Question: Case study solution required for questions N, O and P only regarding Chicago Corpration Case at chapter 17, the case no is 10p in (Financial

Case study solution required for questions N, O and P only regarding Chicago Corpration Case at chapter 17, the case no is 10p in (Financial Accounting Book (14th Edition). i was able to find the case but there is no answers! I have attached the financials as PDF also here is the link to the case, it includes all financial statements you need, your help is highly appreciated.

here is the link to the case in Chegg websit:

http://www.chegg.com/homework-help/comprehensive-review-problem-exhibits-1711-1712-present-part-chapter-17-problem-10p-solution-9781111823450-exc

here is the link to the book the case from:

http://www.chegg.com/textbooks/financial-accounting-14th-edition-9781111823450-1111823456?trackid=51e6b63a&strackid=29013c2d&ii=1

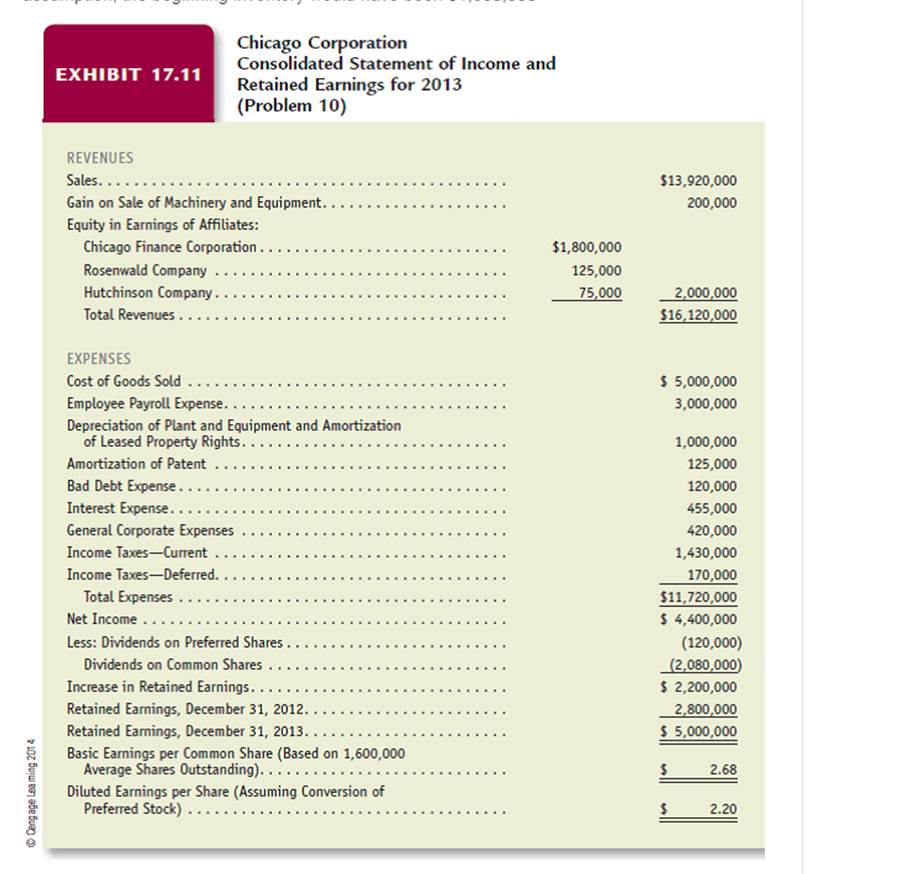

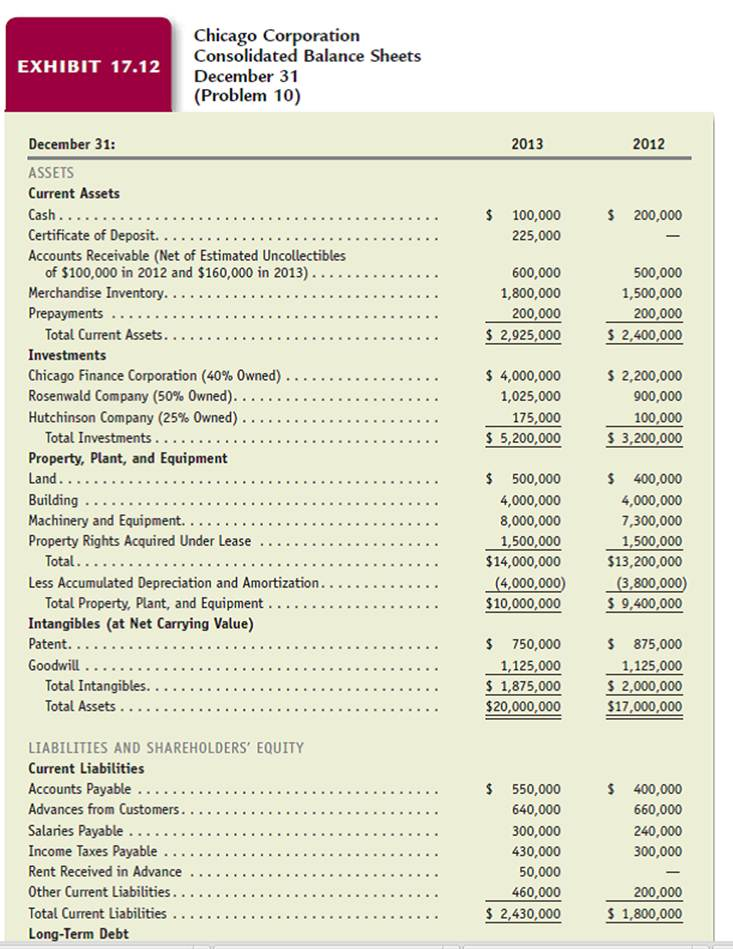

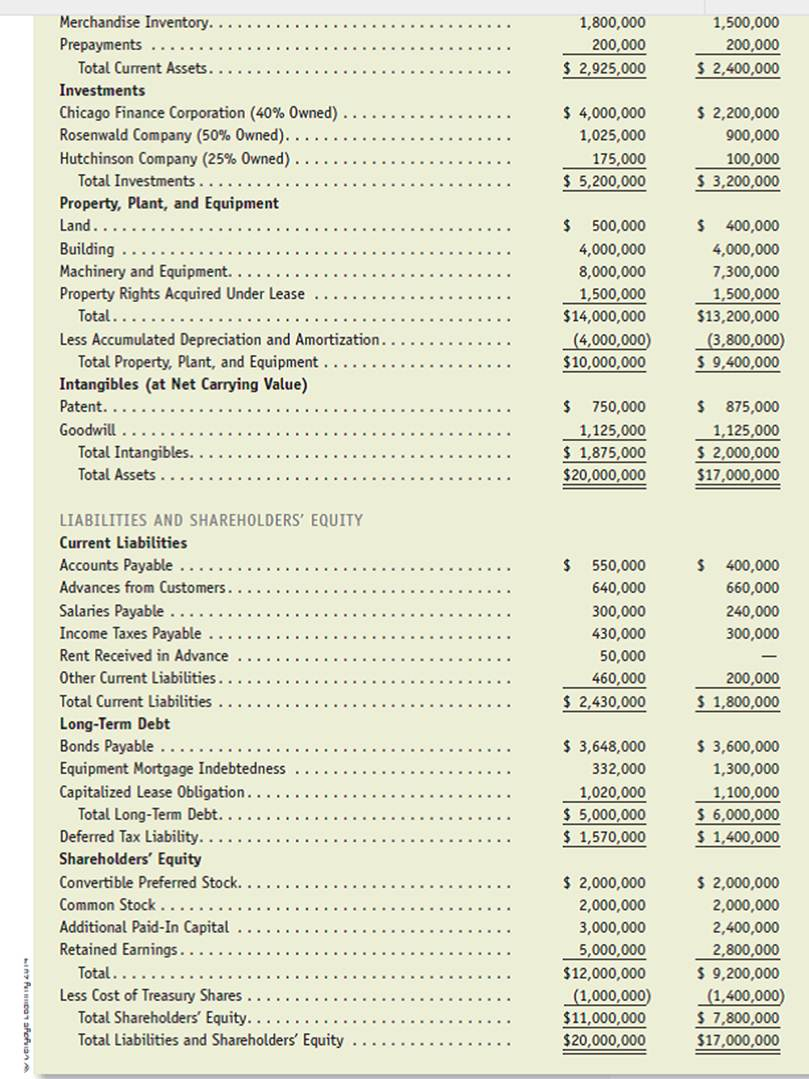

Question N: during 2013, Chicago Co paid $170,000 to the lessor of property represented on the balance sheet by "property rights acquired under lease" Property rights acquired under lease have a 10-years life, and Chicago Co amortizes them on a straight-line basis. what was the total expense reported by Chicago Co during 2013 from using the leased property?

Question O: how would the financial statements differ if Chicago Co accounted for inventories on the lower-of-cost-or-market basis and if the market value of these inventories had been $1,600,000 at the end of 2013? Disregard income tax effects.

Qestion P: refer to the earing-per-share amounts in the income statement of Chicago Co. How many shares of common stock would the firm issue if holders of the outstanding shares of preferred stock converted them into common stock?

During 2013, Chicago Corporation paid S170,000 to the lessor of property represented on the balance sheet by "Property Rights Acquired Under Lease." Property rights acquired under lease have a 10-year life, and Chicago Corporation amortizes them on a straight-line basis. What was the total expense reported by Chicago Corporation dur ing 2013 from using the leased property? How would the financial statements differ if Chicago Corporation accounted for inven- tories on the lower-of-cost-or-market basis and if the market value of these inventories had been S1,600,000 at the end of 2013? Disregard income tax effects n. o. Refer to the earnings-per-share amounts in the income statement of Chicago Corpora- tion. How many shares of common stock would the firm issue if holders of the out- standing shares of preferred stock converted them into common stock? P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts