Question: Case Study Assignment. Also answer 4 discussion question at the end of the case study. 2-8 HISPANIC MARKETING IN ONLINE AND MOBILE FORMATS The Hispanic

Case Study Assignment.

Also answer 4 discussion question at the end of the case study.

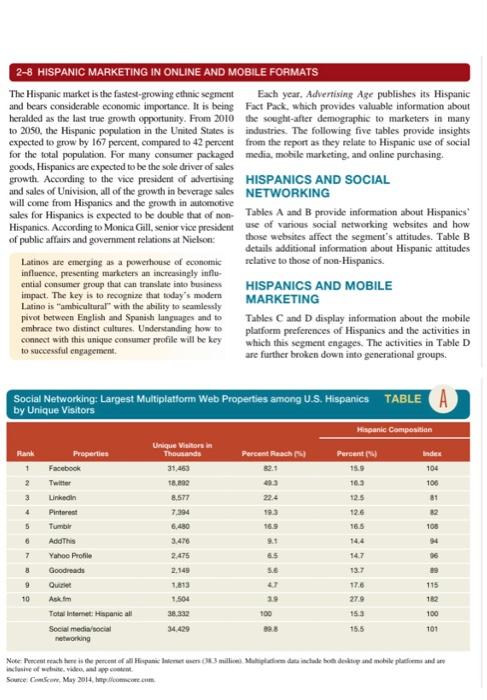

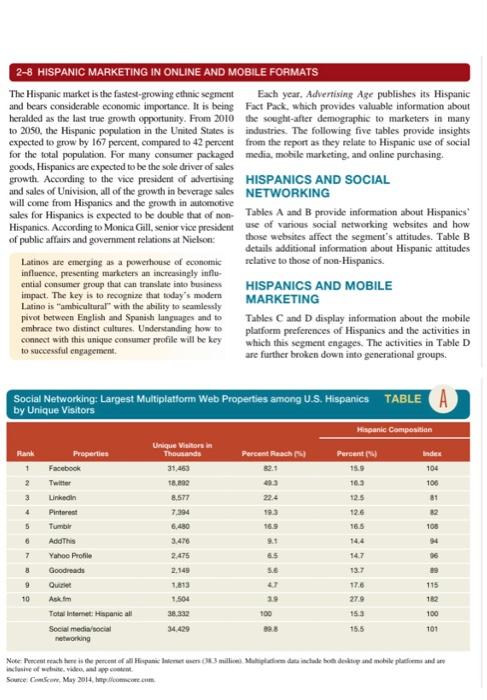

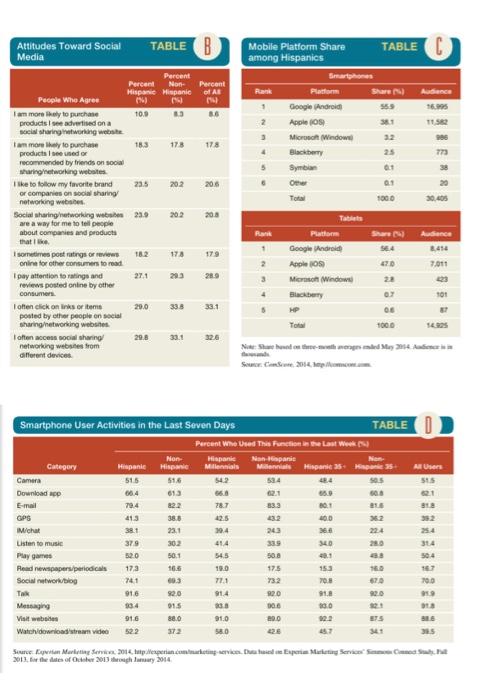

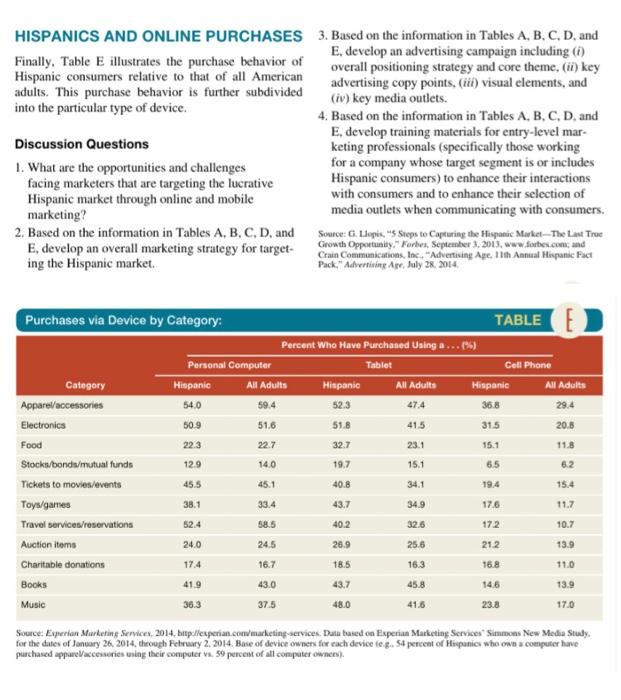

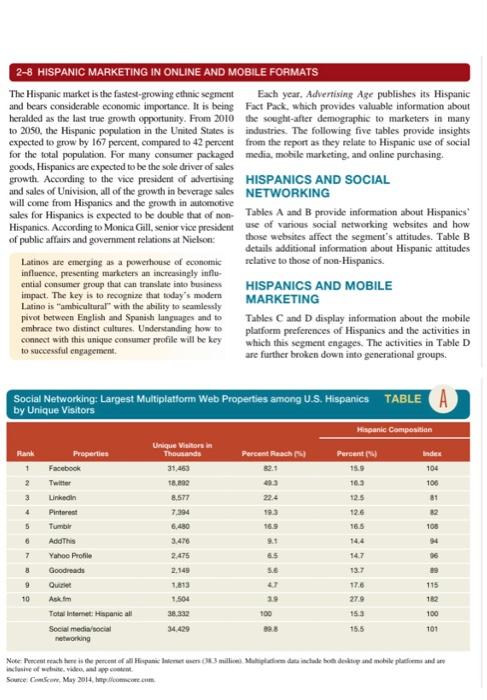

2-8 HISPANIC MARKETING IN ONLINE AND MOBILE FORMATS The Hispanic market is the fastest-growing ethnic segment Each year. Advertising Age publishes its Hispanic and bears considerable economic importance. It is being Fact Pack, which provides valuable information about heralded as the last true growth opportunity. From 2010 the sought-after demographic to marketers in many to 2050, the Hispanic population in the United States is industries. The following five tables provide insights expected to grow by 167 percent, compared to 42 percent from the report as they relate to Hispanic use of social for the total population. For many consumer packaged media, mobile marketing, and online purchasing. goods, Hispanics are expected to be the sole driver of sales growth. According to the vice president of advertising HISPANICS AND SOCIAL and sales of Univision, all of the growth in beverage sales NETWORKING will come from Hispanics and the growth in automotive sules for Hispanics is expected to be double that of non Tables A and B provide information about Hispanics Hispanics. According to Monica Gill, senior vice president use of various social networking websites and how of public affairs and government relations at Nielson: those websites affect the segment's attitudes. Table B details additional information about Hispanic attitudes Latinos are emerging as a powerhouse of economic relative to those of non-Hispanics. influence, presenting marketers an increasingly influ ential consumer group that can translate into business HISPANICS AND MOBILE impact. The key is to recognize that today's modern MARKETING Latino is "ambicultural with the ability to seamlessly pivot between English and Spanish languages and to Tables C and D display information about the mobile embrace two distinct cultures. Understanding how to platform preferences of Hispanics and the activities in connect with this unique consumer profile will he key which this segment engages. The activities in Table D to successful engagement are further broken down into generational groups. Social Networking: Largest Multiplatform Web Properties among U.S. Hispanics TABLE A by Unique Visitors Hispanic Composition Percent Reach Percent (4 Properties Facebook Index Unique Visitors Thousands 31.450 18.02 8.577 7,394 6.480 106 81 224 Rank 1 2 3 4 5 6 7 8 9 12.5 12.6 12 105 3.476 2.475 85 06 Linkedin Pinterest Tumblr AddThis Yahoo Profile Goodreads Que Ask.fm Total Internet: Hispanic alt Social media/ networking 147 137 2.149 29 1.813 126 10 279 1504 38.332 115 18 100 101 100 34.429 15.5 Note Prens heel Higiene 3 millim dhe hile plaiemand Screw May 2014 Attitudes toward Social Media TABLE B TABLE Percent of AB Autons 8.6 Mobile Platform Share among Hispanics Smartphones Platform 1 Google Android 2 Apple OS Micro Windows 4 Blackberry 5 Symbian 6 Other Total 5. 381 11.52 175 178 773 01 01 235 200 30.405 Percent Percent Non- Hispanic Hispanic People Who Agree I am more rely to purchase 10.9 3 products I see adverted on a social sharing working website tam more hely to purchase 18.3 products sed or recommended by friends on so Paringnetworking websites like to follow my favorite brand 202 or companies on social Sharing networking website Social Sharing networking web 23.9 20.2 are a way for me to tell people about companies and products that the sometimes post rates or reviews 18.2 170 online for other consumers to read I pay attention to ratings and 27.1 20.3 reviews posted online by other consumers loften click on links or items 20.0 33. posted by other people on social sharing networking websites often access social Sharing 20.0 33.1 networking websites from different devices Tablets Audience 8.414 179 Rand + 2 3 4 SE4 470 23 7.011 Google Android Apple OS Microsoft Windows Baby 28.9 101 33.1 06 1000 326 Smartphone User Activities in the Last Seven Days TABLED Percent who Used This Function is the last week Hispanic Nanpanis Millennials Hispanitas por 542 594 sas All User SUS 515 83.3 Category Camera Download 1 E-mail GPS Michat Listen to music Play games Read newspapers periodicals Social network blog Non Hispanie Hispanie 516 613 79.4 413 38.8 23.1 379 302 520 50.1 173 16.5 741 916 92.0 934 015 916 880 522 372 28.7 12.5 29.4 414 54.5 400 360 340 352 224 339 500 175 153 19.0 71.1 72 91.4 9:20 910 93.0 20.0 Visit web Watch download Video 91.0 58.0 36 35 41 San Mari 2016. utpeperiun.com.riche Service Samed 2012. the date of October 2013 2014 HISPANICS AND ONLINE PURCHASES 3. Based on the information in Tables A, B, C, D, and Finally, Table E illustrates the purchase behavior of E develop an advertising campaign including (1) Hispanic consumers relative to that of all American overall positioning strategy and core theme, (ii) key adults. This purchase behavior is further subdivided advertising copy points, (iii) visual elements, and into the particular type of device. (iv) key media outlets. 4. Based on the information in Tables A, B, C, D, and E, develop training materials for entry-level mar- Discussion Questions keting professionals (specifically those working 1. What are the opportunities and challenges for a company whose target segment is or includes facing marketers that are targeting the lucrative Hispanic consumers) to enhance their interactions Hispanic market through online and mobile with consumers and to enhance their selection of marketing? media outlets when communicating with consumers. 2. Based on the information in Tables A, B, C, D, and Source: G. Llopis, Steps to Capturing the Hispanic Market - The Last True E, develop an overall marketing strategy for target- Growth Opportunity. Forbes September 2013, www.forbes.com, and Crain Communications, Inc. Advertising Age 11th Annual Hispanic Fact ing the Hispanic market. Pack. Advertising Age, July 28, 2014 TABLE 223 Purchases via Device by Category: Percent Who Have Purchased Using a...( Personal Computer Tablet Cell Phone Category Hispanic All Adults Hispanic All Adults Hispanic All Adults Apparel/accessories 54.0 59.4 52.3 47.4 36.8 29.4 Electronics 50.9 51.6 51.8 41.5 31.5 20.8 Food 22.7 32.7 23.1 15.1 118 Stocks/bonda/mutual funds 129 14.0 19.7 15.1 6.5 Tickets to movies/events 45.5 45.1 40.8 34.1 19.4 15.4 Toys/garnes 38.1 33.4 43.7 34.9 17.6 11.7 Travel services/reservations 52.4 58.5 402 32.6 172 10.7 Auction items 24.0 24.5 26.9 25.6 212 13.9 Charitable donations 17.4 16.7 18.5 16.3 16.8 110 Books 41.9 43.0 146 13.9 Music 36.3 37.5 48.0 41.6 23.8 17.0 45.8 Source: Experian Marketing Services, 2014. http://experian.com marketing services Databased on Experian Marketing Services Simmons New Media Study for the dates of January 26, 2014, through February 2, 2014. Base of device owners for each device te... 54 percent of Hispanics who own a computer have purchased appareccessories using their computer vs. 59 percent of all computer owners)