Question: Case Study: Statement of Advice Terry and Roberta Noack have recently moved to Western Australia from Victoria because Roberta has recently started a new job

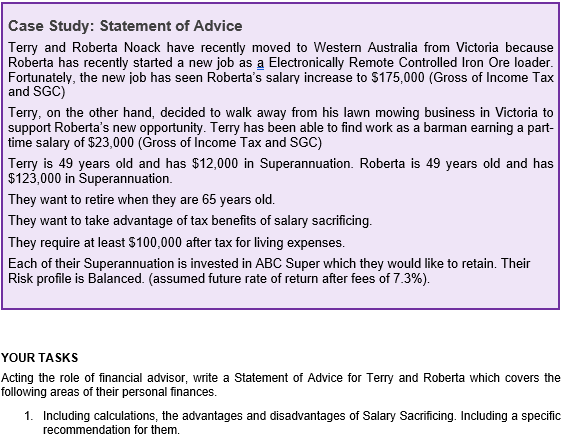

Case Study: Statement of Advice Terry and Roberta Noack have recently moved to Western Australia from Victoria because Roberta has recently started a new job as a Electronically Remote Controlled Iron Ore loader. Fortunately, the new job has seen Roberta's salary increase to $175,000 (Gross of Income Tax and SGC) Terry, on the other hand, decided to walk away from his lawn mowing business in Victoria to support Roberta's new opportunity. Terry has been able to find work as a barman earning a part- time salary of $23,000 (Gross of Income Tax and SGC) Terry is 49 years old and has $12,000 in Superannuation. Roberta is 49 years old and has $123,000 in Superannuation. They want to retire when they are 65 years old. They want to take advantage of tax benefits of salary sacrificing. They require at least $100,000 after tax for living expenses Each of their Superannuation is invested in ABC Super which they would like to retain. Their Risk profile is Balanced. (assumed future rate of return after fees of 7.3%) YOUR TASKS Acting the role of financial advisor, write a Statement of Advice for Terry and Roberta which covers the following areas of their personal finances 1. Including calculations, the advantages and disadvantages of Salary Sacrificing. Including a specific recommendation for them. Case Study: Statement of Advice Terry and Roberta Noack have recently moved to Western Australia from Victoria because Roberta has recently started a new job as a Electronically Remote Controlled Iron Ore loader. Fortunately, the new job has seen Roberta's salary increase to $175,000 (Gross of Income Tax and SGC) Terry, on the other hand, decided to walk away from his lawn mowing business in Victoria to support Roberta's new opportunity. Terry has been able to find work as a barman earning a part- time salary of $23,000 (Gross of Income Tax and SGC) Terry is 49 years old and has $12,000 in Superannuation. Roberta is 49 years old and has $123,000 in Superannuation. They want to retire when they are 65 years old. They want to take advantage of tax benefits of salary sacrificing. They require at least $100,000 after tax for living expenses Each of their Superannuation is invested in ABC Super which they would like to retain. Their Risk profile is Balanced. (assumed future rate of return after fees of 7.3%) YOUR TASKS Acting the role of financial advisor, write a Statement of Advice for Terry and Roberta which covers the following areas of their personal finances 1. Including calculations, the advantages and disadvantages of Salary Sacrificing. Including a specific recommendation for them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts