Question: CASE STUDY 1 A couple Mark, aged 58 and Pauline, aged 54 have two daughters-Kay aged 33 and Teena aged 29. Mark who was a

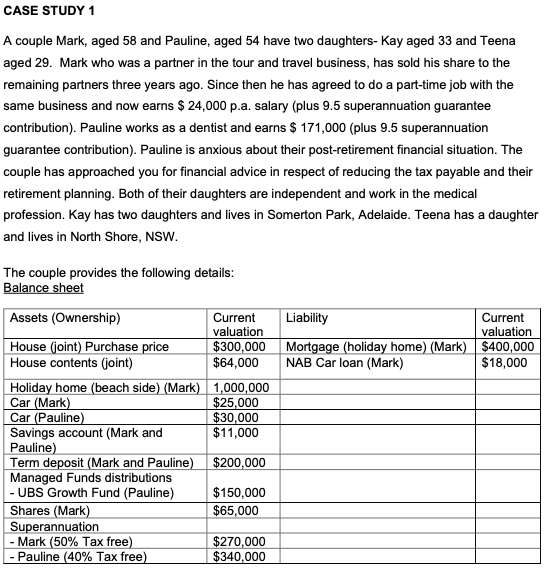

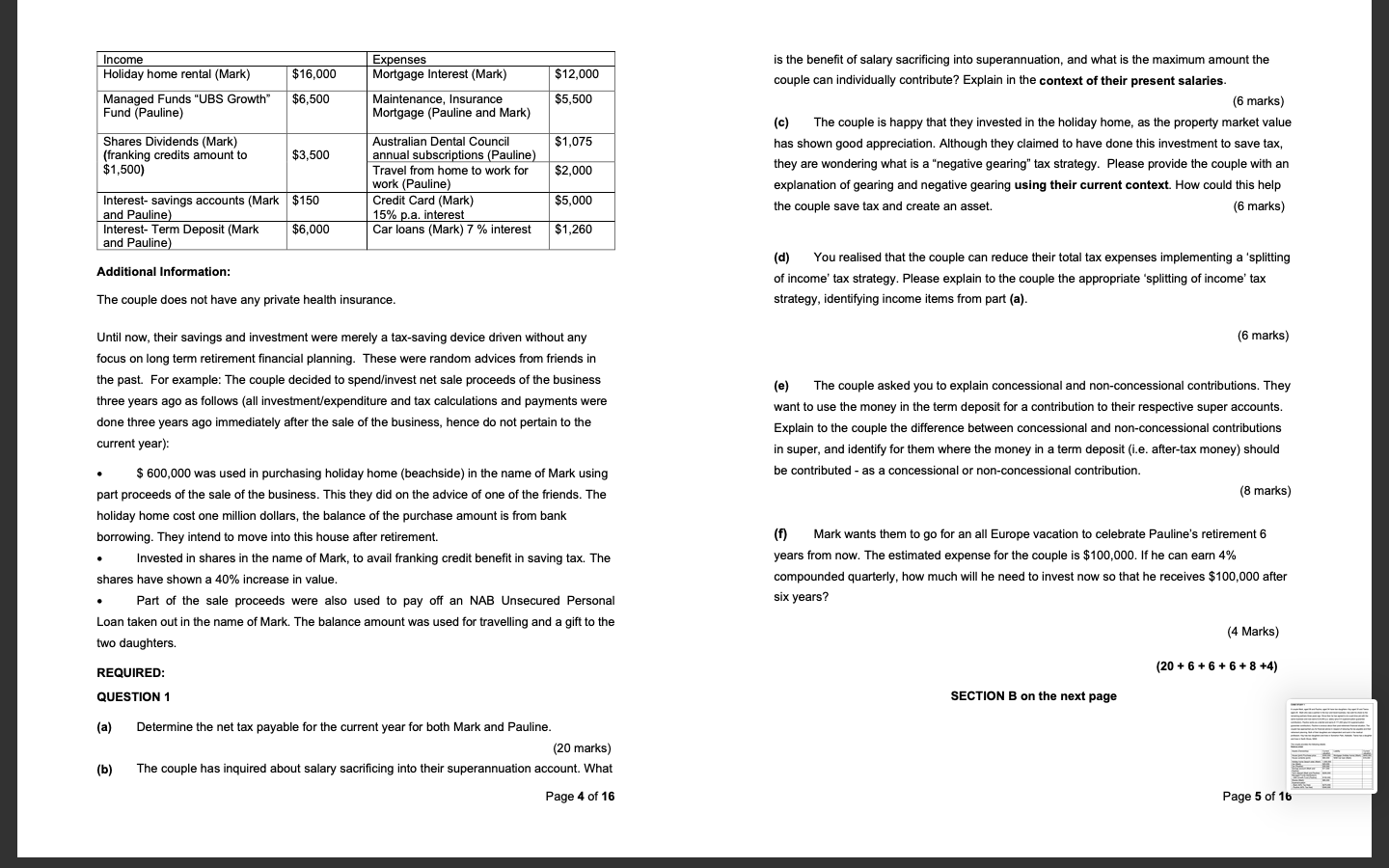

CASE STUDY 1 A couple Mark, aged 58 and Pauline, aged 54 have two daughters-Kay aged 33 and Teena aged 29. Mark who was a partner in the tour and travel business, has sold his share to the remaining partners three years ago. Since then he has agreed to do a part-time job with the same business and now earns $ 24,000 p.a. salary (plus 9.5 superannuation guarantee contribution). Pauline works as a dentist and earns $ 171,000 (plus 9.5 superannuation guarantee contribution). Pauline is anxious about their post-retirement financial situation. The couple has approached you for financial advice in respect of reducing the tax payable and their retirement planning. Both of their daughters are independent and work in the medical profession. Kay has two daughters and lives in Somerton Park, Adelaide. Teena has a daughter and lives in North Shore, NSW. The couple provides the following details: Balance sheet Liability Current valuation Mortgage (holiday home) (Mark) $400,000 NAB Car loan (Mark) $18,000 Assets (Ownership) Current valuation House (joint) Purchase price $300,000 House contents (joint) $64,000 Holiday home (beach side) (Mark) 1,000,000 Car (Mark) $25,000 Car (Pauline) $30,000 Savings account (Mark and $11,000 Pauline) Term deposit (Mark and Pauline) $200,000 Managed Funds distributions - UBS Growth Fund (Pauline) $150,000 Shares (Mark) $65,000 Superannuation Mark (50% Tax free) $270,000 - Pauline (40% Tax free) $340,000 Income Holiday home rental (Mark) Expenses Mortgage Interest (Mark) $ 16,000 $12,000 Managed Funds "UBS Growth" Fund (Pauline) $6,500 $5,500 Maintenance, Insurance Mortgage (Pauline and Mark) is the benefit of salary sacrificing into superannuation, and what is the maximum amount the couple can individually contribute? Explain the context of their present salaries (6 marks) (c) The couple is happy that they invested in the holiday home, as the property market value has shown good appreciation. Although they claimed to have done this investment to save tax, they are wondering what is a "negative gearing" tax strategy. Please provide the couple with an explanation of gearing and negative gearing using their current context. How could this help the couple save tax and create an asset. (6 marks) $1,075 Shares Dividends (Mark) (franking credits amount to $1,500) $3,500 Australian Dental Council annual subscriptions (Pauline) Travel from home to work for work (Pauline) Credit Card (Mark) 15% p.a. interest Car loans (Mark) 7 % interest $2,000 $5,000 Interest- savings accounts (Mark $150 and Pauline) Interest-Term Deposit (Mark $6,000 and Pauline) $1,260 Additional Information: (d) You realised that the couple can reduce their total tax expenses implementing a 'splitting of income tax strategy. Please explain to the couple the appropriate 'splitting of income tax strategy, identifying income items from part (a). The couple does not have any private health insurance. (6 marks) Until now, their savings and investment were merely a tax-saving device driven without any focus on long term retirement financial planning. These were random advices from friends in the past. For example: The couple decided to spend/invest net sale proceeds of the business three years ago as follows (all investment/expenditure and tax calculations and payments were done three years ago immediately after the sale of the business, hence do not pertain to the current year): (e) The couple asked you to explain concessional and non-concessional contributions. They want to use the money in the term deposit for a contribution to their respective super accounts. Explain to the couple the difference between concessional and non-concessional contributions in super, and identify for them where the money in a term deposit (i.e. after-tax money) should be contributed - as a concessional or non-concessional contribution. (8 marks) $ 600,000 was used in purchasing holiday home (beachside) in the name of Mark using part proceeds of the sale of the business. This they did on the advice of one of the friends. The holiday home cost one million dollars, the balance of the purchase amount is from bank borrowing. They intend to move into this house after retirement. Invested in shares in the name of Mark, to avail franking credit benefit in saving tax. The shares have shown a 40% increase in value. Part of the sale proceeds were also used to pay off an NAB Unsecured Personal Loan taken out in the name of Mark. The balance amount was used for travelling and a gift to the two daughters. (f) Mark wants them to go for an all Europe vacation to celebrate Pauline's retirement 6 years from now. The estimated expense for the couple is $100,000. If he can earn 4% compounded quarterly, how much will he need to invest now so that he receives $100,000 after six years? (4 Marks) REQUIRED: (20 + 6 + 6 + 6 + 8 +4) QUESTION 1 SECTION B on the next page (a) Determine the net tax payable for the current year for both Mark and Pauline. (20 marks) The couple has inquired about salary sacrificing into their superannuation account. What Page 4 of 16 (b) Page 5 of 16 CASE STUDY 1 A couple Mark, aged 58 and Pauline, aged 54 have two daughters-Kay aged 33 and Teena aged 29. Mark who was a partner in the tour and travel business, has sold his share to the remaining partners three years ago. Since then he has agreed to do a part-time job with the same business and now earns $ 24,000 p.a. salary (plus 9.5 superannuation guarantee contribution). Pauline works as a dentist and earns $ 171,000 (plus 9.5 superannuation guarantee contribution). Pauline is anxious about their post-retirement financial situation. The couple has approached you for financial advice in respect of reducing the tax payable and their retirement planning. Both of their daughters are independent and work in the medical profession. Kay has two daughters and lives in Somerton Park, Adelaide. Teena has a daughter and lives in North Shore, NSW. The couple provides the following details: Balance sheet Liability Current valuation Mortgage (holiday home) (Mark) $400,000 NAB Car loan (Mark) $18,000 Assets (Ownership) Current valuation House (joint) Purchase price $300,000 House contents (joint) $64,000 Holiday home (beach side) (Mark) 1,000,000 Car (Mark) $25,000 Car (Pauline) $30,000 Savings account (Mark and $11,000 Pauline) Term deposit (Mark and Pauline) $200,000 Managed Funds distributions - UBS Growth Fund (Pauline) $150,000 Shares (Mark) $65,000 Superannuation Mark (50% Tax free) $270,000 - Pauline (40% Tax free) $340,000 Income Holiday home rental (Mark) Expenses Mortgage Interest (Mark) $ 16,000 $12,000 Managed Funds "UBS Growth" Fund (Pauline) $6,500 $5,500 Maintenance, Insurance Mortgage (Pauline and Mark) is the benefit of salary sacrificing into superannuation, and what is the maximum amount the couple can individually contribute? Explain the context of their present salaries (6 marks) (c) The couple is happy that they invested in the holiday home, as the property market value has shown good appreciation. Although they claimed to have done this investment to save tax, they are wondering what is a "negative gearing" tax strategy. Please provide the couple with an explanation of gearing and negative gearing using their current context. How could this help the couple save tax and create an asset. (6 marks) $1,075 Shares Dividends (Mark) (franking credits amount to $1,500) $3,500 Australian Dental Council annual subscriptions (Pauline) Travel from home to work for work (Pauline) Credit Card (Mark) 15% p.a. interest Car loans (Mark) 7 % interest $2,000 $5,000 Interest- savings accounts (Mark $150 and Pauline) Interest-Term Deposit (Mark $6,000 and Pauline) $1,260 Additional Information: (d) You realised that the couple can reduce their total tax expenses implementing a 'splitting of income tax strategy. Please explain to the couple the appropriate 'splitting of income tax strategy, identifying income items from part (a). The couple does not have any private health insurance. (6 marks) Until now, their savings and investment were merely a tax-saving device driven without any focus on long term retirement financial planning. These were random advices from friends in the past. For example: The couple decided to spend/invest net sale proceeds of the business three years ago as follows (all investment/expenditure and tax calculations and payments were done three years ago immediately after the sale of the business, hence do not pertain to the current year): (e) The couple asked you to explain concessional and non-concessional contributions. They want to use the money in the term deposit for a contribution to their respective super accounts. Explain to the couple the difference between concessional and non-concessional contributions in super, and identify for them where the money in a term deposit (i.e. after-tax money) should be contributed - as a concessional or non-concessional contribution. (8 marks) $ 600,000 was used in purchasing holiday home (beachside) in the name of Mark using part proceeds of the sale of the business. This they did on the advice of one of the friends. The holiday home cost one million dollars, the balance of the purchase amount is from bank borrowing. They intend to move into this house after retirement. Invested in shares in the name of Mark, to avail franking credit benefit in saving tax. The shares have shown a 40% increase in value. Part of the sale proceeds were also used to pay off an NAB Unsecured Personal Loan taken out in the name of Mark. The balance amount was used for travelling and a gift to the two daughters. (f) Mark wants them to go for an all Europe vacation to celebrate Pauline's retirement 6 years from now. The estimated expense for the couple is $100,000. If he can earn 4% compounded quarterly, how much will he need to invest now so that he receives $100,000 after six years? (4 Marks) REQUIRED: (20 + 6 + 6 + 6 + 8 +4) QUESTION 1 SECTION B on the next page (a) Determine the net tax payable for the current year for both Mark and Pauline. (20 marks) The couple has inquired about salary sacrificing into their superannuation account. What Page 4 of 16 (b) Page 5 of 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts