Question: Case material: Your company is considering replacing its old and relatively inefficient operating system with new technology. The new technology, which will cost $2 million

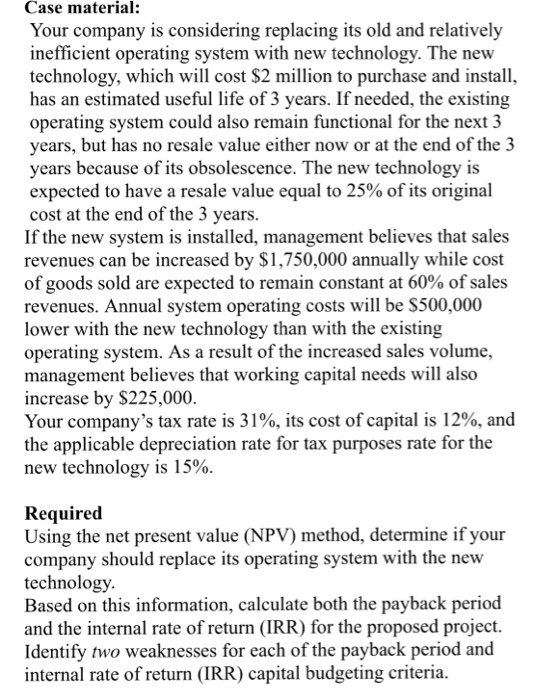

Case material: Your company is considering replacing its old and relatively inefficient operating system with new technology. The new technology, which will cost $2 million to purchase and install, has an estimated useful life of 3 years. If needed, the existing operating system could also remain functional for the next 3 years, but has no resale value either now or at the end of the 3 years because of its obsolescence. The new technology is expected to have a resale value equal to 25% of its original cost at the end of the 3 years If the new system is installed, management believes that sales revenues can be increased by $1,750,000 annually while cost of goods sold are expected to remain constant at 60% of sales revenues. Annual system operating costs will be S500,000 lower with the new technology than with the existing operating system. As a result of the increased sales volume, management believes that working capital needs will also increase by $225,000. Your company's tax rate is 31%, its cost of capital is 12%, and the applicable depreciation rate for tax purposes rate for the new technology is 15% Required Using the net present value (NPV) method, determine if your company should replace its operating system with the new technology Based on this information, calculate both the payback period and the internal rate of return (IRR) for the proposed project. Identify two weaknesses for each of the payback period and internal rate of return (IRR) capital budgeting criteria

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts