Question: I. Case study Assignment Question(s): Read carefully case No 8 from your textbook ( entitled iRobot: Finding the Right Market Mix?) and answer the following

Assignment Question(s):

Read carefully case No 8 from your textbook (entitled iRobot: Finding the Right Market Mix?) and answer the following questions: (1 mark each question)

Suppliers:

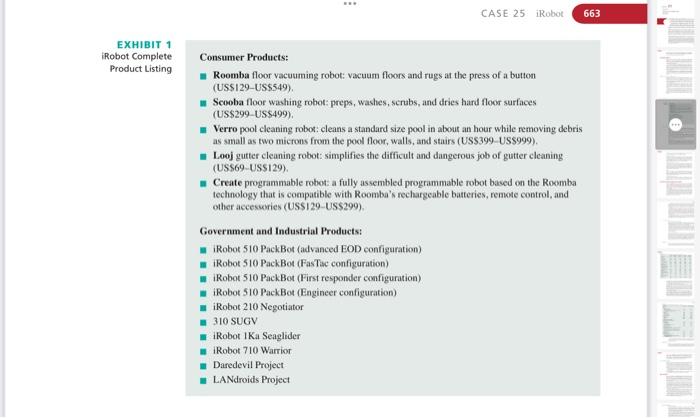

and render patents useless. Additionally, iRobot is highly dependent on several third-party suppliers to manufacture its consumer products. It also depends on the U.S. govermment for the sales of its military products. Any volatility in its supply chain or in government fiscal policy will have grave consequenoes upon the company's future. History In the late 1980s, the coolest robots in the world were being developed at the MTT Artificial Intelligence Lab. These robots, modeled on insects, captured the imagination of researchers, explorers, military, and dreamers alike, iRobot cofounders, MIT professor Rodney Brooks and graduates Colin Angle and Helen Greiner, saw this technology as the basis for a whole new class of robots that could make people's lives easier and more fun. In 1990 , iRobot was incorporated in the state of Delaware. After leaving the MIT extraterrestrial labs, the three entrepreneurs focused their business on extraterrestrial exploration, introducing the Genghis for robotic researchers in 1990. In 1998, the founders shifted their focus onto military tactile robots and consumer robots after landing a pivotal contract with the U.S. Defense Advanced Research Project Agency (DARPA). This contract provided funding for the necessary R\&D to develop new technologies. As a direct result, iRobot delivered the PacBot to the government in 2001 to assist in the search at the NYC World Trade Center. In 2010, thousands of PacBots were serving the country on the war front. In 2002, iRobot began selling its first practical and affordable home robot, the Roomba vacuuming robot. With millions of Roomba vacuums sold, iRobot has continued to develop and unveil new consumer robots such as a robotic gutter cleaner and a pool vacuum. In 2005, iRobot raised US\$120 million in its IPO and began trading on the NASDAQ stock exchange. iRobot designs and builds robots for consumer, government, and industrial use, as shown in Exhibit 1. On the consumer robots front, the company offers floor cleaning robots, pool cleaning robots, gutter cleaning robots, and programmable robots. iRobot sells its home robots through a network of over 30 national retailers. Intemationally, iRobot relies on a network of in-country distributors to sell these products to retail stores in their respective countries. iRobot also sells its products through its own online store and other online stores like Amazon and Wal-Mart. Home robots have been the company's most successful products, with over 5 million units sold worldwide. Sales of home robots accounted for 55.5% and 56.4% of iRobot's total revenue in 2009 and 2008 , respectively. 2 Currently, iRobot is exploring new technological opportunities, including those that can automatically clean windows, showers, and toilets. The potential to fully clean one's house using automated robots is appealing to customers. On the government and industrial robotics front, iRobot offered both ground and maritime unmanned vehicles, selling the vehicles directly to end-users or through prime contractors and distributors.' Its government customers included the U.S. Army, U.S. Marine Corp. U.S. Army and Marine Corps Robotic Systems Joint Program office, U.S. Navy EOD Technical Division, U.S. Air Force, and Domestic Police and First Responders. For 2009 and 2008,36.9% and 40.3% (respectively) of iRobot total rovenue came from the U.S. government. Consumer Products: Roomba floor vacutuming robot: vacuum floors and rugs at the press of a button (USS129-USS549). in Scooba floor washing robot: preps, washes, scrubs, and dries hard floor surfaces (US\$299-USS499), - Verro pool cleaning robot: cleans a standard size pool in about an hour while removing debris as small as two microns from the pool floor, walls, and stairs (USS399-US\$999). - Looj gutter cleaning robot: simplifies the difficult and dangerous job of gutter cleaning (USS69-US\$129). - Create progranmable robot: a fully assembled programmable robot based on the Roxmba technology that is compatible with Roomba's rechargeable batteries, remote cootrol, and other acceswories (USS129-US\$299), Government and Industrial Products: iRobot 510 PackBot (advanced EOD configuration) iRobot 510 PackBot (FasTac configuration) iRobot 510 PackBot (First responder configuration) iRobot 510 PackBot (Engineer configuration) iRobot 210 Negotiator 310SUGV iRobot I Ka Seaglider iRobot 710 Warrior Daredevil Project LANdroids Project The robot-based products market is an emerging market with high entry barriers because it requires new entrants to have access to advanced technology, as well as large amounts of capital to invest in R&D. As a result, the market has relatively few companies competing with each other. iRobot competes with large and small companies, government contractors, and governmentsponsored laboratories and universities, It also competes with companies producing traditional push vacuum cleaners, such as Dyson and Oreck. Many of iRobot's competitors have significantly more financial resources. These include Sweden-based AB Electrolux, German-based Krcher, South Korea-based Samsung. UK-based QinetiQ, and U.S.-based Lockheed, all of whom compete against iRobot mainly in the robot vacuum cleaning market and the unmanned ground vehicle market. The iRobot product (for example, its Roomba vacuum robot) is not the most expensive product, but is rated the highest across the majority of comparison points. AB Electrolux Founded in 1910, Electrolux is headquartered in Stockholm, Sweden. It does business in 150 countries with sales of 109 billion SEK (USSI5 billion), and is engaged in the manufacture and sales of tousehold and professional appliances. Its Electrolux Trilobite vacuum cleaner competed with the iRobot's Roomba vacuum cleaner in intemational markets. Although Electrolux Trilobite is currently unavailable in the United States, it will likely soon Robot be sold on the company's website. An Electrolux Trilobite is priced at about US\$1800, much more than a Roomba, which retails for between US $200 and US $500. Alfred Krcher GmbH \& Co. Founded in 1935, Krcher is a German manufacturer of cleaning systems and equipment, and is known for its high-pressure cleaners. Krcher does business worldwide, with sales of E1.3 billion (US\$1.7 billion). In 2003, it launched Krcher RC 3000 , the world's first autonomous cleaning system, which competes with the iRobot Roomba vacuum cleaner in international markets. Karcher RC 3000 is not currently sold in the United States but can be purchased and shipped directly from Germany for approximately US\$1500. Samsung Electronics Co., Ltd Founded in 1969. Samsung is headquartered in South Korea. It is the world's largest electronics company, with a revenue of US $117.4 billion in 2009 . It is a prominent player in the world market for more than 60 products, including home appliances such as washing machines, refrigerators, ovens, and vacuum cleaners. In November 2009. Samsung launched Tango, its autonomous vacuum cleaner robot, which is available in South Korea. In March 2010, the company premiered the Samsung NaviBot, an autonomous vacuum cleaner, in Europe. It was priced at 400 to 600 (US\$516 to US\$774). QinetiQ Founded in 2001, QinetiQ is a defense technology company headquartered in the UK with revenues of fl.6 billion (US $2.4 billion). It produces aircraft, unmanned acrial vehicles, and energy products. iRobot's stiffest competitor in the unmanned aerial vehicles market is QinetiQ, which has 2500 Talon robots deployed in Irac and Afghanistan. iRobot had delivered more than 3000 PackBot robots worldwide. Lockheed Martin Corporation Based in Maryland, the U.S.-based Lockheed is the world's second-largest defense contractor by revenue and employs 140,000 people worldwide. It was formed by the merger of Lockheed and Martin Marietta in 1995, and competed with iRobot in the unmanned ground vehicle market. Research and Development at iRobot Research and development (R\&D) is a critical part of iRobot's success. The company spends nearly 6% of its revenue on R\&D. In 2009 , its total R\&D costs were US\$45.5 million, of which US\$14.7 million was internally funded, while the remaining amount was funded by government-sponsored research and development contracts, iRobot believes that by utilizing R\&D capital it will be able to respond and stay ahead of customer needs by bringing new, innovative products to the market. As of 2009, iRobot had 538 full-time employees, 254 of which were in R\&D., The company's core technology areas are collaborative systems, semi-autonomous operations, advanced platforms, and human-robot interaction. Each area provides a unique benefit to the development and advancement of robot technology. Research in these fields is done using three different methods: team organization, spiral development, and the leveraged model. Team organization revolves around small teams that focus on certain specific projects or robots. They work together with all the different lines of the business to ensure that a product is well integrated. Primary locations for these teams are Bedford, Massachusetts; Durham, North Carolina; and San Luis Obispo, Califomia. CASE 25 iRobot 665 Spiral development is used for military products. Newly created products are sent into the field and tested by soldiers with in in-field engineer nearby to receive feedback from the soldiers on the product's performance. Updates and improvements are made in a timely manner, and the product is sent back to the field for retesting. This method of in-field testing has allowed iRobot to quickly improve its technology and design so it can truly fulfill the needs of its end-users. The leveraged model uses other organizations for funding, research, and product development. iRobot's next generation of military products are supported by various U.S. government organizations. Although the government has certain rights to these products, iRobot does sults Sales, Net Income, and Gross Margins From 2005 through 2009, iRobot's total revenue more than doubled, from US\$142 million to US\$299 million. Revenues received from products accounted for nearly 88% of total revenue, far greater than the remaining 12% received from contract revenue, though contract revenue showed a record high of US\$36 million by the end of 2009. (See Exhibit 2). Revenues from 2009 showed a decline of US\$9 million from 2008 that was mainly attributable to a 6.3% decrease in home robots shipped. This decrease resulted from softening demand in the domestic market. On a more positive note, the total US $30.9 million decrease in domestic sales was partially offset by an increase in international sales (US\$23.2 million). Even though revenues declined in 2009 , iRobot was able to control its costs and operating expenses, resulting in an increase in net income of over four-fold, from US\$756.000 in 2008 to US\$3.3 million in 2009. Cash and Long-Term Debt iRobot is in a strong financial position regarding cash and long-term debt. In 2009, iRobot increased its cash position by over US $11 million while decreasing the amount of long-term debt by about USS400,600. Its cash position by the end of 2009 was US\$72 million versus USS41 million in 2010 , an increase of over 77%. This put iRobot in a good position to continue investing in research and development even if sales began to slow. At the end of 2009 , iRobot's long-term debt was just over USS4 million (see Exhibit 3), iRobot's financial status gives it a competitive edge, as it should be able to withstand both current and future unforeseen swings in sales, supplier issues, and the cancellation of govemment contracts. iRobot's promotion strategies vary by product group, but neither its defense product group nor its home care product group utilize television or radio advertising. Since defense products are produced solely for the U.S. government, promotion is unnecessary. Home care products, on Operations iRobot is not a manufacturing company, nor has it ever claimed to be. Its core competency is to design, develop, and market robots, not manufacture them. All non-core activities are outsourced to third parties skilled in manufacturing. While third-party manufacturers provide the raw materials and labor, iRobot concentrates on developing and optimizing prototypes. CASE 25 iRobot Up until April 2010, iRobot used only two third-party manufacturers for its consumer products: Jetta Co. Ltd. and Kin Yat Industrial Co. Lid., both located in China. iRobot did not have a long-term contract with either company, and the manufacturing was done on a purchase-order basis. This changed in April 2010, when iRobot entered a multi-year manufacturing agreement with electronic parts maker Jabil Circuit Ine., which henceforth would make, test, and supply iRobot's consumer products, including the Roomba. Robotic Industry Robots serve a wide variety of industries, such as the consumer, automotive, military. construction, agricultural, space, renewable energy, medical, law enforcement, utilities, manufacturing, entertainment, mining, transportation, space, and warchouse industries, In 2008 , before the economic downturn, the global market for industry robot systems was estimated to be about 110,000 units, 7 Industrial robot sales worldwide in 2009 slumped by about 50% compared to 2008 . The sales started to improve from the third quarter of 2009 onward, with the slow recovery coming from emerging markets in Asia and especially from China. In North America and Europe, sales were also seen slowly improving from late 2009." The sales of professional services robots, including military and defense robots, were about US\$II billion at the end of 2008 and were expected to grow by US\$10 billion for the period of 2009 to 2012. The 2009 economic recession had negative impacts on consumer spending. iRobot domestic sales of robot vacuum cleaners, predominantly the Roomba, were down comparable to other US\$400 discretionary purchases, and its international sales also experienced a slowdown. 11 In addition to lower consumer demand, the national and intemational credit crunches led to a scarcity of credit, tighter lending standards, and higher interest rates on consumer and business loans. Continued disruptions in credit markets may limit consumer credit availability and impact home robot sales. If the robot market does not experience significant growth, the entire industry may not survive, "Fallout has forced the robotics industry to look outside of its comfort zone and move into emerging energy technologies like batteries, wind, and solar power," said Roger Christian, Vice President of Marketing and International Groups at Motoman Inc. He also predicted growing demand for robotics in health care and the food and beverage industry. 12 Under the Obama administration, there were economic incentives devoted to R\&D in alternative energy industries. For example, "the Stimulus Act passed by Congress in early 2009, a US\$787 billion package of tax cuts, state aid, and government contracts, has made some impact on the alternative energy market in favor of robotics," ,13 In addition to its home care and military markets, iRobot hoped to expand into the civil law enforcement market and the maritime market. It also explored possibilities in the health care market. 14 It partnered with the toy company Hasbro to enter the toy market with My Real Baby-an evolutionary doll that has animatronics and emotional response software. iRobot continued to grow its international presence by entering new markets. The percentage of its international sales rose from 38% in 2008 to 53.8% in 2009.15 Its growing focus on international sales resulted in an increase of US $23.2 million in international home robots revenue for 2009 compared to 2008 . iRobot also sold its military products overseas in compliance with the International Traffic in Arms Regulations. iRobot was competing in a new and emerging market. Although the industry had relatively low competition, analysts believed iRobot needed "more competition, not less, to help build up the total scale and visibility of the fledgling industry it had been pioneering. +16 If the demand for the home robots became stagnant or declined, this would greatly impact the vitality of iRobot and put it under pressure to remain innovative and adaptive to consumer needs in the event that it did gain widespread popularity. iRobot's consumer products were primarily a luxury supplemental good gauged toward the middle and upper class. iRobot's home cleaning robots were reasonably priced from US\$129 to US\$1000, depending on the model and accessories. Such a price range was comparable with luxury brands of vacuum machines. However, times of economic recession could prove to be a problem for iRobot's consumer goods sales given that diseretionary budgets have contracted. To save money, iRobot's base customers may revert to manual labor. Supply Chain For many years, iRobot had only two China-based manufacturers to produce its home cleaning robots and no long-term contract with either of those companies. Its best-selling Roomba 400 series and Scooba series, for example, were both produced by Jetta at a single plant in China. This put iRobot in a high-risk situation if Jetta was unable to deliver products for any unforeseen reason, or if quality started to dip below standards. Fortunately, iRobot was aware of the problem and signed a new manufacturing agreement with U.S.-based Jabil Circuit. This relationship provided iRobot with numerous benefits, including diversifying key elements of its supply chain, providing geographic flexibility to address new markets, and expanding overall capacity to meet growing demands. explained Jeffrey Beck, president of iRobot's Home Robots Division. Whether this attempt to diversify its supply chain with a new partnership will work out is of crucial importance for iRobot. Intellectual Property Continued development of products that are difficult to duplicate through reverse engineering will be the key to success in the area of intellectual property. By maintaining strong relationships and giving superior service to customers such as govemment agencies, iRobot can create an advantage even if they are unable to ultimately protect their technology from being duplicated. At the same time, iRobot also needs to ensure that its employees will continue to be innovative and create new technologies to keep iRobot competitive for years to come. Strategic Alliances iRobot relied on strategic alliances to provide technology, complementary product offerings, and better and quicker access to markets. It entered an agreement with The Boeing Company iRobot to develop and market a commercial version of the SUGV that was being developed under the Army's BCTM (formerly FCS) program. It also formed an alliance with Advanced Scientific Concepts Inc. for exclusive rights to use the latter's LADAR technology of unmanned ground vehicles. In exchange, iRobot commited itself to purchase units from Advanced Scientific Concepts. iRobot's Challenge iRobot's focus on home cleaning products differentiates it from all the other manufacturers in the robotics industry, which are mainly focused on manufacturing robots for the automotive sector. iRobot's focus on two entirely different markets consumer and military-allows it (1) the ability to leverage its core capabilities and diversification, and (2) provides it with a hedge against slower demand in one sector. By introducing robotics to the consumer market, iRobot has created a "blue ocean of new opportunities." However, iRobot had numerous competitors with more experience in the consumer marketplace. An analyst wondered if the long-term success in the consumer market would require iRobot to develop more "blue oceans," Also, did it make sense for iRobot to continue to develop new consumer products or would it be better off focusing on the military and acrospace murketplace

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts