Question: Case: Decision Analysis based on Expected Value Decision tree - Wikipedia Decision trees are powerful graphical models that provide a clear and structured framework for

Case: Decision Analysis based on Expected Value

Decision tree - Wikipedia

Decision trees are powerful graphical models that provide a clear and structured framework for making complex decisions under uncertainty. This intuitive visual representation allows decision makers to analyze various alternatives, consider potential outcomes, and select the most favorable course of action based on objective reasoning.

A decision tree is constructed as a tree-like diagram, with nodes representing decision points and branches representing possible outcomes or events that may occur. At the core of the tree lies the initial decision, known as the root node. From this node, the tree branches out into different paths, each corresponding to a specific decision or chance event. The tree continues to expand until it reaches terminal nodes, also known as leaves, which represent the final outcomes or payoffs of the decision-making process.

The power of decision trees lies in their ability to handle situations with uncertainty and multiple possible scenarios. At each decision node, the decision maker is presented with different options, and each branch corresponds to a distinct choice. Alongside decision nodes, chance nodes represent uncertain events with associated probabilities, reflecting the likelihood of each event occurring.

When faced with uncertainty, decision makers assign probabilities to the chance nodes based on historical data, expert opinions, or any available information. By quantifying uncertainties in this manner, decision trees allow decision-makers to evaluate their choices and assess the potential risks and rewards of each option using the expected value. Ultimately, the decision tree leads to the selection of the path with the most favorable expected value, which represents the optimal decision under uncertainty.

Decision trees are applicable to a wide range of decision-making scenarios. Their graphical nature facilitates effective communication and understanding among stakeholders, making decision trees an intuitive structured framework for solving problems with uncertainty.

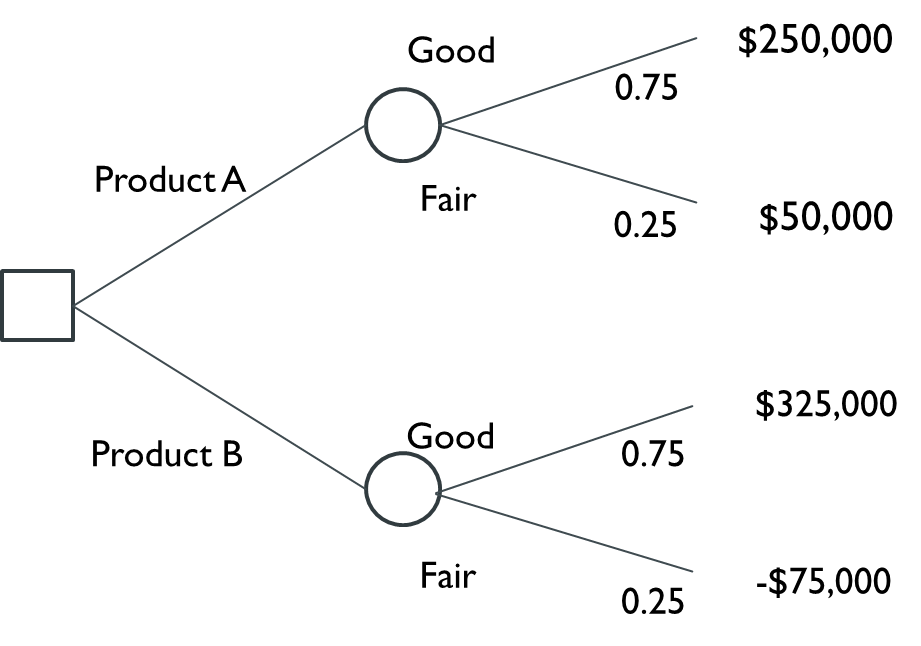

In the following example, we have learned to work backwards to evaluate the expected pay off for each decision and choose the product with the highest payoff. (E[A]=$200,000; E[B]=%225,000, so product B)

Activity:

CW Logistics has decided to build a new warehouse to support its supply chain activities. They have the option of building either a large warehouse or a small one. Construction costs for the large facility are $8 million versus $3 million for the small facility. The profit (excluding construction cost) depends on the volume of work the company expects to contract for in the future. This is summarized in the following table (in millions of dollars):

High VolumeLow Volume Large Warehouse$35$20 Small Warehouse$25$15

The company believes that there is a 60% chance that the volume of demand will be high. a. Construct a decision tree to identify the best choice with its net expected payoff. b. Suppose that the company engages an economic expert to provide an opinion about the volume of work based on a forecast of economic conditions. Historically, the number of times actually high volume out of the times the expert predicted upward was 75%, and the number of times actually low volume out of the times he predicted downward was 90%. In contrast to the companys assessment, the expert believes that the chance for high demand is 70%. Determine the best strategy if their predictions suggest that the economy will improve or will deteriorate. Now find the optimal choice with its expected payoff. Guide: For part a, construct a decision tree with branches for each of the available options. Enter the parameters to calculate the expected profit. After that, be sure to subtract the construction cost to reflect the net expected profit for each option. Choose the optimal option. For part b, match the probabilities with the given values. We can ignore the original 60% and rely on the experts prediction. Set up 2 decision trees, one for high demand, another for low demand with their probabilities from the expert.

Use the given conditional probabilities P(high | predicts up) and P(low | predicts down) to build the decision trees. Choose the optimal decision for each tree (one for high demand and another for low demand, then calculate the overall expected payoff with the probability weight).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts