Question: Please help me . I will give good rating . Please urgent You are provided with an evaluation of two projects with 5-years expected useful

Please help me . I will give good rating . Please urgent

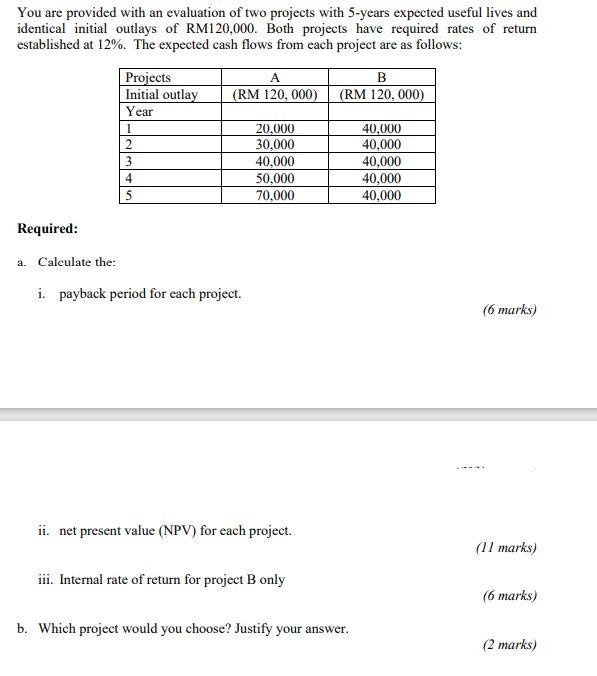

You are provided with an evaluation of two projects with 5-years expected useful lives and identical initial outlays of RM120,000. Both projects have required rates of return established at 12%. The expected cash flows from each project are as follows: A (RM 120, 000) B (RM 120,000) Projects Initial outlay Year 1 2 3 4 5 20.000 30,000 40,000 50,000 70,000 40,000 40,000 40,000 40,000 40,000 Required: a. . Calculate the i. payback period for each project. (6 marks) ii. net present value (NPV) for each project. (11 marks) iii. Internal rate of return for project B only (6 marks) b. Which project would you choose? Justify your answer. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts