Question: Case 2 Question 1 (30 marks) Car-making companies are aggressively considering further development of self- driving vehicles. Suppose the car-making companies have the following two

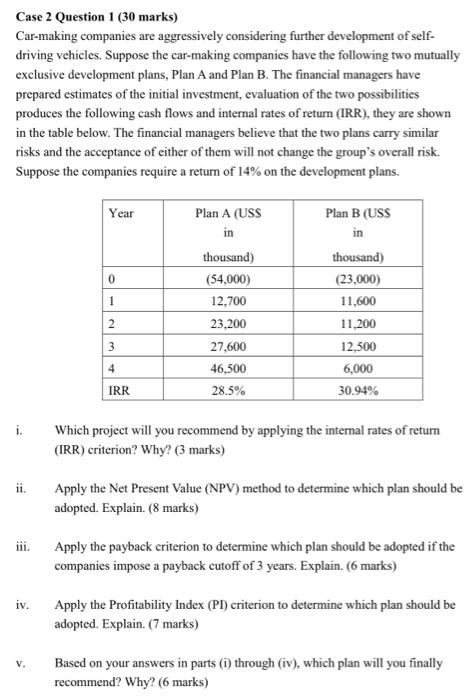

Case 2 Question 1 (30 marks) Car-making companies are aggressively considering further development of self- driving vehicles. Suppose the car-making companies have the following two mutually exclusive development plans, Plan A and Plan B. The financial managers have prepared estimates of the initial investment, evaluation of the two possibilities produces the following cash flows and internal rates of return (IRR), they are shown in the table below. The financial managers believe that the two plans carry similar risks and the acceptance of either of them will not change the group's overall risk. Suppose the companies require a return of 14% on the development plans. Year 0 1 Plan A (USS in thousand) (54,000) 12,700 23,200 27,600 46,500 28.5% Plan B (USS in thousand) (23,000) 11,600 11,200 12,500 6,000 30.94% 2 3 4 IRR i. Which project will you recommend by applying the internal rates of return (IRR) criterion? Why? (3 marks) ii. Apply the Net Present Value (NPV) method to determine which plan should be adopted. Explain. (8 marks) Apply the payback criterion to determine which plan should be adopted if the companies impose a payback cutoff of 3 years. Explain. (6 marks) iv. Apply the Profitability Index (PI) criterion to determine which plan should be adopted. Explain. (7 marks) V. Based on your answers in parts (1) through (iv), which plan will you finally recommend? Why? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts