Question: Suppose you are the engineering representative on a team working for a small manufacturing firm that is interested developing a potential new product. The proposed

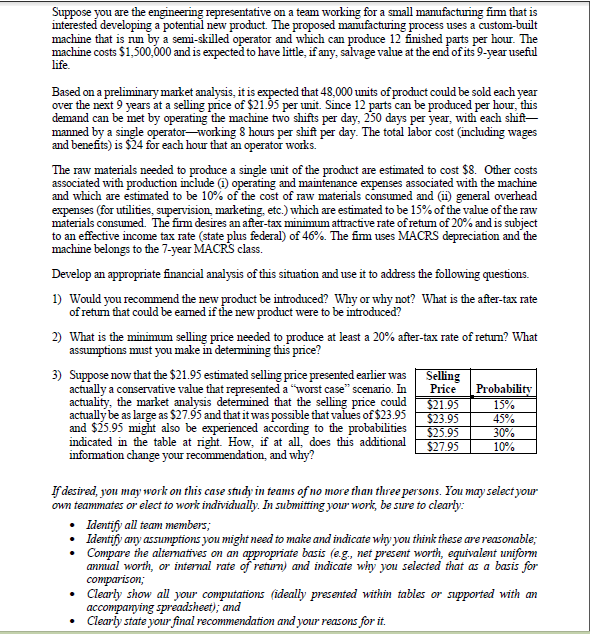

Suppose you are the engineering representative on a team working for a small manufacturing firm that is interested developing a potential new product. The proposed manufacturing process uses a custom-built machine that is run by a semi-skilled operator and which can produce 12 finished parts per hour. The machine costs $1, 500,000 and is expected to have little, if any, salvage value at the end of its 9-year useful life. Based on a preliminary market analysis, it is expected that 48,000 units of product could be sold each year ova- the next 9 years at a selling price of $21.95 per unit. Since 12 parts can be produced per hour, this demand can be met by operating the machine two shifts per day. 250 days per year, with each shift-manned by a single operator-working 8 hours per shift per day. The total labor cost (including wages and benefits) is $24 for each hour that an operator works. The raw materials needed to produce a single unit of the product are estimated to cost $8. Other costs associated with production include (i) operating and maintenance expenses associated with the machine and which are estimated to be 10% of the cost of raw materials consumed and (ii) general overhead expenses (for utilities, supervision, marketing, etc.) which are estimated to be 15% of the value of the raw materials consumed. The firm desires an after-tax minimum attractive rate of return of 20% and is subject to an effective income tax rate (state plus federal) of 46%. The firm uses MACRS depreciation and the machine belongs to die 7-year MACES class. Develop an appropriate financial analysis of this situation and use it to address the following questions. Would you recommend the new product be introduced? Why or why not? What is die after-tax rate of return that could be earned if die new product were to be introduced? What is the minimum selling price needed to produce at least a 20% after-tax rate of return? What assumptions must you make in determining this price? Suppose now that die $21.95 estimated selling price presented earlier was actually a conservative value that represented a "worst case" scenario. In actuality, the market analysis determined that the selling price could actually be as large as $27.95 and that it was possible that values of $23.95 and $25.95 might also be experienced according to the probabilities indicated m the table at right. How, if at all, does this additional information change your recommendation, and why? If desired, you may work on this case study in teams of no more than three persons. You may select your own teammates or elect to work individually. In submitting your work, be sure to clearly: Identify all team members; Identify any assumptions you might need to make and indicate why you think these are reasonable; Compare the alternatives on an appropriate basis (e.g., net present worth, equivalent uniform annual worth, or internal rate of return) and indicate why you selected that as a basis for comparison; Clearly show all your computations ideally presented within tables or supported with an accompanying spreadsheet); and Clearly state your final recommendation and your reasons for it. Suppose you are the engineering representative on a team working for a small manufacturing firm that is interested developing a potential new product. The proposed manufacturing process uses a custom-built machine that is run by a semi-skilled operator and which can produce 12 finished parts per hour. The machine costs $1, 500,000 and is expected to have little, if any, salvage value at the end of its 9-year useful life. Based on a preliminary market analysis, it is expected that 48,000 units of product could be sold each year ova- the next 9 years at a selling price of $21.95 per unit. Since 12 parts can be produced per hour, this demand can be met by operating the machine two shifts per day. 250 days per year, with each shift-manned by a single operator-working 8 hours per shift per day. The total labor cost (including wages and benefits) is $24 for each hour that an operator works. The raw materials needed to produce a single unit of the product are estimated to cost $8. Other costs associated with production include (i) operating and maintenance expenses associated with the machine and which are estimated to be 10% of the cost of raw materials consumed and (ii) general overhead expenses (for utilities, supervision, marketing, etc.) which are estimated to be 15% of the value of the raw materials consumed. The firm desires an after-tax minimum attractive rate of return of 20% and is subject to an effective income tax rate (state plus federal) of 46%. The firm uses MACRS depreciation and the machine belongs to die 7-year MACES class. Develop an appropriate financial analysis of this situation and use it to address the following questions. Would you recommend the new product be introduced? Why or why not? What is die after-tax rate of return that could be earned if die new product were to be introduced? What is the minimum selling price needed to produce at least a 20% after-tax rate of return? What assumptions must you make in determining this price? Suppose now that die $21.95 estimated selling price presented earlier was actually a conservative value that represented a "worst case" scenario. In actuality, the market analysis determined that the selling price could actually be as large as $27.95 and that it was possible that values of $23.95 and $25.95 might also be experienced according to the probabilities indicated m the table at right. How, if at all, does this additional information change your recommendation, and why? If desired, you may work on this case study in teams of no more than three persons. You may select your own teammates or elect to work individually. In submitting your work, be sure to clearly: Identify all team members; Identify any assumptions you might need to make and indicate why you think these are reasonable; Compare the alternatives on an appropriate basis (e.g., net present worth, equivalent uniform annual worth, or internal rate of return) and indicate why you selected that as a basis for comparison; Clearly show all your computations ideally presented within tables or supported with an accompanying spreadsheet); and Clearly state your final recommendation and your reasons for it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts