Question: CASE STUDY 1 CALLABLE BOND A $5000 callable bond matures on 1 September 2021 at par. It is callable on 1 September 2014, 2016 or

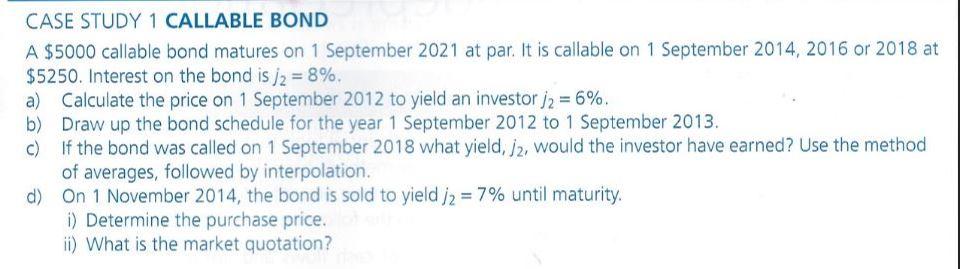

CASE STUDY 1 CALLABLE BOND A $5000 callable bond matures on 1 September 2021 at par. It is callable on 1 September 2014, 2016 or 2018 at $5250. Interest on the bond is j2 = 8%. a) Calculate the price on 1 September 2012 to yield an investor j2 = 6%. b) Draw up the bond schedule for the year 1 September 2012 to 1 September 2013 If the bond was called on 1 September 2018 what yield, /2, would the investor have earned? Use the method of averages, followed by interpolation. d) On 1 November 2014, the bond is sold to yield 12 = 7% until maturity. i) Determine the purchase price. ii) What is the market quotation? CASE STUDY 1 CALLABLE BOND A $5000 callable bond matures on 1 September 2021 at par. It is callable on 1 September 2014, 2016 or 2018 at $5250. Interest on the bond is j2 = 8%. a) Calculate the price on 1 September 2012 to yield an investor j2 = 6%. b) Draw up the bond schedule for the year 1 September 2012 to 1 September 2013 If the bond was called on 1 September 2018 what yield, /2, would the investor have earned? Use the method of averages, followed by interpolation. d) On 1 November 2014, the bond is sold to yield 12 = 7% until maturity. i) Determine the purchase price. ii) What is the market quotation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts