Question: Case Study 2 35 marks FSB Ltd has a new project under consideration which will cost $10,000,000. The project is expected to generate before-tax cash

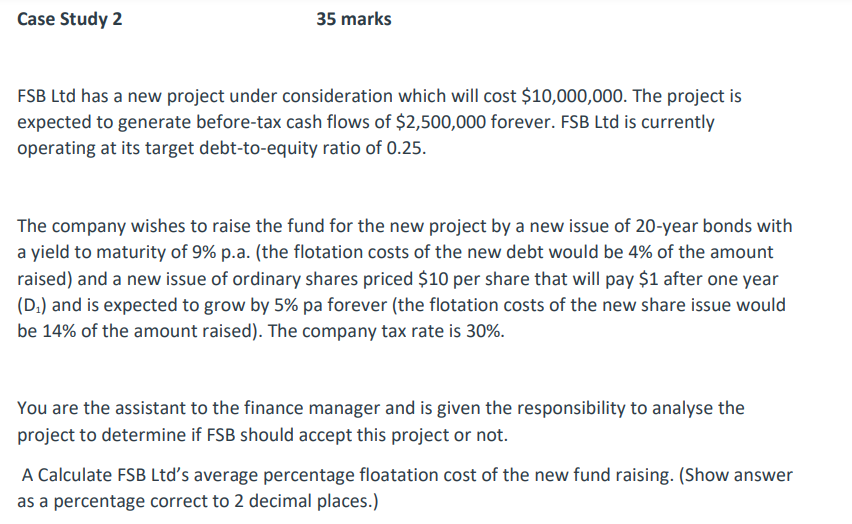

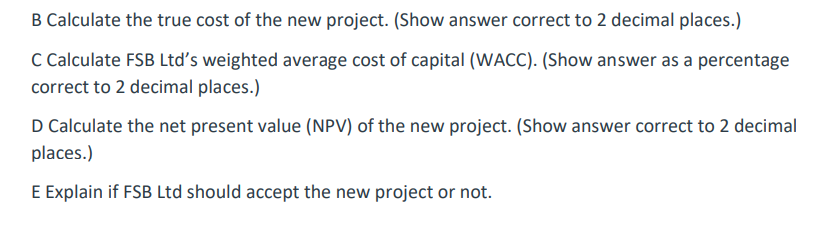

Case Study 2 35 marks FSB Ltd has a new project under consideration which will cost $10,000,000. The project is expected to generate before-tax cash flows of $2,500,000 forever. FSB Ltd is currently operating at its target debt-to-equity ratio of 0.25. The company wishes to raise the fund for the new project by a new issue of 20-year bonds with a yield to maturity of 9% p.a. (the flotation costs of the new debt would be 4% of the amount raised) and a new issue of ordinary shares priced $10 per share that will pay $1 after one year (D.) and is expected to grow by 5% pa forever (the flotation costs of the new share issue would be 14% of the amount raised). The company tax rate is 30%. You are the assistant to the finance manager and is given the responsibility to analyse the project to determine if FSB should accept this project or not. A Calculate FSB Ltd's average percentage floatation cost of the new fund raising. (Show answer as a percentage correct to 2 decimal places.) B Calculate the true cost of the new project. (Show answer correct to 2 decimal places.) C Calculate FSB Ltd's weighted average cost of capital (WACC). (Show answer as a percentage correct to 2 decimal places.) D Calculate the net present value (NPV) of the new project. (Show answer correct to 2 decimal places.) E Explain if FSB Ltd should accept the new project or not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts