Question: CASE ANALYSIS CASE NAME: JOHNSON & JOHNSON REQUIREMENTS: (KEEP IT SHORT) NO EXTERNAL USE OR OTHER CHEGG ANSWERS!! Assume the role of an external consultant

CASE ANALYSIS CASE NAME: JOHNSON & JOHNSON

REQUIREMENTS: (KEEP IT SHORT) NO EXTERNAL USE OR OTHER CHEGG ANSWERS!!

Assume the role of an external consultant hired by the firms corporate leadership Identifies one strategic issue faced by the firm; Provides at least one piece of concrete evidence to show that this is a strategic issue Provides one recommendation that addresses the strategic issue. Provides at least one piece of evidence to show that this recommendation would help resolve the strategic issue

READING:

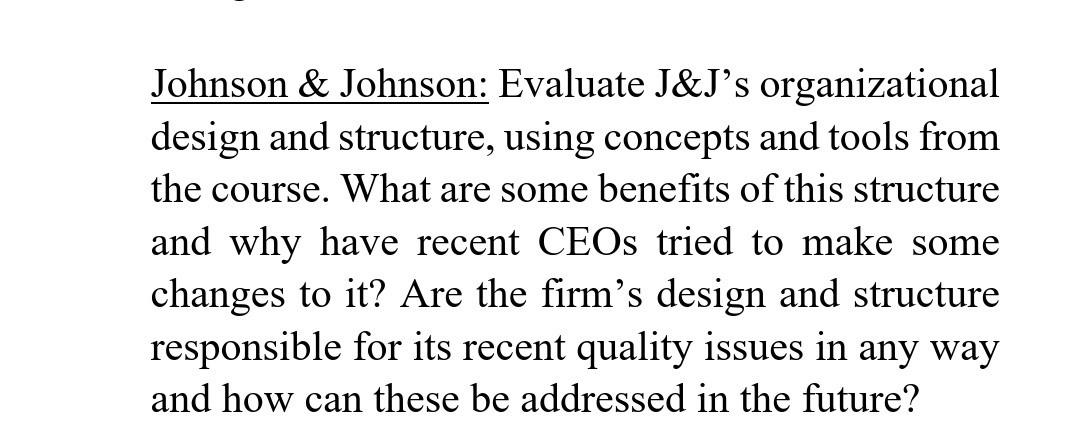

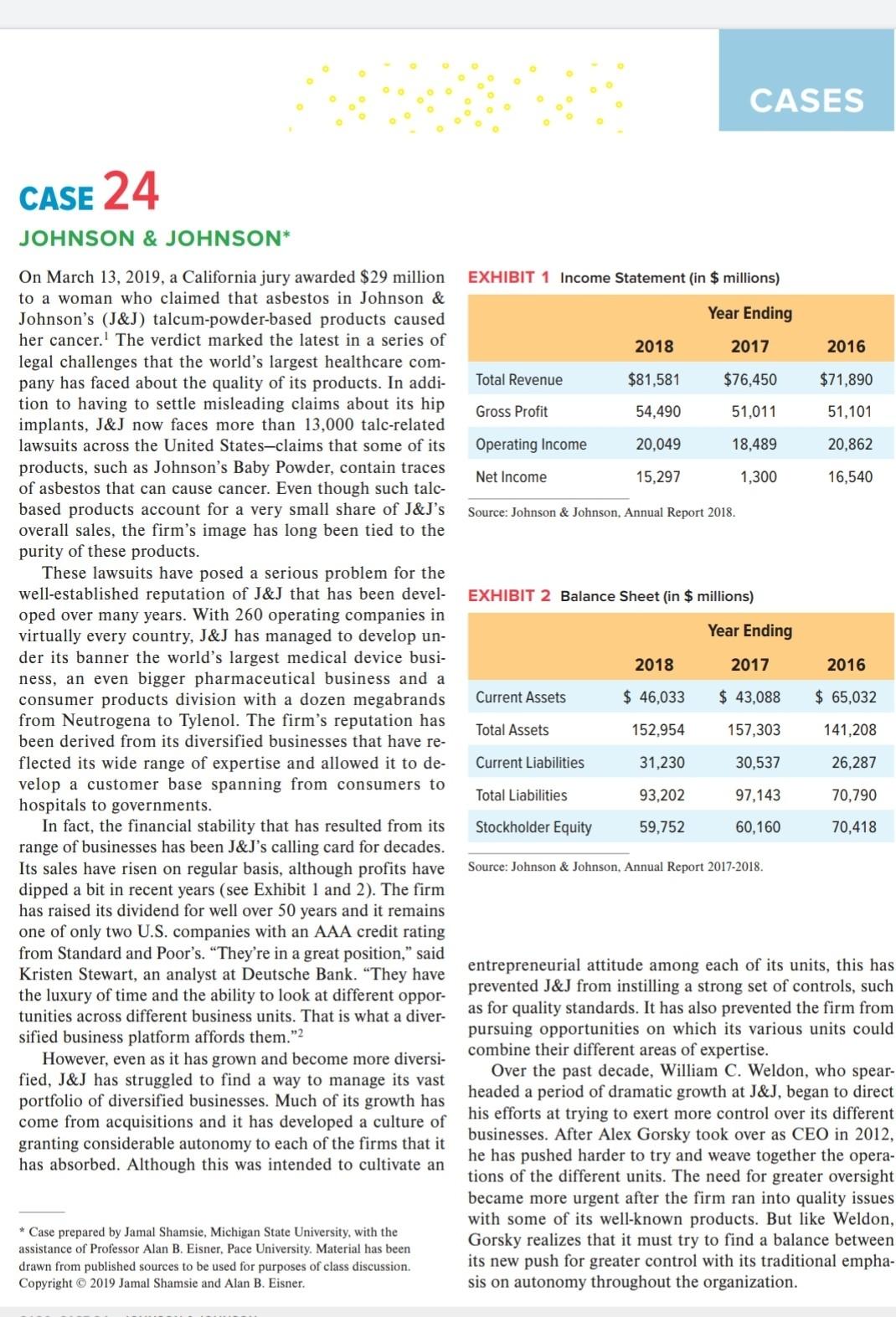

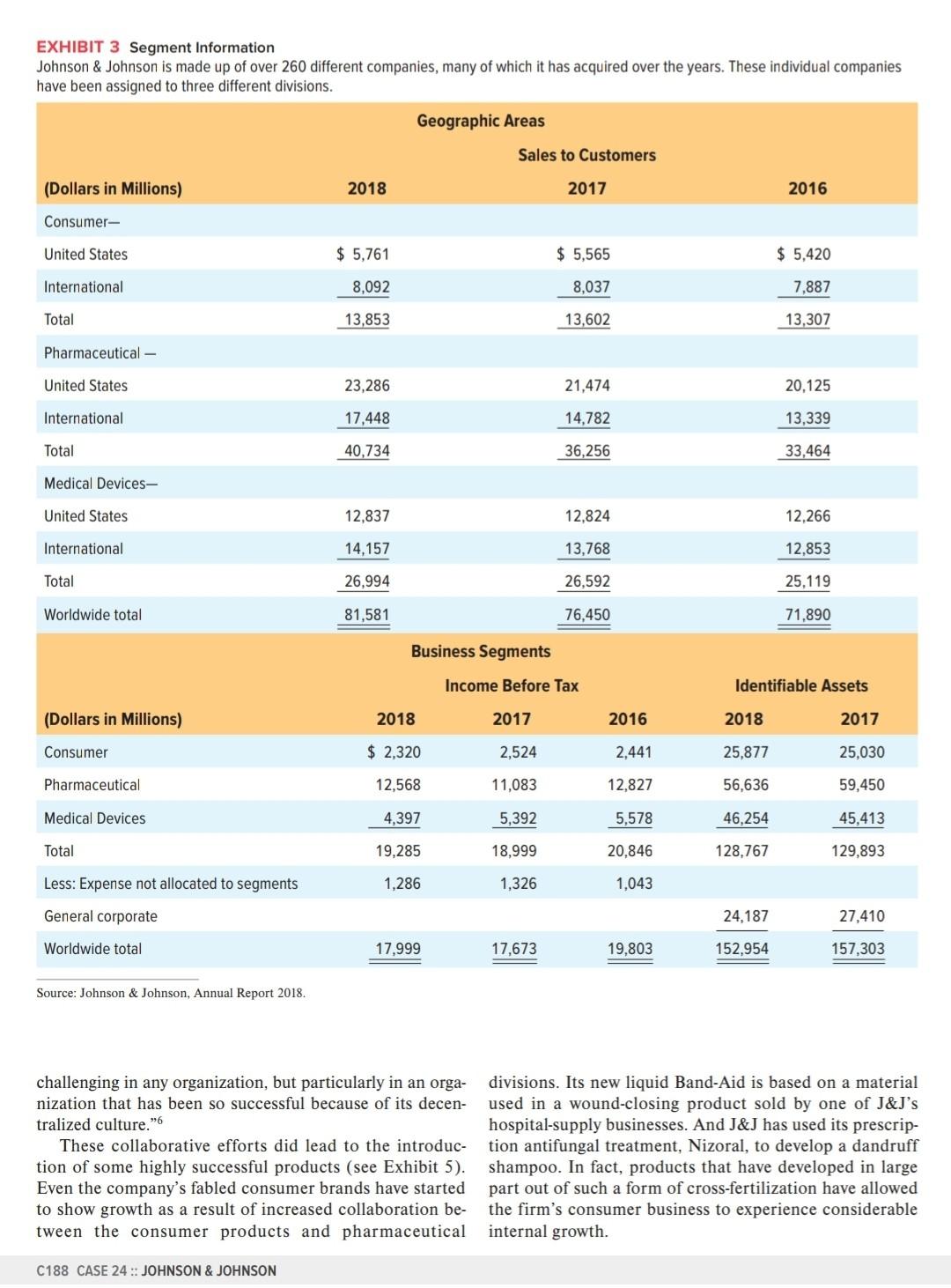

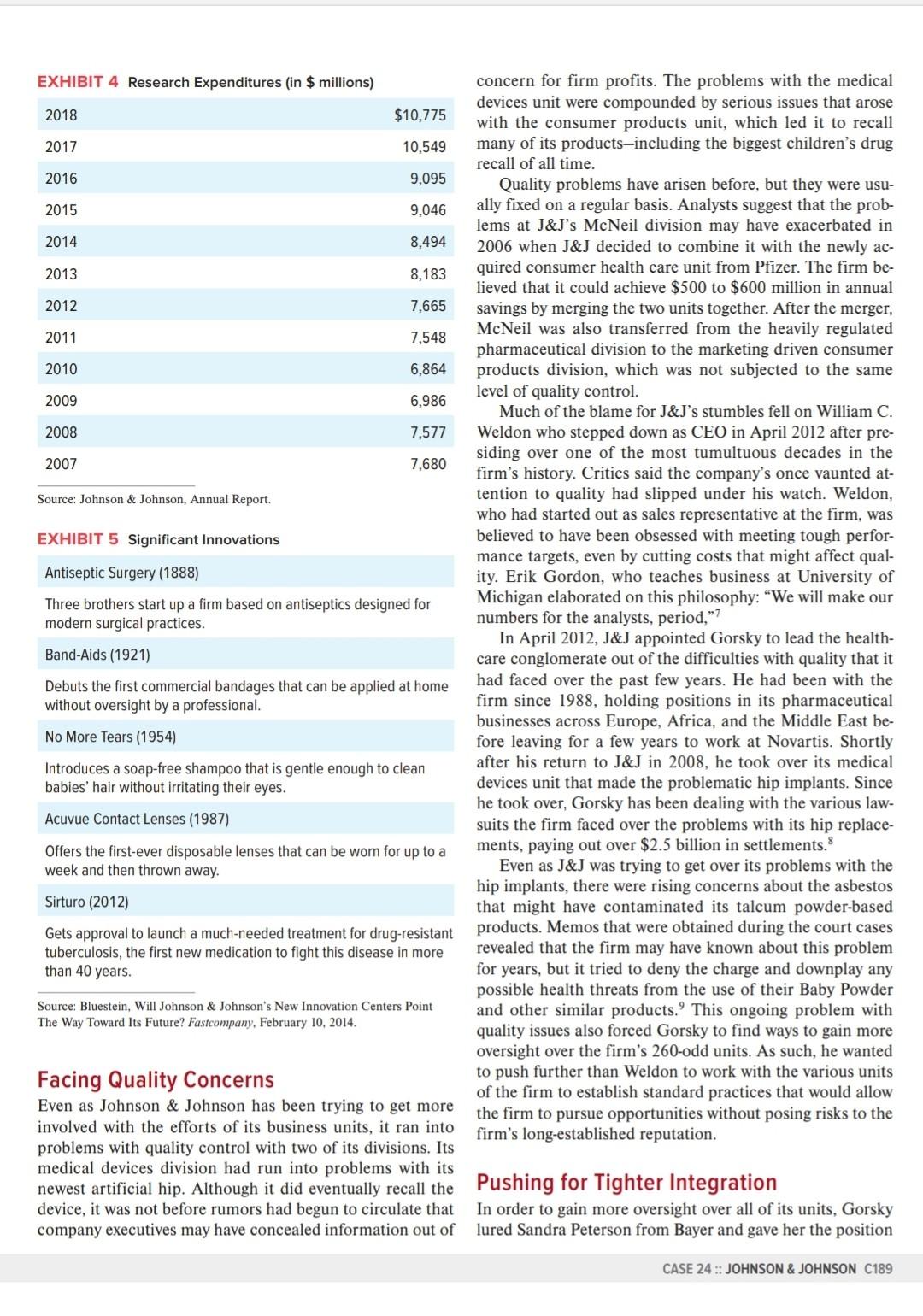

Johnson \& Johnson: Evaluate J\&J's organizational design and structure, using concepts and tools from the course. What are some benefits of this structure and why have recent CEOs tried to make some changes to it? Are the firm's design and structure responsible for its recent quality issues in any way and how can these be addressed in the future? On March 13, 2019, a California jury awarded \$29 million EXHIBIT 1 Income Statement (in \$ millions) to a woman who claimed that asbestos in Johnson \& Johnson's (J\&J) talcum-powder-based products caused her cancer. 1 The verdict marked the latest in a series of legal challenges that the world's largest healthcare company has faced about the quality of its products. In addition to having to settle misleading claims about its hip implants, J\&J now faces more than 13,000 talc-related lawsuits across the United States-claims that some of its products, such as Johnson's Baby Powder, contain traces of asbestos that can cause cancer. Even though such talcoverall sales, the firm's image has long been tied to the purity of these products. These lawsuits have posed a serious problem for the well-established reputation of J&J that has been developed over many years. With 260 operating companies in virtually every country, J\&J has managed to develop under its banner the world's largest medical device business, an even bigger pharmaceutical business and a from Neutrogena to Tylenol. The firm's reputation has been derived from its diversified businesses that have reflected its wide range of expertise and allowed it to develop a customer base spanning from consumers to hospitals to governments. In fact, the financial stability that has resulted from its range of businesses has been J\&J's calling card for decades. Its sales have risen on regular basis, although profits have Source: Johnson \& Johnson, Annual Report 2017-2018. dipped a bit in recent years (see Exhibit 1 and 2). The firm has raised its dividend for well over 50 years and it remains one of only two U.S. companies with an AAA credit rating from Standard and Poor's. "They're in a great position," said Kristen Stewart, an analyst at Deutsche Bank. "They have entrepreneurial attitude among each of its units, this has the luxury of time and the ability to look at different oppor- prevented J&J from instilling a strong set of controls, such tunities across different business units. That is what a diver- as for quality standards. It has also prevented the firm from pursuing opportunities on which its various units could sifiedbusinessplatformaffordsthem."2However,evenasithasgrownandbecomemorediversi-pursuingopportunitiesonwhichitsvariousunitscouldcombinetheirdifferentareasofexpertise. fied, J\&J has struggled to find a way to manage its vast Over the past decade, William C. Weldon, who spear- headed a period of dramatic growth at J\&J, began to direct portfolio of diversified businesses. Much of its growth has headed a period of dramatic growth at J\&J, began to direct come from acquisitions and it has developed a culture of granting considerable autonomy to each of the firms that it businesses. After Alex Gorsky took over as CEO in 2012, has absorbed. Although this was intended to cultivate an he has pushed harder to try and weave together the operations of the different units. The need for greater oversight became more urgent after the firm ran into quality issues "Case prepared by Jamal Shamsie, Michigan State University, with the with some of its well-known products. But like Weldon, "assistance of Professor Alan B. Eisner, Pace University. Material has been Gorsky realizes that it must try to find a balance between drawn from published sources to be used for purposes of class discussion. its new push for greater control with its traditional empha- EXHIBIT 3 Segment Information Johnson \& Johnson is made up of over 260 different companies, many of which it has acquired over the years. These individual companies challenging in any organization, but particularly in an orga- divisions. Its new liquid Band-Aid is based on a material nization that has been so successful because of its decen- used in a wound-closing product sold by one of J\&J's tralized culture." 6 hospital-supply businesses. And J\&J has used its prescrip- These collaborative efforts did lead to the introduc- tion antifungal treatment, Nizoral, to develop a dandruff tion of some highly successful products (see Exhibit 5). shampoo. In fact, products that have developed in large Even the company's fabled consumer brands have started part out of such a form of cross-fertilization have allowed to show growth as a result of increased collaboration be- the firm's consumer business to experience considerable tween the consumer products and pharmaceutical internal growth. concern for firm profits. The problems with the medical devices unit were compounded by serious issues that arose with the consumer products unit, which led it to recall many of its products-including the biggest children's drug recall of all time. Quality problems have arisen before, but they were usually fixed on a regular basis. Analysts suggest that the problems at J\&J's McNeil division may have exacerbated in 2006 when J&J decided to combine it with the newly acquired consumer health care unit from Pfizer. The firm believed that it could achieve $500 to $600 million in annual savings by merging the two units together. After the merger, McNeil was also transferred from the heavily regulated pharmaceutical division to the marketing driven consumer level of quality control. Much of the blame for J\&J's stumbles fell on William C. Weldon who stepped down as CEO in April 2012 after presiding over one of the most tumultuous decades in the firm's history. Critics said the company's once vaunted atwho had started out as sales representative at the firm, was believed to have been obsessed with meeting tough performance targets, even by cutting costs that might affect quality. Erik Gordon, who teaches business at University of Michigan elaborated on this philosophy: "We will make our numbers for the analysts, period,"7 In April 2012, J\&J appointed Gorsky to lead the healthcare conglomerate out of the difficulties with quality that it had faced over the past few years. He had been with the firm since 1988 , holding positions in its pharmaceutical businesses across Europe, Africa, and the Middle East before leaving for a few years to work at Novartis. Shortly after his return to J\&J in 2008 , he took over its medical devices unit that made the problematic hip implants. Since suits the firm faced over the problems with its hip replacements, paying out over $2.5 billion in settlements. 8 Even as J&J was trying to get over its problems with the hip implants, there were rising concerns about the asbestos that might have contaminated its talcum powder-based products. Memos that were obtained during the court cases revealed that the firm may have known about this problem for years, but it tried to deny the charge and downplay any possible health threats from the use of their Baby Powder and other similar products.' This ongoing problem with quality issues also forced Gorsky to find ways to gain more to push further than Weldon to work with the various units of the firm to establish standard practices that would allow the firm to pursue opportunities without posing risks to the firm's long-established reputation. Pushing for Tighter Integration In order to gain more oversight over all of its units, Gorsky lured Sandra Peterson from Bayer and gave her the position of group worldwide chairman. The newly created position more than 3,400 opportunities through these centers, leadgave Peterson sweeping responsibly to oversee technology ing to 200 partnerships. across the entire firm. Gorsky believed that the very nature of the job required him to hire an outsider who had not had Is There a Cure Ahead? much exposure to J\&J's existing culture. Because decentral- Gorsky's biggest challenge came from a demand that ization had allowed each of the business units to make all of Johnson \& Johnson might be better off if it was broken off their own decisions, there had been no consistency in their into smaller companies, perhaps along the lines of its differdifferent practices. Gorsky wanted to bring order to this un- ent divisions. There were growing concerns about the abilwieldly machine. "Sometimes a customer doesn't want to ity of the conglomerate to provide sufficient supervision to deal with 250 J\&J's" he said. 10 dealwith250J&Js"hesaid.PetersonworkedfeverishlytoaligneverythingfromGorskydismissedtheproposal,claimingthatJ&Jdrewsub-allofitssubsidiariesthatwerespreadallovertheglobe. HR policy to procurement processes from the 250 busi- stantial benefits from the diversified nature of its business units that had been making their own decisions inde- nesses. Given the enormous shifts in the healthcare pendently. She covered everything from the timing of industry and the large number of government and institufinancial forecasts to employee car policies. She also con- tional customers and partners involved, he believes that the solidated all of the firm's data-all of its 120,000 employees firm's huge scale could be a rare asset for negotiating deals. to a single HR database. Her efforts to process tons of In support of this belief, Gorsky has pointed to J\&J's contained upwards of 500 terabytes of data. By the time $3.4 billion in cash. The acquisition will accelerate the Peterson decided to leave J&J in October 2018, she firm's entry into surgical robotics and other interventional claimed that her streamlining process would save the firm applications that have shown considerable potential for about$1billion.Afarmoresignificantefforthadalreadybeeninitiatedgrowth."Webelievethecombinationofbest-in-classrobot-ics,advancedinstrumentation,andunparalleledend-to-end by Paul Stoffels when he was appointed J\&J's global head connectivity will make a meaningful difference in patient of pharmaceuticals a few years ago. All of the units that outcomes," said Ashley McEvoy, executive vice president, operated within the pharmaceutical division had also oper- who is in charge of J\&J's medical devices division. 12 In anated with complete autonomy. In particular, J\&J's seven dif- other step, the firm has been working on an app in collaboferent drug R\&D organizations had operated in completely ration with Apple for its watch that can provide better data siloed fashion. In some cases, multiple companies pursued on cardiac issues. the development of the same drugs and each had its own Even as Gorsky plots a course for the future of J\&J, he is system for handling clinical or regulatory development. aware that its stock has been struggling recently because of Stoffels began to merge all of the units under his purview some slower-growing segments of its business. He realizes into one group and organized it to target 11 different dis- that it may not be possible to count on much growth from eases. In the process, 12 of the division's 25 facilities were its existing model that grants considerable autonomy to shuttered and nearly 200 projects were slashed. each of its businesses. Above all, he feels strongly that he This new integrated unit developed a streamlined devel- must provide more direction for these units, partly to enopment process, a highly coordinated system that Stoffels courage them to collaborate with each other in order to purcalls Accererando. Under this model, global teams- sue emerging opportunities. He also understands that it is statisticians in China, data managers in India, regulatory critical for J\&J to take steps to develop sufficient contro folks in Europe-work 24/7 to speed drugs to market. The that can minimize future problems with quality control. folks in Europe-work 24/7 to speed drugs to market. The that can minimize future problems with quality control. assembly-line approach has cut months and, in some cases, Overall, it is clear that the healthcare giant has to reyears off the development time. Its increase in drug approv- think the process by which it manages its diversified portfoals over the past decade have put J\&J in a league of its own. lio of companies in order to ensure it can keep growing "No other company has come close to that," said Bernard without creating issues that can pose further threats to its Munos,apharmaceuticalinnovationconsultant.11Stoffelshasaccomplishedmorethanjustreducingthereputation."ThisisacompanythatwaspurerthanCaesarswife,thiswasthegoldstandard,andallofasuddenitjust Stoffelshasaccomplishedmorethanjustreducingtheseemslikethingsarebreakingdown,"saidWilliamTrom-wife,thiswasthegoldstandard,andallofasuddenitjust time needed to bring drugs to market. He has begun to look seems like things are breaking down," said William Tromown business units or from entrepreneurs or scientists out- Joseph's University in Philadephia. 13 side the firm. He has set up four innovation centers in biotech clusters-Cambridge, MA; Menlo Park, CA; London; ENDNOTES and Shanghai-around the world, places where scientific 1. Hsu, T. 2019. Johnson \& Johnson hit with $29 million verdict in case over entrepreneurs can interact with J\&J's own drug and techtalc and asbestos. New York Times, March 14, https://www.nytimes.com/ nology scouts. His flexible approach with these outsiders 2. Fry, E. 2016. Can big still be beautiful? Fortune, August 1, p.84. lets J\&J work with them more casually and helps build 3. Thomas, K. and R. Abelson. 2012. J\&J chief to resign one role. New stronger relationships. Since 2013, the firm has reviewed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts