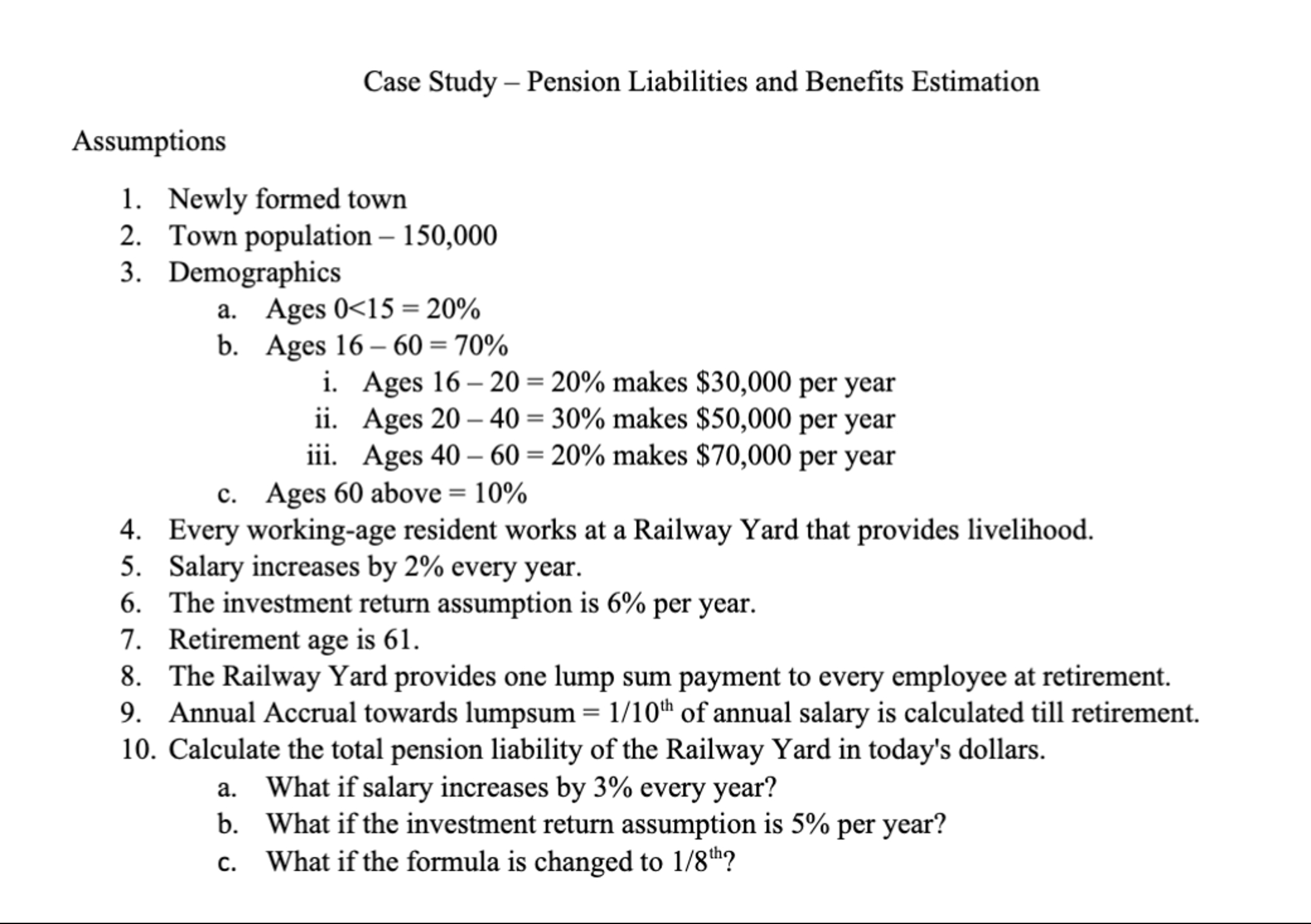

Question: Case Study - Pension Liabilities and Benefits Estimation Assumptions Newly formed town Town population - 1 5 0 , 0 0 0 Demographics a .

Case Study Pension Liabilities and Benefits Estimation

Assumptions

Newly formed town

Town population

Demographics

a Ages

b Ages

i Ages makes $ per year

ii Ages makes $ per year

iii. Ages makes $ per year

c Ages above

Every workingage resident works at a Railway Yard that provides livelihood.

Salary increases by every year.

The investment return assumption is per year.

Retirement age is

The Railway Yard provides one lump sum payment to every employee at retirement.

Annual Accrual towards lumpsum of annual salary is calculated till retirement.

Calculate the total pension liability of the Railway Yard in today's dollars.

a What if salary increases by every year?

b What if the investment return assumption is per year?

c What if the formula is changed to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock