Question: CASE STUDY You are the engineering representative on a team for a new product introduction. The proposed manufacturing process uses a semi-automated machine along with

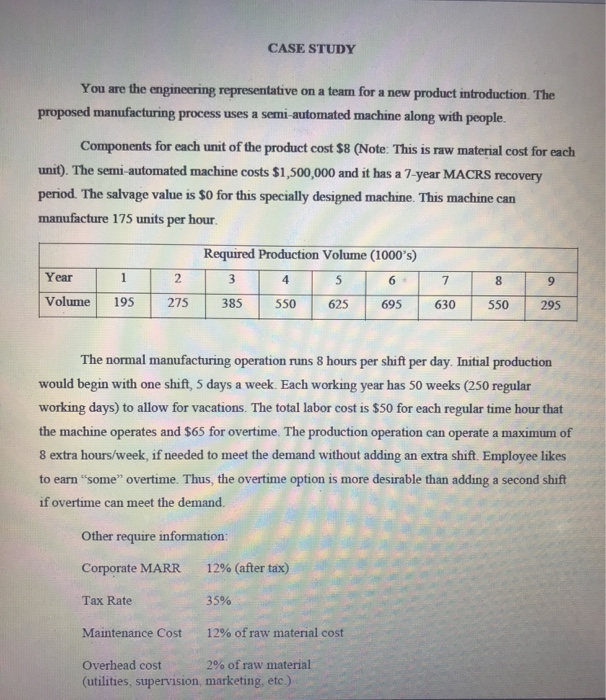

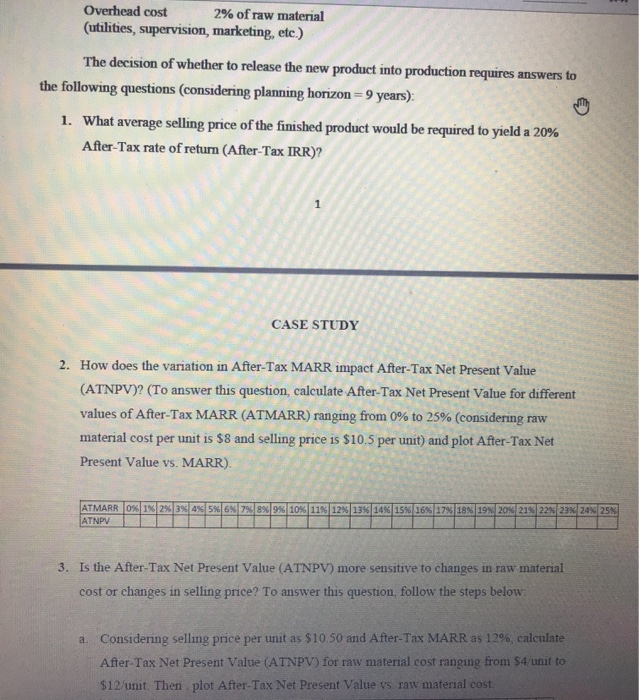

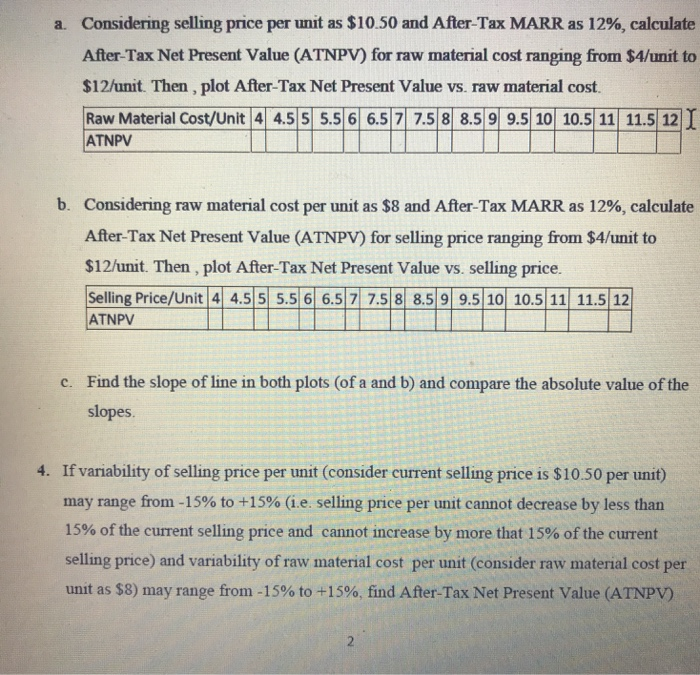

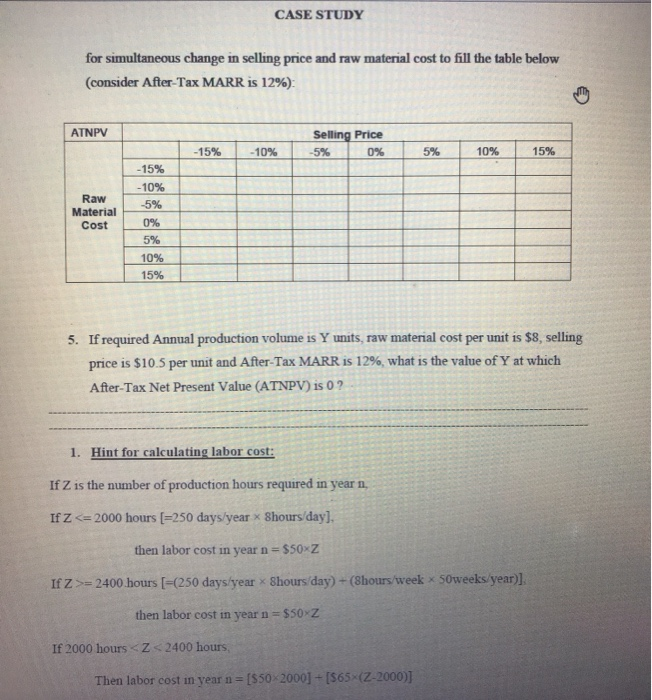

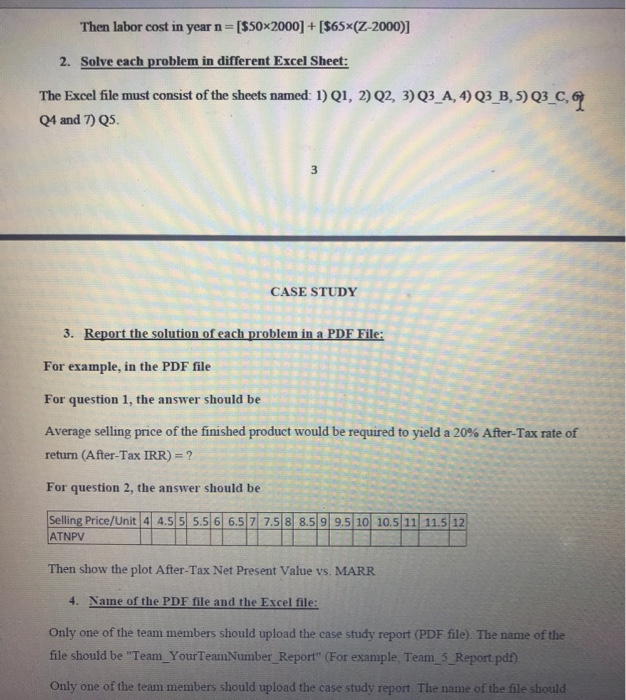

CASE STUDY You are the engineering representative on a team for a new product introduction. The proposed manufacturing process uses a semi-automated machine along with people. Components for each unit of the product cost $8 (Note: This is raw material cost for each unit). The semi-automated machine costs $1,500,000 and it has a 7-year MACRS recovery period. The salvage value is $0 for this specially designed machine. This machine can manufacture 175 units per hour Year Volume 7 1 195 Required Production Volume (1000's) 3 4 5 6 385 550 625 695 2 275 The normal manufacturing operation runs 8 hours per shift per day. Initial production would begin with one shift, 5 days a week. Each working year has 50 weeks (250 regular working days) to allow for vacations. The total labor cost is $50 for each regular time hour that the machine operates and $65 for overtime. The production operation can operate a maximum of 8 extra hours/week, if needed to meet the demand without adding an extra shift. Employee likes to earn "some" overtime. Thus, the overtime option is more desirable than adding a second shift if overtime can meet the demand. Other require information: Corporate MARR 12% (after tax) Tax Rate 35% Maintenance Cost 12% of raw material cost Overhead cost 2% of raw material (utilities, supervision, marketing, etc.) Overhead cost 2% of raw material (utilities, supervision, marketing, etc.) The decision of whether to release the new product into production requires answers to the following questions considering planning horizon = 9 years) 1. What average selling price of the finished product would be required to yield a 20% After-Tax rate of return (After-Tax IRR)? CASE STUDY 2. How does the variation in After-Tax MARR impact After-Tax Net Present Value (ATNPV)? (To answer this question, calculate After-Tax Net Present Value for different values of After-Tax MARR (ATMARR) ranging from 0% to 25% (considering raw material cost per unit is $8 and selling price is $10.5 per unit) and plot After-Tax Net Present Value vs. MARR). AFMARR |0y| 16|2|36|as56|6s|7x|sx|20|15||2336|25|36|37|18|39) 2010208) 226| 23 24 255 ATNPV 3. Is the After-Tax Net Present Value (ATNPV) more sensitive to changes in raw material cost or changes in selling price? To answer this question, follow the steps below a. Considering selling price per unit as $10.50 and After-Tax MARR as 12%, calculate After-Tax Net Present Value (ATNPV) for raw material cost ranging from $4/unit te $12/unit. Then plot After-Tax Net Present Value vs raw material cost. a. Considering selling price per unit as $10.50 and After-Tax MARR as 12%, calculate After-Tax Net Present Value (ATNPV) for raw material cost ranging from $4/unit to $12/unit. Then , plot After-Tax Net Present Value vs. raw material cost. Raw Material Cost/Unit 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12 1 ATNPV b. Considering raw material cost per unit as $8 and After-Tax MARR as 12%, calculate After-Tax Net Present Value (ATNPV) for selling price ranging from $4/unit to $12/unit. Then , plot After-Tax Net Present Value vs. selling price. Selling Price/Unit 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12 ATNPV c. Find the slope of line in both plots (of a and b) and compare the absolute value of the slopes. 4. If variability of selling price per unit (consider current selling price is $10.50 per unit) may range from -15% to +15% (1.e. selling price per unit cannot decrease by less than 15% of the current selling price and cannot increase by more that 15% of the current selling price) and variability of raw material cost per unit (consider raw material cost per unit as $8) may range from -15% to +15%, find After-Tax Net Present Value (ATNPV) CASE STUDY for simultaneous change in selling price and raw material cost to fill the table below (consider After-Tax MARR is 12%) ATNPV Selling Price -5% 0% -15% -10% 5% 10% 15% -15% -10% -5% Raw Material Cost 0% 5. If required Annual production volume is Y units, raw material cost per unit is $8, selling price is $10.5 per unit and After-Tax MARR is 12%, what is the value of Y at which After-Tax Net Present Value (ATNPV) is 0? 1. Hint for calculating labor cost: If Z is the number of production hours required in year n. If Z Shours/day], then labor cost in year n = $50XZ If Z>= 2400 hours [=(250 days/year Shours/day) + (8hours/week Shours/day], then labor cost in year n = $50XZ If Z>= 2400 hours [=(250 days/year Shours/day) + (8hours/week

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts