Question: Case Study Read the information below and then answer the questions which follow. Sonja (born 1965). They are the parents of three children: on December

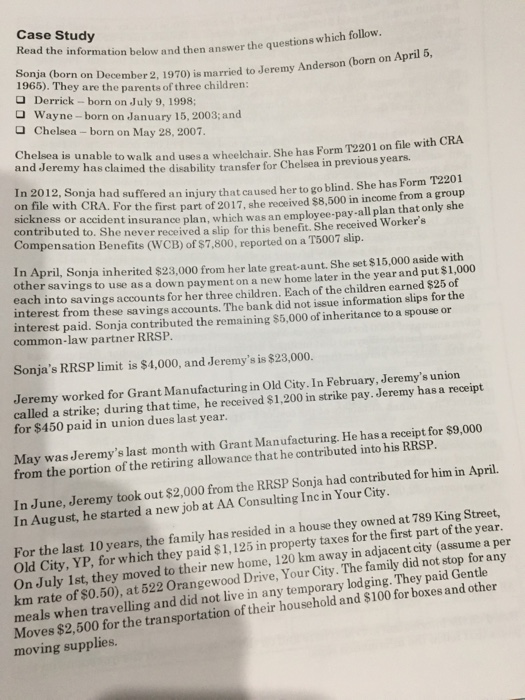

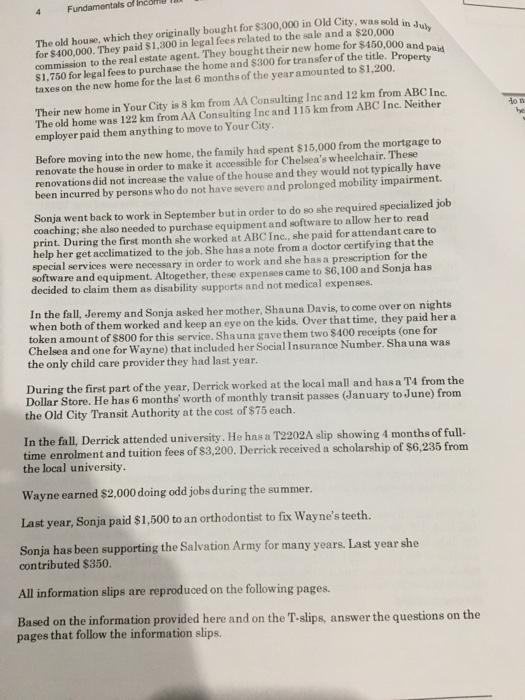

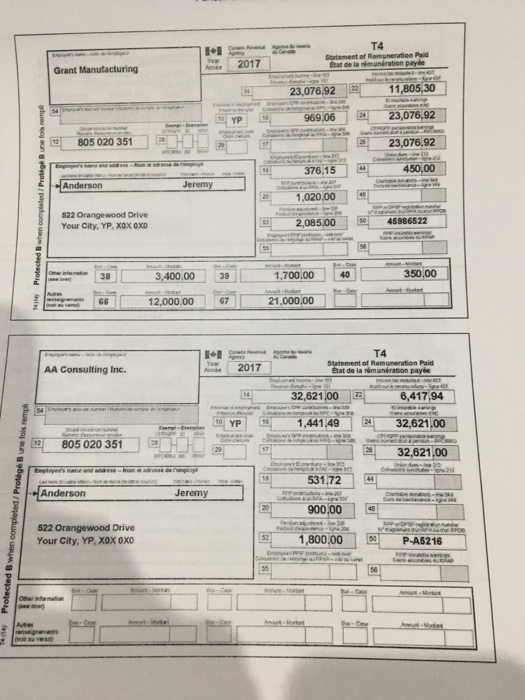

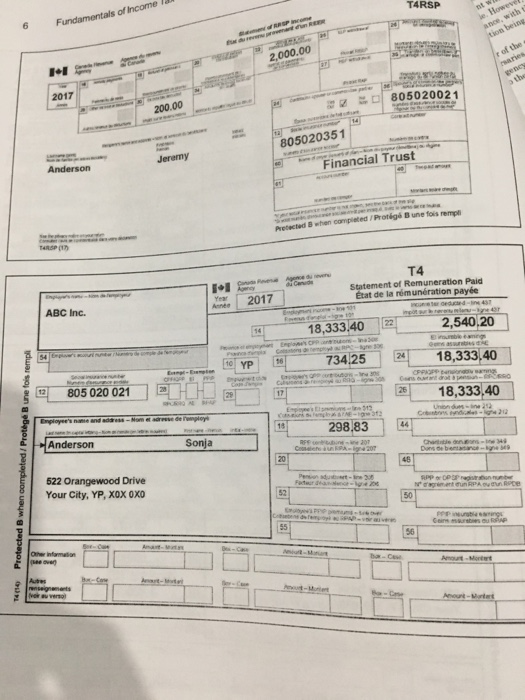

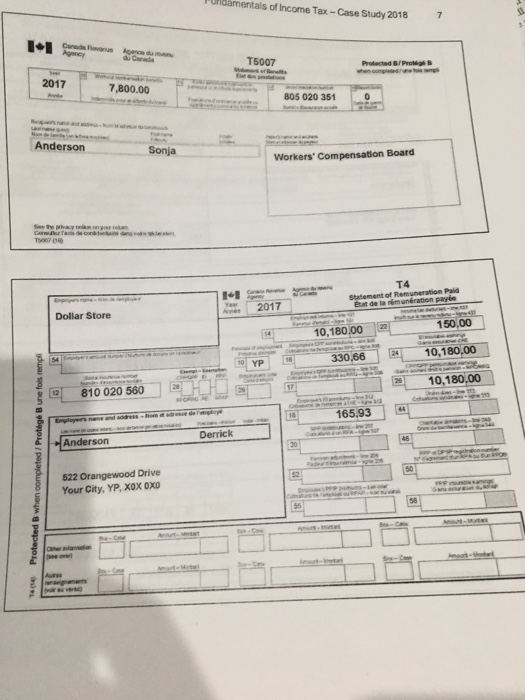

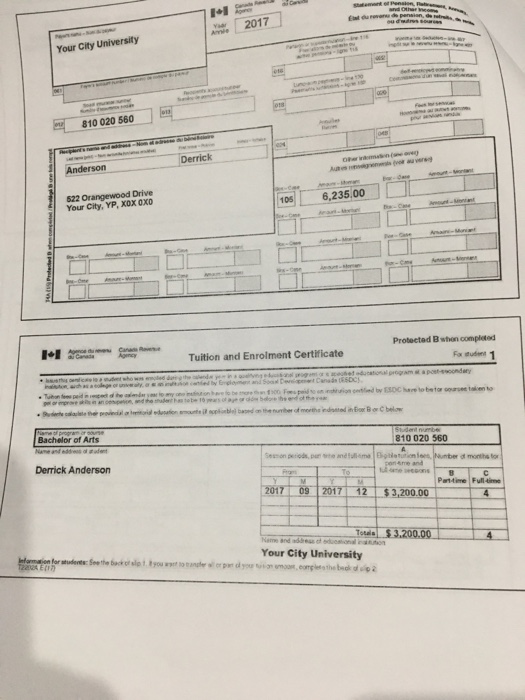

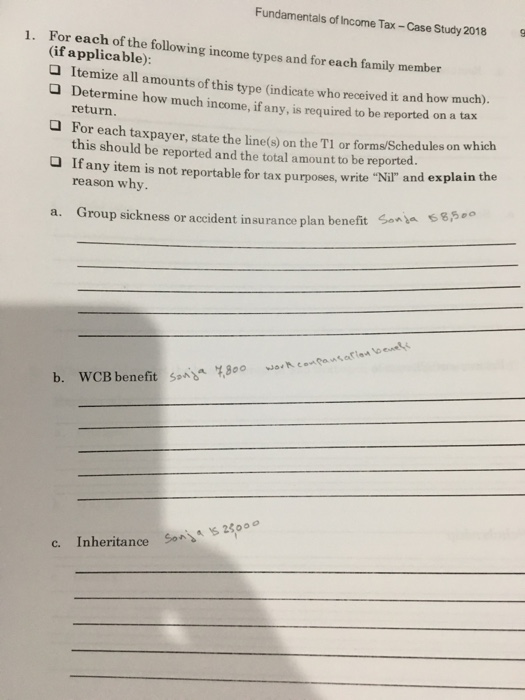

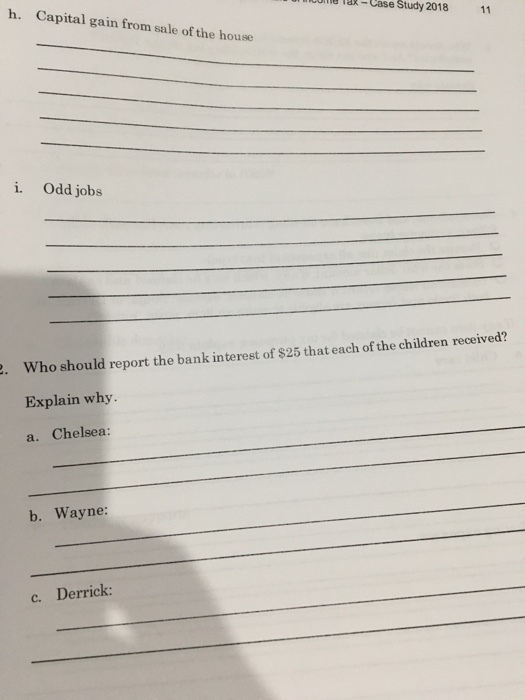

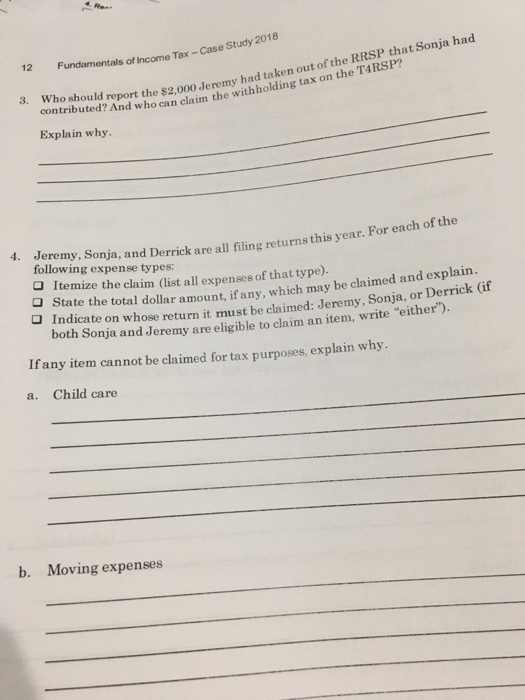

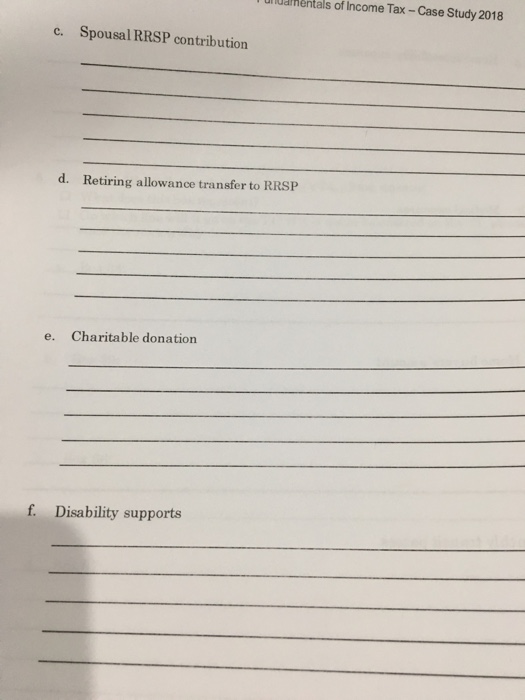

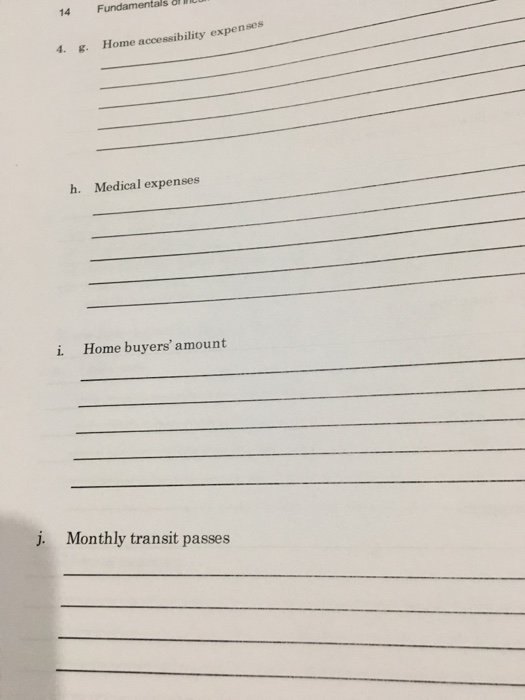

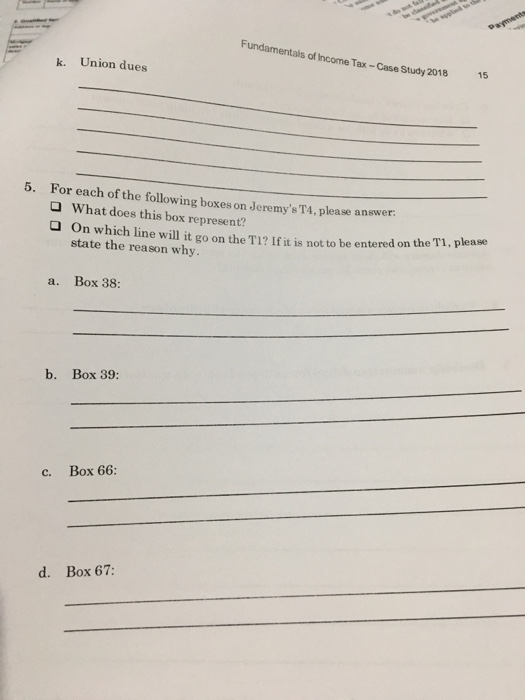

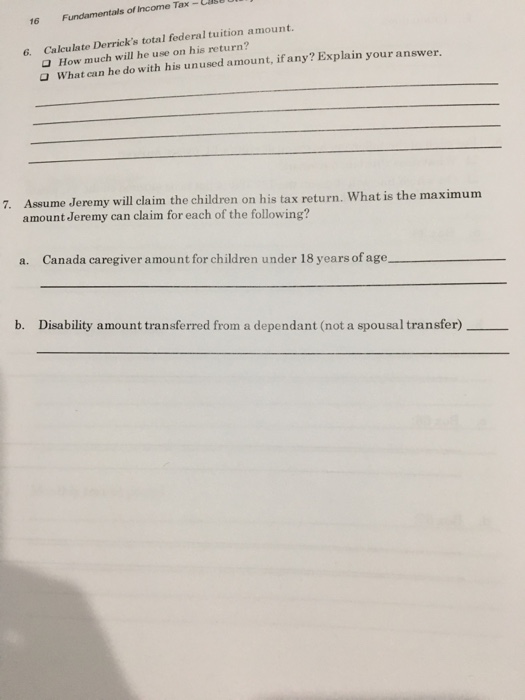

Case Study Read the information below and then answer the questions which follow. Sonja (born 1965). They are the parents of three children: on December 2, 1970) is married to Jeremy Anderson (born on Ap O Derrick -born on July 9, 1998; Wayne- born on January 15, 2003; and O Chelsea born on May 28, 2007 Chelsea is unable to walk and uses a wheelchair. She has Form 2201 on file with CRA and Jeremy has claimed the disability transfer for Chelsea in prev n 2012, Sonja had suffered an injury that caused her to go blind. She has Form T2201 file with CRA. For the wth CRA. For the first part of 2017, she received $8,500 in income from a group sickn ess or accid ent insurance plan, which was an employee-pay-all plan that only she contributed to. She never received a slip for this benefit. She received Worker's Compensation Benefits (WCB) of $7,800, reported on a T5007 slip In April, Sonja inherited $23,000 from her late great-aunt. She set $15,000 aside with other savings to use as a down paymenton a new home later in the year and put $1,000 each into savings accounts for her three children. Each of the children earned $25 of interest from these savings accounts. The bank did not issue information slips for the interest paid. Sonja contributed the remaining $5,000 of inheritance to a spouse or common-law partner RRSP. Sonja's RRSP limit is $4,000, and Jeremy's is $23,000. Jeremy worked for Grant Manufacturing in Old City. In February, Jeremy's union called a strike; during that time, he received $1,200 in strike pay. Jeremy has a receipt for $450 paid in union dues last year May was Jeremy's last month with Grant Manufacturing. He has a receipt for $9,000 from the portion of the retiring allowance that he contributed into his RRSP In June, Jeremy took out $2,000 from the RRSP Sonja had contributed for him in April. In August, he started a new job at AA Consulting Inc in Your City For the last 10 years, the family has resided in a house they owned at 789 King Street, Old City, YP, for which they paid $1,125 in property taxes for the first part of the year. On July 1st, they moved to their new home, 120 km away in adjacent city (assume a per km rate of $0.50), at 522 Orangewood Drive, Your City. The family did not stop for any meals when travelling and did not live in any temporary lodging. They paid Gentle Moves $2,500 for the transportation of their household and $100 for boxes and other moving supplies. Fundamentals of Incom! The old house, which they originally bought for $300,000 in Old City, was for $400,000. They paid $1,300 in legal fees related to the sale and a $20,000 ,000 a commission to the real estate agent. They bought their new home for $450 . Propertyd s1,750 for legal fees to purchase the home and $300 for transfer of the title $1,200 taxes on the new home for the last 6 months of the yearamounted to Their new home in Your City is 8 km from AA Consulting Inc and 12 km from ABC Inc. The old home was i 22 km froma AA Consulting Inc and i 15 km from ABC Inc. Neither employer paid them anything to move to Your City Before moving into the new home, the family had spent $15,000 from the mortgage to renovate the house in order to make it accessible for Chelsea's wheelchair. These renovations did not increase the value of the house and they would not typically have been incurred by persons who do not have severe and prolonged mobility impairment. Sonja went back to work in September but in order to do so she required specialized job coaching; she also needed to purchase equipment and software to allow her to read rint. During the first month she worked at ABC Inc., she paid for attendant care to elp her get acclimatized to the job. She has a note from a doctor certifying that the special services were necessary in order to work and she has a prescription for the software and equipment. Altogether, these expenses came to $6,100 and Sonja has decided to claim them as disability supports and not medical expenses. In the fall, Jeremy and Sonja asked her mother, Shauna Davis, to come over on n when both of them worked and keep an eye on the kids. Over that time, they paid her a token amount of $800 for this service. Shauna gavethem two $400 receipts (one for Chelsea and one for Wayne) that included her Social Insurance Number. Sha una was the only child care provider they had last year During the first part of the year, Derrick worked at the local mall and has a T4 from the Dollar Store. He has 6 months' worth of monthly transit passes (January to June) from the Old City Transit Authority at the cost of $75 each In the fall, Derrick attended university. He has a T2202A slip showing 4 months of full. time enrolment and tuition fees of $3,200. Derrick received a scholarship of $6,235 f the local university Wayne earned $2,000 doing odd jobs during the summer. Last year, Sonja paid $1,500 to an orthodontist to fix Wayne's teeth. Sonja has been supporting the Salvation Army for many years. Last year she contributed $350. All information slips are reproduced on the following pages. Based on the information provided here and on the T-alips, answer the questions on the pages that follow the information slips. T4 Statement of Remuneration Paid eat de la dimuniration payk 2017 Grant Manufacturing 11,805,30 23,076.92 23,076.92 450,00 23,076.92 0: YP. 969.06] 805 020 351 376.15 Jeremy 1,020.00] 522 Orangewood Drive Your City, YP, XOX 0X0 2,085.00 , 45986522 1,700,00 40 350.00 E-.t667[ 12,000.00 67 il 21,000,001- T4 Statement of Remuneration Paid AA Consulting Inc. e 2017 Etat de la rmunrabon pay 32,621.00 6,417 94 32,621.00 531.7244 Anderson Jeremy 900,00 522 Orangewood Drive Your City, YP, 1,800.00 P-A5216 T4RSP 2,000.00 e of the 2017 200.00 K 805020021 805020351 T4 ABC Inc. | 2017 tat de la rmunration paye 18,333,40 22 2,540,20 734:25 18,333.40 2 18,333,40 54 -121-805 020 021 17 298.834 Anderson 20 522 Orangewood Drive Your City, YP, XOX 0xo 50 56 amentals of Income Tax-Case Study 2018 7 T5007 2017 7,800.00 805 020 351 Anderson Sonja Workers' Compensation Board T4 Statement of Remuneration Paid -2017 Dollar Store 150,00 10,180,00 2 - . 330.66 10,180,00 10 YP 10,180.00 810 020 560 | 134 1121 TL_ 165.93 Derrick 50 522 Orangewood Drive Your City, YP, XOx 0xo 2017 Your City University 810 020 560 522 Orangewood Drive Your City, YP, XOXOXO 6,235,00 Protected B whon completed Tuition and Enrolment Certificate Bachelor of Arts 810 020 560 Derrick Anderson d months for Your City University Fundamentals of Income Tax-Case Study 2018 For each of the following income types and for each family member (if applicable): O Itemize all amounts of this type ( O Determine how much income, if any, is required to be reported on a a 1. indicate who received it and how much). return. For each taxpayer, state the line(s) on the Tlorforms Schedules on which this should be reported and the total amount to be reported. Ifany item is not reportable for tax purposes, write "Nil and explain the reason why a. Group sickness or accident insurance plan benefit S85 b. WCB benefit SgA8 c. Inheritance SonS25 Uldamentals of Income Tax-Case Study d. Remuneration from employer (a laries es, wages, taxable benefits, ete e. Strike pay f. Retirement allowance g. Scholarship h. Capital gain from sale of the house uax-Case Study 2018 1 i. Odd jobs Who should report the bank interest of $25 that each of the children received? Explain why. a. Chelsea: b. Wayne: c. Derrick: contributed? Aport the$2,000 Jeremy had taken out of the RRSP that Sonja had Explain why ntals of Income Tax - Case Study 2018 Who can claim the withholding tax on the T4RSP? can o should ropd 3. Who should report the S 4. Jeremy, Sonjan, and Derrick are all fling returns thisear or ena 4. Jerem y, Sonja, and Derrick are all filing returns this year. For each o following expense types: O Itemize the claim (list all expenses of that type). State the total dollar amount, if any, which may be claimed and explain. ndicate on whose return it must be claimed: Jeremy, Sonja, or Derrick (if onja and Jeremy are eligible to claim an item, write "either). Ifany item cannot be claimed for tax purposes, explain why a. Child care b. Moving expenses Udnentals of Income Tax-Case Study 2018 c. Spousal RRSP contribution d. Retiring allowance transfer to RRSP e. Charitable donation f. Disability supports 14 Fundamentalsf 4. &.Home accessibility expense h. Medical expenses i. Home buyers' amount j. Monthly transit passes Fundamentals of Income Tax-Case Study 2018 15 k. Union dues 5. For each of the following boxes on Jeremy's T4, please answer What does this box represent? OOn which line will it go on the T1? Ifit is not to be entered on the T1, please state the reason why. a. Box 38: b. Box 39: c. Box 66: d. Box 67 16 Fundamentals of Income Tax-L Calculate Derrick's total federal tuition amount. OHow much will he use on his return? 6. What can he do with his unused amount, if any? Explain your answer. me Jeremy will claim the children on his tax return. What is the maximum amount Jeremy can claim for each of the following? 7. Assu a. Canada caregiver amount for children under 18 years of age. b. Disability amount transferred from a dependant (not a spousal transfer) (not a spousal transfer) Case Study Read the information below and then answer the questions which follow. Sonja (born 1965). They are the parents of three children: on December 2, 1970) is married to Jeremy Anderson (born on Ap O Derrick -born on July 9, 1998; Wayne- born on January 15, 2003; and O Chelsea born on May 28, 2007 Chelsea is unable to walk and uses a wheelchair. She has Form 2201 on file with CRA and Jeremy has claimed the disability transfer for Chelsea in prev n 2012, Sonja had suffered an injury that caused her to go blind. She has Form T2201 file with CRA. For the wth CRA. For the first part of 2017, she received $8,500 in income from a group sickn ess or accid ent insurance plan, which was an employee-pay-all plan that only she contributed to. She never received a slip for this benefit. She received Worker's Compensation Benefits (WCB) of $7,800, reported on a T5007 slip In April, Sonja inherited $23,000 from her late great-aunt. She set $15,000 aside with other savings to use as a down paymenton a new home later in the year and put $1,000 each into savings accounts for her three children. Each of the children earned $25 of interest from these savings accounts. The bank did not issue information slips for the interest paid. Sonja contributed the remaining $5,000 of inheritance to a spouse or common-law partner RRSP. Sonja's RRSP limit is $4,000, and Jeremy's is $23,000. Jeremy worked for Grant Manufacturing in Old City. In February, Jeremy's union called a strike; during that time, he received $1,200 in strike pay. Jeremy has a receipt for $450 paid in union dues last year May was Jeremy's last month with Grant Manufacturing. He has a receipt for $9,000 from the portion of the retiring allowance that he contributed into his RRSP In June, Jeremy took out $2,000 from the RRSP Sonja had contributed for him in April. In August, he started a new job at AA Consulting Inc in Your City For the last 10 years, the family has resided in a house they owned at 789 King Street, Old City, YP, for which they paid $1,125 in property taxes for the first part of the year. On July 1st, they moved to their new home, 120 km away in adjacent city (assume a per km rate of $0.50), at 522 Orangewood Drive, Your City. The family did not stop for any meals when travelling and did not live in any temporary lodging. They paid Gentle Moves $2,500 for the transportation of their household and $100 for boxes and other moving supplies. Fundamentals of Incom! The old house, which they originally bought for $300,000 in Old City, was for $400,000. They paid $1,300 in legal fees related to the sale and a $20,000 ,000 a commission to the real estate agent. They bought their new home for $450 . Propertyd s1,750 for legal fees to purchase the home and $300 for transfer of the title $1,200 taxes on the new home for the last 6 months of the yearamounted to Their new home in Your City is 8 km from AA Consulting Inc and 12 km from ABC Inc. The old home was i 22 km froma AA Consulting Inc and i 15 km from ABC Inc. Neither employer paid them anything to move to Your City Before moving into the new home, the family had spent $15,000 from the mortgage to renovate the house in order to make it accessible for Chelsea's wheelchair. These renovations did not increase the value of the house and they would not typically have been incurred by persons who do not have severe and prolonged mobility impairment. Sonja went back to work in September but in order to do so she required specialized job coaching; she also needed to purchase equipment and software to allow her to read rint. During the first month she worked at ABC Inc., she paid for attendant care to elp her get acclimatized to the job. She has a note from a doctor certifying that the special services were necessary in order to work and she has a prescription for the software and equipment. Altogether, these expenses came to $6,100 and Sonja has decided to claim them as disability supports and not medical expenses. In the fall, Jeremy and Sonja asked her mother, Shauna Davis, to come over on n when both of them worked and keep an eye on the kids. Over that time, they paid her a token amount of $800 for this service. Shauna gavethem two $400 receipts (one for Chelsea and one for Wayne) that included her Social Insurance Number. Sha una was the only child care provider they had last year During the first part of the year, Derrick worked at the local mall and has a T4 from the Dollar Store. He has 6 months' worth of monthly transit passes (January to June) from the Old City Transit Authority at the cost of $75 each In the fall, Derrick attended university. He has a T2202A slip showing 4 months of full. time enrolment and tuition fees of $3,200. Derrick received a scholarship of $6,235 f the local university Wayne earned $2,000 doing odd jobs during the summer. Last year, Sonja paid $1,500 to an orthodontist to fix Wayne's teeth. Sonja has been supporting the Salvation Army for many years. Last year she contributed $350. All information slips are reproduced on the following pages. Based on the information provided here and on the T-alips, answer the questions on the pages that follow the information slips. T4 Statement of Remuneration Paid eat de la dimuniration payk 2017 Grant Manufacturing 11,805,30 23,076.92 23,076.92 450,00 23,076.92 0: YP. 969.06] 805 020 351 376.15 Jeremy 1,020.00] 522 Orangewood Drive Your City, YP, XOX 0X0 2,085.00 , 45986522 1,700,00 40 350.00 E-.t667[ 12,000.00 67 il 21,000,001- T4 Statement of Remuneration Paid AA Consulting Inc. e 2017 Etat de la rmunrabon pay 32,621.00 6,417 94 32,621.00 531.7244 Anderson Jeremy 900,00 522 Orangewood Drive Your City, YP, 1,800.00 P-A5216 T4RSP 2,000.00 e of the 2017 200.00 K 805020021 805020351 T4 ABC Inc. | 2017 tat de la rmunration paye 18,333,40 22 2,540,20 734:25 18,333.40 2 18,333,40 54 -121-805 020 021 17 298.834 Anderson 20 522 Orangewood Drive Your City, YP, XOX 0xo 50 56 amentals of Income Tax-Case Study 2018 7 T5007 2017 7,800.00 805 020 351 Anderson Sonja Workers' Compensation Board T4 Statement of Remuneration Paid -2017 Dollar Store 150,00 10,180,00 2 - . 330.66 10,180,00 10 YP 10,180.00 810 020 560 | 134 1121 TL_ 165.93 Derrick 50 522 Orangewood Drive Your City, YP, XOx 0xo 2017 Your City University 810 020 560 522 Orangewood Drive Your City, YP, XOXOXO 6,235,00 Protected B whon completed Tuition and Enrolment Certificate Bachelor of Arts 810 020 560 Derrick Anderson d months for Your City University Fundamentals of Income Tax-Case Study 2018 For each of the following income types and for each family member (if applicable): O Itemize all amounts of this type ( O Determine how much income, if any, is required to be reported on a a 1. indicate who received it and how much). return. For each taxpayer, state the line(s) on the Tlorforms Schedules on which this should be reported and the total amount to be reported. Ifany item is not reportable for tax purposes, write "Nil and explain the reason why a. Group sickness or accident insurance plan benefit S85 b. WCB benefit SgA8 c. Inheritance SonS25 Uldamentals of Income Tax-Case Study d. Remuneration from employer (a laries es, wages, taxable benefits, ete e. Strike pay f. Retirement allowance g. Scholarship h. Capital gain from sale of the house uax-Case Study 2018 1 i. Odd jobs Who should report the bank interest of $25 that each of the children received? Explain why. a. Chelsea: b. Wayne: c. Derrick: contributed? Aport the$2,000 Jeremy had taken out of the RRSP that Sonja had Explain why ntals of Income Tax - Case Study 2018 Who can claim the withholding tax on the T4RSP? can o should ropd 3. Who should report the S 4. Jeremy, Sonjan, and Derrick are all fling returns thisear or ena 4. Jerem y, Sonja, and Derrick are all filing returns this year. For each o following expense types: O Itemize the claim (list all expenses of that type). State the total dollar amount, if any, which may be claimed and explain. ndicate on whose return it must be claimed: Jeremy, Sonja, or Derrick (if onja and Jeremy are eligible to claim an item, write "either). Ifany item cannot be claimed for tax purposes, explain why a. Child care b. Moving expenses Udnentals of Income Tax-Case Study 2018 c. Spousal RRSP contribution d. Retiring allowance transfer to RRSP e. Charitable donation f. Disability supports 14 Fundamentalsf 4. &.Home accessibility expense h. Medical expenses i. Home buyers' amount j. Monthly transit passes Fundamentals of Income Tax-Case Study 2018 15 k. Union dues 5. For each of the following boxes on Jeremy's T4, please answer What does this box represent? OOn which line will it go on the T1? Ifit is not to be entered on the T1, please state the reason why. a. Box 38: b. Box 39: c. Box 66: d. Box 67 16 Fundamentals of Income Tax-L Calculate Derrick's total federal tuition amount. OHow much will he use on his return? 6. What can he do with his unused amount, if any? Explain your answer. me Jeremy will claim the children on his tax return. What is the maximum amount Jeremy can claim for each of the following? 7. Assu a. Canada caregiver amount for children under 18 years of age. b. Disability amount transferred from a dependant (not a spousal transfer) (not a spousal transfer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts