Question: CASE STUDY ON KAPAL LAYAR SDN BHD The managing director, R. Krishnan Lee is upset that for the forthing management meeting, the pro-forma financial statement

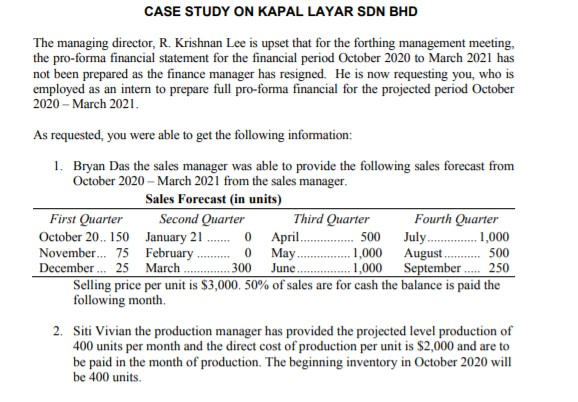

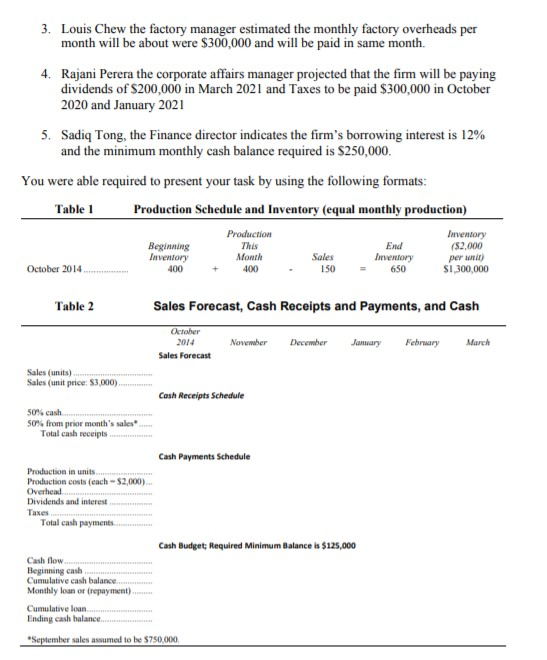

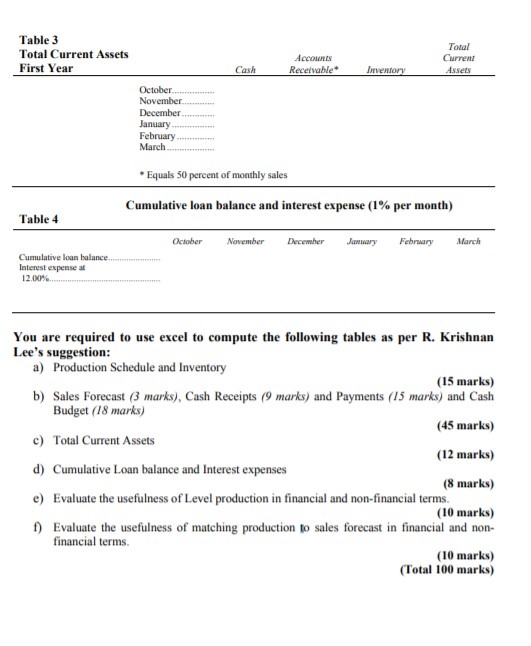

CASE STUDY ON KAPAL LAYAR SDN BHD The managing director, R. Krishnan Lee is upset that for the forthing management meeting, the pro-forma financial statement for the financial period October 2020 to March 2021 has not been prepared as the finance manager has resigned. He is now requesting you, who is employed as an intern to prepare full pro-forma financial for the projected period October 2020 - March 2021 As requested, you were able to get the following information: 1. Bryan Das the sales manager was able to provide the following sales forecast from October 2020 - March 2021 from the sales manager. Sales Forecast (in units) First Quarter Second Quarter Third Quarter Fourth Quarter October 20.. 150 January 21 April July...... 1,000 November... 75 February May 1,000 August December ... 25 March 300 June. 1,000 September ..... 250 Selling price per unit is $3,000, 50% of sales are for cash the balance is paid the following month. 2. Siti Vivian the production manager has provided the projected level production of 400 units per month and the direct cost of production per unit is $2,000 and are to be paid in the month of production. The beginning inventory in October 2020 will be 400 units. 500 0 0 500 3. Louis Chew the factory manager estimated the monthly factory overheads per month will be about were $300,000 and will be paid in same month. 4. Rajani Perera the corporate affairs manager projected that the firm will be paying dividends of $200,000 in March 2021 and Taxes to be paid $300,000 in October 2020 and January 2021 5. Sadiq Tong, the Finance director indicates the firm's borrowing interest is 12% and the minimum monthly cash balance required is $250,000 You were able required to present your task by using the following formats: Table 1 Production Schedule and Inventory (equal monthly production) Production Inentory Beginning ($2,000 Inventory Inventory per unit) End This Month 400 Sales October 2014 400 150 650 $1,300,000 Table 2 Sales Forecast, Cash Receipts and Payments, and Cash February March October 2014 November December Jomary Sales Forecast Sales (units) Sales (unit price: $3,000). Cash Receipts Schedule 50% cash 50% from prior month's sales Total cash receipts Cash Payments Schedule Production in units Production costs (each - $2,000) Overhead Dividends and interest Taxes Total cash payments Cash Budget Required Minimum Balance is $125,000 Cash flow Beginning cash Cumulative cash balance Monthly loan or repayment) Cumulative loan Ending cash balance September sales assumed to be $750,000 Table 3 Total Current Assets First Year Accounts Receivable Total Current Assets Cash Inventory October November December January February March Equals 50 percent of monthly sales Cumulative loan balance and interest expense (1% per month) Table 4 October November December January February March Cumulative loan balance, Interest expense at 12.00% You are required to use excel to compute the following tables as per R. Krishnan Lee's suggestion: a) Production Schedule and Inventory (15 marks) b) Sales Forecast (3 marks), Cash Receipts (9 marks) and Payments (15 marks) and Cash Budget (18 marks) (45 marks) c) Total Current Assets (12 marks) d) Cumulative Loan balance and Interest expenses (8 marks) e) Evaluate the usefulness of Level production in financial and non-financial terms. (10 marks) 1) Evaluate the usefulness of matching production to sales forecast in financial and non- financial terms. (10 marks) (Total 100 marks) CASE STUDY ON KAPAL LAYAR SDN BHD The managing director, R. Krishnan Lee is upset that for the forthing management meeting, the pro-forma financial statement for the financial period October 2020 to March 2021 has not been prepared as the finance manager has resigned. He is now requesting you, who is employed as an intern to prepare full pro-forma financial for the projected period October 2020 - March 2021 As requested, you were able to get the following information: 1. Bryan Das the sales manager was able to provide the following sales forecast from October 2020 - March 2021 from the sales manager. Sales Forecast (in units) First Quarter Second Quarter Third Quarter Fourth Quarter October 20.. 150 January 21 April July...... 1,000 November... 75 February May 1,000 August December ... 25 March 300 June. 1,000 September ..... 250 Selling price per unit is $3,000, 50% of sales are for cash the balance is paid the following month. 2. Siti Vivian the production manager has provided the projected level production of 400 units per month and the direct cost of production per unit is $2,000 and are to be paid in the month of production. The beginning inventory in October 2020 will be 400 units. 500 0 0 500 3. Louis Chew the factory manager estimated the monthly factory overheads per month will be about were $300,000 and will be paid in same month. 4. Rajani Perera the corporate affairs manager projected that the firm will be paying dividends of $200,000 in March 2021 and Taxes to be paid $300,000 in October 2020 and January 2021 5. Sadiq Tong, the Finance director indicates the firm's borrowing interest is 12% and the minimum monthly cash balance required is $250,000 You were able required to present your task by using the following formats: Table 1 Production Schedule and Inventory (equal monthly production) Production Inentory Beginning ($2,000 Inventory Inventory per unit) End This Month 400 Sales October 2014 400 150 650 $1,300,000 Table 2 Sales Forecast, Cash Receipts and Payments, and Cash February March October 2014 November December Jomary Sales Forecast Sales (units) Sales (unit price: $3,000). Cash Receipts Schedule 50% cash 50% from prior month's sales Total cash receipts Cash Payments Schedule Production in units Production costs (each - $2,000) Overhead Dividends and interest Taxes Total cash payments Cash Budget Required Minimum Balance is $125,000 Cash flow Beginning cash Cumulative cash balance Monthly loan or repayment) Cumulative loan Ending cash balance September sales assumed to be $750,000 Table 3 Total Current Assets First Year Accounts Receivable Total Current Assets Cash Inventory October November December January February March Equals 50 percent of monthly sales Cumulative loan balance and interest expense (1% per month) Table 4 October November December January February March Cumulative loan balance, Interest expense at 12.00% You are required to use excel to compute the following tables as per R. Krishnan Lee's suggestion: a) Production Schedule and Inventory (15 marks) b) Sales Forecast (3 marks), Cash Receipts (9 marks) and Payments (15 marks) and Cash Budget (18 marks) (45 marks) c) Total Current Assets (12 marks) d) Cumulative Loan balance and Interest expenses (8 marks) e) Evaluate the usefulness of Level production in financial and non-financial terms. (10 marks) 1) Evaluate the usefulness of matching production to sales forecast in financial and non- financial terms. (10 marks) (Total 100 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts