Question: Case Problem 9.1 Brett Runs Some Technical Measures on a Stock Brett Daly is an active stock trader and an avid market technician. He got

Case Problem 9.1 Brett Runs Some Technical Measures on a Stock

Brett Daly is an active stock trader and an avid market technician. He got into technical analysis about 10 years ago, and although he now uses the Internet for much of his analytical work, he still enjoys running some of the numbers and doing some of the charting himself. Brett likes to describe himself as a serious stock trader who relies on technical analysis for somebut certainly not allof the information he uses to make an investment decision; unlike some market technicians, he does not totally ignore a stock's fundamentals. Right now, he's got his eye on a stock that he's been tracking for the past three or four months.

The stock is Nautilus Navigation, a mid-sized high-tech company that's been around for a number of years and has a demonstrated ability to generate profits year-in and yearout. The problem is that the earnings are a bit erratic, tending to bounce up and down from year to year, which causes the price of the stock to be a bit erratic as well. And that's exactly why Brett likes the stockthe volatile prices enable him, as a trader, to move in and out of the stock over relatively short (three- to six-month) periods of time.

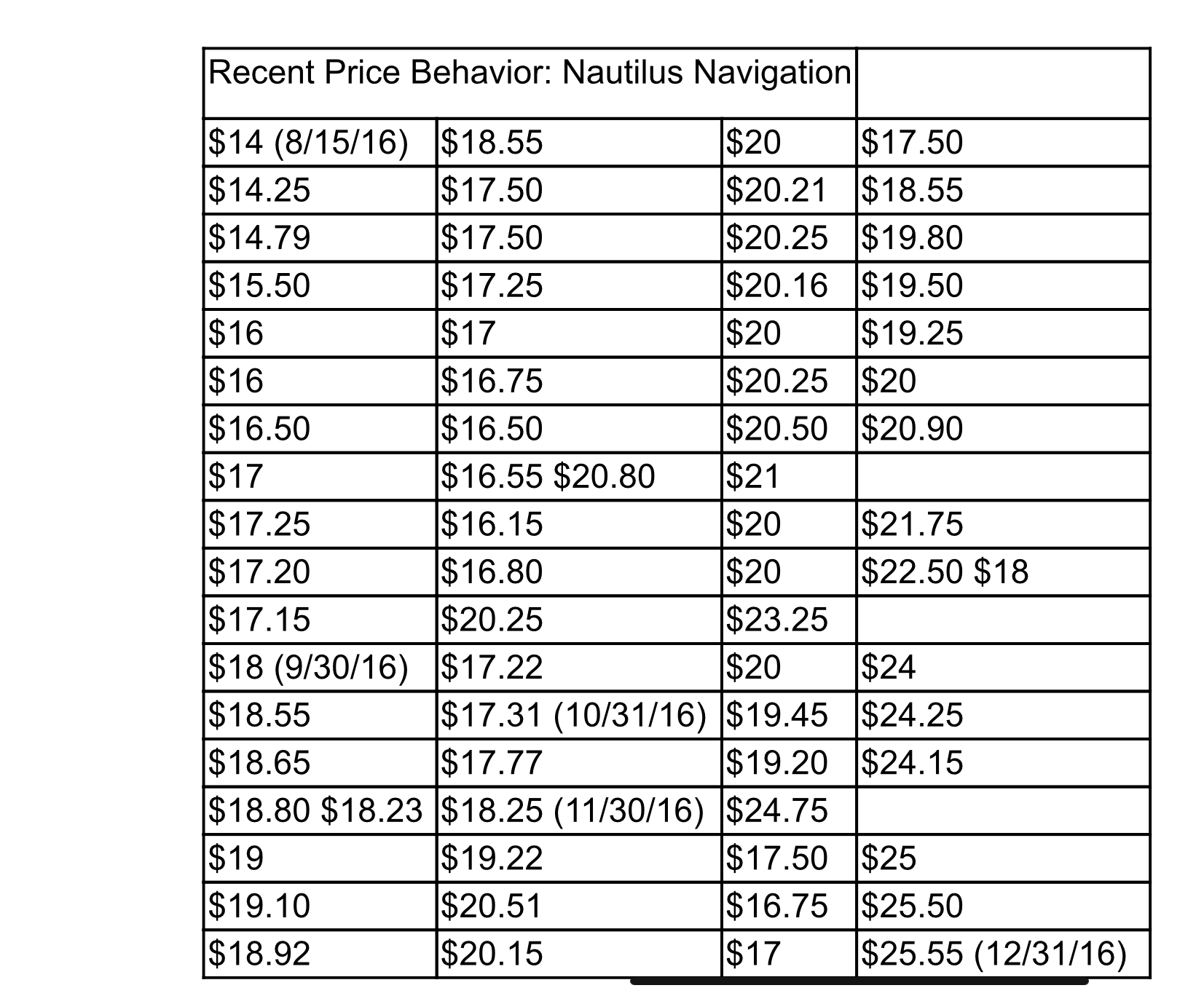

Brett has already determined that the stock has "decent" fundamentals, so he does not worry about its basic soundness. Hence, he can concentrate on the technical side of the stock. In particular, he wants to run some technical measures on the market price behavior of the security. He's obtained recent closing prices on the stock, which are shown in the table below.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts