Question: Case 2: Saito Solar Start Assignment Due Thursday by 12:01pm Points 100 Submitting a file upload 1) Why would one prefer cash flows rather than

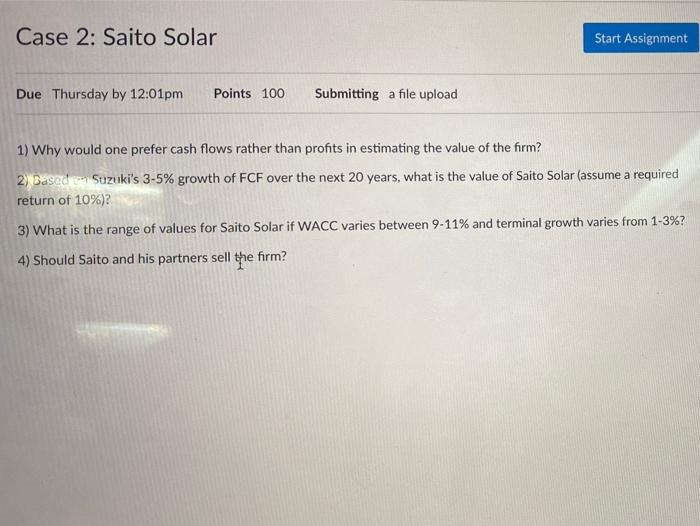

Case 2: Saito Solar Start Assignment Due Thursday by 12:01pm Points 100 Submitting a file upload 1) Why would one prefer cash flows rather than profits in estimating the value of the form? 2) Based Suzuki's 3-5% growth of FCF over the next 20 years, what is the value of Saito Solar (assume a required return of 10%)? 3) What is the range of values for Saito Solar if WACC varies between 9-11% and terminal growth varies from 1-3%? 4) Should Saito and his partners sell the firm? Case 2: Saito Solar Start Assignment Due Thursday by 12:01pm Points 100 Submitting a file upload 1) Why would one prefer cash flows rather than profits in estimating the value of the form? 2) Based Suzuki's 3-5% growth of FCF over the next 20 years, what is the value of Saito Solar (assume a required return of 10%)? 3) What is the range of values for Saito Solar if WACC varies between 9-11% and terminal growth varies from 1-3%? 4) Should Saito and his partners sell the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts