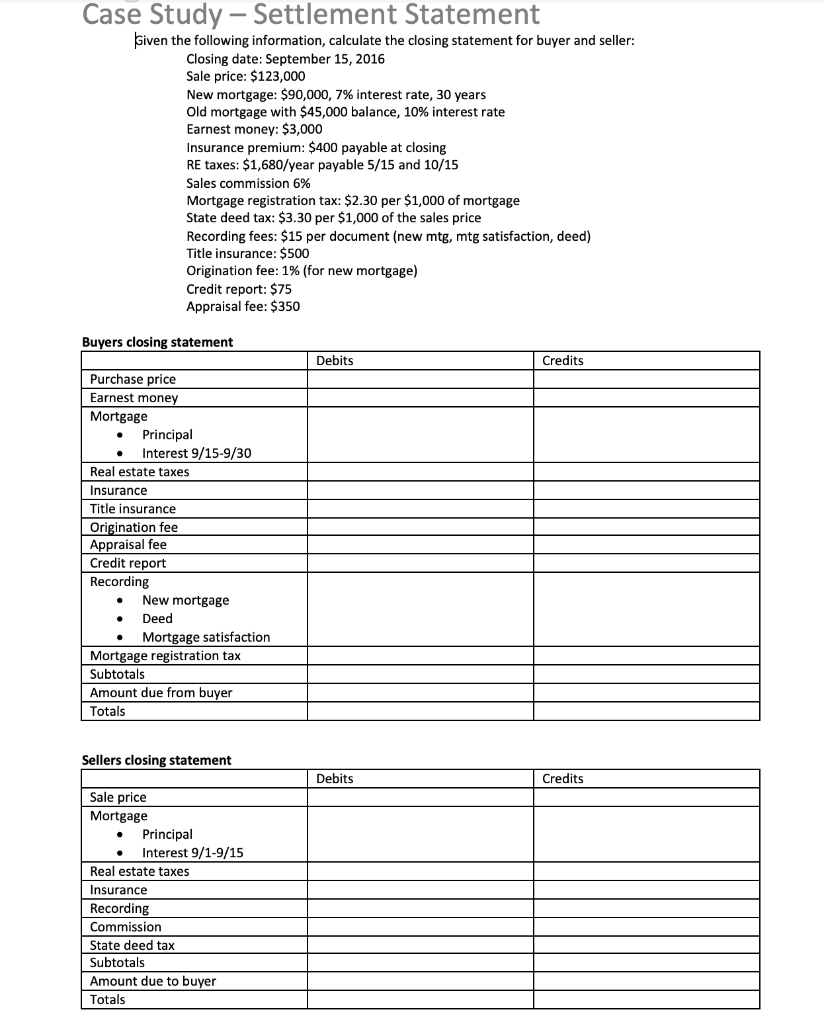

Question: Case Study Settlement Statement Given the following information, calculate the closing statement for buyer and seller: Closing date: September 15, 2016 Sale price: $123,000 New

Case Study Settlement Statement Given the following information, calculate the closing statement for buyer and seller: Closing date: September 15, 2016 Sale price: $123,000 New mortgage: $90,000, 7% interest rate, 30 years Old mortgage with $45,000 balance, 10% interest rate Earnest money: $3,000 Insurance premium: $400 payable at closing RE taxes: $1,680/year payable 5/15 and 10/15 Sales commission 6% Mortgage registration tax: $2.30 per $1,000 of mortgage State deed tax: $3.30 per $1,000 of the sales price Recording fees: $15 per document (new mtg, mtg satisfaction, deed) Title insurance: $500 Origination fee: 1% (for new mortgage) Credit report: $75 Appraisal fee: $350 Buyers closing statement Debits Credits Purchase price Earnest money Mortgage Principal Interest 9/15-9/30 Real estate taxes Insurance Title insurance Origination fee Appraisal fee Credit report Recording New mortgage Deed Mortgage satisfaction Mortgage registration tax Subtotals Amount due from buyer Totals Sellers closing statement Debits Credits Sale price Mortgage Principal Interest 9/1-9/15 Real estate taxes Insurance Recording Commission State deed tax Subtotals Amount due to buyer Totals Case Study Settlement Statement Given the following information, calculate the closing statement for buyer and seller: Closing date: September 15, 2016 Sale price: $123,000 New mortgage: $90,000, 7% interest rate, 30 years Old mortgage with $45,000 balance, 10% interest rate Earnest money: $3,000 Insurance premium: $400 payable at closing RE taxes: $1,680/year payable 5/15 and 10/15 Sales commission 6% Mortgage registration tax: $2.30 per $1,000 of mortgage State deed tax: $3.30 per $1,000 of the sales price Recording fees: $15 per document (new mtg, mtg satisfaction, deed) Title insurance: $500 Origination fee: 1% (for new mortgage) Credit report: $75 Appraisal fee: $350 Buyers closing statement Debits Credits Purchase price Earnest money Mortgage Principal Interest 9/15-9/30 Real estate taxes Insurance Title insurance Origination fee Appraisal fee Credit report Recording New mortgage Deed Mortgage satisfaction Mortgage registration tax Subtotals Amount due from buyer Totals Sellers closing statement Debits Credits Sale price Mortgage Principal Interest 9/1-9/15 Real estate taxes Insurance Recording Commission State deed tax Subtotals Amount due to buyer Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts