Question: CASE STUDY. Fruit-To-Go (FTG) processes fruit for shipping overseas FTG commissioned a study to look into the feasibility of changing the packaging of the fruit

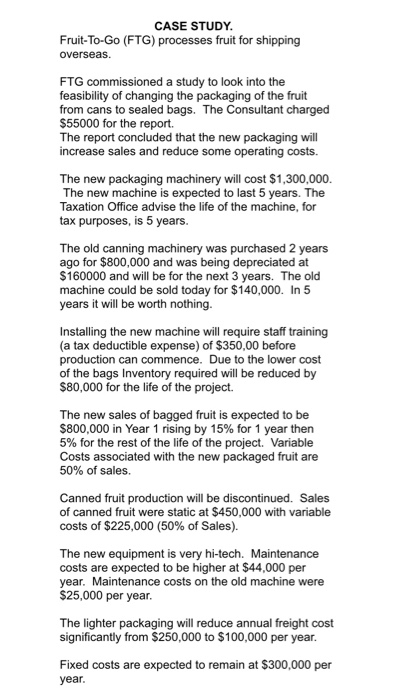

CASE STUDY. Fruit-To-Go (FTG) processes fruit for shipping overseas FTG commissioned a study to look into the feasibility of changing the packaging of the fruit from cans to sealed bags. The Consultant charged $55000 for the report. The report concluded that the new packaging will increase sales and reduce some operating costs. The new packaging machinery will cost $1,300,000. The new machine is expected to last 5 years. The Taxation Office advise the life of the machine, for tax purposes, is 5 years. The old canning machinery was purchased 2 years ago for $800,000 and was being depreciated at $160000 and will be for the next 3 years. The old machine could be sold today for $140,000. In 5 years it will be worth nothing Installing the new machine will require staff training (a tax deductible expense) of $350,00 before production can commence. Due to the lower cost of the bags Inventory required will be reduced by $80,000 for the life of the project. The new sales of bagged fruit is expected to be $800,000 in Year 1 rising by 15% for 1 year then 5% for the rest of the life of the project. Variable Costs associated with the new packaged fruit are 50% of sales. Canned fruit production will be discontinued. Sales of canned fruit were static at $450,000 with variable costs of $225,000 (50% of Sales). The new equipment is very hi-tech. Maintenance costs are expected to be higher at $44,000 per year. Maintenance costs on the old machine were $25,000 per year The lighter packaging will reduce annual freight cost significantly from $250,000 to $100,000 per year Fixed costs are expected to remain at $300,000 per year CASE STUDY. Fruit-To-Go (FTG) processes fruit for shipping overseas FTG commissioned a study to look into the feasibility of changing the packaging of the fruit from cans to sealed bags. The Consultant charged $55000 for the report. The report concluded that the new packaging will increase sales and reduce some operating costs. The new packaging machinery will cost $1,300,000. The new machine is expected to last 5 years. The Taxation Office advise the life of the machine, for tax purposes, is 5 years. The old canning machinery was purchased 2 years ago for $800,000 and was being depreciated at $160000 and will be for the next 3 years. The old machine could be sold today for $140,000. In 5 years it will be worth nothing Installing the new machine will require staff training (a tax deductible expense) of $350,00 before production can commence. Due to the lower cost of the bags Inventory required will be reduced by $80,000 for the life of the project. The new sales of bagged fruit is expected to be $800,000 in Year 1 rising by 15% for 1 year then 5% for the rest of the life of the project. Variable Costs associated with the new packaged fruit are 50% of sales. Canned fruit production will be discontinued. Sales of canned fruit were static at $450,000 with variable costs of $225,000 (50% of Sales). The new equipment is very hi-tech. Maintenance costs are expected to be higher at $44,000 per year. Maintenance costs on the old machine were $25,000 per year The lighter packaging will reduce annual freight cost significantly from $250,000 to $100,000 per year Fixed costs are expected to remain at $300,000 per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts