Question: Case Study 2 15 Marks All has $9,000 to invest and is considering the following securities for his portfolio: a. Ordinary shares of Biotech Ltd

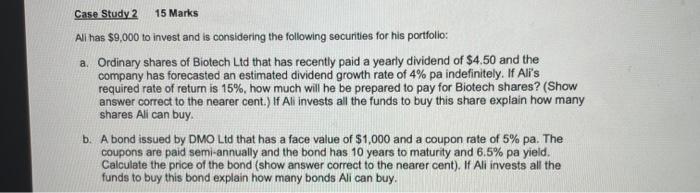

Case Study 2 15 Marks All has $9,000 to invest and is considering the following securities for his portfolio: a. Ordinary shares of Biotech Ltd that has recently paid a yearly dividend of $4.50 and the company has forecasted an estimated dividend growth rate of 4% pa indefinitely. If Ali's required rate of return is 15%, how much will he be prepared to pay for Biotech shares? (Show answer correct to the nearer cent.) If Ali invests all the funds to buy this share explain how many shares All can buy. b. A bond issued by DMO Ltd that has a face value of $1,000 and a coupon rate of 5% pa. The coupons are paid semi-annually and the bond has 10 years to maturity and 6.5% pa yield. Calculate the price of the bond (show answer correct to the nearer cent). If Ali invests all the funds to buy this bond explain how many bonds Ali can buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts