Question: Case discussion no.1 Case to be discussed: Foreign Exchange Hedging Strategies at General Motors: Transactional and Translational Exposures HBSP Product #: 205095-PDF-ENG 1. Describe GM

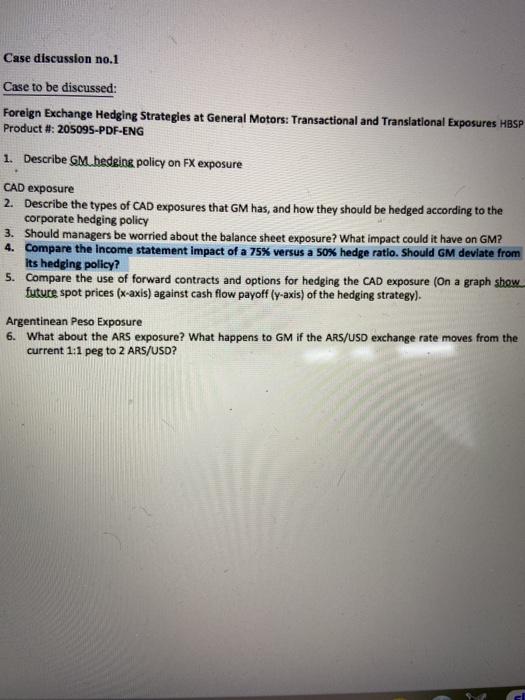

Case discussion no.1 Case to be discussed: Foreign Exchange Hedging Strategies at General Motors: Transactional and Translational Exposures HBSP Product #: 205095-PDF-ENG 1. Describe GM bedring policy on FX exposure CAD exposure 2. Describe the types of CAD exposures that GM has, and how they should be hedged according to the corporate hedging policy 3. Should managers be worried about the balance sheet exposure? What impact could it have on GM? 4. Compare the income statement impact of a 75% versus a 50% hedge ratio. Should GM deviate from Its hedging policy? 5. Compare the use of forward contracts and options for hedging the CAD exposure (On a graph show future spot prices (x-axls) against cash flow payoff (y-axis) of the hedging strategy). Argentinean Peso Exposure 6. What about the ARS exposure? What happens to GM if the ARS/USD exchange rate moves from the current 1:1 peg to 2 ARS/USD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts