Question: Case Study Prepare Comprehensive Income Statement and Statement of Changes in Equity Fergie Ltd incurs the following expenses and income for the year ended 30

Case Study Prepare Comprehensive Income Statement and Statement of Changes in Equity

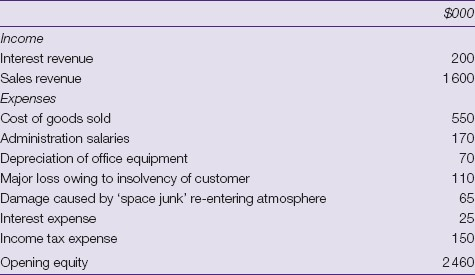

Fergie Ltd incurs the following expenses and income for the year ended 30 June 2015.

The income tax expense of $150 000 is calculated after considering a tax deduction of $21 450, which related to the damage caused by the space junk. Tax rate is 33 per cent.

During the year there has also been an increase in the revaluation surplus of $80 000 as a result of a revaluation of land of $80 000. The balance of the revaluation surplus at 1 July 2014 was $nil. A new accounting standard has also been introduced, which has a transitional provision allowing initial write-offs to be recognised as a decrease against retained earnings. The decrease against retained earnings amounts to $50 000. Retained earnings at the beginning of the financial year were $1 950 000, and dividends of $200 000 were paid during the financial year. Issued share capital at 1 July 2014 and 30 June 2015 was $510 000.

REQUIRED

Prepare an income statement (in a single statement with expenses shown by function) and a statement of changes in equity in conformity with AASB 101. Provide only those notes that can be reasonably determined from the above information

income Interest revenue Sales revenue Expenses Cost of goods sold Administration salaries Depreciation of office equipment Major loss owing to insolvency of customer Damage caused by 'space junk' re-entering atmosphere Interest expense Income tax expense Opening equity 1600 170 70 110 150 2460

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts