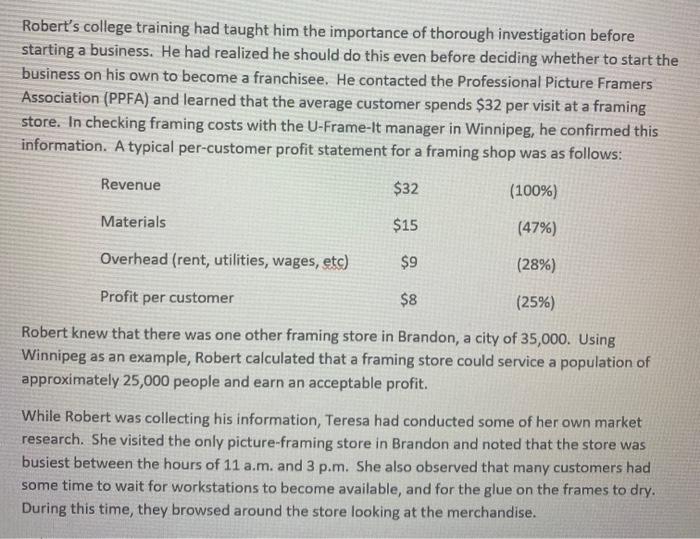

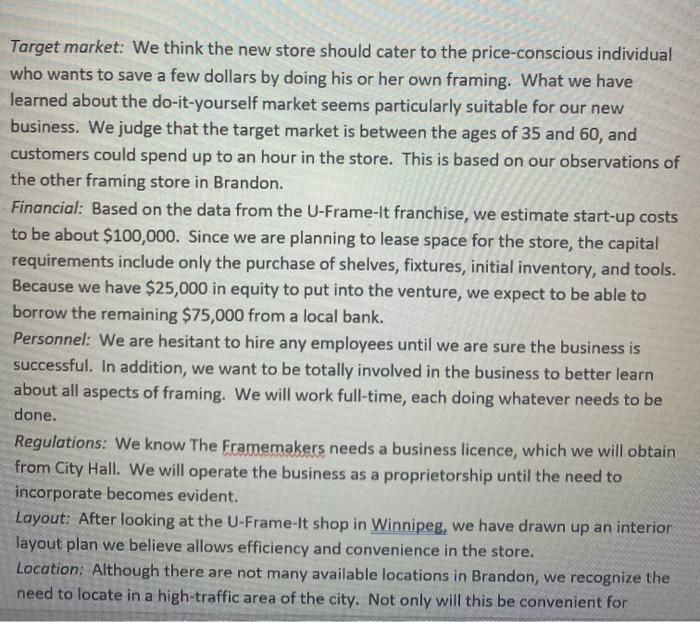

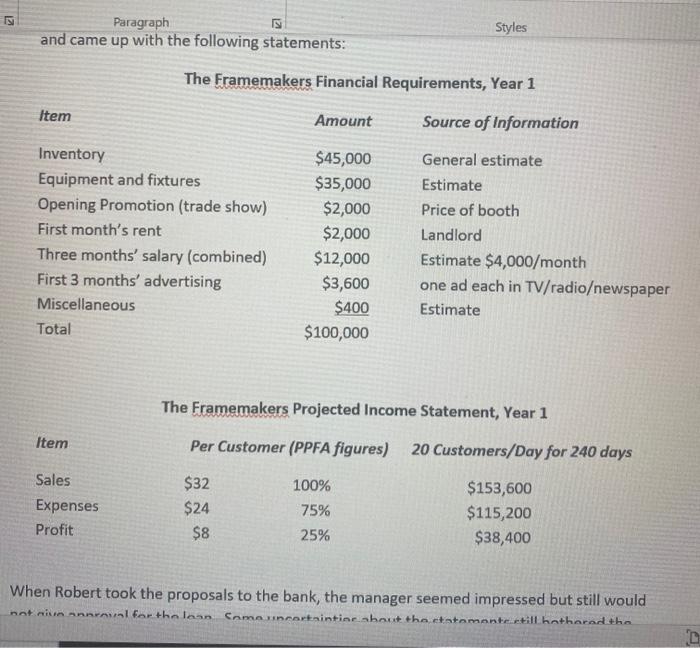

Case Study (20 marks available) Robert and Teresa Norman are facing a big decision. They are contemplating Robert leaving his job managing his father's painting business to set up their own retail picture-framing store. As they think about this dilemma, their minds wander back to the events that led up the impending decision. Robert was raised in a small town about 32 kilometers south of Brandon, Manitoba. His father was a painter, and Robert worked in the painting business part-time for several years. After graduating from high school, he completed a two-year business administration in interior design course at a college in the United States. It was there that he met and married his wife, Teresa. Teresa studied interior design at college. She came from a small farming community near Robert's hometown. One of her favourite pastimes when she was growing up was taking pictures of the beautiful scenery and making frames for them. Teresa, an only child, had always been very independent. Her parents, farmers, spent a lot of time tending to the farm. Teresa started helping them when she was very young by doing the bookkeeping and other administrative jobs. Styles he wanted to get some outside business experience first. As a result, he found a job in a Walmart store in Winnipeg after graduation. Robert enjoyed working with people in the retail setting, but felt frustrated working for a large company. He wanted to be on his own, and dreamed of someday running his own business. While Robert worked at Walmart, Teresa was developing her photography skills, working for local retailers helping them create online advertising and occasionally taking pictures at weddings. Although she was fairly busy with this, she did not feel at if she were being challenged. Finally, after two years with Walmart, the Normans decided to leave Winnipeg and return to Brandon where they could begin to take over the painting business. Robert's father was pleased with their decision and, since he was approaching retirement age, allowed his son to assume a major role in the business. Robert managed the business for six years with Teresa doing the bookkeeping. But although it provided a steady income, he could see that the growth possibilities in terms of income and challenge were limited. In addition, he soon realized that he did not like painting as much as he thought he would. As a result, he and Teresa started looking around for sideline opportunities to earn a little extra money. One they particularly enjoyed was assembling and selling picture frames. One day, while in Winnipeg to buy some water-seal paint, Robert ran across a small retail store called U-Frame-It. He went in to look around and talk to the manager about the business. He was impressed by the manager's enthusiasm and noticed that the store was extremely busy, Robert immediately began wondering about the possibility of starting his own picture framing store. Excited by what he had seen, Robert returned to Brandon without even buying his paint and told Teresa what had happened. She was extremely enthusiastic about the idea. Robert's Robert's college training had taught him the importance of thorough investigation before starting a business. He had realized he should do this even before deciding whether to start the business on his own to become a franchisee. He contacted the Professional Picture Framers Association (PPFA) and learned that the average customer spends $32 per visit at a framing store. In checking framing costs with the U-Frame-It manager in Winnipeg, he confirmed this information. A typical per-customer profit statement for a framing shop was as follows: Revenue $32 (100%) Materials $15 (47%) Overhead (rent, utilities, wages, etc) $9 (28%) Profit per customer $8 (25%) Robert knew that there was one other framing store in Brandon, a city of 35,000. Using Winnipeg as an example, Robert calculated that a framing store could service a population of approximately 25,000 people and earn an acceptable profit. While Robert was collecting his information, Teresa had conducted some of her own market research. She visited the only picture-framing store in Brandon and noted that the store was busiest between the hours of 11 a.m. and 3 p.m. She also observed that many customers had some time to wait for workstations to become available, and for the glue on the frames to dry. During this time, they browsed around the store looking at the merchandise. Target market: We think the new store should cater to the price-conscious individual who wants to save a few dollars by doing his or her own framing. What we have learned about the do-it-yourself market seems particularly suitable for our new business. We judge that the target market is between the ages of 35 and 60, and customers could spend up to an hour in the store. This is based on our observations of the other framing store in Brandon. Financial: Based on the data from the U-Frame-It franchise, we estimate start-up costs to be about $100,000. Since we are planning to lease space for the store, the capital requirements include only the purchase of shelves, fixtures, initial inventory, and tools. Because we have $25,000 in equity to put into the venture, we expect to be able to borrow the remaining $75,000 from a local bank. Personnel: We are hesitant to hire any employees until we are sure the business is successful. In addition, we want to be totally involved in the business to better learn about all aspects of framing. We will work full-time, each doing whatever needs to be done. Regulations: We know The Framemakers needs a business licence, which we will obtain from City Hall. We will operate the business as a proprietorship until the need to incorporate becomes evident. Layout: After looking at the U-Frame-It shop in Winnipeg, we have drawn up an interior layout plan we believe allows efficiency and convenience in the store. Location: Although there are not many available locations in Brandon, we recognize the need to locate in a high-traffic area of the city. Not only will this be convenient for Paragraph and came up with the following statements: Styles The Framemakers Financial Requirements, Year 1 Item Amount Source of Information Inventory Equipment and fixtures Opening Promotion (trade show) First month's rent Three months' salary (combined) First 3 months' advertising Miscellaneous Total $45,000 $35,000 $2,000 $2,000 $12,000 $3,600 $400 $100,000 General estimate Estimate Price of booth Landlord Estimate $4,000/month one ad each in TV/radioewspaper Estimate The Framemakers Projected Income Statement, Year 1 Item Per Customer (PPFA figures) 20 Customers/Day for 240 days 100% Sales Expenses Profit $32 $24 $8 75% $153,600 $115,200 $38,400 25% When Robert took the proposals to the bank, the manager seemed impressed but still would not rinnanfortholes Comencertainting about the statemente tillhethered the al Exam Fall 2020 - Read-Only - Word Search eferences Mailings Review View Help Soda PDF 11 Creator EL AaBbCcDc AaBbCcDc AaBb C AaBbcc Aa Normal T No Space Heading 1 Heading 2 Tit Paragraph Styles Review Robert and Teresa's experience developing The Framemakers, and discuss the following questions: 1. What aspects of Robert and Teresa Norman's backgrounds and personalities will contribute to their success with The Framemakers? Answer: 2. What positive things did Robert and Teresa do in investigating the feasibility of the new store? What additional information might they have collected, and from what sources could this information be obtained? Answer: 3. From the information provided, evaluate the business plan they have prepared for their new business. What parts are good, and what parts could be improved? Answer: 4. What are the pros and cons for the Normans operating a U-Frame-It franchise instead of starting up their business from scratch? Answer: 5. Assuming that you are the bank manager, evaluate the financial requirements and projections Robert and Teresa prepared. What additional information would you want them to provide? If you were the bank manager, would you approve the additional loan request? Answer: 6. If you were Robert or Teresa, what would you do