Question: CASE STUDY - Emergency Power Project Case Study Objectives Upon completion of this case study report, you should be able to: 1. apply engineering economic

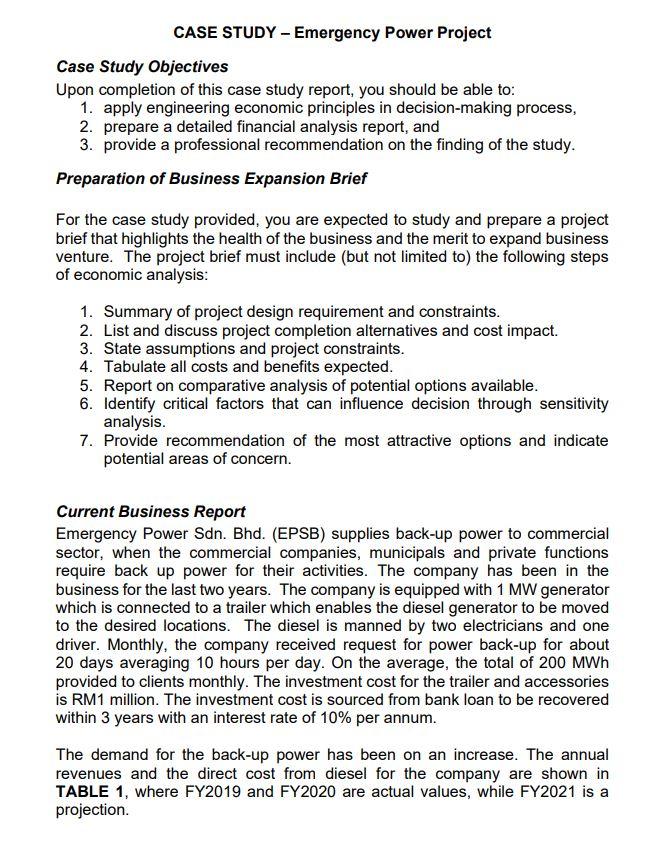

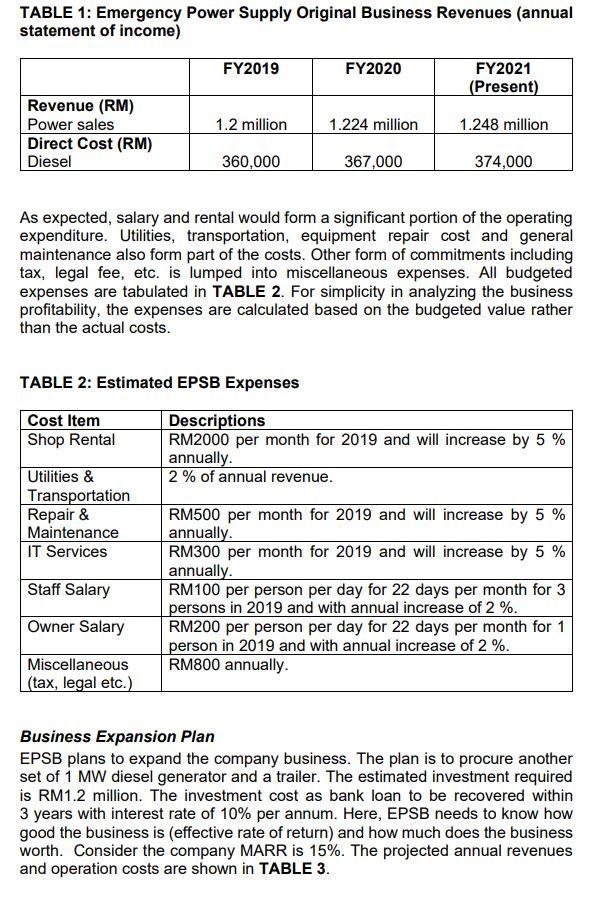

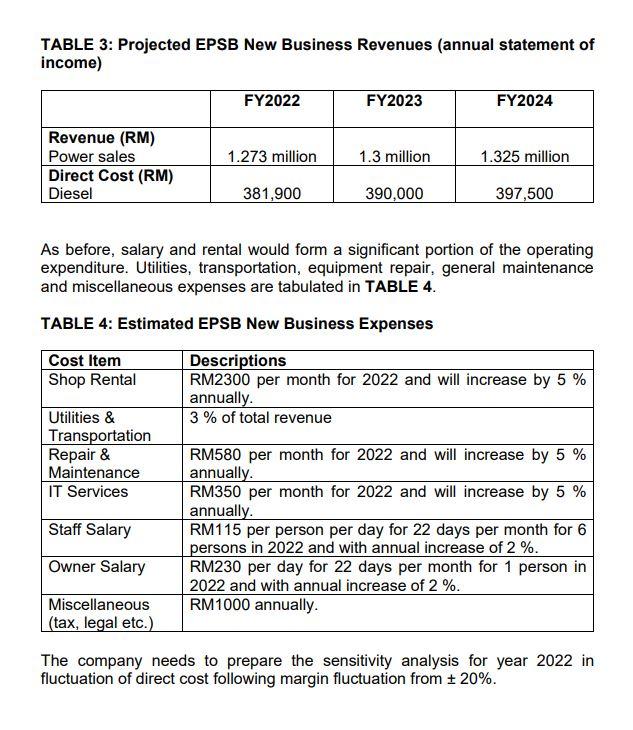

CASE STUDY - Emergency Power Project Case Study Objectives Upon completion of this case study report, you should be able to: 1. apply engineering economic principles in decision-making process, 2. prepare a detailed financial analysis report, and 3. provide a professional recommendation on the finding of the study. Preparation of Business Expansion Brief For the case study provided, you are expected to study and prepare a project brief that highlights the health of the business and the merit to expand business venture. The project brief must include (but not limited to the following steps of economic analysis: 1. Summary of project design requirement and constraints. 2. List and discuss project completion alternatives and cost impact. 3. State assumptions and project constraints. 4. Tabulate all costs and benefits expected. 5. Report on comparative analysis of potential options available. 6. Identify critical factors that can influence decision through sensitivity analysis. 7. Provide recommendation of the most attractive options and indicate potential areas of concern. Current Business Report Emergency Power Sdn. Bhd. (EPSB) supplies back-up power to commercial sector, when the commercial companies, municipals and private functions require back up power for their activities. The company has been in the business for the last two years. The company is equipped with 1 MW generator which is connected to a trailer which enables the diesel generator to be moved to the desired locations. The diesel is manned by two electricians and one driver. Monthly, the company received request for power back-up for about 20 days averaging 10 hours per day. On the average, the total of 200 MWh provided to clients monthly. The investment cost for the trailer and accessories is RM1 million. The investment cost is sourced from bank loan to be recovered within 3 years with an interest rate of 10% per annum. The demand for the back-up power has been on an increase. The annual revenues and the direct cost from diesel for the company are shown in TABLE 1, where FY2019 and FY2020 are actual values, while FY2021 is a projection. TABLE 1: Emergency Power Supply Original Business Revenues (annual statement of income) FY2019 FY2020 FY2021 (Present) Revenue (RM) Power sales 1.2 million 1.224 million 1.248 million Direct Cost (RM) Diesel 360,000 367,000 374,000 As expected, salary and rental would form a significant portion of the operating expenditure. Utilities, transportation, equipment repair cost and general maintenance also form part of the costs. Other form of commitments including tax, legal fee, etc. is lumped into miscellaneous expenses. All budgeted expenses are tabulated in TABLE 2. For simplicity in analyzing the business profitability, the expenses are calculated based on the budgeted value rather than the actual costs. TABLE 2: Estimated EPSB Expenses Cost Item Shop Rental Descriptions RM2000 per month for 2019 and will increase by 5% annually. 2% of annual revenue. Utilities & Transportation Repair & Maintenance IT Services Staff Salary RM500 per month for 2019 and will increase by 5 % annually. RM300 per month for 2019 and will increase by 5 % annually. RM100 per person per day for 22 days per month for 3 persons in 2019 and with annual increase of 2 %. RM200 per person per day for 22 days per month for 1 person in 2019 and with annual increase of 2%. RM800 annually. Owner Salary Miscellaneous (tax, legal etc.) Business Expansion Plan EPSB plans to expand the company business. The plan is to procure another set of 1 MW diesel generator and a trailer. The estimated investment required is RM1.2 million. The investment cost as bank loan to be recovered within 3 years with interest rate of 10% per annum. Here, EPSB needs to know how good the business is (effective rate of return) and how much does the business worth. Consider the company MARR is 15%. The projected annual revenues and operation costs are shown in TABLE 3. TABLE 3: Projected EPSB New Business Revenues (annual statement of income) FY2022 FY2023 FY2024 Revenue (RM) Power sales Direct Cost (RM) Diesel 1.273 million 1.3 million 1.325 million 381,900 390,000 397,500 As before, salary and rental would form a significant portion of the operating expenditure. Utilities, transportation, equipment repair, general maintenance and miscellaneous expenses are tabulated in TABLE 4. TABLE 4: Estimated EPSB New Business Expenses Cost Item Shop Rental Descriptions RM2300 per month for 2022 and will increase by 5 % annually. 3% of total revenue Utilities & Transportation Repair & Maintenance IT Services Staff Salary RM580 per month for 2022 and will increase by 5 % annually. RM350 per month for 2022 and will increase by 5 % annually. RM115 per person per day for 22 days per month for 6 persons in 2022 and with annual increase of 2%. RM230 per day for 22 days per month for 1 person in 2022 and with annual increase of 2%. RM1000 annually. Owner Salary Miscellaneous (tax, legal etc.) The company needs to prepare the sensitivity analysis for year 2022 in fluctuation of direct cost following margin fluctuation from + 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts