Question: Case Study 7.3 Estimating I only need to fill in 3 rows on Figure 1, the spreadsheet.The pics are the entire problem. However, the prof

Case Study 7.3 Estimating

I only need to fill in 3 rows on Figure 1, the spreadsheet.The pics are the entire problem. However, the prof did provide an example:

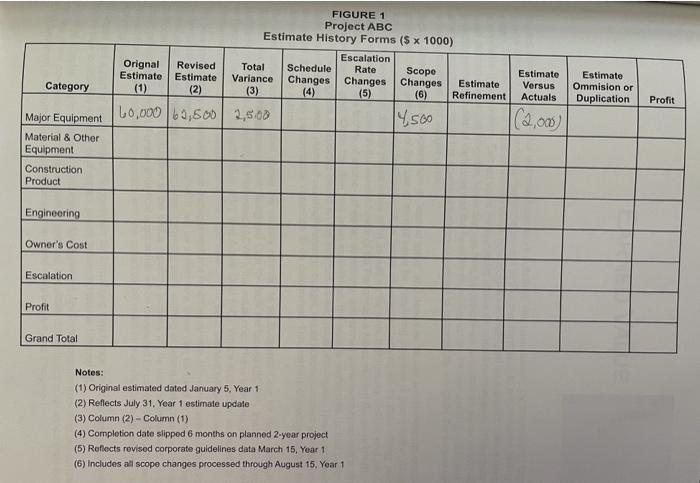

For Category, Major Equipment

Column 1. Original estimate is 60 million - 60,000 (in 1000's)

Column 6. Scope changes for major equipment , under the 3rd item provided in the case study is 4.5 million 4500 (in 1000's) - 4500

Column 7. Estimate Vs Actuals - Under the 6th point in the case study, is 2 million less than the plan. - (2000)

The total Variance Column 3 is 4500 - 2000 = 2500

Revised estimate = 60,000 + 2500 = 62500.

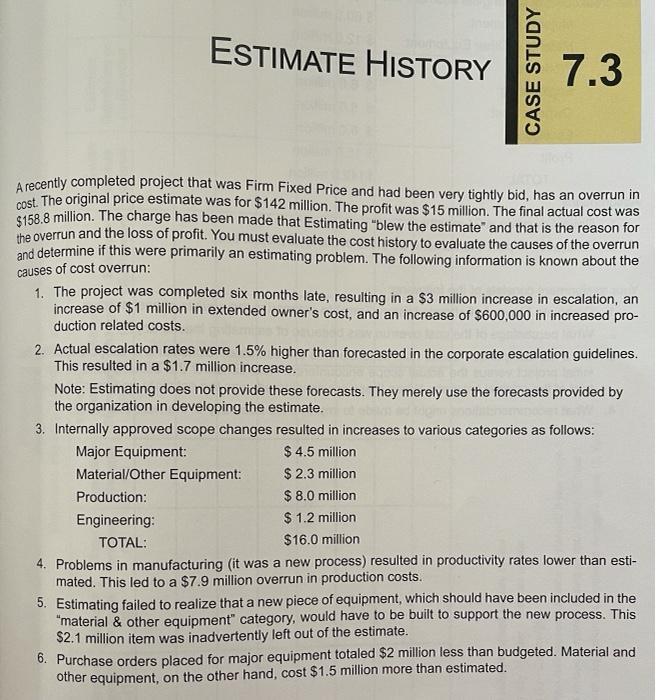

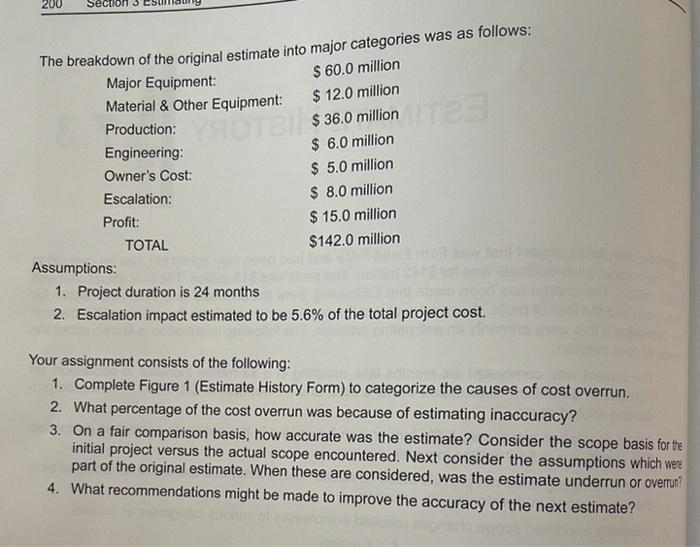

ESTIMATE HISTORY 7.3 A recently completed project that was Firm Fixed Price and had been very tightly bid, has an overrun in cost. The original price estimate was for $142 million. The profit was $15 million. The final actual cost was $158.8 million. The charge has been made that Estimating "blew the estimate" and that is the reason for the overrun and the loss of profit. You must evaluate the cost history to evaluate the causes of the overrun and determine if this were primarily an estimating problem. The following information is known about the causes of cost overrun: 1. The project was completed six months late, resulting in a $3 million increase in escalation, an increase of $1 million in extended owner's cost, and an increase of $600,000 in increased production related costs. 2. Actual escalation rates were 1.5% higher than forecasted in the corporate escalation guidelines. This resulted in a $1.7 million increase. Note: Estimating does not provide these forecasts. They merely use the forecasts provided by the organization in developing the estimate. 3. Internally approved scope changes resulted in increases to various categories as follows: 4. Problems in manufacturing (it was a new process) resulted in productivity rates lower than estimated. This led to a $7.9 million overrun in production costs. 5. Estimating failed to realize that a new piece of equipment, which should have been included in the "material \& other equipment" category, would have to be built to support the new process. This $2.1 million item was inadvertently left out of the estimate. 6. Purchase orders placed for major equipment totaled $2 million less than budgeted. Material and other equipment, on the other hand, cost $1.5 million more than estimated. The brra-da.u n tha nrininal estimate into major categories was as follows: Assumptions: 1. Project duration is 24 months 2. Escalation impact estimated to be 5.6% of the total project cost. Your assignment consists of the following: 1. Complete Figure 1 (Estimate History Form) to categorize the causes of cost overrun. 2. What percentage of the cost overrun was because of estimating inaccuracy? 3. On a fair comparison basis, how accurate was the estimate? Consider the scope basis for initial project versus the actual scope encountered. Next consider the assumptions which we part of the original estimate. When these are considered, was the estimate underrun or overu 4. What recommendations might be made to improve the accuracy of the next estimate? FIGURE 1 Project ABC Estimate Historv Forms (S1Snn) Notes: (1) Original estimated dated January 5, Year 1 (2) Reflects July 31, Year 1 estimate update (3) Column (2) - Column (1) (4) Completion date slipped 6 months on planned 2-year project (5) Roflects revisod corporate guidelines data March 15, Year 1 (6) Includes all scope changes processed through August 15, Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts