Question: Case #3: Assessing bad debts and sales returns extra Credit Salem Corp. began the year with the following account balances corresponding to its receivables. Salem

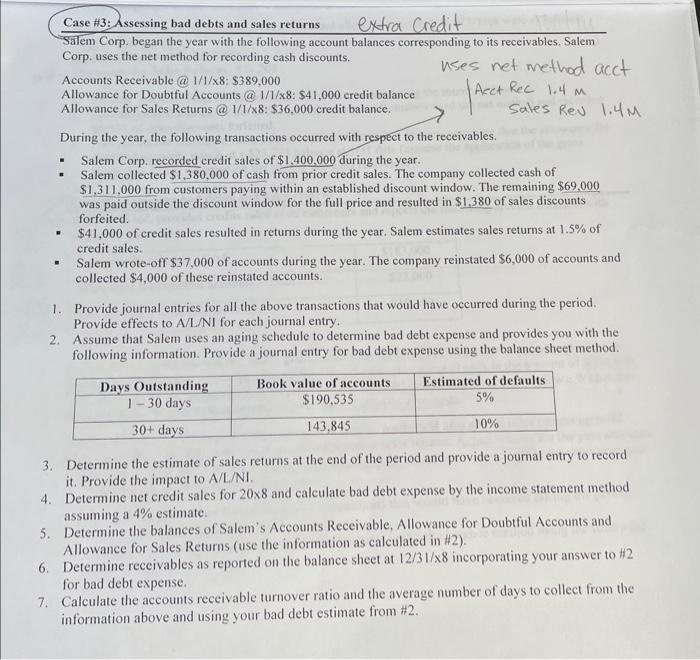

Case \#3: Assessing bad debts and sales returns extra Credit Salem Corp. began the year with the following account balances corresponding to its receivables. Salem Corp. uses the net method for recording cash discounts. Accounts Receivable@1/1/x8: $389,000 Allowance for Doubtful Accounts (a) 1/1/x8: $41,000 credit balance Allowance for Sales Returns @1/1/x8: \$36,000 credit balance. uses net method acct Acet Rec 1.4m sales Rev 1.4M During the year, the following transactions occurred with respect to the receivables. - Salem Corp, recorded credit sales of $1,400,000 during the year. - Salem collected $1,380,000 of cash from prior credit sales. The company collected cash of $1,311,000 from customers paying within an established discount window. The remaining $69,000 was paid outside the discount window for the full price and resulted in $1,380 of sales discounts forfeited. - $41,000 of credit sales resulted in returns during the year. Salem estimates sales returns at 1.5% of credit sales. - Salem wrote-off $37,000 of accounts during the year. The company reinstated $6,000 of accounts and collected $4,000 of these reinstated accounts. 1. Provide journal entries for all the above transactions that would have occurred during the period. Provide effects to A/L/NI for each journal entry. 2. Assume that Salem uses an aging schedule to determine bad debt expense and provides you with the following information. Provide a journal entry for bad debt expense using the balance sheet method. 3. Determine the estimate of sales returns at the end of the period and provide a journal entry to record it. Provide the impact to A/L/NI. 4. Determine net credit sales for 208 and calculate bad debt expense by the income statement method assuming a 4% estimate. 5. Determine the balances of Salem's Accounts Receivable, Allowance for Doubtful Accounts and Allowance for Sales Returns (use the information as calculated in $2 ). 6. Determine receivables as reported on the balance sheet at 12/31/8 incorporating your answer to $2 for bad debt expense. 7. Calculate the accounts receivable turnover ratio and the average number of days to collect from the information above and using your bad debt estimate from $2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts