Question: CASE 15 Tiffany & Co. and TJX: Comparing Financial Performance Calculate the following for both Tiffany and TJX using data from the abbreviated income statements

CASE 15 Tiffany & Co. and TJX: Comparing Financial Performance

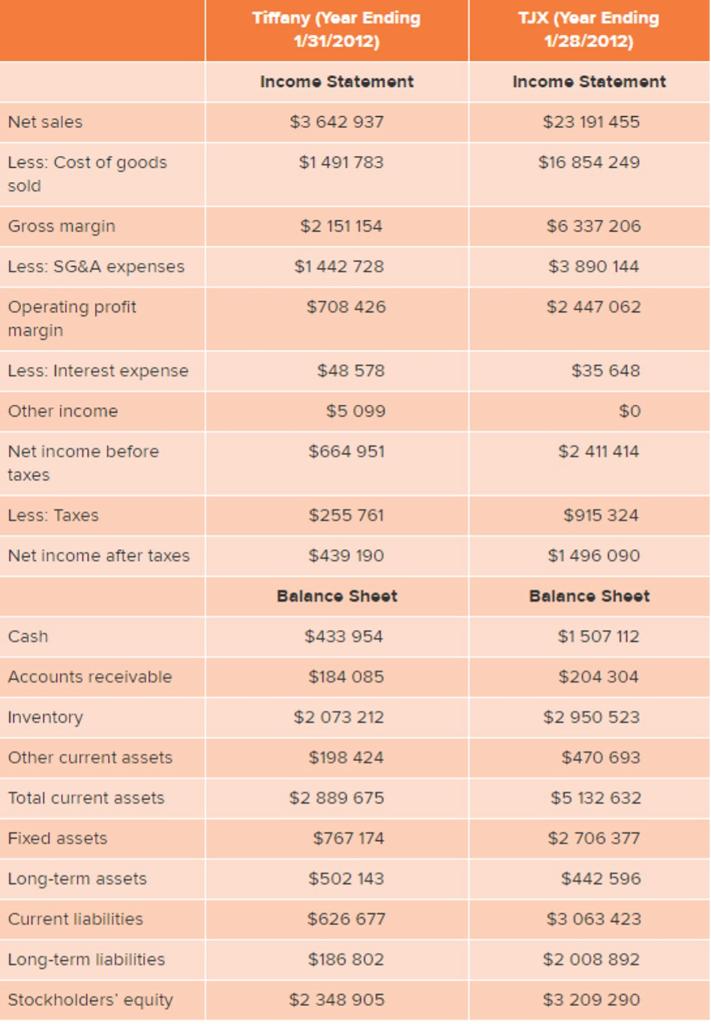

- Calculate the following for both Tiffany and TJX using data from the abbreviated income statements and balance sheets in Exhibit 1.

- Gross margin percentage

- SG&A expense percentage

- Operating profit margin percentage

- Net profit margin (after taxes) percentage

- Inventory turnover

- Asset turnover

- Return on Assets (ROA) percentage

- Compare and contrast the calculated financial figures for Tiffany and TJX. Analyze and discuss why the percentages and ratios differ for the two retailers.

- Analyze which retailer has the better overall financial performance.

- Why is ROA a good measure of a retailers financial performance?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock