Question: CASE REFERENCE AND QUESTIONS 1. Begin your writing by comparing the database management systems (DBMS) that are specified in the case and explaining the importance

CASE REFERENCE AND QUESTIONS

1. Begin your writing by comparing the database management systems (DBMS) that are specified in the case and explaining the importance they have when defining the data storage capacity. 2. Choose the DBMS that should be used according to the case studied. Explain and justify your answer. 3. Conclude your writing by discussing the importance of requirements in the information delivery component. It specifies what would be the strategy used for the delivery of information according to the case studied.

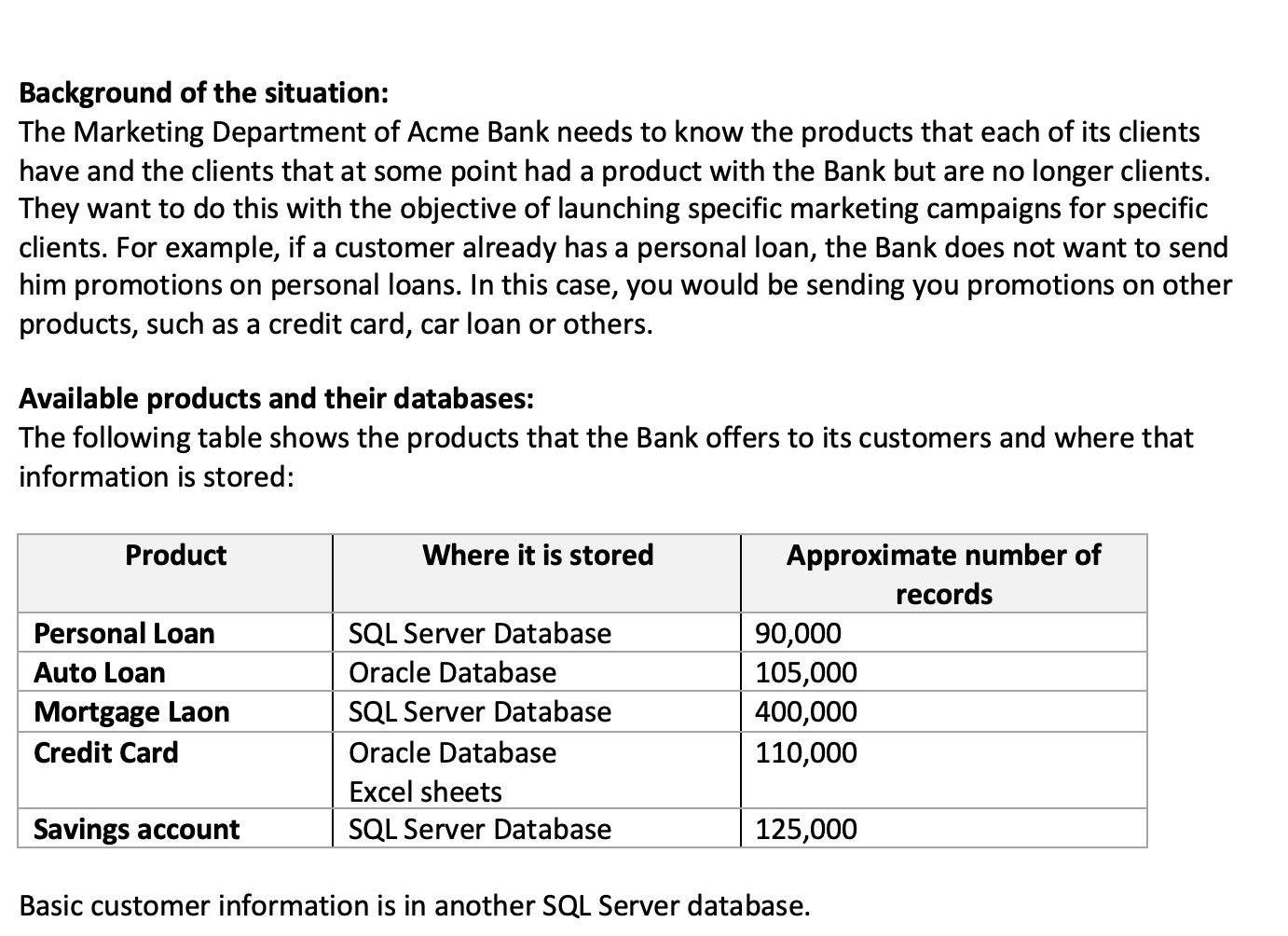

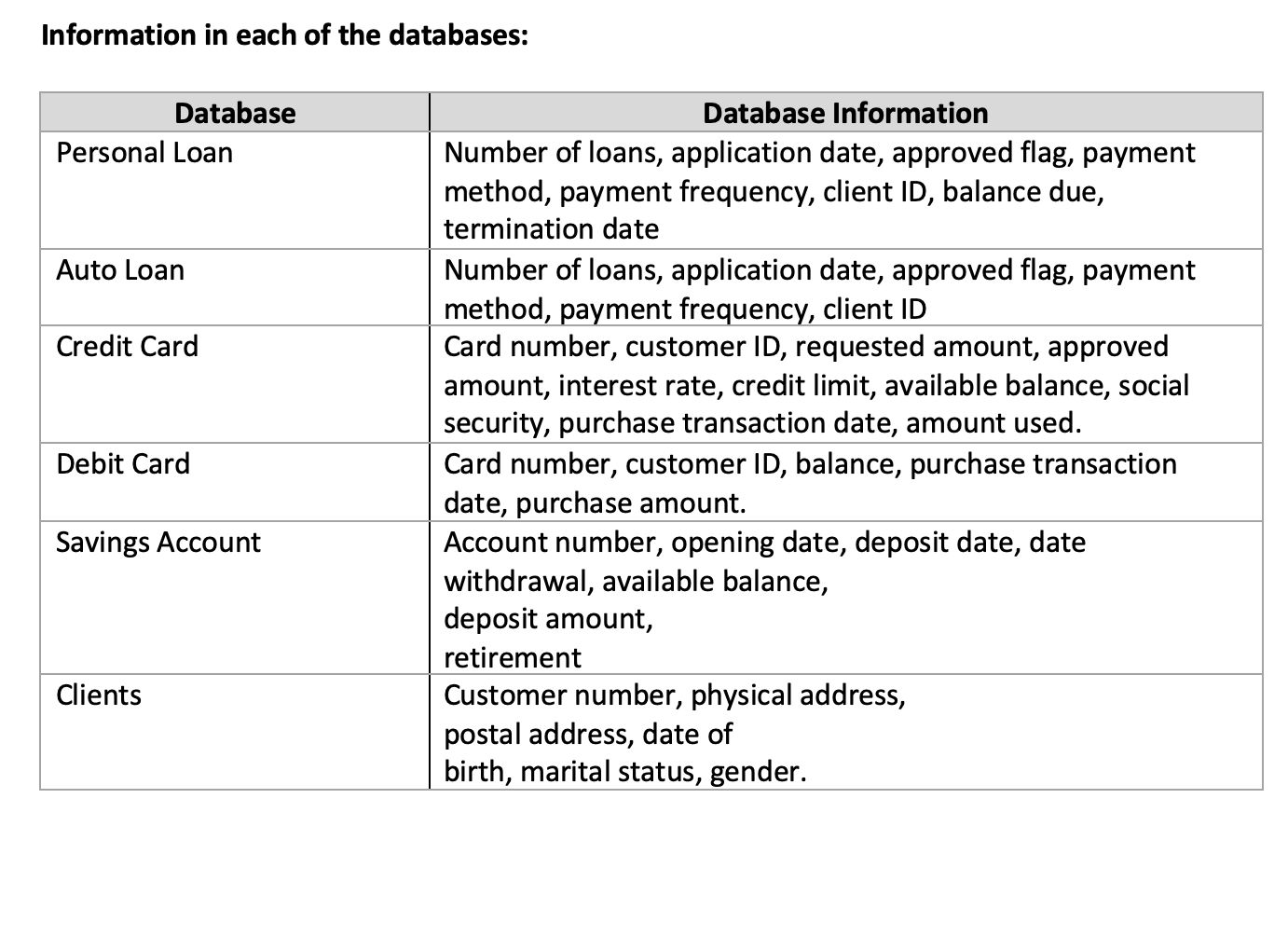

Background of the situation: The Marketing Department of Acme Bank needs to know the products that each of its clients have and the clients that at some point had a product with the Bank but are no longer clients. They want to do this with the objective of launching specific marketing campaigns for specific clients. For example, if a customer already has a personal loan, the Bank does not want to send him promotions on personal loans. In this case, you would be sending you promotions on other products, such as a credit card, car loan or others. Available products and their databases: The following table shows the products that the Bank offers to its customers and where that information is stored: Product Where it is stored Personal Loan Auto Loan Mortgage Laon Credit Card SQL Server Database Oracle Database SQL Server Database Oracle Database Excel sheets SQL Server Database Approximate number of records 90,000 105,000 400,000 110,000 Savings account 125,000 Basic customer information is in another SQL Server database. Information in each of the databases: Database Personal Loan Auto Loan Credit Card Database Information Number of loans, application date, approved flag, payment method, payment frequency, client ID, balance due, termination date Number of loans, application date, approved flag, payment method, payment frequency, client ID Card number, customer ID, requested amount, approved amount, interest rate, credit limit, available balance, social security, purchase transaction date, amount used. Card number, customer ID, balance, purchase transaction date, purchase amount. Account number, opening date, deposit date, date withdrawal, available balance, deposit amount, retirement Customer number, physical address, postal address, date of birth, marital status, gender. Debit Card Savings Account ClientsStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts