Question: Case 15 provides a WACC calculation that contains errors based on conceptual mistakes in the analysis. Read the case carefully and present your answers to

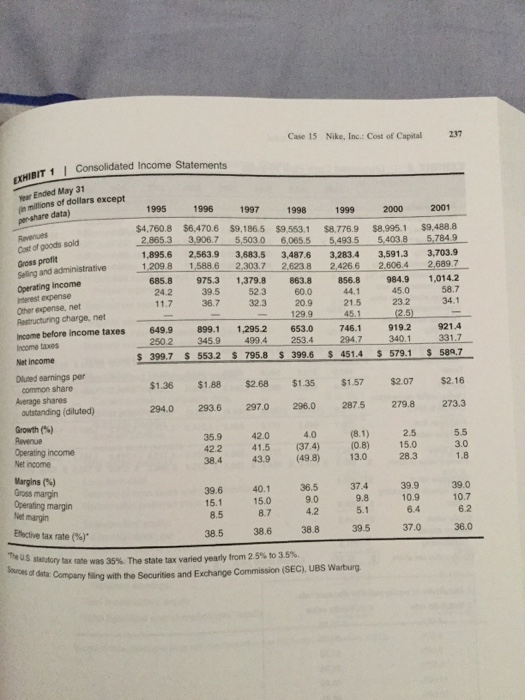

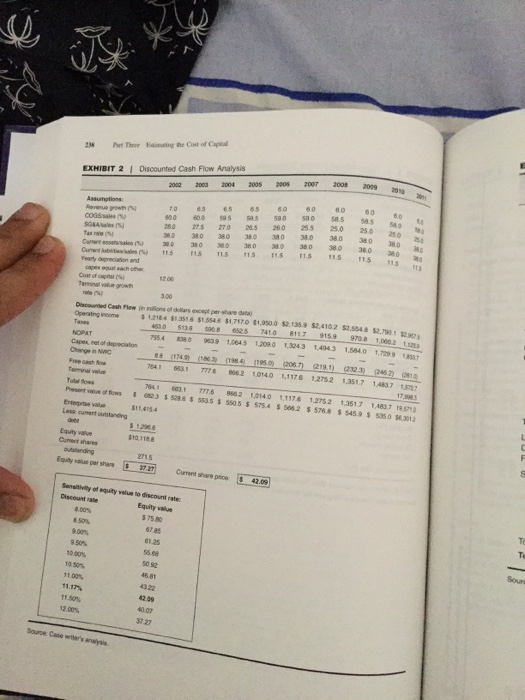

Nike, Inc.: Cost of Capital Group, a mutua fund 5, Ford, a portfolio manager at the athletic man- management firm, pored over analysts' of Inc., beginning of the year. Nike, share price had declined from the emphasis Ford was considering buying some shares for the fund with an Large-Cap Fund, which invested mostly in Fortune 500 companies, market had General Motors, value investing. Its top holdings inc stocks. While the stock performed and other generally old-economy Large-Cap Fund had 500 fell declined over the last 18 months, the NorthPoint even as the S&P versus extremely well. In 2000, the fund earned a return of 20.7%, at 6.4% 10 At the end of June 2001, the fund's year-to-date returns stood -7.3% for the S&P 500. an analysts' meeting to dis- Only a week earlier, on June 28, 2001, Nike had held Nike close its fiscal year 2001 results. The meeting, however, had another purpose: Since management wanted to communicate a strategy for revitalizing the company. fallen 1997, its revenues had plateaued at around S9 billion, while net income had from almost $800 million to $580 million (see Exhibit 1). Nike's market share in US. athletic shoes had fallen from 48%. in 1997, to 42% in 2000. In addition, recent supply chain issues and the adverse effect of a strong dollar had negatively affected the meeting, management revealed plans to address both top-line growth and operating performance. To boost revenue, the company would develop more athletic- shoe products in the midpriced segment a segment that Nike had overlooked in recent years Nike also planned to push its apparel line, which, under the recent leadership of Nike's fiscal year ended in May. Douglas los Do something Nike's insularity and Foot-Dragging Have It Running in Place, Robson, Businesweek (2 July 2001). sneakers in this segment sold for $70-$90 a pair. niscase was prepared from publicly available information by Jessica Chan. under the supervision of Robert F.Bruner and with the assistance of Sean D.Carr The financial support of the Batten Institute is ineffecive handling as a for class discussion rather than to illustrate effective or of an administrative situation c 2001 by the of Virginia Darden rights reserved. To order University ased in a hingcom. Ne part of this ies, send an e-mail to salese spreadsheet, publicarion may be reproduced, stored in a retrieval system. otherwise rransmitted in any form or by any meanr -electronic, mechanical, photocopylng or withovr the permission of the Darden School Foundation. Rev. 10M05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts