Question: Case Study 3 It is 01 January 2021. A group of three individuals have formed a company, Orraway Adventures Limited ('OAL), and have subscribed a

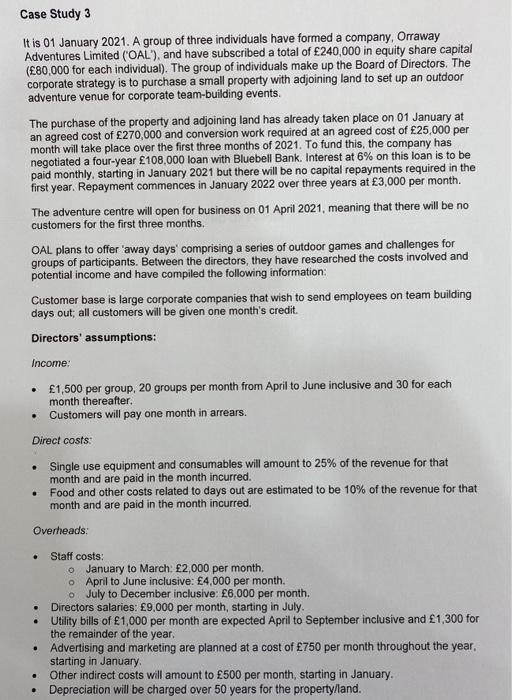

Case Study 3 It is 01 January 2021. A group of three individuals have formed a company, Orraway Adventures Limited ('OAL"), and have subscribed a total of 240,000 in equity share capital (80,000 for each individual). The group of individuals make up the Board of Directors. The corporate strategy is to purchase a small property with adjoining land to set up an outdoor adventure venue for corporate team-building events. The purchase of the property and adjoining land has already taken place on 01 January at an agreed cost of 270,000 and conversion work required at an agreed cost of 25,000 per month will take place over the first three months of 2021. To fund this, the company has negotiated a four-year 108,000 loan with Bluebell Bank. Interest at 6% on this loan is to be paid monthly, starting in January 2021 but there will be no capital repayments required in the first year. Repayment commences in January 2022 over three years at 3,000 per month. The adventure centre will open for business on 01 April 2021, meaning that there will be no customers for the first three months. OAL plans to offer 'away days' comprising a series of outdoor games and challenges for groups of participants. Between the directors, they have researched the costs involved and potential income and have compiled the following information: Customer base is large corporate companies that wish to send employees on team building days out; all customers will be given one month's credit. Directors' assumptions: Income: 1,500 per group, 20 groups per month from April to June inclusive and 30 for each month thereafter. Customers will pay one month in arrears. . Direct costs: Single use equipment and consumables will amount to 25% of the revenue for that month and are paid in the month incurred. Food and other costs related to days out are estimated to be 10% of the revenue for that month and are paid in the month incurred. Overheads: . Staff costs: o January to March: 2,000 per month o April to June inclusive: 4,000 per month o July to December inclusive: 6,000 per month. Directors salaries: 9,000 per month, starting in July. Utility bills of 1,000 per month are expected April to September inclusive and 1,300 for the remainder of the year. Advertising and marketing are planned at a cost of 750 per month throughout the year, starting in January Other indirect costs will amount to 500 per month, starting in January. Depreciation will be charged over 50 years for the property/land. . . Required: Prepare a monthly cash flow projection for 2021 (12 marks) 2. Prepare an annual profit forecast for 2021 (8 marks) 3. What impact do you think the Covid-19 pandemic might have on each of the assumptions made by the OAL Board of Directors? Case Study 3 It is 01 January 2021. A group of three individuals have formed a company, Orraway Adventures Limited ('OAL"), and have subscribed a total of 240,000 in equity share capital (80,000 for each individual). The group of individuals make up the Board of Directors. The corporate strategy is to purchase a small property with adjoining land to set up an outdoor adventure venue for corporate team-building events. The purchase of the property and adjoining land has already taken place on 01 January at an agreed cost of 270,000 and conversion work required at an agreed cost of 25,000 per month will take place over the first three months of 2021. To fund this, the company has negotiated a four-year 108,000 loan with Bluebell Bank. Interest at 6% on this loan is to be paid monthly, starting in January 2021 but there will be no capital repayments required in the first year. Repayment commences in January 2022 over three years at 3,000 per month. The adventure centre will open for business on 01 April 2021, meaning that there will be no customers for the first three months. OAL plans to offer 'away days' comprising a series of outdoor games and challenges for groups of participants. Between the directors, they have researched the costs involved and potential income and have compiled the following information: Customer base is large corporate companies that wish to send employees on team building days out; all customers will be given one month's credit. Directors' assumptions: Income: 1,500 per group, 20 groups per month from April to June inclusive and 30 for each month thereafter. Customers will pay one month in arrears. . Direct costs: Single use equipment and consumables will amount to 25% of the revenue for that month and are paid in the month incurred. Food and other costs related to days out are estimated to be 10% of the revenue for that month and are paid in the month incurred. Overheads: . Staff costs: o January to March: 2,000 per month o April to June inclusive: 4,000 per month o July to December inclusive: 6,000 per month. Directors salaries: 9,000 per month, starting in July. Utility bills of 1,000 per month are expected April to September inclusive and 1,300 for the remainder of the year. Advertising and marketing are planned at a cost of 750 per month throughout the year, starting in January Other indirect costs will amount to 500 per month, starting in January. Depreciation will be charged over 50 years for the property/land. . . Required: Prepare a monthly cash flow projection for 2021 (12 marks) 2. Prepare an annual profit forecast for 2021 (8 marks) 3. What impact do you think the Covid-19 pandemic might have on each of the assumptions made by the OAL Board of Directors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts