Question: Case study solution required for questions D to P regarding Chicago Corpration Case at chapter 17, the case no is 10p in (Financial Accounting Book

Case study solution required for questions D to P regarding Chicago Corpration Case at chapter 17, the case no is 10p in (Financial Accounting Book (14th Edition). i was able to find the case but there is no answers! Also, i bough the solution manual frm Chegg and it includes only solutions for the odd questions. I have attached the financials as PDF also here is the link to the case, it includes all financial statements you need, your help is highly appreciated.

here is the link to the case in Chegg websit:

http://www.chegg.com/homework-help/comprehensive-review-problem-exhibits-1711-1712-present-part-chapter-17-problem-10p-solution-9781111823450-exc

here is the link to the book the case from:

http://www.chegg.com/textbooks/financial-accounting-14th-edition-9781111823450-1111823456?trackid=51e6b63a&strackid=29013c2d&ii=1

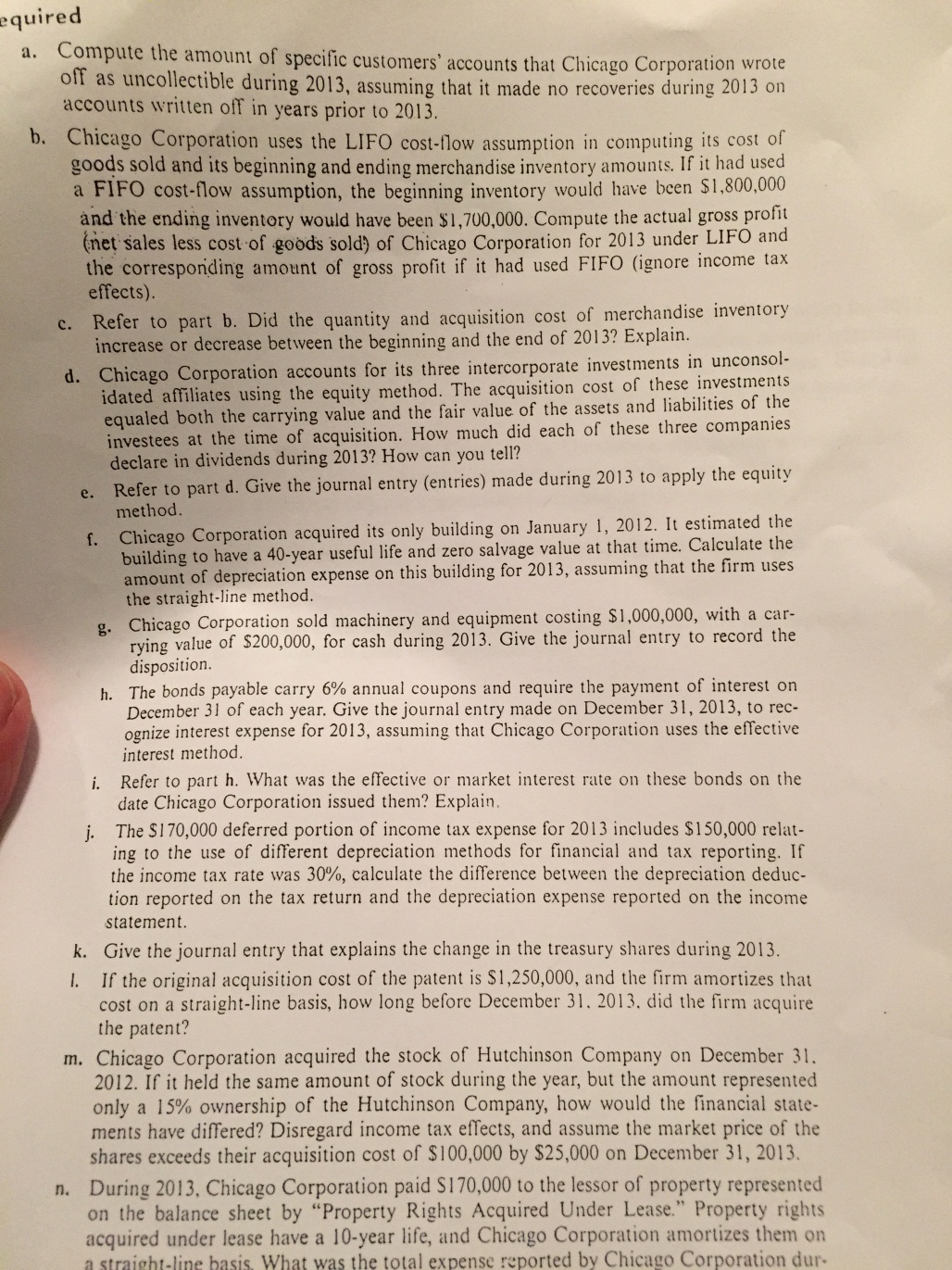

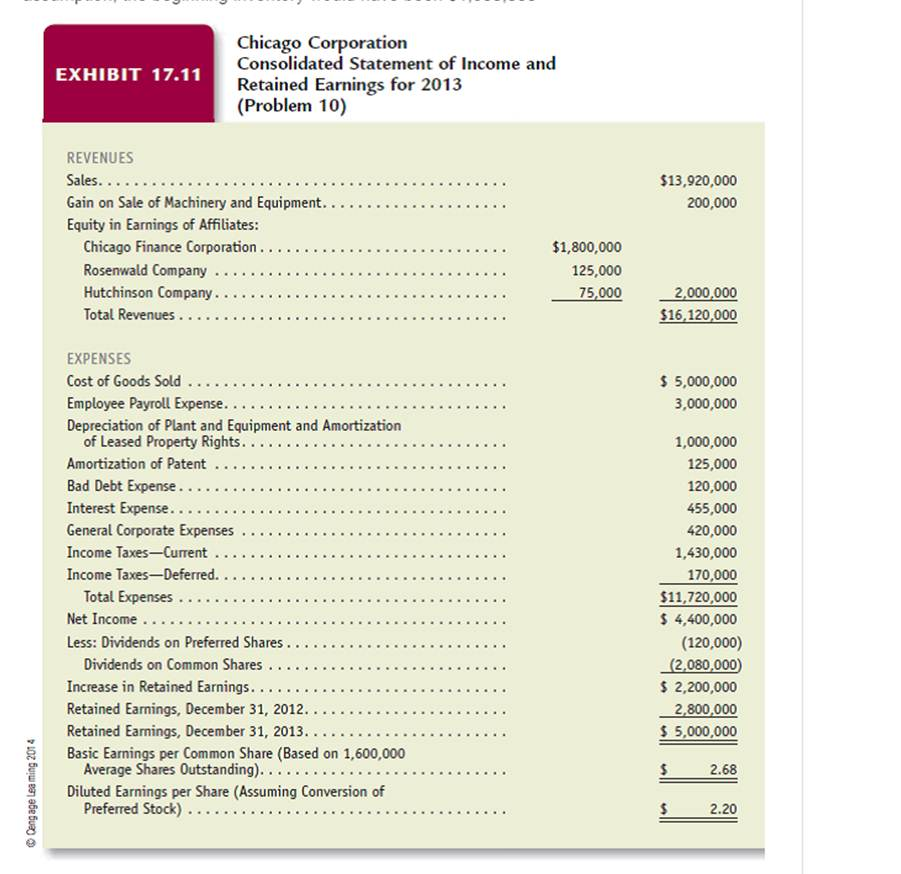

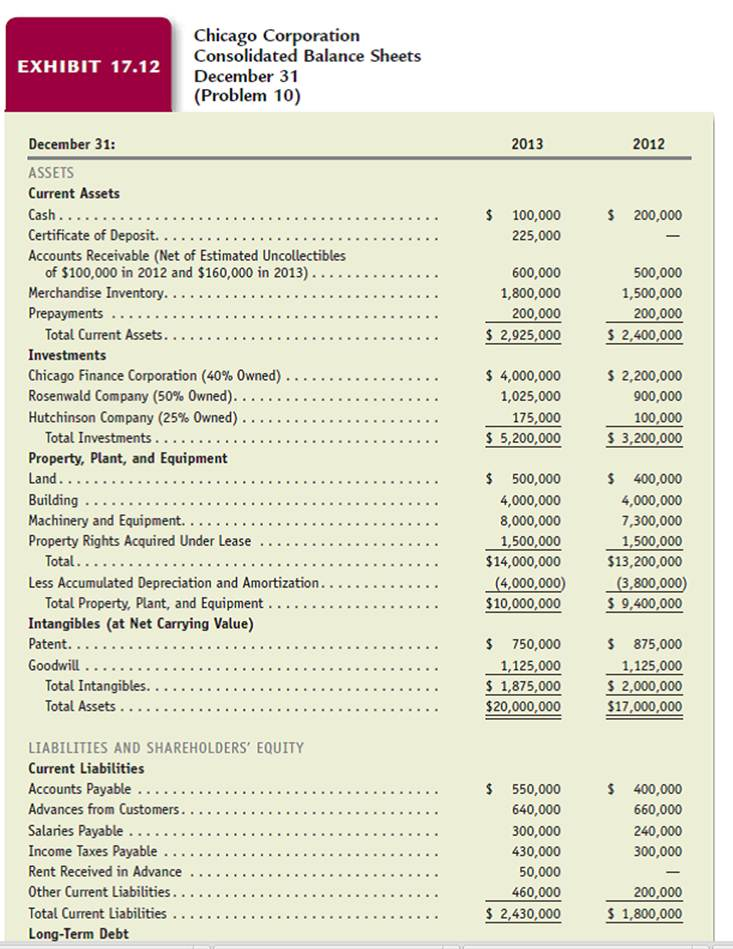

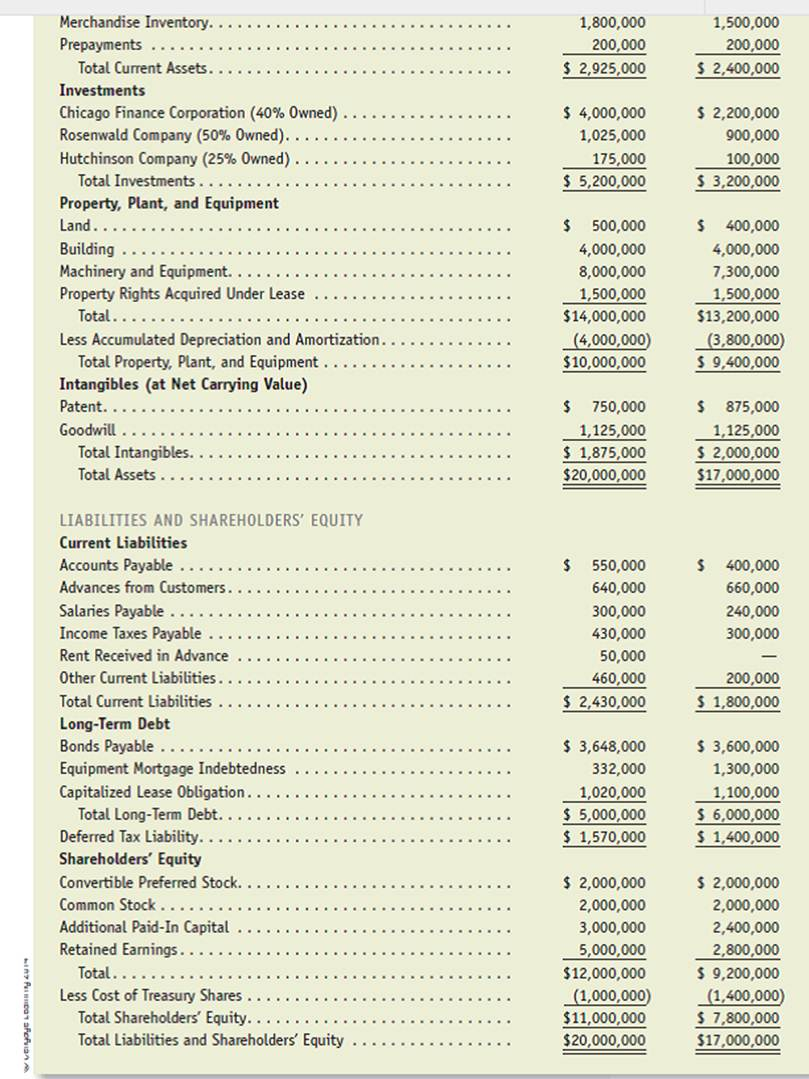

cquired a Compute the amount of specific customers' accounts that Chicago Corporation wrote off as uncollectible during 2013, assuming that it nade no recoveries during 2013 accounts written off in years prior to 2013, b. Chicago Corporation uses the LIFO costlow assumption in computing its cost of goods sold and its beginning and ending merchandise inventory amounts. If it had used a FIFO cost-flow assumption, the beginning inventory would have been $1,800,000 and the ending inventory would have been 1,700,000. Compute the actual gross profit (net sales less cost of goods solds of Chicago Corporation 2013 for under LIFO and the corresponding amount of gross profit if it had used FIFO (ignore income tax effects). E. Refer to part b. Did the quantity and acquisition cost of merchandise inventory increase or decrease between beginning the of 2013Explain. the and end ? d. Chicago Corporation accounts for its three intercorporate investments in unconsol idated affiliates using the equity method. The acquisition cost of these investments equaled both the carrying value and the fair value of the assets and liabilities of the investees at the time of acquisition. How much did each of these three companies in dividends during 2013? How can you tell? C. Refer to part d. Give the journal entry (entries) made during 2013 to apply the equity method. 1. Chicago Corporation acquired building on January its only timeCalculate the building to a 40-year useful life zero salvage value have and at that . amount of depreciation expense on this building for 2013firm uses , assuming that the the straight-line method. B. machinery and costing 000 Chicago Corporation sold equipment $1,000,, with a car rying value of $200000, for cash during 20is,Give the journal entry to record the disposition. h. The bonds payable carry 6% annual coupons and require the payment of interest on December 31 of each yearGive the journal entry made on December 31, 2013, to rec ognize interest expense for 2013, assuming that Chicago Corporation uses the effective interest method. - 2012. It estimated the Refer to part h. What was the effective or market interest rate on these bonds on the date Chicago Corporation issued them? Explain The S170,000 deferred portion of income tax expense for 2013 includes $150,000 relat ing to the use of different depreciation methods for financial nd tax reporting. If the income tax rate was 30%, calculate the difference bet the depreciation deduc . ion reported on the tax return and the depreciation expense reported on the income statement K. Give the journal entry that explains the change in the treasury shares during 2013, If the original acquisition cost of the patent is $1250,000, and the firm amortizes that cost on a straight-line basis, how long before December 31, 2013, did the firm acquire the patent M. Chicago Corporation acquired the stock of Hutchinson Company on December 2012. If it held the same amount of stock during the yearbut the amount repr only a 15% ownership of the Hutchinson Companyhow would the financial state ments have differed? Disregard income tax effects, and assume the market price of the shares exceeds their acquisition cost of $100,000 by $25,000 on December 31, 2013, n. During 2013, Chicago Corporation paid SI 170,000 to the lessor of property represented on the balance sheet by "Property Rights Acquired Under Lease." Property rights acquired under lease have a 10-year life, nd Chicago Corporation amortizes them on a straight ine basis what was the total expense reported by Chicago Corporation dur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts