Question: CASE STUDY [50 Marks] The case study consists of two questions for two organisations. Question 1 (25 Marks) Hadlows manufactures furniture. It has two production

![CASE STUDY [50 Marks] The case study consists of two questions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd9c7adca00_69866fd9c7a745bd.jpg)

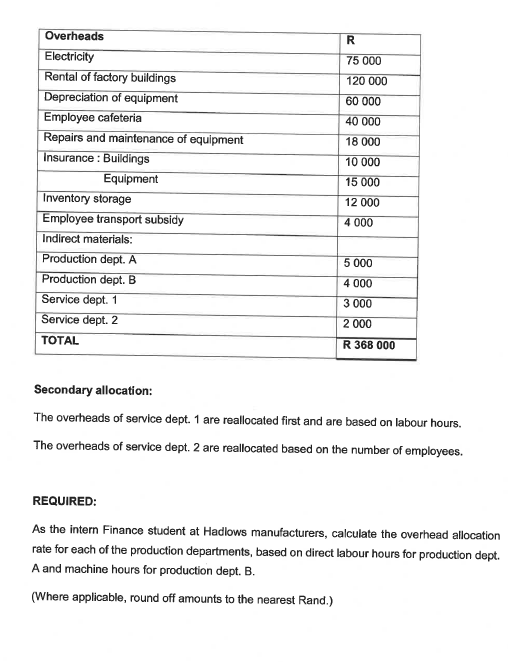

CASE STUDY [50 Marks] The case study consists of two questions for two organisations. Question 1 (25 Marks) Hadlows manufactures furniture. It has two production departments and two service departments. The following information was gathered to allocate overheads among the different departments Production ce centre ce centre dept. B dept. A 2 Num employees Value equipment Floor area Direct labour 24 hours Machine hours 30 000 Kilowatt hours200 Materials usage R 125 000 of 4 of R 200 000 R 180 R 4 R 20 600 200 100 18 500 28 000 180 R 75 000 R 8 000 R 12 000 The budgeted overheads for 2018 are as follows Overheads Electricity Rental of factory buildings 75 000 120 000 60 of equipment Employee cafeteria Repairs and maintenance of equipment nsurance: Buildings 18 000 10 000 Equipment Inventory storage 12 000 oyee transport subsidy 4 000 Indirect materials: Production n dept. 4 000 Service dept. rvice dept. 2 TOTAL R 368 000 Secondary allocation: The overheads of service dept. 1 are reallocated first and are based on labour hours. The overheads of service dept. 2 are reallocated based on the number of employees. REQUIRED: As the intern Finance student at Hadlows manufacturers, calculate the overhead allocation rate for each of the production departments, based on direct labour hours for production dept. A and machine hours for production dept. B (Where applicable, round off amounts to the nearest Rand.) CASE STUDY [50 Marks] The case study consists of two questions for two organisations. Question 1 (25 Marks) Hadlows manufactures furniture. It has two production departments and two service departments. The following information was gathered to allocate overheads among the different departments Production ce centre ce centre dept. B dept. A 2 Num employees Value equipment Floor area Direct labour 24 hours Machine hours 30 000 Kilowatt hours200 Materials usage R 125 000 of 4 of R 200 000 R 180 R 4 R 20 600 200 100 18 500 28 000 180 R 75 000 R 8 000 R 12 000 The budgeted overheads for 2018 are as follows Overheads Electricity Rental of factory buildings 75 000 120 000 60 of equipment Employee cafeteria Repairs and maintenance of equipment nsurance: Buildings 18 000 10 000 Equipment Inventory storage 12 000 oyee transport subsidy 4 000 Indirect materials: Production n dept. 4 000 Service dept. rvice dept. 2 TOTAL R 368 000 Secondary allocation: The overheads of service dept. 1 are reallocated first and are based on labour hours. The overheads of service dept. 2 are reallocated based on the number of employees. REQUIRED: As the intern Finance student at Hadlows manufacturers, calculate the overhead allocation rate for each of the production departments, based on direct labour hours for production dept. A and machine hours for production dept. B (Where applicable, round off amounts to the nearest Rand.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts