Question: Case 17-36 Comprehensive Case on Joint Cost Allocation (LO 17-4, 17-5) Valdosta Chemical Company manufactures two industrial chemical products in a joint process. In May,

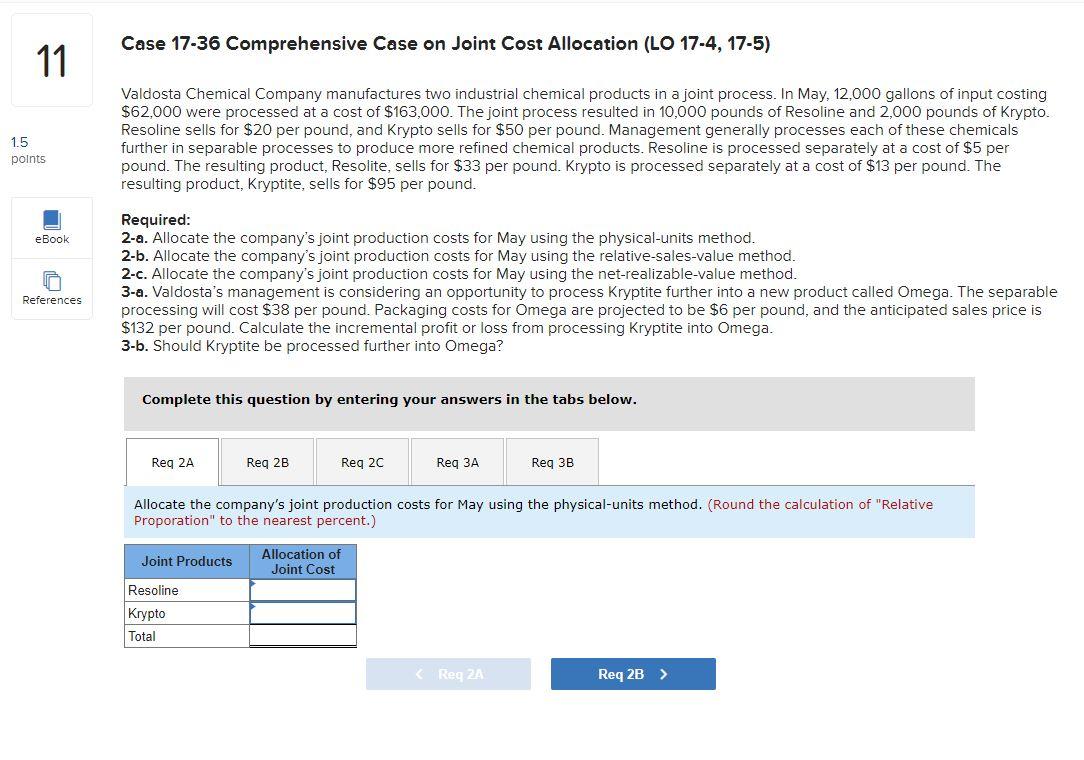

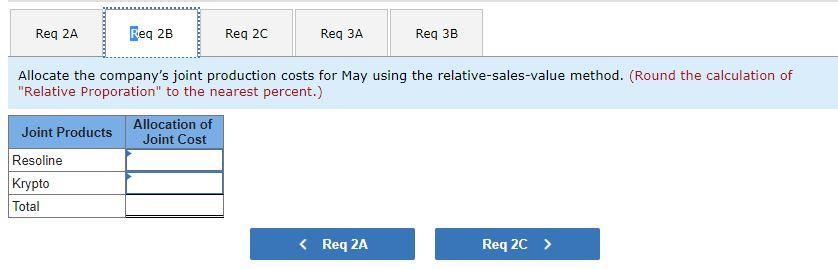

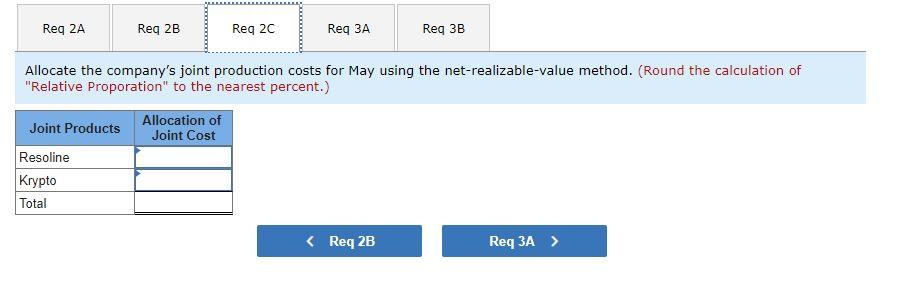

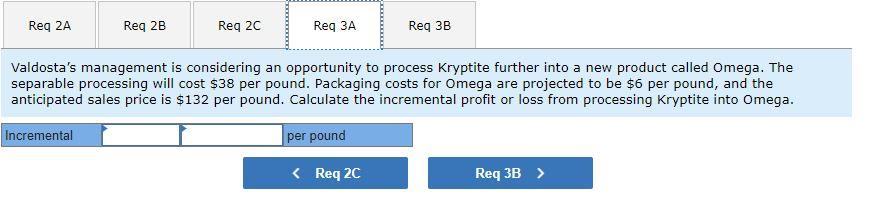

Case 17-36 Comprehensive Case on Joint Cost Allocation (LO 17-4, 17-5) Valdosta Chemical Company manufactures two industrial chemical products in a joint process. In May, 12,000 gallons of input costing $62,000 were processed at a cost of $163,000. The joint process resulted in 10,000 pounds of Resoline and 2,000 pounds of Krypto. Resoline sells for $20 per pound, and Krypto sells for $50 per pound. Management generally processes each of these chemicals further in separable processes to produce more refined chemical products. Resoline is processed separately at a cost of $5 per pound. The resulting product, Resolite, sells for $33 per pound. Krypto is processed separately at a cost of $13 per pound. The resulting product, Kryptite, sells for $95 per pound. Required: 2-a. Allocate the company's joint production costs for May using the physical-units method. 2-b. Allocate the company's joint production costs for May using the relative-sales-value method. 2-c. Allocate the company's joint production costs for May using the net-realizable-value method. 3-a. Valdosta's management is considering an opportunity to process Kryptite further into a new product called Omega. The separable processing will cost $38 per pound. Packaging costs for Omega are projected to be $6 per pound, and the anticipated sales price is $132 per pound. Calculate the incremental profit or loss from processing Kryptite into Omega. 3-b. Should Kryptite be processed further into Omega? Complete this question by entering your answers in the tabs below. Allocate the company's joint production costs for May using the physical-units method. (Round the calculation of "Relative Proporation" to the nearest percent.) Allocate the company's joint production costs for May using the relative-sales-value method. (Round the calculation of "Relative Proporation" to the nearest percent.) Allocate the company's joint production costs for May using the net-realizable-value method. (Round the calculation of "Relative Proporation" to the nearest percent.) Valdosta's management is considering an opportunity to process Kryptite further into a new product called Omega. The separable processing will cost $38 per pound. Packaging costs for Omega are projected to be $6 per pound, and the anticipated sales price is $132 per pound. Calculate the incremental profit or loss from processing Kryptite into Omega. Should Kryptite be processed further into Omega

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts