Question: Case #4 Sulic Company processes a single joint product into three separate products. During April the joint costs of processing were $440,000. Production and sales

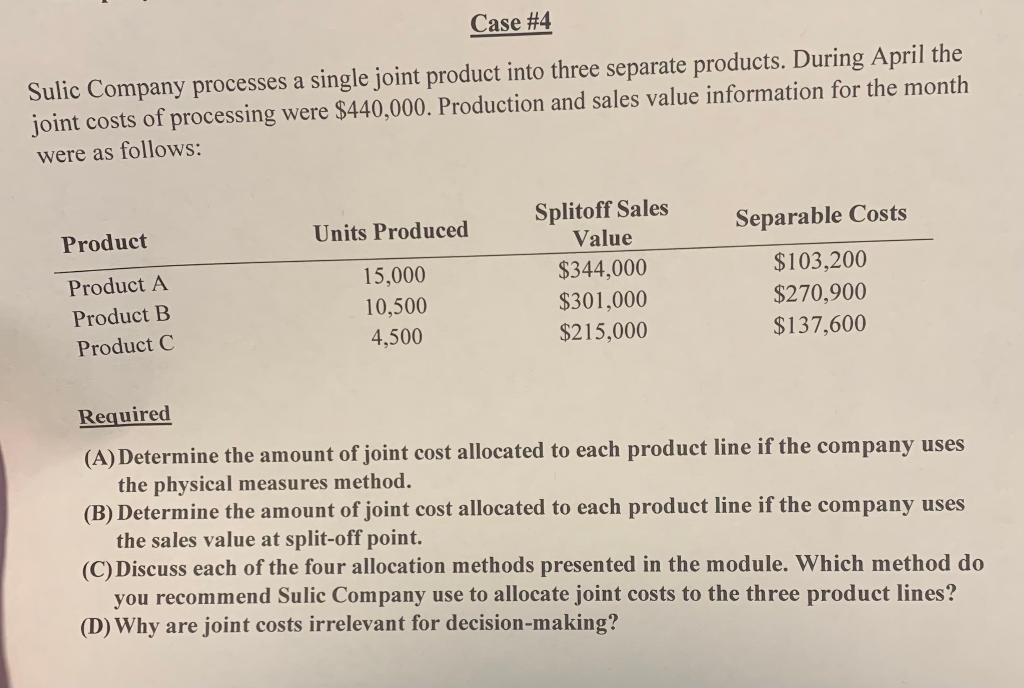

Case #4 Sulic Company processes a single joint product into three separate products. During April the joint costs of processing were $440,000. Production and sales value information for the month were as follows: Units Produced Separable Costs Product Splitoff Sales Value $344,000 $301,000 $215,000 15,000 10,500 4,500 Product A Product B Product C $103,200 $270,900 $137,600 Required (A)Determine the amount of joint cost allocated to each product line if the company uses the physical measures method. (B) Determine the amount of joint cost allocated to each product line if the company uses the sales value at split-off point. (C) Discuss each of the four allocation methods presented in the module. Which method do you recommend Sulic Company use to allocate joint costs to the three product lines? (D) Why are joint costs irrelevant for decision-making

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts