Question: Case Questions for Valuing Lockheed Martin and Leidos - Fall 2021 1. Analyze the industries where Leidos and the IS&GS division are in using 1)

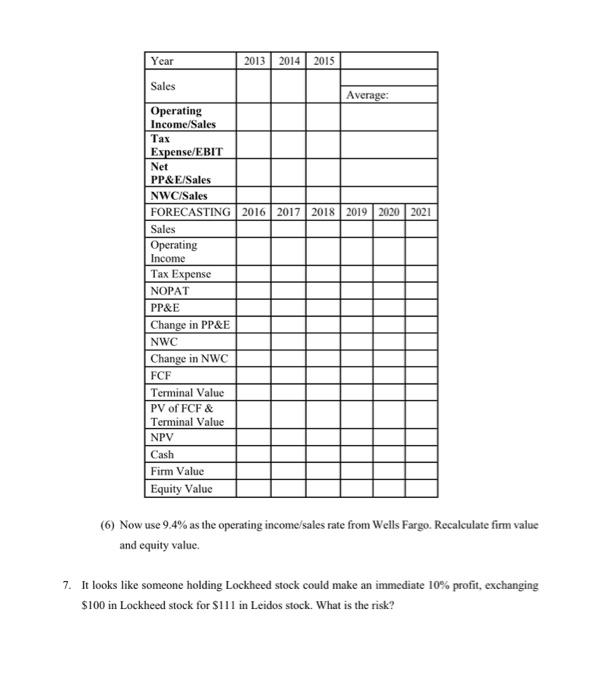

Case Questions for Valuing Lockheed Martin and Leidos - Fall 2021 1. Analyze the industries where Leidos and the IS&GS division are in using 1) Porter's Five Forces analysis and 2) SWOT (strengths, weaknesses, opportunities, and threats) 2. Evaluate keeping Lockheed Martin shares with a SWOT analysis. 03-06: The case provides analyst estimates of the value of the post-RMT Leidas Holdings. Use discounted cash flow and comparable multiples valuation to determine whether post-RMT Leidosis fairly valued and whether the two components of post-RMT Leidos (the IS&GS division and pre-RMT Leidos) were valued appropriately. Find an appropriate discount rate using comparable company and market information given in the case. 3. LDOS's equity beta: when calculating the equity beta of LDOS, we could use the leverage-adjusted average of its four competitors (=1.19) or the LDOS's own equity beta (=1.82). Considering LDOS is a young company, explain why the average beta is a better choice than its own one for its post-RMT beta estimation? 4. Calculate LDOS' cost of equity using the capital asset pricing model. 5. Calculate LDOS" WACC. Note that to calculate WACC, the weights of debt and equity used are those of post-RMT Leidos. The tax rate can be calculated as Taxes Pretax Income. 6. Calculate the firm value and the equity value. To determine whether or not Clarke should accept the tender offer, discounted cash flow valuations are needed for the IS&GS division, and for pre-RMT and pot-RMT Leidos. Free cash flows to the firm were projected using 3-year historical averages of costs, working capital, and capital expenditures to sales. After 5 years, we assume that the firm would grow at the industry average growth rate. This calculates an enterprise value. Information Systems and Global Services Assumptions base case, no synergies): D) Sales forecast is industry rate of 2.7%, given in thecase. 2) Historicalaverages for operating income to sales, income tax to taxable income. working capital to sales, and capital expenditures were used to make forecasts. 3) Depreciation was estimated as 1% of sales. 4) The long-term GDP growth rate (from Case Exhibit 8) was used as the perpetuity terminal growth rate. 5) All cash on the balance sheet is assumed to be non-operating cash. Follow the steps below to calculate the FCFF with forecasting the Free Cash Flow from 2016- 2021: (1) Calculate the Operating Income from 2016-2021. Operating Income Sales rate for the projection of the next five years was computed from the rates given in 2013-2015. This result is different than the estimates for post-RMT Leidos, which listed this ratio as 9.4% in case exhibit 7 for 2016 (2) Calculate the income tax rate from 2016-2021. The income tax expense rate was computed using the average tax rate from 2013 to 2015. (3) Calculate PP&E from 2016-2021. The PP&E rates were calculated from the historical percent of sales in 2014 and 2015. (4) Calculate the net working capital from 2016-2021. The net working capital to sales ratio was calculated, as the average of 2014 and 2015. Working capital was defined as current assets - accounts payable. (5) Finally, calculate the firm value and the equity value: a) The IS&Gs division cash flows were discounted using Leidos' discount rate calculated using comparable betas. b) Use the operating income/sales rate calculated in (1). Year 2013 2014 2015 Sales Average: Operating Income Sales Tax Expense/EBIT Net PP&E/Sales NWC/Sales FORECASTING 2016 2017 2018 2019 2020 2021 Sales Operating Income Tax Expense NOPAT PP&E Change in PP&E NWC Change in NWC FCF Terminal Value PV of FCF & Terminal Value NPV Cash Firm Value Equity Value (6) Now use 9.4% as the operating income sales rate from Wells Fargo. Recalculate fim value and equity value. 7. It looks like someone holding Lockheed stock could make an immediate 10% profit, exchanging $100 in Lockheed stock for S111 in Leidos stock. What is the risk