Question: Case A Table 2 Demand During One Bank BlueSky flies three airplanes between Houston and three cities, Chicago, Miami, and Phoenix. These Destination Total demand

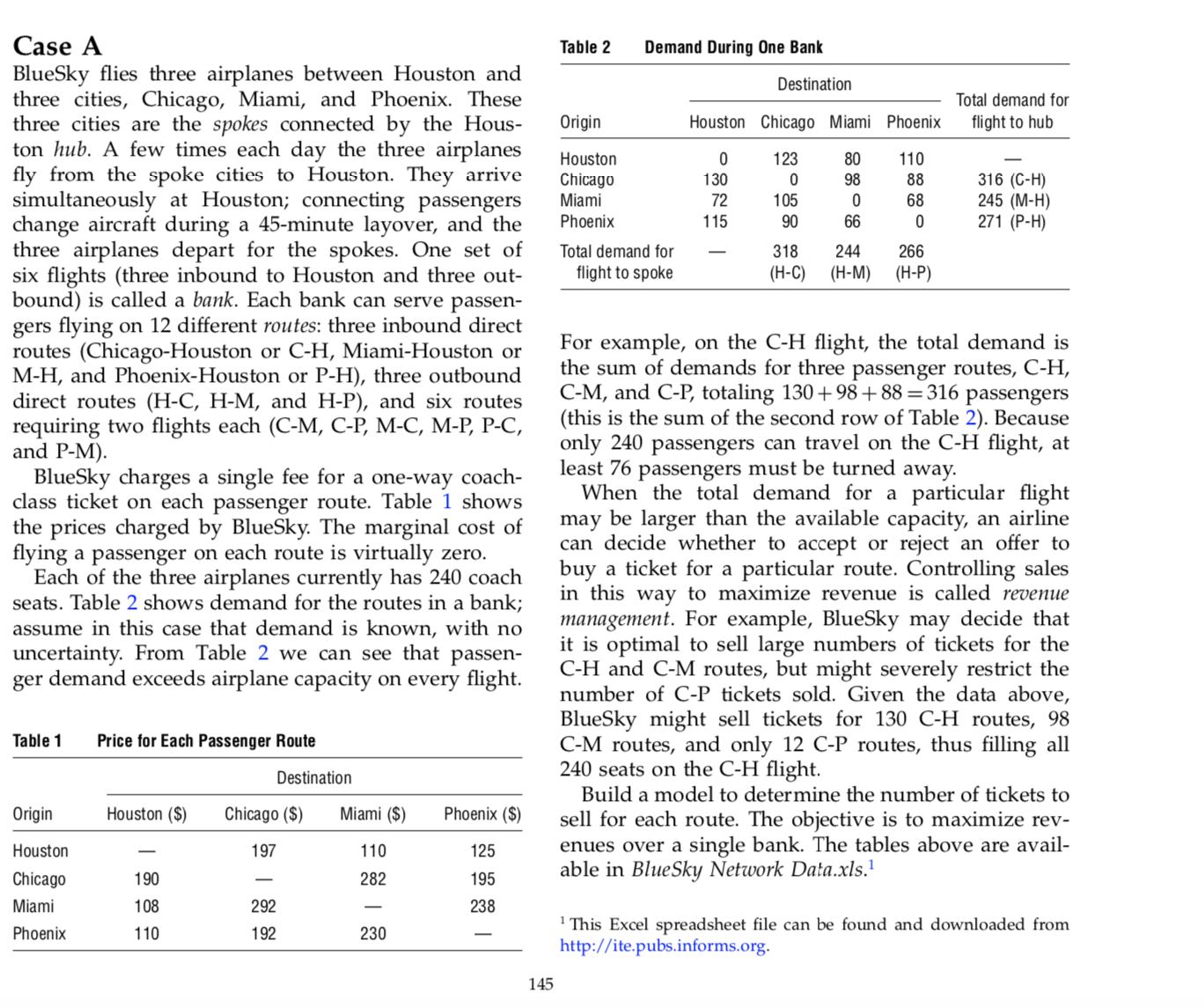

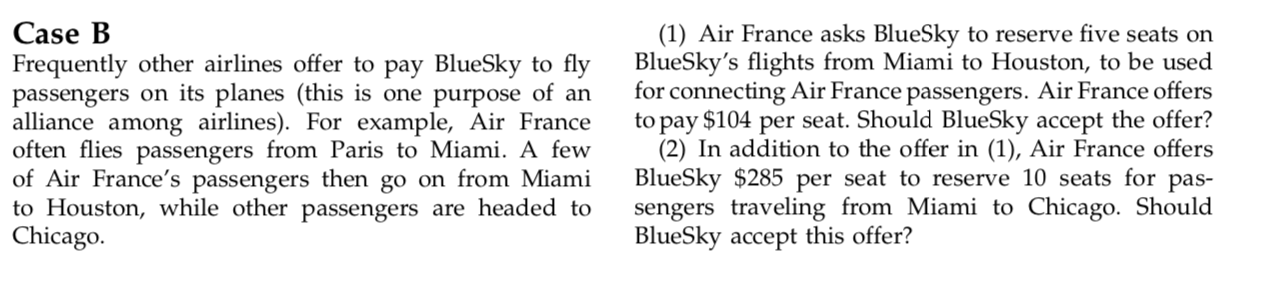

Case A Table 2 Demand During One Bank BlueSky flies three airplanes between Houston and three cities, Chicago, Miami, and Phoenix. These Destination Total demand for three cities are the spokes connected by the Hous- Origin Houston Chicago Miami Phoenix flight to hub ton hub. A few times each day the three airplanes fly from the spoke cities to Houston. They arrive Houston 0 123 80 110 Chicago 130 0 98 88 316 (C-H) simultaneously at Houston; connecting passengers Miami 72 105 0 68 245 (M-H) change aircraft during a 45-minute layover, and the Phoenix 115 90 99 0 271 (P-H) three airplanes depart for the spokes. One set of Total demand for 318 244 266 six flights (three inbound to Houston and three out- flight to spoke (H-C) (H-M) ( H-P) bound) is called a bank. Each bank can serve passen- gers flying on 12 different routes: three inbound direct routes (Chicago-Houston or C-H, Miami-Houston or For example, on the C-H flight, the total demand is M-H, and Phoenix-Houston or P-H), three outbound the sum of demands for three passenger routes, C-H, direct routes (H-C, H-M, and H-P), and six routes C-M, and C-P, totaling 130+ 98 + 88 =316 passengers requiring two flights each (C-M, C-P, M-C, M-P, P-C, (this is the sum of the second row of Table 2). Because and P-M). only 240 passengers can travel on the C-H flight, at BlueSky charges a single fee for a one-way coach- least 76 passengers must be turned away. class ticket on each passenger route. Table 1 shows When the total demand for a particular flight the prices charged by BlueSky. The marginal cost of may be larger than the available capacity, an airline flying a passenger on each route is virtually zero. can decide whether to accept or reject an offer to Each of the three airplanes currently has 240 coach buy a ticket for a particular route. Controlling sales seats. Table 2 shows demand for the routes in a bank; in this way to maximize revenue is called revenue assume in this case that demand is known, with no management. For example, BlueSky may decide that uncertainty. From Table 2 we can see that passen- it is optimal to sell large numbers of tickets for the ger demand exceeds airplane capacity on every flight. C-H and C-M routes, but might severely restrict the number of C-P tickets sold. Given the data above, BlueSky might sell tickets for 130 C-H routes, 98 Table 1 Price for Each Passenger Route C-M routes, and only 12 C-P routes, thus filling all Destination 240 seats on the C-H flight. Houston ($) Chicago ($) Miami ($) Phoenix ($) Build a model to determine the number of tickets to Origin sell for each route. The objective is to maximize rev- Houston 197 110 125 enues over a single bank. The tables above are avail- Chicago 190 282 195 able in BlueSky Network Data.xls.' Miami 108 292 238 Phoenix 110 192 230 This Excel spreadsheet file can be found and downloaded from http://ite.pubs.informs.org. 145Case B (1) Air France asks BlueSky to reserve five seats on Frequently other airlines offer to pay BlueSky to fly BlueSky's flights from Miami to Houston, to be used passengers on its planes (this is one purpose of an for connecting Air France passengers. Air France offers alliance among airlines). For example, Air France to pay $104 per seat. Should BlueSky accept the offer? often flies passengers from Paris to Miami. A few (2) In addition to the offer in (1), Air France offers of Air France's passengers then go on from Miami BlueSky $285 per seat to reserve 10 seats for pas- to Houston, while other passengers are headed to sengers traveling from Miami to Chicago. Should Chicago. BlueSky accept this offer?Case C BlueSky is replacing the three aircraft that y in and out of its Houston hub. It plans to purchase the three new aircraft from the Airbus A330 / A340 family. BlueSky has already decided to configure the three aircraft with only coach seats and no first-class cabin, but the airline has not yet decided on the size of the aircraft. The A330/ A340 family comes in a wide range of sizes, from 240 to 380 coach seats. To decide on an aircraft size, BlueSky must consider both the cost and revenue implications. On the cost side, a larger aircraft is more expensive to purchase and more costly to operate. The purchasing terms and performance data show that the total cost of one ight from, say, Houston to Miami, includes a xed cost of $12,000 and an additional cost of $40 per seat. These numbers are calculated from all costs associated with the ight, including fuel, labor, and maintenance. The cost parameters for the other ve ights in each bank in and out of Houston are nearly identical because all six ights are approximately the same length. (1) Assume that BlueSky purchases three identical aircraft. How many coach seats should BlueSky order for the three new aircraft? (2) Now suppose that the three aircraft can be dif- ferent sizes, between 240 and 380 coach seats. (a) How do you think the three aircraft should be allocated among the six routes? In other words, should the same aircraft always y the same routes? Why or why not? (Hint: You do not need an optimiza- tion model to answer this question). (b) How many coach seats should BlueSky order for each of the three new aircraft? (3) Because it is cheaper to manufacture three iden- tical planes, Airbus is offering BlueSky a one-time, $5 million discount if it will order three identical air- craft. Should BlueSky take the discount? In decid- ing this, you may assume that BlueSky operates 3 banks per weekday through Houston, and that the revenues and demands for every bank on every week- day are equal to the demands in Tables 1 and 2 of the (A) Case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts