Question: CASE B: Ignore the facts provided in Case A . After close of business on December 3 1 , 2 0 X 8 Eastside Inc.

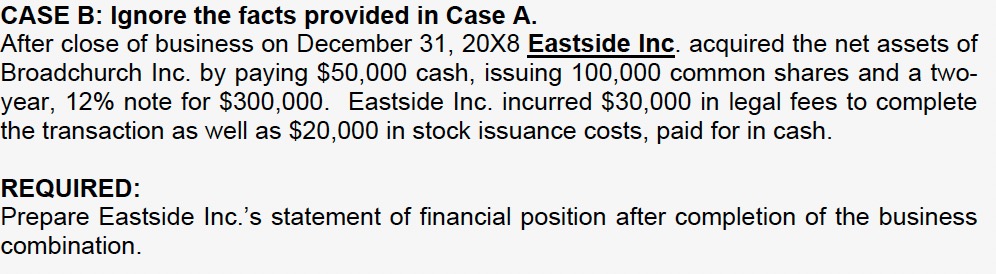

CASE B: Ignore the facts provided in Case A

After close of business on December X Eastside Inc. acquired the net assets of

Broadchurch Inc. by paying $ cash, issuing common shares and a two

year, note for $ Eastside Inc. incurred $ in legal fees to complete

the transaction as well as $ in stock issuance costs, paid for in cash.

REQUIRED:

Prepare Eastside Inc.s statement of financial position after completion of the business

combination.

QUESTION

Broadchurch Inc. and Eastside Inc. had the following Statement of Financial Position on December X and the associated fair values prior to acquisition;

Broadchurch Inc. Eastside Inc. Book Values Fair Values Book Values Fair Values Cash $ $ $ $ Accounts receivable Inventory Land PPE net Intangible assets Goodwill $ $ Current Liabilities $ $ $ $ Longterm liabilities Common shares Retained earnings $ $

Additional information:

Prior to the acquisition, Broadchurch Inc. had shares outstanding, while Eastside Inc. had shares outstanding. The market price of Broadchurch Inc.s shares on December X and on January X was $ per share, and the price of Eastside Inc.s shares was $ per share. Broadchurch Inc. had ongoing litigation against it The legal team expects that the lawsuit could be settled for $ Eastside Inc. has an unrecorded trademark worth $

DO CASE B PLEASE.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock