Question: Please answer Discuss the possible challenges Amazon could face in China going forward. What should it do in such a scenario? What are the future

Please answer

Discuss the possible challenges Amazon could face in China going forward. What should it do in such a scenario?

What are the future challenges?

Use the BCG Matrix to evaluate Amazons situation (Suggested but not required)Make some recommendations

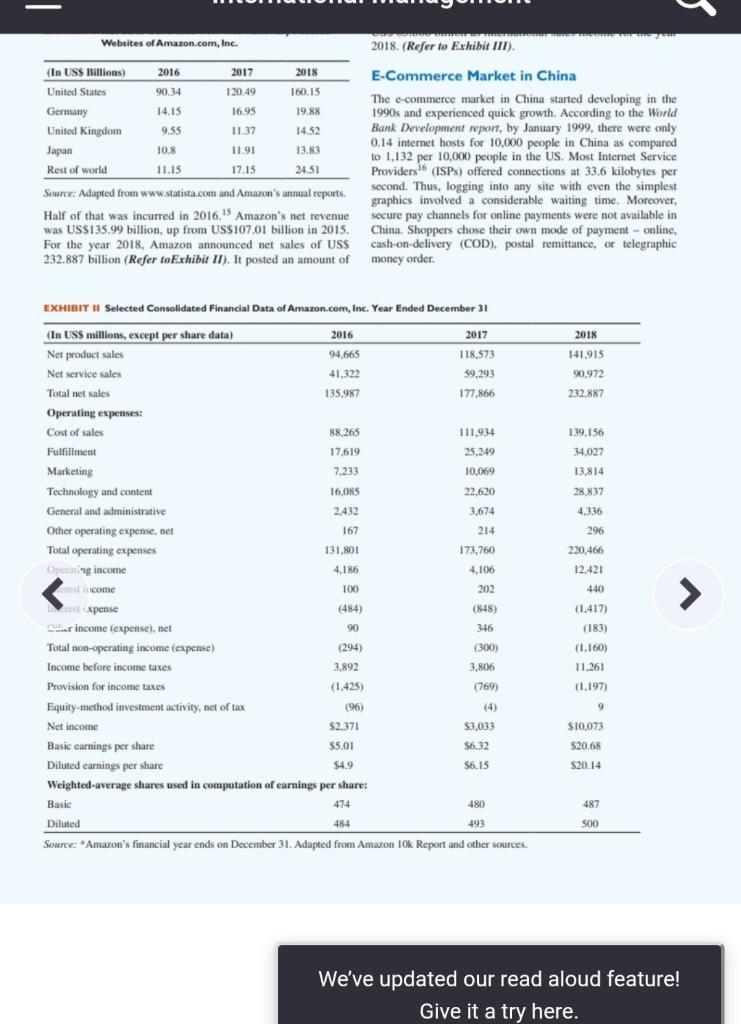

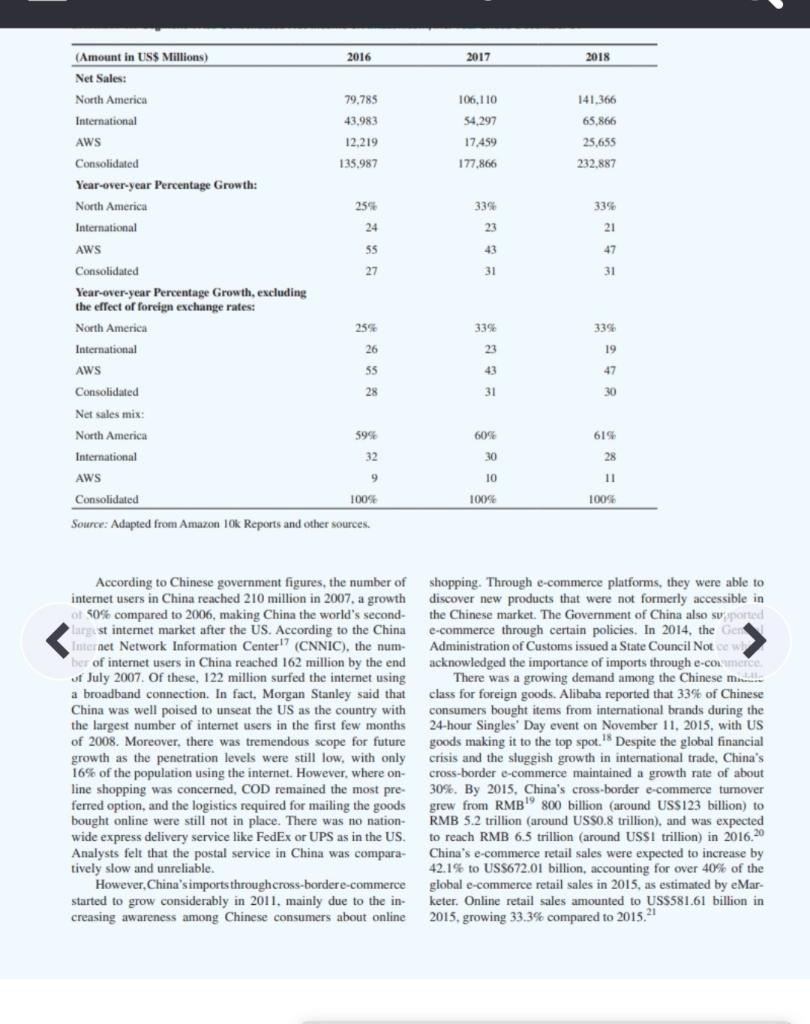

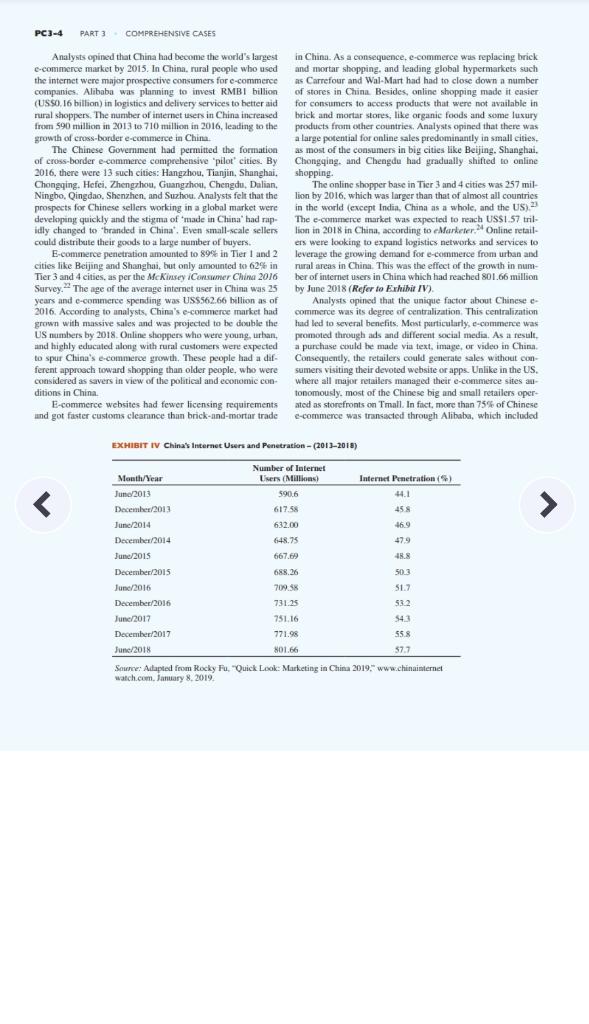

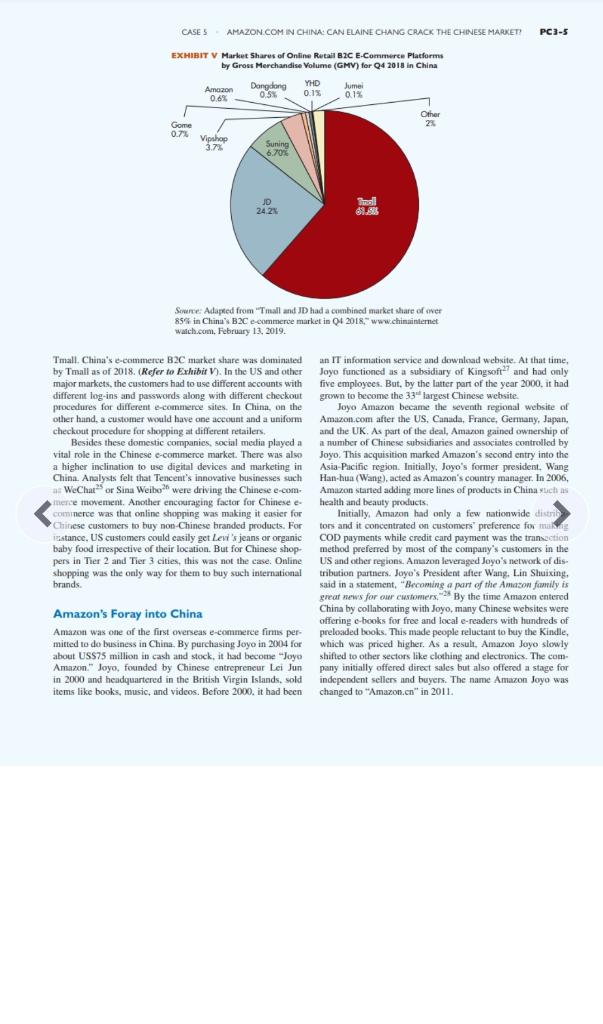

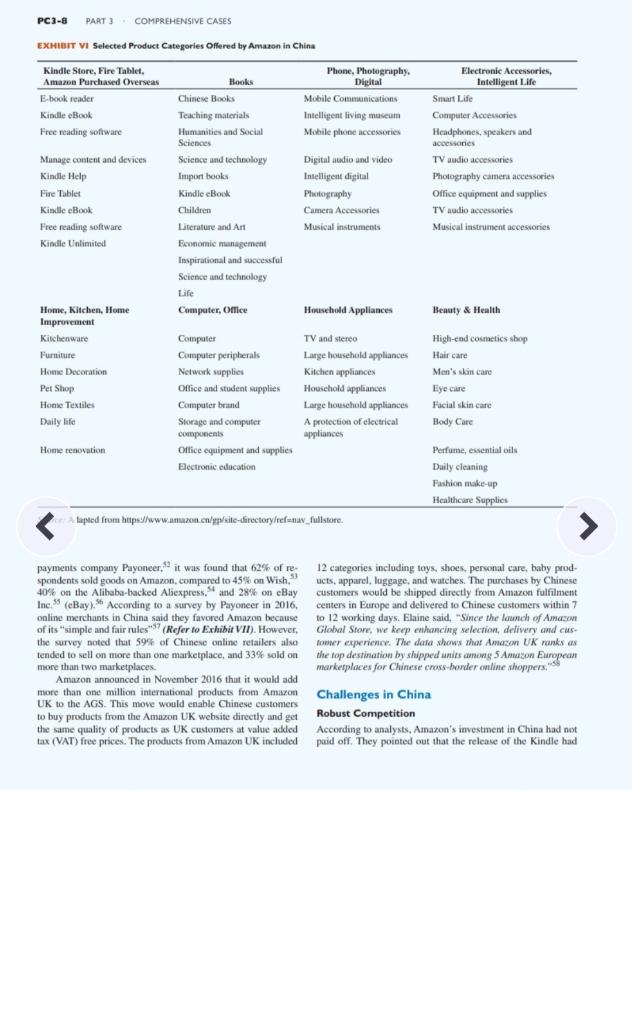

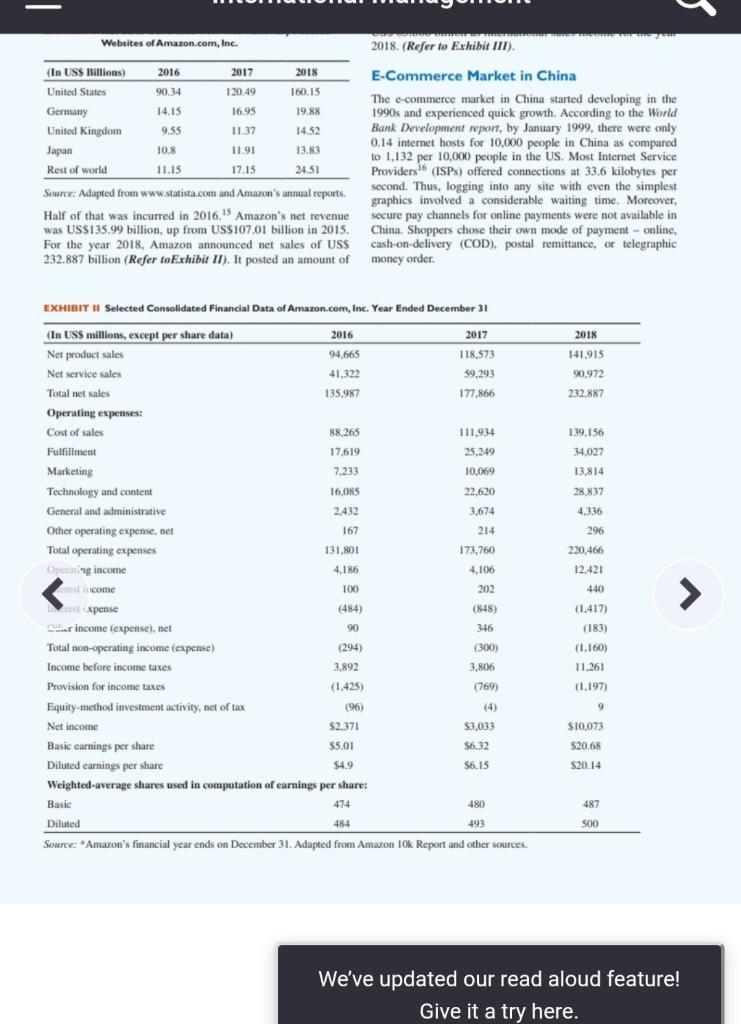

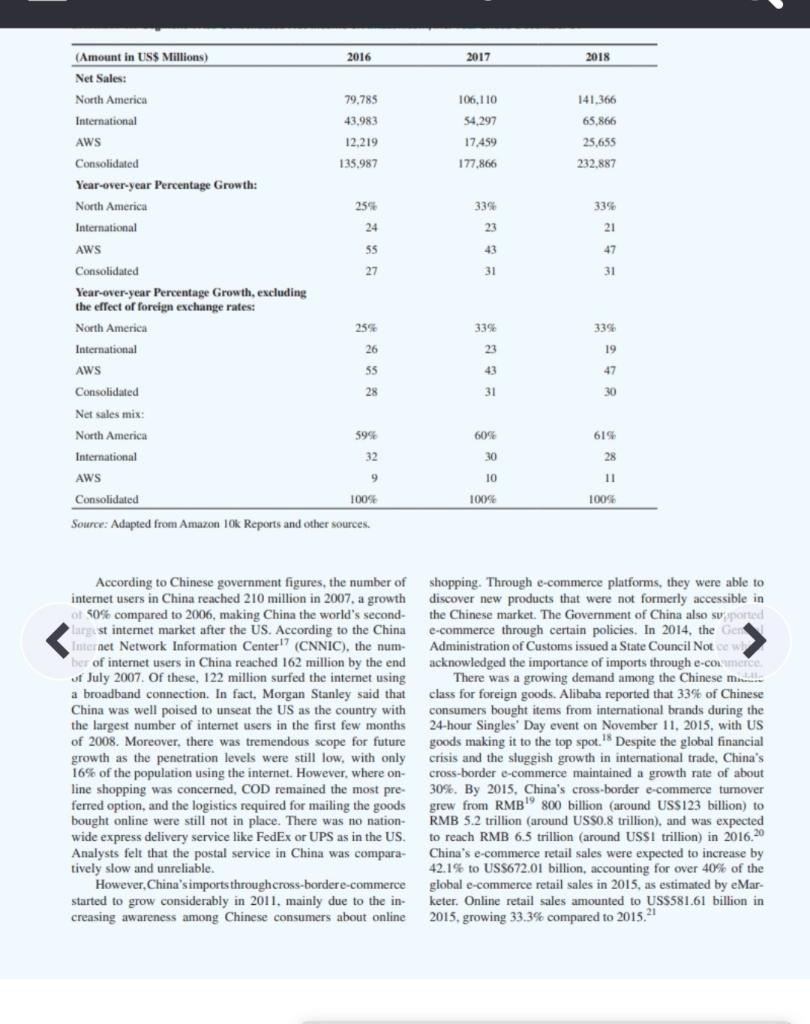

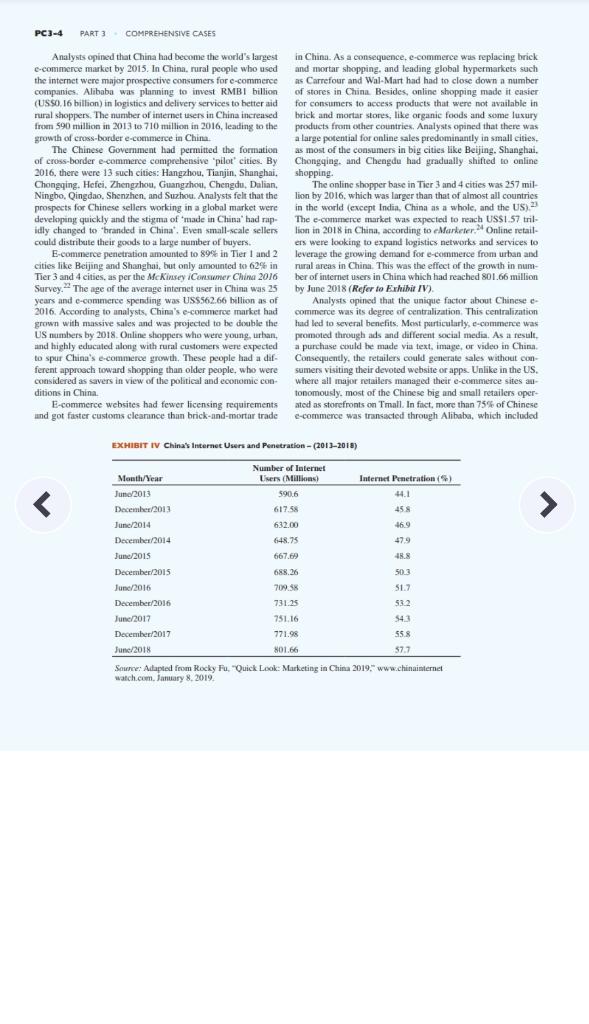

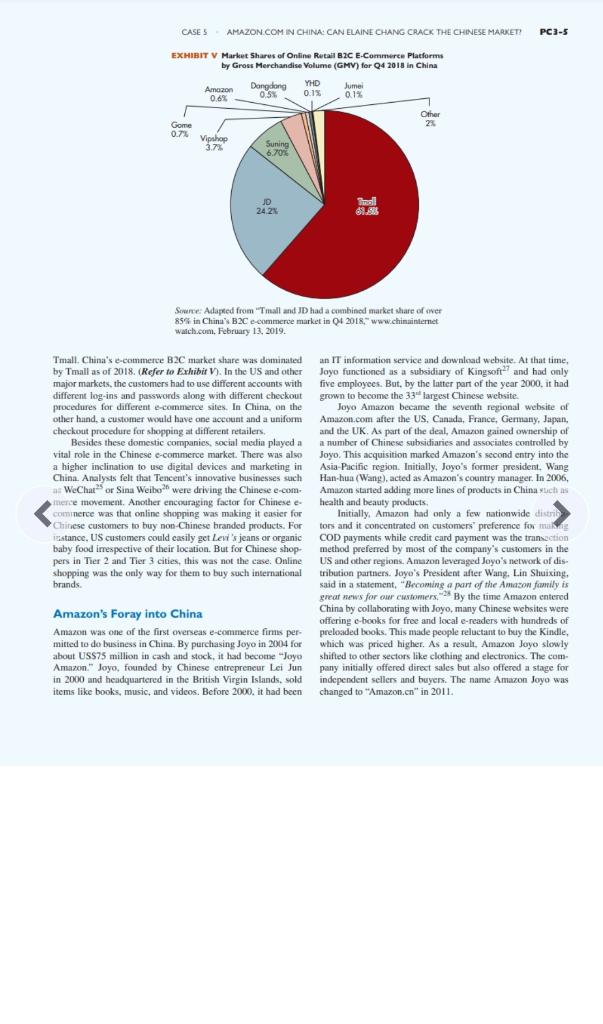

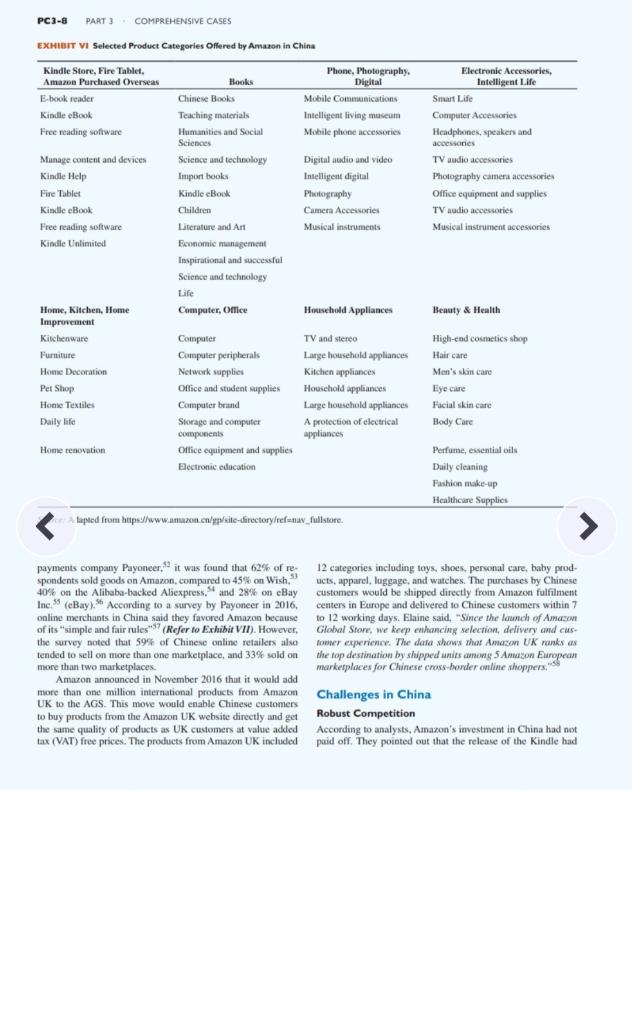

PART 3: Comprehensive Cases ICMR ml Center for Management Buisonch Case 5 Amazon.com in China: Can Elaine Chang Crack the Chinese Market? www.mineers This one was written by Kati Vined Babu, under the direction of Delaprati Purkaasti. Tas Hyderabad "China is a very important market for Amazon. We're commer ted to growing our business here." "The demand for international brands is rising rapidly, thanks to cross-border online shopping, which is probe ably one of the fastest rising trends in e-commerce -ELAINE CHANG, VICE PRESIDENT OF AMAZON AND PRESIDENT OF AMAZON CHINA, IN 2017 "Amazem is a prime example of a company which thought it could succeed in an entirely different market just by continuing to do business as usual ...). This method of going about globalizing a product will almost never result in good success and analysts are actually calling for Amazon to pull out of China. CLAYTON JACOBS, AN ENTREPRENEUR-IN-RESIDENCE WITH AND THE HEAD OF CROSS-CULTURAL DESIGN, AT READ WRITE, IN 2017 Amazon.com, Inc. (Amazon) entered China in 2004, taking over Joyo.com (Joyo) for US$75 million. But as of mid-2018, Amazon held less than a 1% e-commerce market share in Chi na, according to research firm eMarketer Analysts pointed out that despite its global growth, Amazon had not been able to make a mark in China. Amazon was facing stiff competition from local companies such as Jingdong Mall (D), Tencent Holdings Limited (Tencent). Taobao Mall (Tmall) owned by Alibaba Group Holding Limited (Alibaba), etc., despite the scorching growth of e-commerce in China. Apart from stiff local competition, factors such as censor ship by Chinese regulators over the internet, restrictions on for eign investment, and counterfeit sellers, were posing big chal- lenges for the company in China. Analysts were left wondering whether Amazon had localized its innovations enough to ap- peal to the Chinese consumers and whether Amazon had really understood the Chinese-commerce market. While speculations were on about Amazon merging a certain portion of its overseas VP of Amazon and Amazon China president, had the big re- sponsibility of streamlining Amazon's operations in the country and overcoming the challenges. prices, a wide selection, and a great customer experience, Amazon was able to drive traffic (customers and increase sales, which in tum attracted third-party sellers and accelerated the wheel. In 2002, Amazon identified a new arena of growth by launching Amazon Web Services (AWS), a platform of computing services offered online for other websites or client side applications by Amazon. These web services provided developers access to Amazon's technology infrastructure that they could use to run virtually any type of business. The move was largely successful and within five years of its launch, AWS had grown into one of the largest computing services platforms in the world In 2003, Amazon expanded its overseas business by launching international websites in Asia-Pacific and European countries. To deliver goods to end consumers at a reasonable price, Amazon employed a business model called the Online Retailers of Physical Goods' wherein it obtained products di- rectly from the distributors rather than stocking all the goods in its warehouse. In 2005, it launched a free shipping program for its customers called Amazon Prime 12 wherein customers received free two-day shipping on their purchases for a fee of US$79 per year. In 2006, Amazon developed a new business model aimed at serving an entirely different customer--the third-party seller. The company offered fulfilment services to sellers through the Fulfilment by Amazon (FRA) program where merchants sent cartons of their products to Amazon's warehouses while Amazon took the orders online, shipped the products, answered queries, and processed returns. In late 2007, it released the Kindle e-book reader for which it had to partner with indepen- dent publishers to generate content for the kindle. In July 2009, Amazon acquired US-based online shoe re- tailer Zappos." In 2012, it forayed into the world of designer fashion, selling high-end clothing, shoes, handbags, and acces sories through its website, Amazon Fashion Amazon had individual retail websites for the US, the UK and Ireland, France, Canada, Germany, Italy. Spain the Netherlands, Australia, Brazil, Japan, China, India, and Mexico. As of 2015, the e-retailer reported more than 304 mil- lion active customer accounts worldwide. Due to Amazon's global scope and reach, it was also considered one of the most valuable brands worldwide. However, Amazon's interna- tional segment was much less compared to North American market by size as Amazon got a major portion of its income from its US market (Refer to Exhibit I). Its growth rate was also less than that in its home market. The company posted a total operating loss abroad of more than US$2.6 billion. About Amazon Amazon was founded in June 1994 by Jeff Bezos (Bezos). In June 1995, he launched his online bookstore, Amazon.com. It soon increased its product portfolio and became a force to reckon with in retailing Analysts felt that by offering low PC3-1 4 Websites of Amazon.com, Inc. 2018. (Refer to Exhibit III). (In USS Billions) 2016 2017 2018 E-Commerce Market in China United States 90.34 120.49 160.15 The e-commerce market in China started developing in the Germany 14.15 16.95 19.88 1990s and experienced quick growth. According to the World United Kingdom 9.55 11.37 14.52 Bank Development report, by January 1999, there were only Japan 10.8 0.14 internet hosts for 10,000 people in China as compared 11.91 13.83 to 1.132 per 10,000 people in the US. Most Internet Service Rest of world 11.15 17.15 24.51 Providers 16 (ISPs) offered connections at 33.6 kilobytes per Source: Adapted from www.statista.com and Amazon's annual reports, second. Thus, logging into any site with even the simplest graphics involved a considerable waiting time. Moreover, Half of that was incurred in 2016." Amazon's net revenue secure pay channels for online payments were not available in was US$135.99 billion, up from US$107.01 billion in 2015. China. Shoppers chose their own mode of payment - Online, For the year 2018, Amazon announced net sales of US$cash-on-delivery (COD). postal remittance, or telegraphic 232.887 billion (Refer toExhibit II). It posted an amount of money order. 2018 141.915 90.972 232.887 139.156 34,027 13,814 28,837 4,336 296 220,466 12.421 EXHIBIT HI Selected Consolidated Financial Data of Amazon.com, Inc. Year Ended December 31 (In USS millions, except per share data) 2016 2017 Net product sales 94.665 118,573 Net service sales 41.322 59,293 Total net sales 135.987 177,866 Operating expenses: Cost of sales 88.265 111.934 Fulfillment 17.619 25,249 Marketing 7.233 10,069 Technology and content 16,085 22,620 General and administrative 2,432 3,674 Other operating expense, net 167 214 Total operating expenses 131,801 173,760 Operating income 4.186 4,106 cest income 100 202 expense (484) (848) income (expense), net 90 346 Total non-operating income (expense) (294) (300) Income before income taxes 3,892 Provision for income taxes (1.425) (769) Equity-method investment activity, net of tax (96) (4) Net income $2,371 $3,033 Basic earnings per share $5.01 56.32 Diluted camnings per share $4.9 $6.15 Weighted average shares used in computation of earnings per share: Basic 474 480 Diluted 484 493 Source: Amazon's financial year ends on December 31. Adapted from Amazon 10k Report and other sources. 440 > (1.417) 3,806 (183) (1.160) 11.261 (1.197) 9 $10.073 $20.68 $20.14 487 500 We've updated our read aloud feature! Give it a try here. 2016 2017 2018 (Amount in US$ Millions) Net Sales: North America International 79,785 141.366 106,110 54,297 43.983 65,866 AWS 17.459 25.655 12.219 135,987 177.866 232.887 Consolidated Year-over-year Percentage Growth: North America International 255 335 335 24 23 21 55 43 47 27 31 31 AWS Consolidated Year-over-year Percentage Growth, excluding the effect of foreign exchange rates: North America International 255 339 339 26 23 19 AWS 55 43 47 Consolidated 28 31 30 Net sales mix North America 599 60% 615 International 32 30 28 AWS 9 10 11 Consolidated 100% 100% 1005 Source: Adapted from Amazon 10k Reports and other sources. There was importance the la According to Chinese government figures, the number of shopping. Through e-commerce platforms, they were able to internet users in China reached 210 million in 2007, a growth discover new products that were not formerly accessible in of 50% compared to 2006, making China the world's second- the Chinese market. The Government of China also suported st internet market after the US. According to the China Internet Network Information Center? (CNNIC), the num e-commerce through certain policies. In 2014, the Administration of Customs issued a State Council Note of internet users in China reached 162 million by the end acknowledged the imports through e-cou uf July 2007. Of these, 122 million surfed the internet using a broadband connection. In fact, Morgan Stanley said that for foreign goods. Alibaba reported that 33% of class Mans China was well poised to unseat the US as the country with ported that 33% of Chinese consumers bought items from international brands during the largest number of internet users in the first few months 24-hour Singles Day event on November 11, 2015, with US of 2008. Moreover, there was tremendous scope for future goods making it to the top spot. ' Despite the global financial growth as the penetration crisis and the sluggish growth in international trade, China's 16% of the population using the internet. However, where only cross-border e-commerce maintained a growth rate of about line shopping was concerned, COD remained the most pre- 30%. By 2015, China's cross-border.com e-commerce turnover and the logistics required for mailing the goods grew from RMB 800 billion (around USS123 billion) to bought online were still not in place. There was no nation- wide express delivery service like FedEx or UPS as in the US. RMB 6.5 trillion (around USSI trillion in 2016,20 Analysts felt that the postal service in China was compara- e-commerce retail sales were expected to increase by tively slow and unreliable. 42.1% to US$672.01 billion, accounting for over 40% of the However, China'simports through cross-bordere-commerce global e-commerce retail sales in 2015, as estimated by eMar- started to grow considerably in 2011. mainly due to the in- keter. Online retail sales amounted to US$581.61 billion in creasing awareness among Chinese consumers about online 2015. growing 33.3% compared to 2015.21 ferred to TO China's PC3-4 PART 3 COMPREHENSIVE CASES Analysts opined that China had become the world's largest e-commerce market by 2015. In China, rural people who used the internet were major prospective consumers for e-commerce companies. Alibaba was planning to invest RMBI billion (USSO. 16 billion) in logistics and delivery services to better aid rural shoppers. The number of internet users in China increased from 590 million m 2013 to 710 million in 2016, leading to the growth of cross-border e-commerce in China The Chinese Government had permitted the formation of cross-border e-commerce comprehensive 'pilot' cities. By 2016, there were 13 such cities: Hangzhou, Tianjin, Shanghai, Chongqing. Hefei, Zhengzhou, Guangzhou, Chengdu, Dalian, Ningbo, Qingdao, Shenzhen, and Suzhou. Analysts felt that the prospects for Chinese sellers working in a global market were developing quickly and the stigma of made in China'had rap- idly changed to 'branded in China'. Even small-scale sellers could distribute their goods to a large number of buyers, E-commerce penetration amounted to 89% in Tier 1 and 2 cities like Beijing and Shanghai, but only amounted to 62% in Tier 3 and 4 cities, as per the McKinsey iConsumer China 2016 Survey. The age of the average internet user in China was 25 years and e-commerce spending was US$562.66 billion as of 2016. According to analysts, China's e-commerce market had grown with massive sales and was projected to be double the US numbers by 2018. Online shoppers who were young, urban, and highly educated along with rural customers were expected to spur China's e-commerce growth. These people had a dif- ferent approach toward shopping than older people, who were considered as savers in view of the political and economic con ditions in China. E-commerce websites had fewer licensing requirements and got faster customs cleanince thun brick-and-mortar trade in China. As a consequence, e-commerce was replacing brick and mortar shopping, and leading global hypermarkets such as Carrefour and Wal-Mart had had to close down a number of stores in China. Besides, online shopping made it easier for consumers to access products that were not available in brick and mortar stores, like organic foods and some luxury products from other countries. Analysts opined that there was a a large potential for online sales predominantly in small cities, as most of the consumers in big cities like Beijing, Shanghai, Chongqing, and Chengdu had gradually shifted to online shopping. The online shopper base in Tier 3 and 4 cities was 257 mil- lion by 2016, which was larger than that of almost all countries in the world (except India, China as a whole, and the US) The e-commerce market was expected to reach US$157 tril- lion in 2018 in China, according to cMarketer. Online retail- ers were looking to expand logistics networks and services to leverage the growing demand for e-commerce from urban and rural areas in China. This was the effect of the growth in num her of internet users in China which had reached 801.66 million by June 2018 (Refer to Exhibit IV). Analysts opined that the unique factor about Chinese commerce was its degree of centralization. This centralization had led to several benefits. Most particularly, e-commerce was promoted through ads and different social media. As a result, a purchase could be made via text, image, or video in China. Consequently, the retailers could generate sales without con sumers visiting their devoted website or apps. Unlike in the US where all major retailers managed their e-commerce sites au tonomously. most of the Chinese big and small retailers oper ated as storefronts on Tmall. In fact, more than 75% of Chinese e-commerce was transacted through Alibaba, which included EXHIBIT IV China's Internet Users and Penetration - (2013-2018) ) 160 5.9 179 Number of Internet Month/Year Users ( Mos) Internet Penetration (S) June 2013 5906 44.1 December 2013 617.58 45 June/2014 Desc2014 648.75 June 2015 Sun/2013 667.69 48.8 December 2015 688.26 50.3 June/2016 709 517 December 2016 731.25 June 2012 751.16 543 December 2017 771.98 55.8 Jun/2018 NO. 577 Source: Adapted from Rocky Pu. "Quick Look: Marketing in China 2019. www.chinainternet watch.com. January 8, 2019 CASES AMAZON.COM IN CHINA: CAN ELAINE CHANG CRACK THE CHINESE MARKET PC3-5 EXHIBIT V Market Shares of Online Retail B2C E-Commerce ( Amazon Dangdong YHD Jumei 0.6% 0.5% 0.1% 0.1% Other 2% Gome 0.7% Vigshop 3.7% Suning 6.70% JD 24,2% Troll 81. Source: Adapted from "Tmall and JD had a combined market share of over 854 in China's B2C e-commerce market in Q4 2018," www.chinainternet Watch.com, February 13, 2019. Tmall. China's e-commerce B2C market share was dominated by Tmall as of 2018. (Refer to Exhibit V). In the US and other major markets, the customers had to use different accounts with different log-ins and passwords along with different checkout procedures for different e-commerce sites. In China, on the other hand, a customer would have one account and a uniform checkout procedure for shopping at different retailers Besides these domestic companies, social media played a vital role in the Chinese e-commerce market. There was also a higher inclination to use digital devices and marketing in China. Analysts felt that Tencent's innovative businesses such WeChat or Sina Weibo were driving the Chinese e-com- merce movement. Another encouraging factor for Chinese commerce was that online shopping was making it easier for Chinese customers to buy non-Chinese branded products. For Istance. US customers could casily get Levi's jeans or organic baby food imespective of their location. But for Chinese shop pers in Tier 2 and Tier 3 cities, this was not the case. Online shopping was the only way for them to buy such international brands. an IT information service and download website. At that time, Joyo functioned as a subsidiary of Kingsoft and had only five employees. But, by the latter part of the year 2000, it had grown to become the 33 largest Chinese website Joyo Amazon became the seventh regional website of Amazon.com after the US, Canada, France, Germany, Japan, and the UK. As part of the deal, Amazon gained ownership of a number of Chinese subsidiaries and associates controlled by Joyo. This acquisition marked Amazon's second entry into the Asia-Pacific region. Initially, Joyo's former president, Wang Han-hua (Wang), acted as Amazon's country manager. In 2006, Amazon started adding more lines of products in China such as health and beauty products. Initially, Amazon had only a few nationwide distri tors and it concentrated on customers' preference fox COD payments while credit card payment was the transaction method preferred by most of the company's customers in the US and other regions. Amazon leveraged Joyo's network of dis tribution partners. Joyo's President after Wang, Lin Shuixing, said in a statement, "Becoming a part of the Amazon family is great news for our customers. By the time Amazon entered China by collaborating with Joyo, many Chinese websites were offering e-books for free and local e-readers with hundreds of preloaded books. This made people reluctant to buy the Kindle, which was priced higher. As a result, Amazon Joyo slowly shifted to other sectors like clothing and electronics. The com pany initially offered direct sales but also offered a stage for independent sellers and buyers. The name Amazon Joyo was changed to "Amazon.cn" in 2011 Amazon's Foray into China Amazon was one of the first overseas e-commerce firms per- mitted to do business in China. By purchasing Joyo in 2004 for about US$75 million in cash and stock, it had become "Joya Amazon." Joyo, founded by Chinese entrepreneur Lei Jun in 2000 and headquartered in the British Virgin Islands, sold items like books, music, and videos. Before 2000. it had been PC3-6 PART 3 COMPREHENSIVE CASES As of 2017. Elaine was the president of Amazon China, responsible for the strategy, business development, and overall management of Amazon's e-commerce business and the Kindle business in the country. Elaine joined Amazon as vice president and general manager of Kindle China in May 2013. She led the team to develop the Kindle and digital publishing ecosystem by successfully bringing Kindle's full product portfolio to China, growing Kindle's selection to 420.000 e-books, and building partnerships with more than 660 publishers and importers Elaine was a Bachelor of Science in Electrical Engineering from the University of Washington and a Fellow of the fifth class of the China Fellowship Program and a member of the Aspen Global Leadership Network. Prior to joining Amazon, she had worked for Intel Corporation for around 20 years, hold ing several management positions in the US, the Asia Pacific, and China. In December 2016, Elaine was also recognized as one of the top 25 influential businesswomen by Fortune China 21 Amazon's Expansion in China In China, Amazon had ten operation centers and 400,000 square meters of logistics-based floor space by 2011. It had signed a memorandum of understanding (MOU) with the Beijing and Ningxia governments to develop cloud computing services in 2013. As a result, it expanded AWS to China in 2014. As part of that mee, AWS China developed an incubator in partner ship with the Shanghai Jiading Industrial Zone Development (Group) Co. Lid. It associated with local players to provide groundwork to support AWS, and also started a program to nur- ture more localized services to run in the AWS cloud. The local players included ChinaNet Center and SINNET, which would be providing data centers and ISP services such as infrastruc ture, bandwidth, and network capabilities. Analysts felt that this was an intensive effort by Amazon to get more business from larger corporations but also to leverage a growing community of smaller and medium-sized businesses in China. Andy Jassy, senior vice president, AWS. commented, and prospective AWS customers have asked us to dal AWS Region in China China represents an im Joan Fong-term market segment for AWS. We are looking Hurd 10 working with Chinese customers, partners, and government institutions to help small and large organisations ite cloud computing to innovate and deploy faster, save mmey. expand their peographie reach, and do so without sacrificing security, availability, data durability, and reliability. 34 Amazon entered into a tripartite memorandum of under- standing (MOU) with China (Shanghai) Free Trade Zone (FTZ) and Shanghai Information Investment Inc." in 2014. According to this MOU, the three parties would undertake cross-border e-commerce business and construct an online cross-border- commerce platform, using which Chinese consumers could easily buy products that were offered in other countries by Amazon Global. Under the MOU, Amazon would capitalize and construct Amazon China International Trade headquarters in the FTZ endorsing Shanghai as a global hub for cross-border trade. In the meantime, Amazon intended to build logistics and Warehousing centers in FTZ. As a result, the product selected on Amazon.cn would enter the Chinese foreign trade zone through the cross-border e-commerce platform, while domestic high-quality products from small and medium-sized enterprises (SMEs) would be exported to overseas markets. Amazon launched the Amazon Global Store (AGS) in November 2014 to meet the robust demands of Chinese con sumers for imported products. Globally, this was the first AGS that had a local website and offered a localized shopping expe rience. AGS worked on bringing in genuine and high-quality products to Chinese consumers through direct imports. Doug Gurr (Gurr), then president of Amazon China, said, "Around 5 million international anders have been placed since last November through the AGS an Zen and direct shipment through Amazon global sites in the US and European Union The statistics have shown thar sales through the AGS on Zon tripled in the first five months of 2015. According to AC Nelson. over 50% of Chinese consumers who shopped on overseas web. sites have wsited AGS on Zen since its launch. We take China as a strategically important locale from a global perspective und will continue to invest in China." -37 Amazon increased its logistics operations in China to control the increasing cost of shipping billions of packages. Its plans in China included managing cargo and customs for goods directed to parts in Japan, Europe, and the US. This service was started to serve Amazon's own retail operations and also hosted data for other companies. Michael Yeo, analyst at market research firm IDC said. "The licenses that Amicon he received not only strengthens its own position as a familment channel for its own Crusharder trade, but also allows it to act as a potential competi for to the likes of DHL, FedEx and UPS in delivery services In addition to this, Amazon had submitted its expansion plans in documents filed with the Chinese regulators in 2015, Amazon registered its Chinese subsidiary, Beijing Century Joyo Courier Service as a freight forwarder which did not ship but looked after customs and other documentation with China's transport ministry in 2015, allowing it to export cargo out of China Beijing Century Joyo Courier Service also made ar. allel application with the US Federal Maritime Commission (FMC) in November 2015. Amazon also filed an applic with the Shanghai Shipping Exchange to assist as a shipping broker for 12 trade routes, including Shanghai to Los Angeles and Shanghai to Hamburg In 2015, Amazon launched a virtual store on Alibaba's Tmall to attract the Chinese shoppers. Items like imported food, shoes, toys, and kitchenware sourced directly from over- seas suppliers were listed on Amazon's store on Tmall. Candice Huang, a spokeswoman for Hangzhou, Alibaba, commented "We welcome Awesome to the Alibaba ecosystem, and their presence will further broaden the selection of international products and elevate the shopping experience for Chinese cow sumers on Tmall. This partnership resulted in Amazon get- ting access to 334 million active buyers on Tmall, and increas- ing awareness of its brand in China. Forrester Research analyst Sucharita Mulpur commented. "Everyone knows that Chinese e-commerce is dominated by Alilala and are point you go fish where the fish are CASES AMAZON.COM IN CHINA CAN ELAINE CHANG CRACK THE CHINESE MARKET PC3-7 In 2015, Amazon acquired Twitch." a platform to watch account. According to Wang. 70% of Chinese buyers chose to e-sports or organized video gaming competitions for USS970 pay when the goods were delivered. To make it convenient for million. The acquisition was made to leverage the fame of Chinese customers, Amazon introduced portable Point of Sale Twitch, which had a market of approximately US$612 million (POS) so that the customers could pay the delivery man via a per year and 134 million viewers, credit card at their doorstep. Wang said "Localizing your ser In another effort to gain a share in the Chinese e-commerce vice isn't about what you and I think it's about how the market market. Amazon launched its Prime service in China in October 2016, expecting to repeat the success it had had with the service Amazon also created a Chinese domain name Z.cn, which in the US and other markets in the West. Chinese Prime users was re-directed to Amazon's Chineseofficial website Amazon.cn would be able to get free shipping on orders for overseas prod. The modification was done because Amazon being an English ucts with a minimum purchase for RMB 200 (US$29.50) and word, it was tough for Chinese consumers to remember it. In goods sold within China would be delivered for free. The Prime addition, China was the only country in the world in which membership cost RMB 388 a year (USS57) in China. Amazon Amazon delivered goods on its own. Amazon customers could Prime members could also avail of unlimited free shipping with receive their procurements usually within 2.5 days. This was no minimum purchase on more than 9 million domestic prod- possible because of the 160,000 square meter warehouse lo ucts. To appeal to Chinese consumers, Amazon had reduced cated in Tianjin, north-eastern China. The Amazon delivery the annual membership fee to RMB188 (about US$28) for the service functioned not only in major cities like Beijing and first four months after Amazon Prime's introduction in China. Shanghai but also covered many second tier cities as Amazon However, JD and Alibaba also had membership programs was not subcontracting delivery in China. which were priced lower than Amazon Prime Amazon first started to allow Chinese merchants to sell Amazon opened a showroom in Sanlitun Square in Beijing on Amazon's global sites in 2007. It expanded its app store to in November 2016, presenting imported goods from the e-re China in 2013 as mobile apps users in China had a strong liking tailers of the US and UK e-commerce sites. Customers could for their local language (simplified Chinese) and close to 70% explore different product categories such as Kitchenware, of free downloads in China were from apps that supported sim- children's products, apparel, and electronies. They could get plified Chinese. With the Amazon Prime membership. Amazon demos of the products and purchase them from Amazon.cn. was focussing on enhancing Amazon's mark in China by mak by scanning the product's bar code using their mobile devices. ing it more reasonable to buy forcign products from its site. The merchandise comprised some of the 10 million products Amazon launched a project called Amazon Launchpad" in Amazon sold in China through the imported products section 2014, which provided a platform for exceptional products and of Amazon.cn called Hawaigow, which meant huy from over start-ups in China. The project could successfully help start-ups seas' in Chinese reach most Amazon consumers globally and consumers to get Amazon planned to hire a Chinese content development different products of their choice. Amazon also introduced its team in 2017 to entice studio heads and discuss deals for local Fire tablet in China in 2015. The tablet came installed with movies and TV shows, including original content. However, the feature of an English learning task to offer a personalized experts felt that launching a domestic video service would be reading experience for the different English levels of users a bold step in a country where the media was severely cen Amazon launched a Chinese language version of its man kored by regulators, Russ Grandinetti, Senior Vice President agement system in 2015 for its US and UK websites in 2015 Amazon, in a statement about the launch, said, "Launching Through this, Chinese merchants could get the beneta lique program designed for our Chinese customers shows global product listing service that would enable them up I session with Chinese customer needs and demonstrates product listings and sell them. Fulfilment by Amaz aw long-term commitment to growing our business in China. was introduced for Chinese sellers which would enable we will continue to innovate for customers in China to deliver ship to only one warehouse in Europe, which would delis... mone wale wertime 26 European countries with after-sales service. To help Chinese merchants sell more overseas through Localization Amazon.com, Amazon held different events in Shenzhen and other areas in China. Sebastian Gunningham, global senior According to experts, many successful multinational compa vice president at Amazon, commented, Amacon has an edge nies had failed in the Chinese markets because they could not to help Chinese commies expand out of Chin. We operate . design an effective localization strategy. China's language 109 fulfillment centers and serve 285 million active users all culture, and politics offered distinctive challenges for inter over the world. We plan to increase our ability to facilitate national companies. Amazon had been trying hard to hit the Chinese manufacture creating their own brands for global sweet spot in this regard in China. For instance, non-Chinese consumers. customers typically clicked and hit the back button when they Amazon was also offering a wide range of products were looking back and choosing products. But the Chinese cus- to Chinese customers by localizing the products according tomers preferred to open different windows in their browsers to the preferences of Chinese customers (Refer to Exhibit tabs to explore and choose products, and the composition of VI). According to a survey conducted among 900 Chinese the Amazon.cn website had to take this browsing behavior into e-commerce sellers by US-based Business Business online PC3-8 PART 3 COMPREHENSIVE CASES EXHIBIT VI Selected Product Categories Offered by Amazon in China Kindle Store, Fire Tablet, Amazon Purchased Overseas E-book reader Kindle eBook Free reading software Phone, Photography, Digital Mobile Communications Intelligent living museum Mobile phone accessories Electronic Accessories, Intelligent Life Smart Life Computer Accessories Headphones, speakers and accessories TV audio accessories Photography camera accessories Office equipment and supplies TV audio accessories Musical instrument accessories Books Chinese Books Teaching materials Humanities and Social Sciences Science and technology Import books Kindle eBook Children Literature and Art Economic management Inspirational and successful Science and technology Life Computer, Office Munage content and devices Kindle Help Fire Tablet Kindle eBook Free reading software Kindle Unlimited Digital audio and Video Intelligent digital Photography Camera Accessories Musical instruments Home, Kitchen, Home Improvement Household Appliances Beauty & Health Kitchenware Furniture Home Decoration Pet Shop Home Textiles Daily life Computer Computer peripherals Network supplies Office and student supplies TV and stereo Large household appliances Kitchen appliances Household appliances Large household appliances A protection of electrical High-end cosmetics shop Hair care Men's skin care Eye care Facial skin care Body Care Computer brand appliances Home renovation Storage and computer components Office equipment and supplies Electronic education Perfume, essential oils Daily cleaning Fashion make-up Healthcare Supplies lapted from http://www.amazon.com/gpite-directory ref-nav_fullstore. payments company Payoneer. it was found that 62% ofre 12 categories including toys, shoes, personal care, baby prod. spendents sold goods on Amazon, compared to 45% on Wish. ucts, apparel, luggage, and watches. The purchases by Chinese 40% on the Alibaba-backed Aliexpress. 4 and 28% on eBay customers would be shipped directly from Amazon fulfilment Ine 5 (eBay). According to a survey by Payoneer in 2016, centers in Europe and delivered to Chinese customers within 7 online merchants in China said they favored Amazon because to 12 working days. Elaine said, "Since the launch of Amazon of its simple and fair rules7 (Refer to Exhibit VII). However, Global Store, we keep ethancing selection, delivery and cus- the survey noted that 59% of Chinese online retailers also Tomer experience. The data shows that Amazon UK ranks as tended to sell on more than one marketplace, and 33% sold on the top destination by shipped units among 5 Amazon European more than two marketplaces marketplaces for Chinese cross-border online shoppers." Amazon announced in November 2016 that it would add more than one million international products from Amazon Challenges in China UK to the AGS. This move would enable Chinese customers to buy products from the Amazon UK website directly and get Robust Competition the same quality of products as UK customers at value added According to analysts, Amazon's investment in China had not tax (VAT) free prices. The products from Amazon UK included paid off. They pointed out that the release of the Kindle had CASES AMAZON.COM IN CHINA CAN ELAINE CHANG CRACK THE CHINESE MARKETI PC3-9 c3-4 EXHIBIT VN Top Online Marketplaces among Chinese Sellers as of 2016 45% 40% 28% 19% 8% 5 41 32 3%, 2 With Other Lorado E-Bay Esty Amazon D.com Aliexpress Cdiscount Neweg Lino Juma Source: Adapted from www.businessinsider.com. not been successful and wondered why Amazon had not added Apart from Alibaba, the major competitor for Amazon a Kindle store on its Chinese website till December 2012. By in China was JD, which worked on a direct sales model like that time, its competitor sites had four times the number of Amazon while also having an open market platform like Chinese language books as Amazon's Kindle Store. Moreover, Tmall. eMarketer forecasting director Monica Peart com- Amazon had moved ahead with the launch of its kindle store mented, "Alibaba, Tmall and JD positioned themselves well in China without offering a Kindle Fire or Kindle e-reader. to capitalize on growing consumer demand by creating their As a result, Chinese customers could only read Amazon's e- OW payment systems (e... Alibaba's Alipay and logistical books using a Kindle app on their iPhone, iPads, or Android services (eg. JD operates a self-owned logistics network). In devices. However, Amazon's model of making money from addition, with rising incomes and increased internet access selling e-books appeared unfeasible in China, where online in rural areas the cultural appetite to shop digitally will con content piracy was rampant. Some analysts felt that the first tinae.. Strategic move by Amazon to buy Joyo did not appear to really Amazon and Alibaba functioned on different business benefit it. models. Alibaba operated on Tmall where it directly sold Amazon attributed this situation to regulatory problems goods and services to the customers online. In contrast. in launching its cloud service, which was essential for users Amazon bought goods and services from different suppliers tore and access the books they purchased. As Amazon was in wholesale and sold them to customers online. Analys gling to launch its cloud service in China, local competi- pointed out that Amazon had moved into the Chine con like Alibaba's Aliyun" (Ali Cloud) and Western brands like ket with the same strategy and attitude intended for me Dep Box were contending fiercely for cloud market shares customers. For instance, while Amazon's compens in in China. Eventually, Amazon's cloud service was released in China offered different online payment options for cu China in 2013, ers, Amazon opted for some of those options only much later. Some analysts contended that Amazon's strategy of oper- Further, customers found products priced lower on other sites ating as an autonomous online store was not fruitful in China as than on Amazon. Alibaba's murket supremacy prevented any new player from en Analysts pointed out that Amazon's competitors like Tmall tering the e-commerce customer space. Therefore, Amazon de in China had gained deep insights into the Chinese customers' cided to open a store on Tmall to gain more exposure to China's needs and preferences. For instance, as Tmall had poor online huge customer hase. Analysts opined that Amazon, had, how support for international credit cards, it offered a wide selection ever, failed to recognize the requirements of the Chinese online of alternative money payment options. Most Chinese consum buyers. For instance, it provided product criticisms for each es did not have a credit card. The average income of Chinese listed item, whereas Tmall had an additional chat feature along customers was low when compared to Japanese or American with criticisms which permitted Chinese customers to interact customers and even if a Chinese customer had a steady income. directly with the seller. Analysts opined that Chinese consum he was issued a pre-paid debit card with VISA or MasterCard, ers preferred Tmall to Amazon for this reason as Tmall per Moreover, Alipay was one of the most prevalent on-line pay- mitted the customers to bargain over the price with the seller ment methods, and Amazon had not joined this payment before purchasing a product. gateway PC3-10 PART) COMPREHENSIVE CASES Another problem that Amazon faced in China was that its inferior-quality products. Consumers had trouble differentiat- shipping speed was relatively slow. Amazon could not run its ing between genuine products and fake products because the own parcel delivery system as JD did since it did not possess "Fulfilment by Amazon program authorized the purchases. sufficient knowledge of Chinese locations, nor could it assol This situation had left consumers in a dilemma as they tried to ate with delivery companies as diligently as its rivals such as figure out which products were legitimate Amazon, however, Alibaba. Amazon's main transport source was SF Express contended that it maintained a strict policy against counterfeit- (Shunfeng). In addition, Amazon operated its own Amazon ers: "Amason does not allow the sale of counterfeit item on its Prime delivery service called yuanpei which served only cen- Marketplace and currence of counterfeit products are very tral areas of major cities in China. rare. Every customer who orders on Amazon is covered by our Amazon's acquisition of Twitch also proved a disaster as A-Z guarantee and if they do receive counterfeir gends from a Wang Sicong (Sicong), a Chinese billionaire announced the marketplace seller we will refund or replace that item unveiling of his Panda TV"* to compete with Amazon. Sicong Elaine rolled out a new policy in 2017 in China to support employed Chinese as well as overseas gaming talent and imple the listed brands on Amazon by trying to shut down counterfeit mented strategies to leverage the synergy of e-sports and enter- sellers. Many of these counterfeit sellers were based in China. tainment. Sicong, who was flush with funds and familiar with and it was a challenge for Elaine to stop them from entering the local Chinese gaming culture, was well positioned to take Amazon's supply chain. Amazon also filed lawsuits against on Amazon both counterfeit sellers and fake product reviewers. The com pany spent a lot of money and employed experts to watch out Fraudulent and Counterfeit Sellers for fakes Another problem for Amazon in China was fraudulent third- party sellers, based mostly in China, who usually failed to de Chinese Government Regulations liver the orders. According to the media reports, a seller would China was particular about regulating the internet. Access to open a new account on Amazon.en and start choosing prevalent the internet was possible only through state-owned telecom items to sell," which they could simply select with a few clicks munication operators under the administrative control and reg. using Amazon's seller's platform. The seller would then exhibit ulatory supervision of the Ministry of Industry and Information these items for prices that were usually lower than other ven- Technology of China. Added to that, the national networks in dors. When the orders started rolling in the so-called seller China were connected to the internet through state-owned in- would instantly claim that the items had been shipped from its ternational gateways, which were the only networks through facility to the customer and the customer would make the pay which a national user could connect to the internet outside ment to the seller's account. In fact, the seller' would not even China Amazon could not access substitute networks during have the items in the first place and the customers were duped, occasions of disturbances, failures, or other problems with Amazon, in general, waited for customer complaints to catch China's internet infrastructure. Besides, consistent bandwidth the sellers, but by then, the real criminals would have disap- speed could be a problem for Amazon in China peared with the money Amazon had to follow the regulations of the host govern As a result of such frauds, trusted sellers such as ment in the form of enforcement of contractual relationships Birkenstock decided to leave the Amazon sellers' platform. with respect to the management and control of international Arvording to Birkenstock USA'S CEO David Kahan, "The businesses and licence requirements. These regulations would de marketplace, which operates as an open market, 'cre control foreign investment in and operation of the internet wironment where we experience unacceptable business retail, data centers, delivery, infrastructure, internet content which we believe jeopardier our brand... Policing the sale of media and other products and services. As an tot internally and in parmership with Amazon.com has the Amazon website was operated by local companies owne. pech impossible Chinese nationals in keeping with the licensing requirements in Some industry observers felt that the Chinese consumers China. Amazon said in a regulatory filing to the US Securities were not so knowledgeable as to inspect all the details regard- and Exchange Commission (SEC), "Our Chinese and Indian ing a product, and so many sellers were getting away with businesses and operations may he wave to continue to oper selling counterfeits. Though there was a feedback system in ate if we or cur affiliates are unable to access sufficient funding Amazon, it proved incapable of solving this problem. However, or if China enforces contractual lationships with respect to genuine sellers protested that Amazon was not being proactive the management and control of such businesses enough in keeping counterfeiters off its site, and opined that China's market regulator, the State Administration for counterfeiting did not seem to be a high-priority problem for Industry and Commerce (SAIC), announced in 2015 that it Amazon. Companies like Bed Band Store LLC, which sold pat- would work on reducing e-commerce problems in the country. ented locks and clamps to keep fitted sheets from sliding off a especially counterfeit products and poor customer service, ac hed, claimed that its business went from making US$700,000 cording to Tech in Asia. annually in 2013 to half as much revenue in 2015 due to The National People's Congress (NPC) issued its first counterfeiting, draft of the Electronic Commerce Law on January 26, 2017, Besides this, Amazon sellers alleged in 2016 that Chinese among various laws and regulations being passed by differ- manufacturers were copying their designs and selling low-cost, ent authorities that affected the Chinese e-commerce market. CASES AMAZON.COM IN CHINA: CAN ELAINE CHANG CRACK THE CHINESE MARKET? PC3-11 Analysts opined that Chinese competitors were in a bet- ter position to understand and navigate the regulations in the country. For instance, Alibaba relied on a legal structure known as variable interest entity?? (VIE), which enabled it to bypass the Chinese government's restrictions on foreign own- ership of businesses in certain sectors, including information technology. 78 The NPC had circulated the draft for debate to further regu- late China's e-commerce market. After the draft was passed, e-commerce companies had to rigorously check and modify their operations to ensure compliance with the law. The NPC had announced, on November 7, 2017, that the NPC Standing Committee had issued a second draft of the Electronic Commerce Law. The Draft was applicable to e-commerce undertakings that included local and cross-border trade over the internet and it spoke about the deployment and security of e-commerce data and information, customer and privacy protection, and fair competition. Specifically, it considerably extended the compulsions of e-commerce operators by refer- encing the Cybersecurity Law of 2016 in the context of collect- ing and using the personal information of e-commerce users. Michael Tan and Lynn Zhao, Partner and Associate respec- tively at Taylor Wessing LLP, commented, "It will require e- commerce operators to provide users with clear methods and procedures for accessing, correcting and deleting users in- formation or closing user accounts, and prohibits them from imposing unreasonable conditions on users for these actions. Through this provision, the Draft will provide a more strength- ened protection of the personal information of e-commerce users than the first draft [...we would expect that, after it has been passed, e-commerce operators will need to strictly inspect and adjust their operations to ensure compliance with the law:"73 There were limitations on web content in China. Sometimes, a company could be held accountable for the illegal actions of its customers or users. China also had certain restric- tions on foreign ownership of businesses. For instance, foreign investors could not own more than half of the equity in value added domestic telecom. In November 2017. Amazon agreed to sell parts of its cloud business to Beijing Sinnet Technology Co. Ltd.7* (Sinnet) for up to RMB 2 billion (US$301 million) though it said that it was committed to the Chinese for internet- based computing that could be worth US$30 billion.75 An Amazon spokesperson clarified that Amazon would continue its operations in China but had been forced to divest *certain physical infrastructure assets' in order to conform to Chinese law. Amazon said in a statement, "Chinese law forbids non-Chinese companies from owning or operating certain tech- nology for the provision of cloud services. As a result, in order to comply with Chinese law, AWS sold certain physical infra- structure assets to Sinnet, its long time Chinese partner and AWS seller-of-record for its AWS China (Beijing) Region."76 The Road Ahead The cross-border shopping via AGS had shown significant growth in China. In the first quarter of 2017, total sales from China were 11 times as much as in 2015. Chinese consum- ers had purchased nearly 17 million pieces of cross-border directly delivered merchandise from Amazon China since the official opening of the cross-border direct delivery service in October 2014." However, by mid-2018, Amazon's e-com- merce market share in China was less than 1%. While some analysts felt that Amazon should pull out of China, others felt that Amazon had underinvested in China, and that it was not failing, but having less success than its com- petitors. However, Amazon was partially successful in weaning away some of the cross-border e-commerce market share from JD and Alibaba. But in light of the other limitations, analysts opined that there might be tough times ahead for Amazon in China. However, Amazon had global traction and the support of optimistic shareholders to back up its efforts in China. Gurr said, "If you're not the biggest player in the market, you need to stand out from the rest by having something only you can deliver 80 Can Amazon retaliate from its position and create a sig. nificant imprint in China? Can Elaine sell a foreign online mar- ketplace to Chinese consumers who were used to buying ev- erything from home-grown e-commerce giants such as Tmall, Taobao, and JD, and other local niche players? How? Case Questions 1. Critically analyze Amazon's strategy in China. 2. How could Amazon face up to the fierce competition from e-commerce retailers in China? 3. Discuss the possible challenges Amazon could face in China going forward. What should it do in such a scenario