Question: Case Study 1 Henry, aged 61, and Beatrice, aged 58. are directors of SCG Pty Ltd. SCG Pty Ltd is the trustee of their self

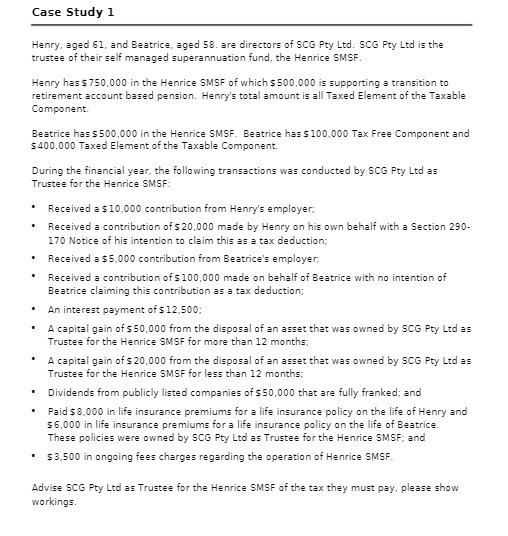

Case Study 1 Henry, aged 61, and Beatrice, aged 58. are directors of SCG Pty Ltd. SCG Pty Ltd is the trustee of their self managed superannuateon fund, the Henrice SMSF. Henry has $750,000 in the Henrice SMSF of which $ 500,000 is supporting a transition to retirement account based pension. Henry's total amount is all Taxed Element of the Taxable Component. Beatrice has $500.000 in the Henrice SMSF. Beatrice has $ 100,000 Tax Free Component and $400,000 Taxed Element of the Taxable Component. During the financial year, the following transactions was conducted by SCG Pty Ltd as Trustee for the Henrice SMSF: Received a $ 10.000 contribution from Henry's employer: Received a contribution of $20,000 made by Henry on his own behalf with a Section 290- 170 Notice of his intention to claim this as a tax deduction; Received a $5.000 contribution from Beatrice's employer, Received a contribution of $100,000 made on behalf of Beatrice with no intention of Beatrice claiming this contribution as a tax deduction; An interest payment of $ 12.500; A capital gain of $50,000 from the disposal of an asset that was owned by SCG Pty Ltd as Trustee for the Henrice SMSF for more than 12 months: A capital gain of $ 20,000 from the disposal of an asset that was owned by SCG Pty Ltd as Trustee for the Henrice SMSF for less than 12 months; Dividends from publicly listed companies of $50,000 that are fully franked; and Paid $8,000 in life insurance premiums for a life insurance policy on the life of Henry and $6,000 in life insurance premiums for a life insurance policy on the life of Beatrice. These policies were owned by SCG Pty Ltd as Trustee for the Henrice SMSF; and $3.500 in ongoing fees charges regarding the operation of Henrice SMSF. Advise SCG Pty Ltd as Trustee for the Henrice SMSF of the tax they must pay, please show workings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts