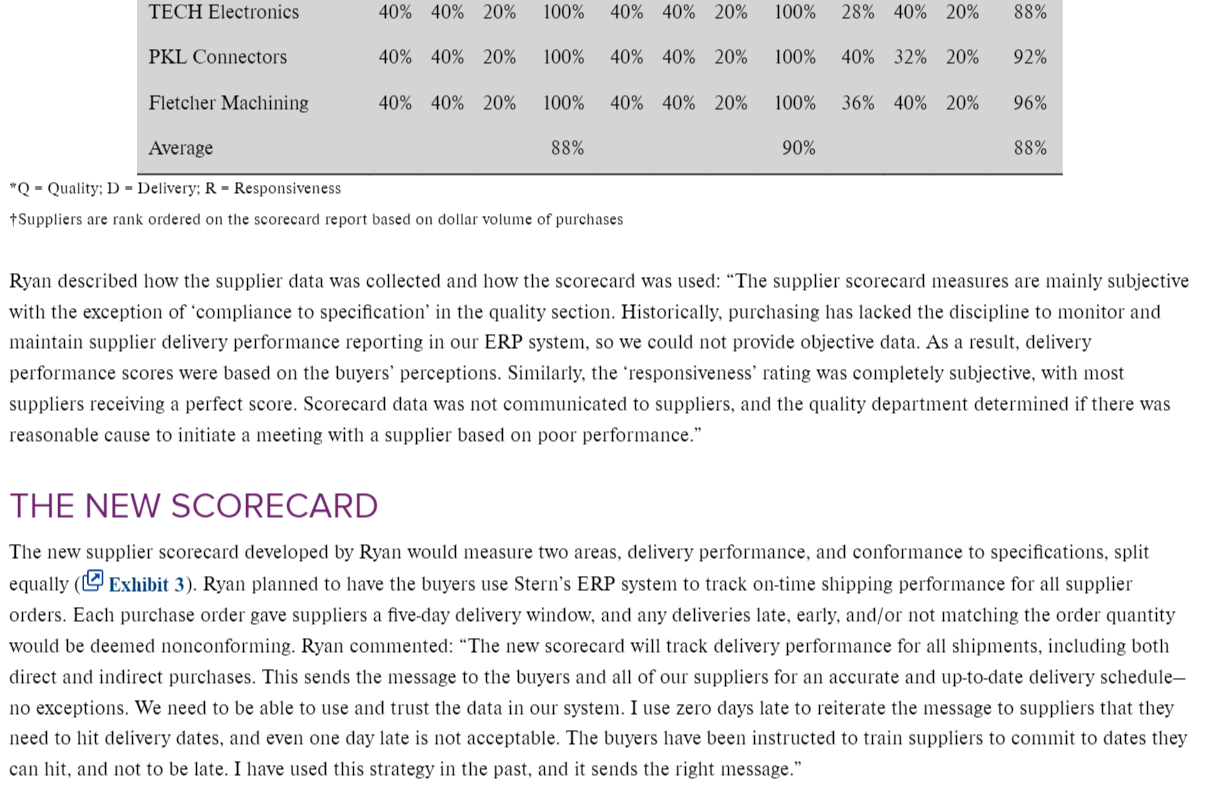

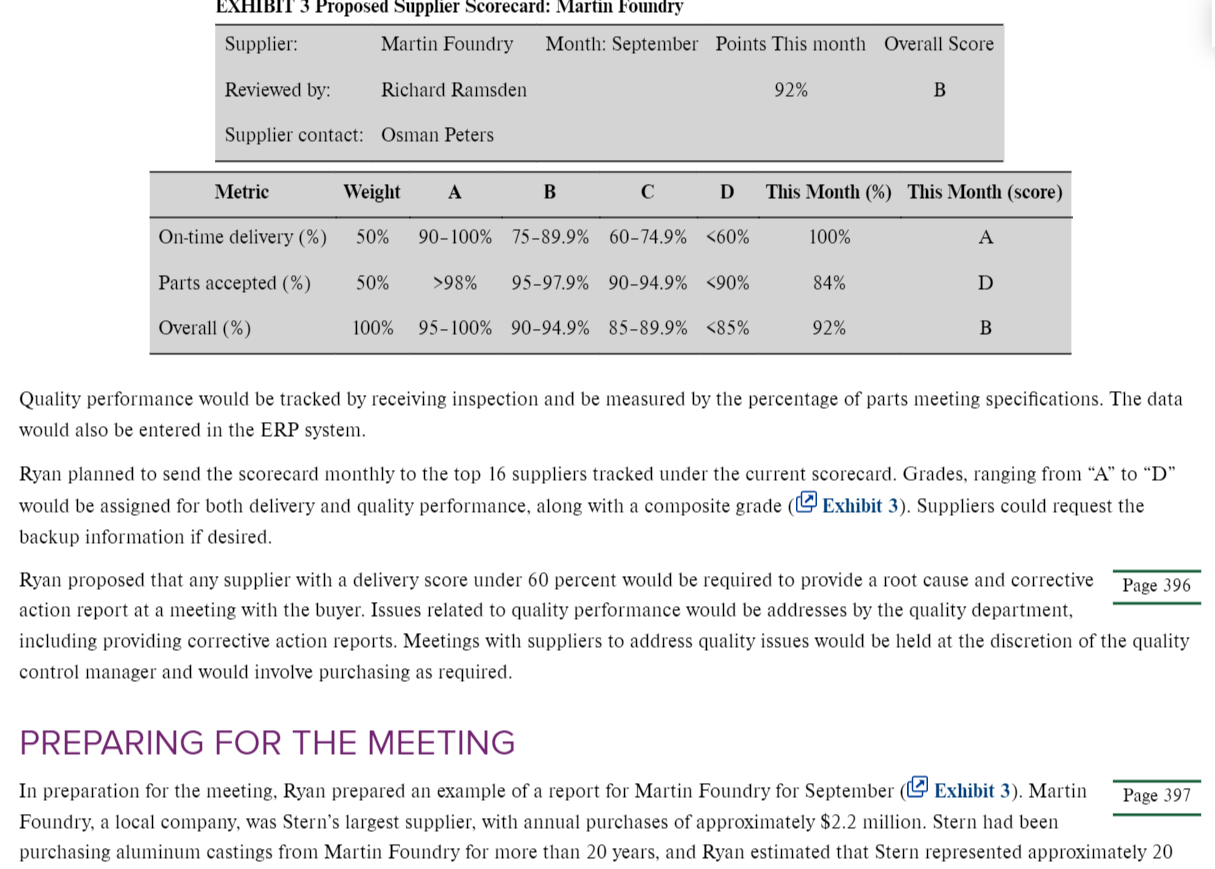

Case 132 Stern Aerospace It had been approximately three months since Ryan Berry started at Stern Aerospace (Stern) as the new manager of inventory control and material scheduling. During the management meeting held the second week of each month, Ryan reported key metrics for the supply chain group, including inventory turns, purchasing cost reduction initiatives, and supplier performance. Two weeks prior, at the September 14 meeting, Jessica Frisch, quality control manager, commented: Supplier scorecard data is provided at each meeting, and for the most part, everything always looks fine. However, I know that we have ongoing quality and delivery problems with some of our suppliers. It is time to evaluate our supplier scorecard and decide if changes are needed. Jeff Wilson, division president, nodded as he responded to Jessica's comment: Our sales are continuing to grow, and I want to closely monitor the performance of our supply chain and our suppliers. We can't afford any problems. Ryan, I know you just arrived a couple of months ago, but I would like you to take a fresh look at our supplier scorecard and give us your feedback and recommendations regarding potential changes at the October meeting. As Ryan sat in his office on October 2, he reflected on the conversation from mid-September. The next management meeting was two weeks away, and he needed to finalize his recommendations for the division's supplier scorecard. STERN AEROSPACE Located in Minneapolis, Minnesota, Stern was leading supplier of hydraulic power generation and fluid distribution components and systems for the military and commercial aerospace sectors. Its products included standard and higher-pressure engine-driven pumps, motor- driven generators, hydraulic thrust reverser and landing gear actuators, hydraulic power transfer units, fluid control components and systems, and a broad range of fluid distribution components, such as tubing, fittings and couplings. The 150,000-square-foot facility included manufacturing operations, engineering, and customer service. Total revenues were $50 million, and Stern was owned by Stern International, a Fortune 500 company with revenues of $15 billion. Stern International supplied systems to customers in a wide range of diversified industrial and aerospace markets. Supply Chain Ryan managed a staff of 11 people, with responsibility for purchasing, material control, scheduling, shipping and receiving, and applications engineering. Stern spent approximately $18 million in the most recent fiscal year on suppliers, including direct (e.g., production parts) and indirect (e.g., office supplies) categories. The top 16 suppliers accounted for approximately 70 percent of total purchases. Major spend categories were castings, extrusions, electronics and electrical components, fasteners, and machining. Dan, along with his two buyers, were responsible for sourcing and coordinating supplier deliveries. The current supplier scorecard had been set-up by Ryan's predecessor and measured supplier performance on a monthly basis in Page 395 three areas: quality, delivery, and responsiveness ( Exhibit 1). Quality and delivery were weighted 40 percent each, and responsiveness represented 20 percent of the total supplier rating. A total of 10 points were allotted within each of the three areas. For example, five points each were allotted for "fit for purpose and compliant to specifications in the quality section. A monthly score of nine out of 10 in quality would therefore translate into a rating of 36 percent out of 40 percent. Exhibit 2 provides the scorecard for Stern's top 16 suppliers for June to August. EXHIBIT 1 Current Supplier Scorecard System Supplier: Scorecard Target Area Key Performance Indicator (KPI) Weight Target Score Maximum Points Quality Fit for purpose Compliant to specifications 40% Delivery In full On time 40% 3 Secureo damage Responsiveness To RFQs To issues after PO is placed 20% EXHIBIT 2 Supplier Scorecard Report June to August Supplier* June July August Q* D* R* Overall Q* D* R* Overall Q* D* R* Overall Martin Foundry 40% 32% 20% 92% 40% 32% 20% 92% 32% 32% 20% 84% JBR Foundry 40% 40% 20% 100% 40% 32% 20% 92% 40% 32% 20% 92% Lawson Foundry 32% 20% 20% 72% 32% 20% 18% 70% 32% 20% 8% 60% NLX Bearings 40% 36% 20% 96% 40% 40% 20% 100% 40% 40% 20% 100% Mitchell Plastics 40% 36% 14% 90% 40% 40% 20% 100% 40% 40% 20% 100% Hoffman Electronics 32% 36% 20% 88% 32% 36% 20% 88% 32% 40% 20% 92% Scott Extrusions 40% 40% 12% 92% 40% 40% 12% 92% 40% 40% 20% 100% Collins Fasteners 32% 40% 20% 92% 40% 40% 20% 100% 40% 40% 20% 100% Innes Electrical 40% 40% 20% 100% 40% 40% 20% 100% 40% 40% 20% 100% Miller Electronic Services 32% 32% 20% 84% 32% 40% 20% 92% 28% 40% 20% 88% Rexel Foundry 40% 36% 20% 96% 40% 40% 20% 100% 40% 40% 20% 100% Tilden Exhibits 40% 40% 20% 100% 40% 40% 20% 100% 40% 40% 20% 100% EGT Extrusions 40% 32% 20% 92% 40% 40% 20% 100% 40% 40% 20% 100% TECH Electronics 40% 40% 20% 100% 40% 40% 20% 100% 28% 40% 20% 88% PKL Connectors 40% 40% 20% 100% 40% 40% 20% 100% 40% 32% 20% 92% Fletcher Machining 40% 40% 20% 100% 40% 40% 20% 100% 36% 40% 20% 96% Average 88% 90% 88% "Q - Quality: D = Delivery: R - Responsiveness + Suppliers are rank ordered on the scorecard report based on dollar volume of purchases Ryan described how the supplier data was collected and how the scorecard was used: "The supplier scorecard measures are mainly subjective with the exception of compliance to specification' in the quality section. Historically, purchasing has lacked the discipline to monitor and maintain supplier delivery performance reporting in our ERP system, so we could not provide objective data. As a result, delivery performance scores were based on the buyers' perceptions. Similarly, the responsiveness' rating was completely subjective, with most suppliers receiving a perfect score. Scorecard data was not communicated to suppliers, and the quality department determined if there was reasonable cause to initiate a meeting with a supplier based on poor performance." THE NEW SCORECARD The new supplier scorecard developed by Ryan would measure two areas, delivery performance, and conformance to specifications, split equally Exhibit 3). Ryan planned to have the buyers use Stern's ERP system to track on-time shipping performance for all supplier orders. Each purchase order gave suppliers a five-day delivery window, and any deliveries late, early, and/or not matching the order quantity would be deemed nonconforming. Ryan commented: The new scorecard will track delivery performance for all shipments, including both direct and indirect purchases. This sends the message to the buyers and all of our suppliers for an accurate and up-to-date delivery schedule- no exceptions. We need to be able to use and trust the data in our system. I use zero days late to reiterate the message to suppliers that they need to hit delivery dates, and even one day late is not acceptable. The buyers have been instructed to train suppliers to commit to dates they can hit, and not to be late. I have used this strategy in the past, and it sends the right message." EXHIBIT 3 Proposed Supplier Scorecard: Martin Foundry Supplier: Martin Foundry Month: September Points This month Overall Score Reviewed by: Richard Ramsden 92% B Supplier contact: Osman Peters Metric Weight A B C D This Month (%) This Month (score) On-time delivery (%) 50% 90-100% 75-89.9% 60-74.9%