Question: Case Study Part 1 Solution Name: Elise Getson Date: 2 0 2 4 - 0 8 - 2 0 9 : 3 5 Part points

Case Study Part Solution

Name: Elise Getson

Date: :

Part points

showed the following alphabetized postclosing trial balance at June

tableAccountBalanceAccounts payable,Accounts receivable,Accumulated depreciation, equipment,CashEquipmentRetained earnings,Share capital,

Note:

There were shares issued and outstanding on June

Depreciation on the equipment is $ per month.

Phantom Consulting Inc.s salaries expense is a total of $ per day for each work day MondayFriday in the month for simplicity, please ignore all statutory holidays

The following source documents are from July:

Deposit slip July

Receipt

Calgary Hydro Bill

Invoice

Purchase Order

Invoice

Receipt

Receipt

InterOffice Memo

Invoice

InterOffice Memo

Customer Statement for WestCo

Invoice

Receipt from Bob's Diner

InterOffice Memo

InterOffice Memo

Receipt

Receipt

Second Time Around Advertising Bill

InterOffice Memo

Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format ddmmm ie January would be Jan

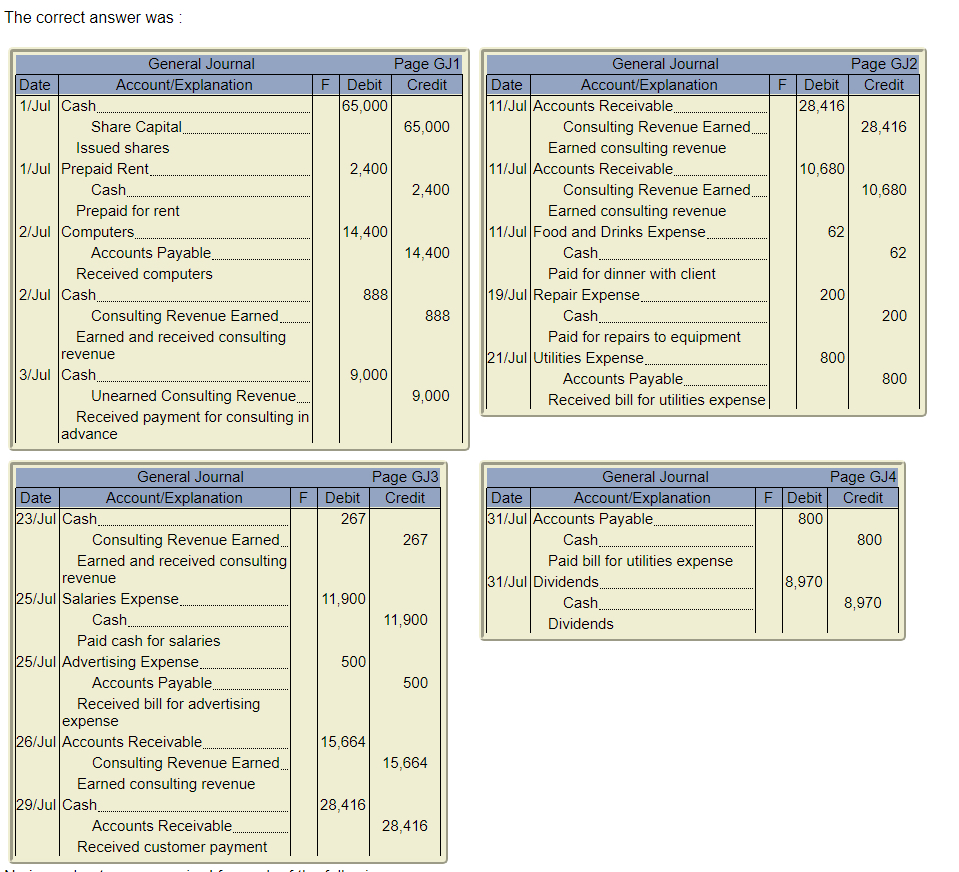

The correct answer was :

tableGeneral Journal,Page GJDateAccountExplanationFDebit,Credit,JulCash,,

tableGeneral Journal,Page GJDateAccountExplanationFDebit,Credit,JulAccounts Receivable,,

Part points

showed the following alphabetized postclosing trial balance at June

tableAccountBalanceAccounts payable,Accounts receivable,Accumulated depreciation, equipment,CashEquipmentRetained earnings,Share capital,Note:

Note:

There were shares issued and outstanding on June

Depreciation on the equipment is $ per month.

Phantom Consulting Inc.s salaries expense is a total of $ per day for each work day MondayFriday in the month for simplicity, please ignore all statutory holidays

The following source documents are from July:

Deposit slip July

Receipt

Calgary Hydro Bill

Invoice

Invoice

Purchase Order

Receipt

InterOffice Memo

Receipt

Invoice

InterOffice Memo

Invoice

Customer Statement for WestCo

Receipt from Bob's Diner

InterOffice Memo

InterOffice Memo

Receipt

Receipt

Second Time Around Advertising Bill

InterOffice Memo

Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format ddmmm ie January would be

Part points

a Prepare an unadjusted trial balance at July HINT: Where do you get the information needed to prepare the unadjusted trial balance?

tabletablePhantom Consulting Inc.Unadjusted Trial BalanceJuly Debit,CreditTotals

Part points

a Prepare an unadjusted trial balance at July HINT: Where do you get the information needed to prepare the unadjusted trial balance?

Part points

Phantom Consulting Inc. is a small computer consulting business. The company is organized as a corporation and provides consulting services, computer system installations, and custom program development. Phantom Consulting Inc. showed the following alphabetized postclosing trial balance at June

tableAccountBalanceAccounts payable,Accounts receivable,Accumulated depreciation, equipment,CashEquipmentRetained earnings,Share capital,

Note:

There were shares issued and outstanding on June

Depreciation on the equipment is $ per month.

Phantom Consulting Inc.s salaries expense is a total of $ per day for each work day MondayFriday in the month for simplicity, please ignore all statutory holidays

The correct answer was :

tableGeneral Journal,Page GJDateAccountExplanationFDebit,CreditJulAccounts Receivable.,,Consulting Revenue Earned...,,Earned consulting revenue,,JulAccounts Receivable....,,Consulting Revenue Earned,,Earned consulting revenue,, Jul,Food and Drinks Expense...,,Cash...,,Paid for dinner with client,,JulRepair Expense...,,Cash....,,Paid for repairs to equipment,,JulUtilities Expense....,,Accounts Payable,,Received bill for utilities expense,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock