Question: Case 2.1 Intel Case (Group) Download The 2019 Intel Form 10-K file from the SEC.gov EDGAR database. View the Intel Corporation 2019 Income Statement from

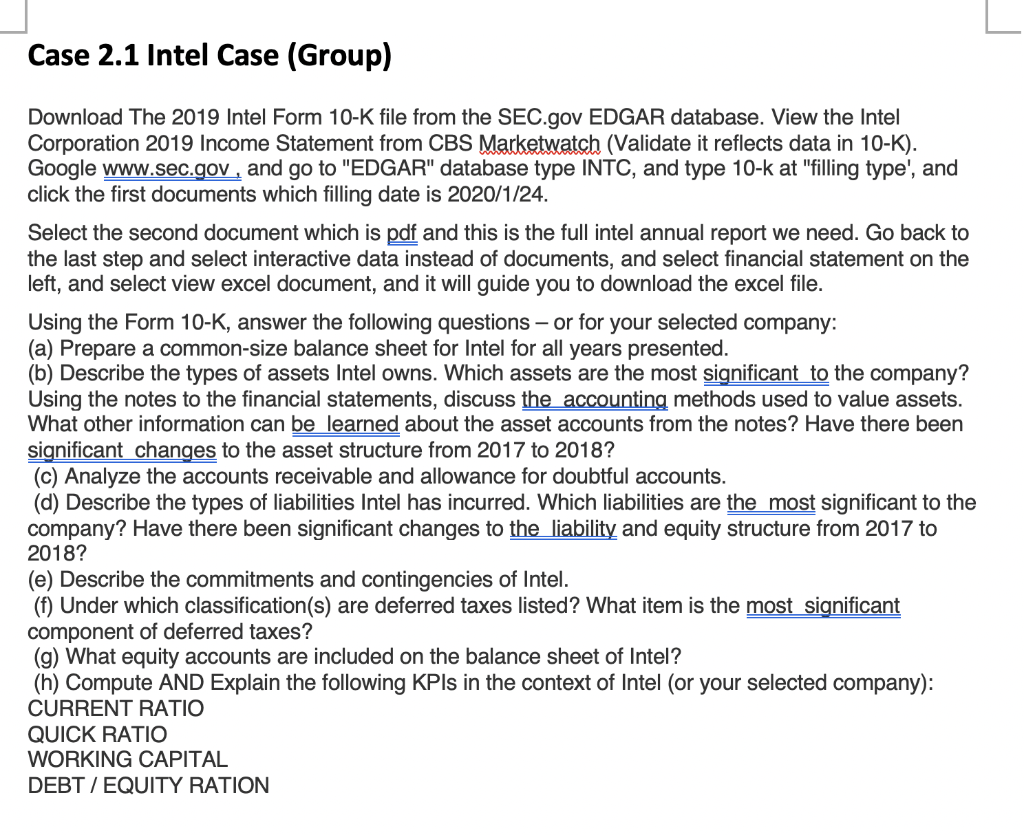

Case 2.1 Intel Case (Group) Download The 2019 Intel Form 10-K file from the SEC.gov EDGAR database. View the Intel Corporation 2019 Income Statement from CBS Marketwatch (Validate it reflects data in 10-K). Google www.sec.gov, and go to "EDGAR" database type INTC, and type 10-k at "filling type', and click the first documents which filling date is 2020/1/24. Select the second document which is pdf and this is the full intel annual report we need. Go back to the last step and select interactive data instead of documents, and select financial statement on the left, and select view excel document, and it will guide you to download the excel file. Using the Form 10-K, answer the following questions - or for your selected company: (a) Prepare a common-size balance sheet for Intel for all years presented. (b) Describe the types of assets Intel owns. Which assets are the most significant to the company? Using the notes to the financial statements, discuss the accounting methods used to value assets. What other information can be learned about the asset accounts from the notes? Have there been significant changes to the asset structure from 2017 to 2018? (c) Analyze the accounts receivable and allowance for doubtful accounts. (d) Describe the types of liabilities Intel has incurred. Which liabilities are the most significant to the company? Have there been significant changes to the liability and equity structure from 2017 to 2018? (e) Describe the commitments and contingencies of Intel. (f) Under which classification(s) are deferred taxes listed? What item is the most significant component of deferred taxes? (g) What equity accounts are included on the balance sheet of Intel? (h) Compute AND Explain the following KPIs in the context of Intel (or your selected company): CURRENT RATIO QUICK RATIO WORKING CAPITAL DEBT / EQUITY RATION Case 2.1 Intel Case (Group) Download The 2019 Intel Form 10-K file from the SEC.gov EDGAR database. View the Intel Corporation 2019 Income Statement from CBS Marketwatch (Validate it reflects data in 10-K). Google www.sec.gov, and go to "EDGAR" database type INTC, and type 10-k at "filling type', and click the first documents which filling date is 2020/1/24. Select the second document which is pdf and this is the full intel annual report we need. Go back to the last step and select interactive data instead of documents, and select financial statement on the left, and select view excel document, and it will guide you to download the excel file. Using the Form 10-K, answer the following questions - or for your selected company: (a) Prepare a common-size balance sheet for Intel for all years presented. (b) Describe the types of assets Intel owns. Which assets are the most significant to the company? Using the notes to the financial statements, discuss the accounting methods used to value assets. What other information can be learned about the asset accounts from the notes? Have there been significant changes to the asset structure from 2017 to 2018? (c) Analyze the accounts receivable and allowance for doubtful accounts. (d) Describe the types of liabilities Intel has incurred. Which liabilities are the most significant to the company? Have there been significant changes to the liability and equity structure from 2017 to 2018? (e) Describe the commitments and contingencies of Intel. (f) Under which classification(s) are deferred taxes listed? What item is the most significant component of deferred taxes? (g) What equity accounts are included on the balance sheet of Intel? (h) Compute AND Explain the following KPIs in the context of Intel (or your selected company): CURRENT RATIO QUICK RATIO WORKING CAPITAL DEBT / EQUITY RATION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts