Question: Case 2 Cash Flow Statement 1) Use the excel sheets you downloaded called Micro Tiles Analysis Template.2) Examine Micro Tiles Cash Flow Statement Sheet #53)

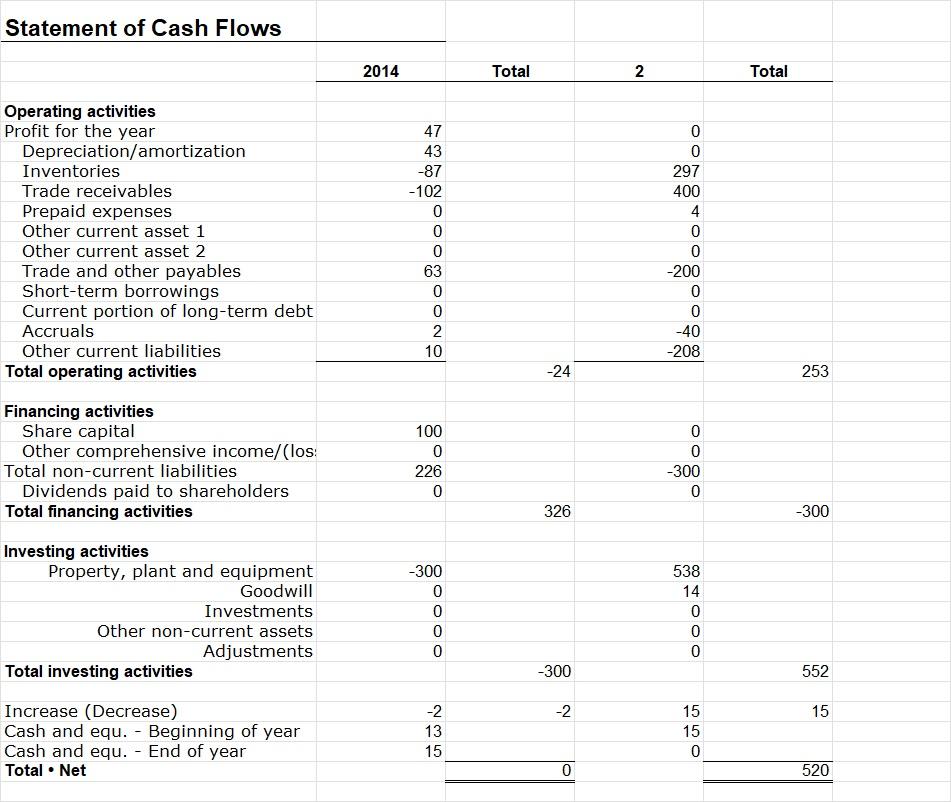

Case 2 Cash Flow Statement 1) Use the excel sheets you downloaded called Micro Tiles Analysis Template.2) Examine Micro Tiles Cash Flow Statement Sheet #53) Explain Operating Activities, Financing Activities, and Investing Activities for Micro Tiles Year 20144) Submit your report on Micro Tiles Cash Flow Statement

Please let me know the explanation and numbers of STATEMENT OF CASH FLOW

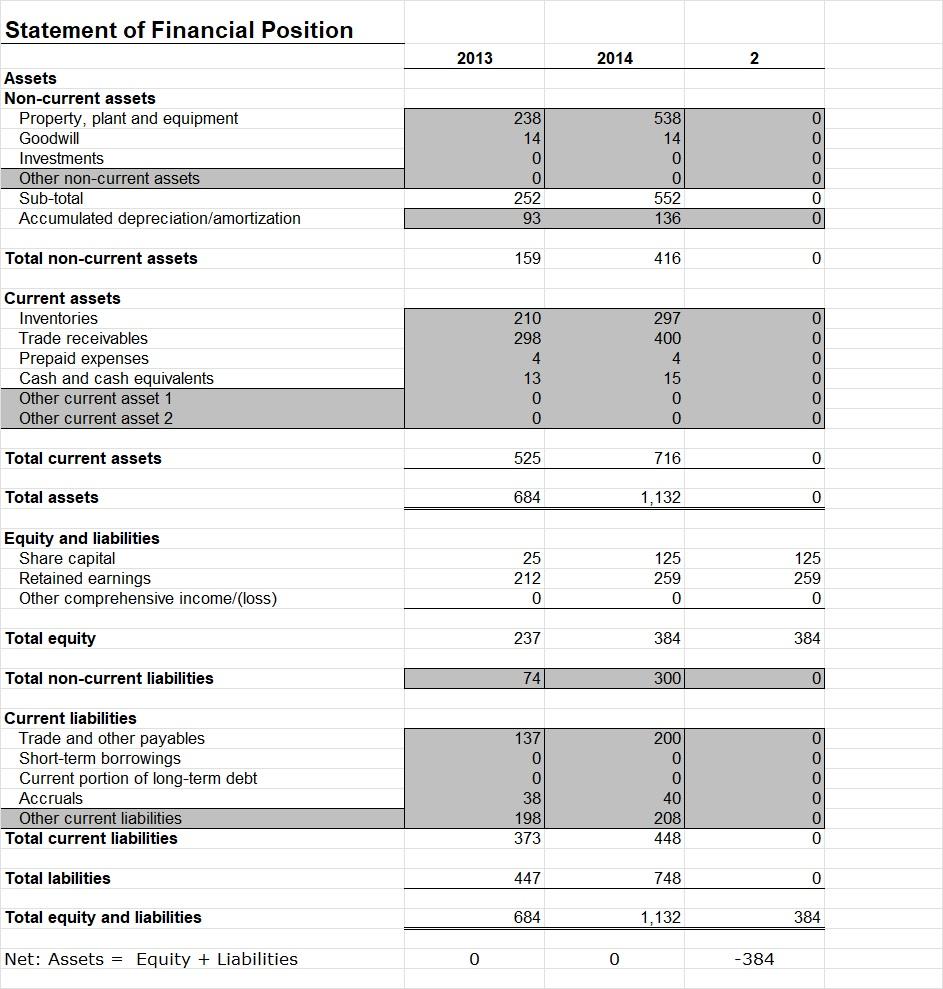

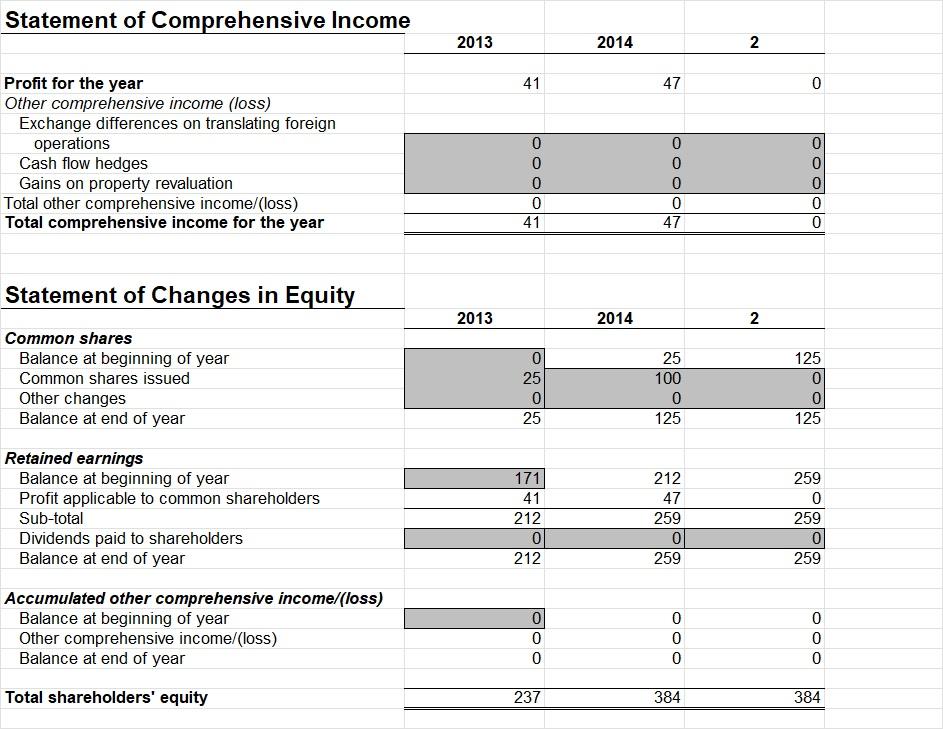

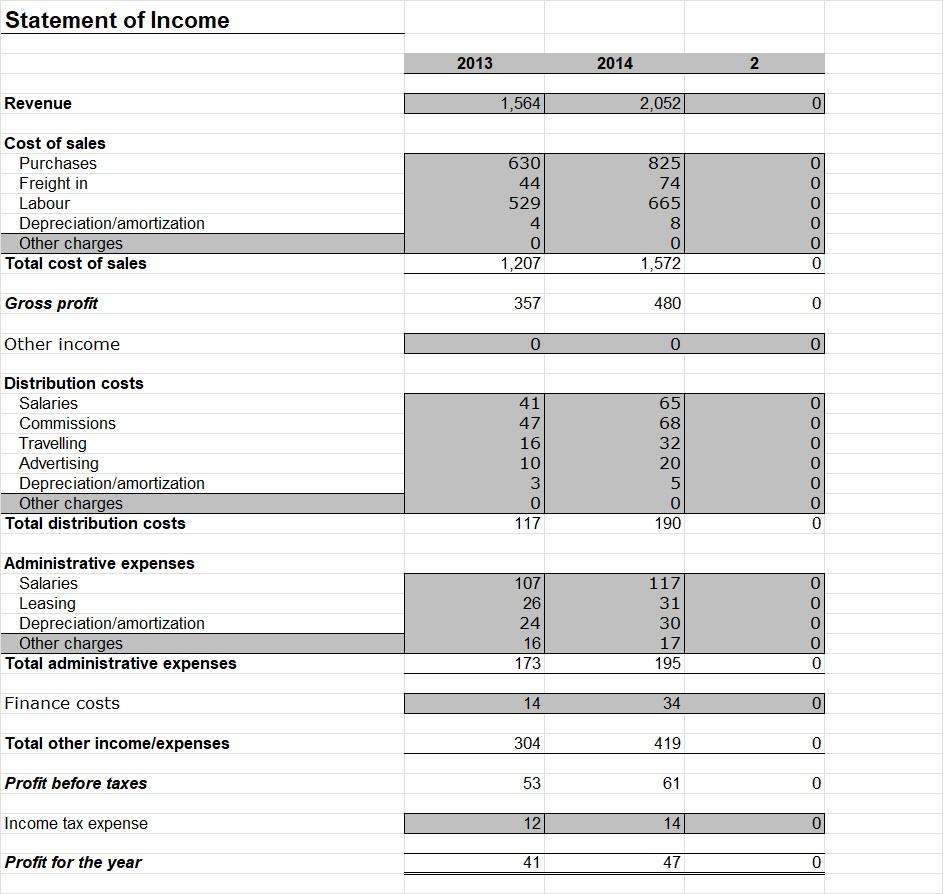

Statement of Financial Position 2013 2014 2 0 0 Assets Non-current assets Property, plant and equipment Goodwill Investments Other non-current assets Sub-total Accumulated depreciation/amortization 0 238 14 0 0 252 93 538) 14 0 0 552 136 0 0 0 Total non-current assets 159 416 0 Current assets Inventories Trade receivables Prepaid expenses Cash and cash equivalents Other current asset 1 Other current asset 2 210 298 4 13 0 0 297 400 4 15 0 0 Total current assets 525 716 0 Total assets 684 1,132 0 Equity and liabilities Share capital Retained earnings Other comprehensive income/(loss) 25 212 125 259 0 125 259 0 0 Total equity 237 384 384 Total non-current liabilities 74 3001 0 Current liabilities Trade and other payables Short-term borrowings Current portion of long-term debt Accruals Other current liabilities Total current liabilities 137 0 0 38 198 373 200 0 0 40 208 448 OOOOOO Total labilities 447 748 0 Total equity and liabilities 684 1.132 384 Net: Assets = Equity + Liabilities 0 0 -384 Statement of Comprehensive Income 2013 2014 2 41 47 0 Profit for the year Other comprehensive income (loss) Exchange differences on translating foreign operations Cash flow hedges Gains on property revaluation Total other comprehensive income/(loss) Total comprehensive income for the year 0 0 0 0 41 0 0 0 0 47 0 0 0 0 0 Statement of Changes in Equity 2013 2014 2 0 25 Common shares Balance at beginning of year Common shares issued Other changes Balance at end of year 25 125 0 0 125 100 0 125 25 Retained earnings Balance at beginning of year Profit applicable to common shareholders Sub-total Dividends paid to shareholders Balance at end of year 171 41 212 0 212 212 47 259 0 259 259 0 259 0 259 Accumulated other comprehensive income (loss) Balance at beginning of year Other comprehensive income/loss) Balance at end of year 0 0 0 0 0 0 0 0 0 Total shareholders' equity 237 384 384 Statement of Income 2013 2014 2 Revenue 1,564 2,052 0 Cost of sales Purchases Freight in Labour Depreciation/amortization Other charges Total cost of sales 630 44 529 4 0 1,207 825 74 665 8 0 1,572 0 0 0 0 0 0 Gross profit 357 480 0 Other income 0 0 0 Distribution costs Salaries Commissions Travelling Advertising Depreciation/amortization Other charges Total distribution costs 41 47 16 10 3 0 117 65 68 32 20 5 0 190 0 0 0 0 0 0 0 Administrative expenses Salaries Leasing Depreciation/amortization Other charges Total administrative expenses 107 26 24 16 173 117 31 30 17 195 0 0 0 0 0 Finance costs 14 34 0 Total other income/expenses 304 419 0 Profit before taxes 53 61 0 Income tax expense 12 14 0 Profit for the year 41 47 0 Statement of Cash Flows 2014 Total 2 Total Operating activities Profit for the year Depreciation/amortization Inventories Trade receivables Prepaid expenses Other current asset 1 Other current asset 2 Trade and other payables Short-term borrowings Current portion of long-term debt Accruals Other current liabilities Total operating activities 47 43 -87 -102 0 0 0 63 0 0 2 10 0 0 297 400 4 0 0 -200 0 0 -40 -208 -24 253 Financing activities Share capital Other comprehensive income/(los: Total non-current liabilities Dividends paid to shareholders Total financing activities 100 0 226 0 0 0 -300 0 326 -300 Investing activities Property, plant and equipment Goodwill Investments Other non-current assets Adjustments Total investing activities -300 0 0 0 0 538 14 0 0 0 -300 552 -2 15 Increase (Decrease) Cash and equ. - Beginning of year Cash and equ. - End of year Total .Net -2 13 15 WN 15 15 0 0 520 Statement of Financial Position 2013 2014 2 0 0 Assets Non-current assets Property, plant and equipment Goodwill Investments Other non-current assets Sub-total Accumulated depreciation/amortization 0 238 14 0 0 252 93 538) 14 0 0 552 136 0 0 0 Total non-current assets 159 416 0 Current assets Inventories Trade receivables Prepaid expenses Cash and cash equivalents Other current asset 1 Other current asset 2 210 298 4 13 0 0 297 400 4 15 0 0 Total current assets 525 716 0 Total assets 684 1,132 0 Equity and liabilities Share capital Retained earnings Other comprehensive income/(loss) 25 212 125 259 0 125 259 0 0 Total equity 237 384 384 Total non-current liabilities 74 3001 0 Current liabilities Trade and other payables Short-term borrowings Current portion of long-term debt Accruals Other current liabilities Total current liabilities 137 0 0 38 198 373 200 0 0 40 208 448 OOOOOO Total labilities 447 748 0 Total equity and liabilities 684 1.132 384 Net: Assets = Equity + Liabilities 0 0 -384 Statement of Comprehensive Income 2013 2014 2 41 47 0 Profit for the year Other comprehensive income (loss) Exchange differences on translating foreign operations Cash flow hedges Gains on property revaluation Total other comprehensive income/(loss) Total comprehensive income for the year 0 0 0 0 41 0 0 0 0 47 0 0 0 0 0 Statement of Changes in Equity 2013 2014 2 0 25 Common shares Balance at beginning of year Common shares issued Other changes Balance at end of year 25 125 0 0 125 100 0 125 25 Retained earnings Balance at beginning of year Profit applicable to common shareholders Sub-total Dividends paid to shareholders Balance at end of year 171 41 212 0 212 212 47 259 0 259 259 0 259 0 259 Accumulated other comprehensive income (loss) Balance at beginning of year Other comprehensive income/loss) Balance at end of year 0 0 0 0 0 0 0 0 0 Total shareholders' equity 237 384 384 Statement of Income 2013 2014 2 Revenue 1,564 2,052 0 Cost of sales Purchases Freight in Labour Depreciation/amortization Other charges Total cost of sales 630 44 529 4 0 1,207 825 74 665 8 0 1,572 0 0 0 0 0 0 Gross profit 357 480 0 Other income 0 0 0 Distribution costs Salaries Commissions Travelling Advertising Depreciation/amortization Other charges Total distribution costs 41 47 16 10 3 0 117 65 68 32 20 5 0 190 0 0 0 0 0 0 0 Administrative expenses Salaries Leasing Depreciation/amortization Other charges Total administrative expenses 107 26 24 16 173 117 31 30 17 195 0 0 0 0 0 Finance costs 14 34 0 Total other income/expenses 304 419 0 Profit before taxes 53 61 0 Income tax expense 12 14 0 Profit for the year 41 47 0 Statement of Cash Flows 2014 Total 2 Total Operating activities Profit for the year Depreciation/amortization Inventories Trade receivables Prepaid expenses Other current asset 1 Other current asset 2 Trade and other payables Short-term borrowings Current portion of long-term debt Accruals Other current liabilities Total operating activities 47 43 -87 -102 0 0 0 63 0 0 2 10 0 0 297 400 4 0 0 -200 0 0 -40 -208 -24 253 Financing activities Share capital Other comprehensive income/(los: Total non-current liabilities Dividends paid to shareholders Total financing activities 100 0 226 0 0 0 -300 0 326 -300 Investing activities Property, plant and equipment Goodwill Investments Other non-current assets Adjustments Total investing activities -300 0 0 0 0 538 14 0 0 0 -300 552 -2 15 Increase (Decrease) Cash and equ. - Beginning of year Cash and equ. - End of year Total .Net -2 13 15 WN 15 15 0 0 520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts