Question: Case Study - Settlement Statement Given the following information, calculate the closing statement for buyer and seller: Closing date: September 15,2016 Sale price: $123,000 New

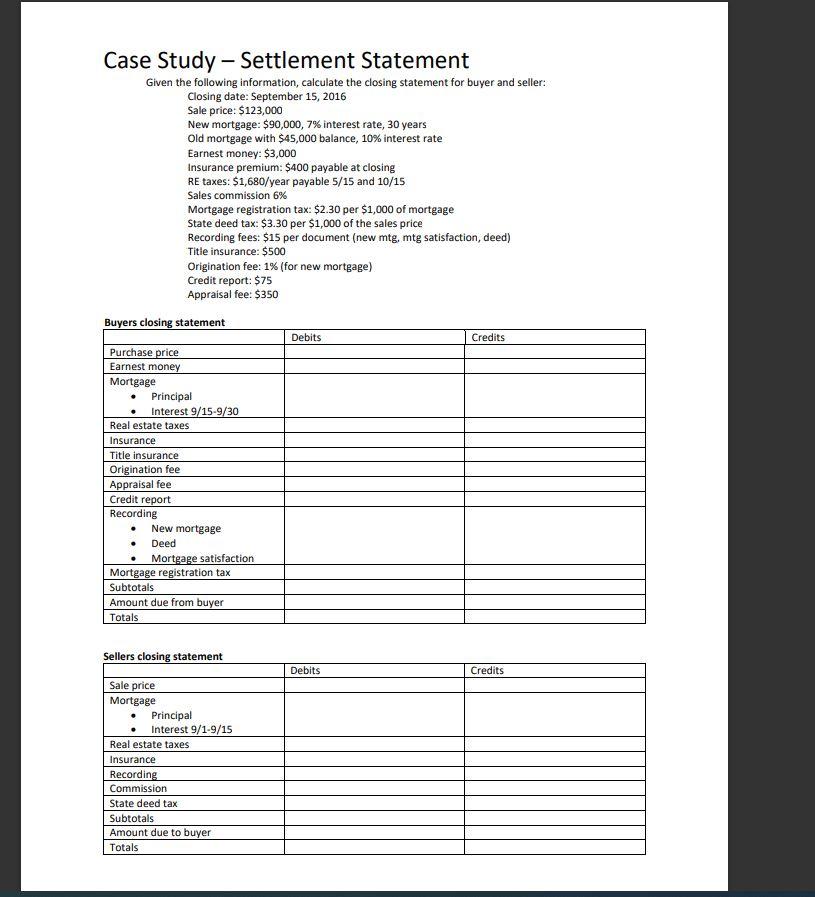

Case Study - Settlement Statement Given the following information, calculate the closing statement for buyer and seller: Closing date: September 15,2016 Sale price: $123,000 New mortgage: $90,000,7% interest rate, 30 years Old mortgage with $45,000 balance, 10% interest rate Earnest money: $3,000 Insurance premium: $400 payable at closing RE taxes: $1,680/ year payable 5/15 and 10/15 Sales commission 6% Mortgage registration tax: $2.30 per $1,000 of mortgage State deed tax: $3.30 per $1,000 of the sales price Recording fees: $15 per document (new mtg, mtg satisfaction, deed) Title insurance: $500 Origination fee: 1% (for new mortgage) Credit report: $75 Appraisal fee: $350 Case Study - Settlement Statement Given the following information, calculate the closing statement for buyer and seller: Closing date: September 15,2016 Sale price: $123,000 New mortgage: $90,000,7% interest rate, 30 years Old mortgage with $45,000 balance, 10% interest rate Earnest money: $3,000 Insurance premium: $400 payable at closing RE taxes: $1,680/ year payable 5/15 and 10/15 Sales commission 6% Mortgage registration tax: $2.30 per $1,000 of mortgage State deed tax: $3.30 per $1,000 of the sales price Recording fees: $15 per document (new mtg, mtg satisfaction, deed) Title insurance: $500 Origination fee: 1% (for new mortgage) Credit report: $75 Appraisal fee: $350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts