Question: Case Study : The problem is to reduce churn ratio by 5% quarterly by analyzing CDR, credit report and billing data of telecom operators to

Case Study: The problem is to reduce churn ratio by 5% quarterly by analyzing CDR, credit report and billing data of telecom operators to mine out churn trends of a specific region or a specific person or and age group.

Questions:

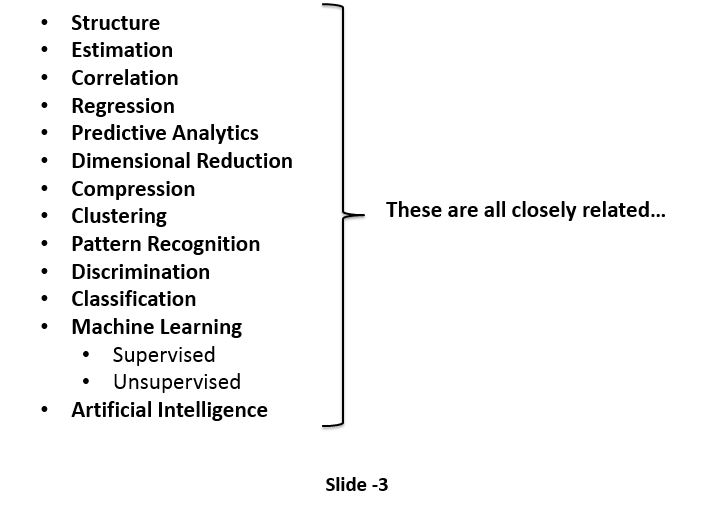

1. Pick three analysis terms from slide 3 that are relevant to your project. Define them and explain why they are relevant: [Slides attached]

2. Describe the difference between calibration (fidelity) and discrimination (accuracy):

3. What are the differences between estimation and classification models?

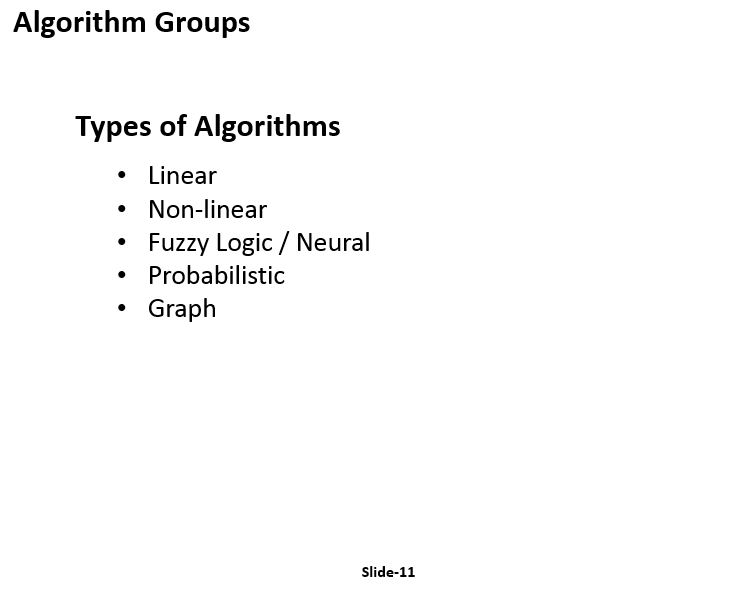

4. Select two of the methods on slide 11 and explain how they are relevant to your problem. Select one method and explain how it would be a poor selection:

5. Describe a model validation method and at least one model quality metric

6. Which type of predictive analysis sounds most exciting to you? Why?

Structure Estimation Correlation Regression Predictive Analytics Dimensional Reduction Compression Clustering Pattern Recognition Discrimination Classification Machine Learning Supervised Unsupervised Artificial Intelligence These are all closely related. Slide -3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts