Question: Case study 1: VAR As a money manager, you are keen to assess your financial risk exposure. Currently, you have on your financial log the

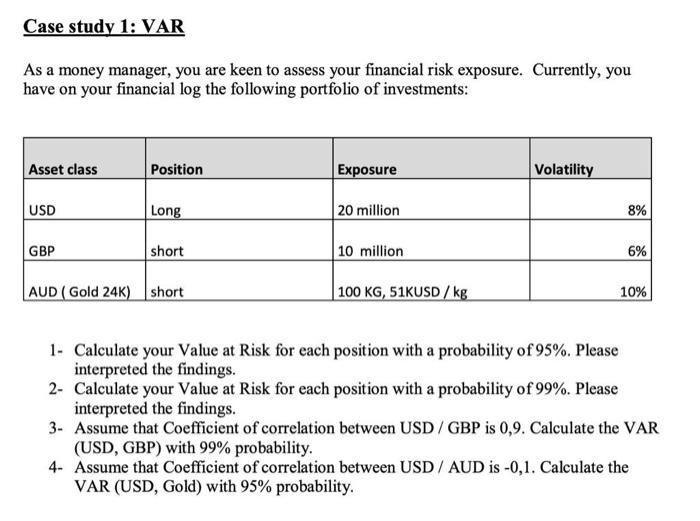

Case study 1: VAR As a money manager, you are keen to assess your financial risk exposure. Currently, you have on your financial log the following portfolio of investments: Asset class Position Exposure Volatility USD Long 20 million 8% GBP short 10 million 6% AUD (Gold 24K) short 100 KG, 51KUSD / kg 10% 1. Calculate your Value at Risk for each position with a probability of 95%. Please interpreted the findings. 2- Calculate your Value at Risk for each position with a probability of 99%. Please interpreted the findings. 3- Assume that Coefficient of correlation between USD/GBP is 0,9. Calculate the VAR (USD, GBP) with 99% probability. 4- Assume that Coefficient of correlation between USD / AUD is -0,1. Calculate the VAR (USD, Gold) with 95% probability. Case study 1: VAR As a money manager, you are keen to assess your financial risk exposure. Currently, you have on your financial log the following portfolio of investments: Asset class Position Exposure Volatility USD Long 20 million 8% GBP short 10 million 6% AUD (Gold 24K) short 100 KG, 51KUSD / kg 10% 1. Calculate your Value at Risk for each position with a probability of 95%. Please interpreted the findings. 2- Calculate your Value at Risk for each position with a probability of 99%. Please interpreted the findings. 3- Assume that Coefficient of correlation between USD/GBP is 0,9. Calculate the VAR (USD, GBP) with 99% probability. 4- Assume that Coefficient of correlation between USD / AUD is -0,1. Calculate the VAR (USD, Gold) with 95% probability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts