Question: CASE TWO EASTERN SMALLWARES LTD. AND BYRON PRODUCTS LTD. Sheila Stekylo is the sole shareholder of Eastern Smallwares Ltd., a Canadian-controlled private corporation based in

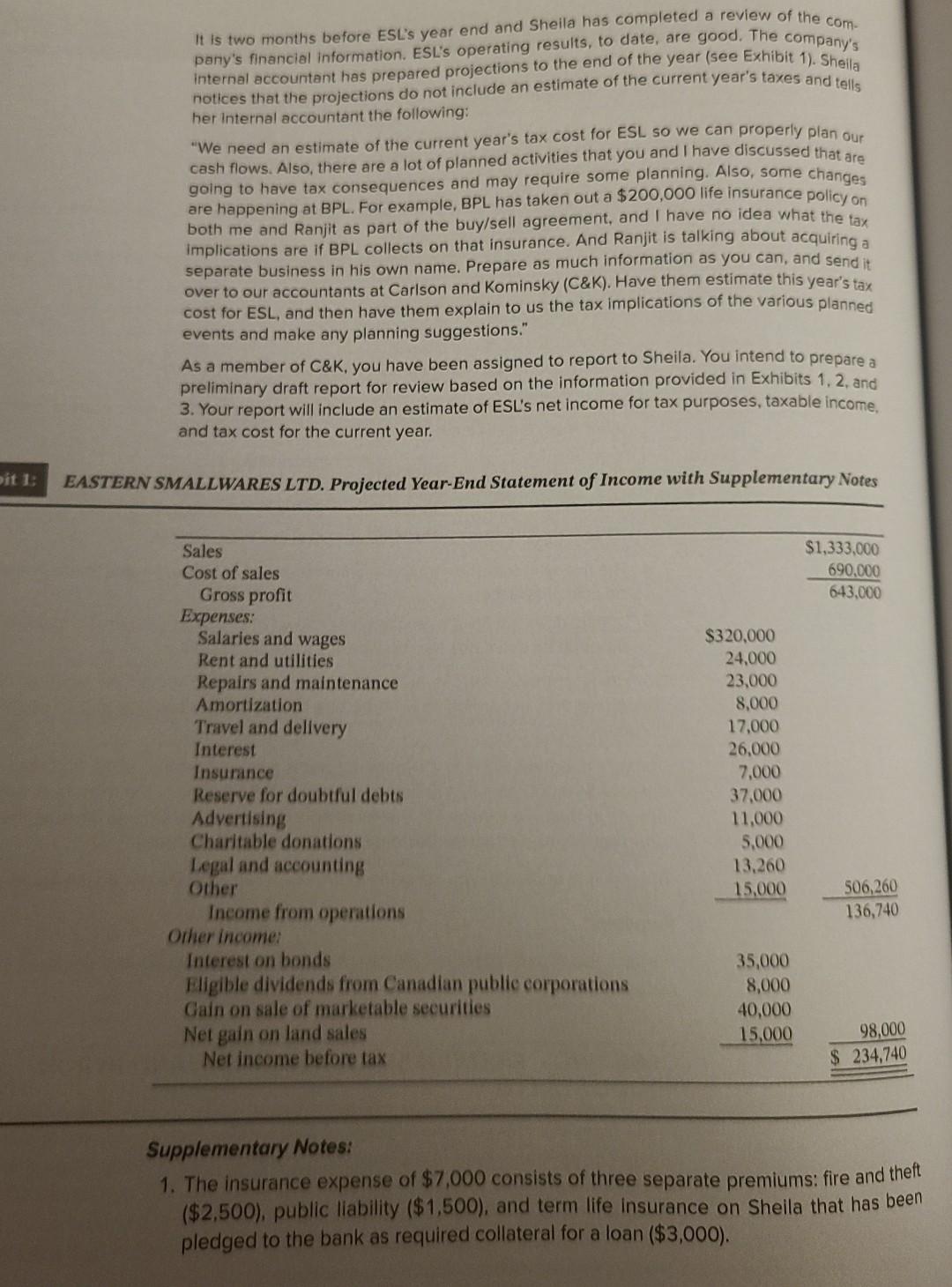

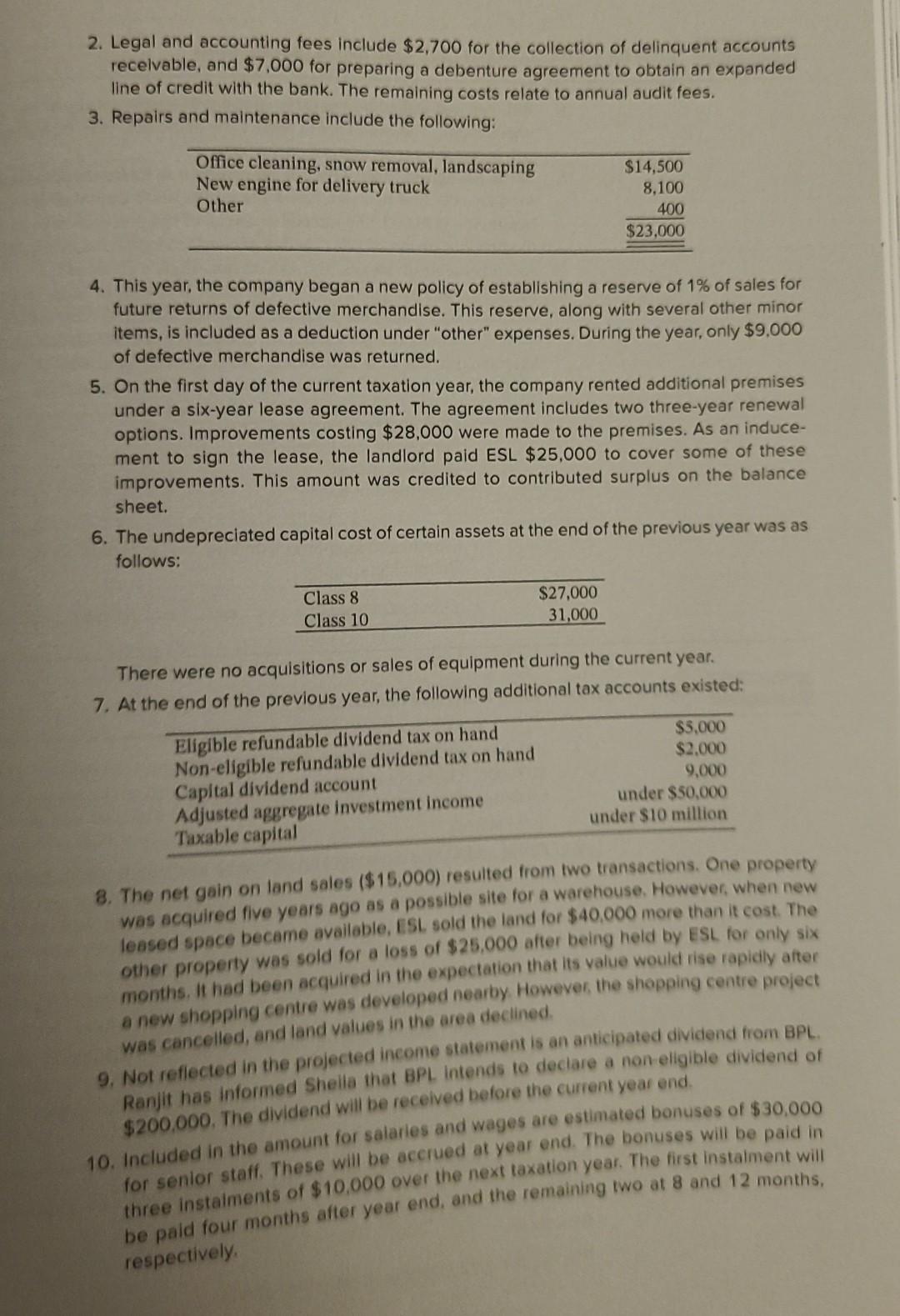

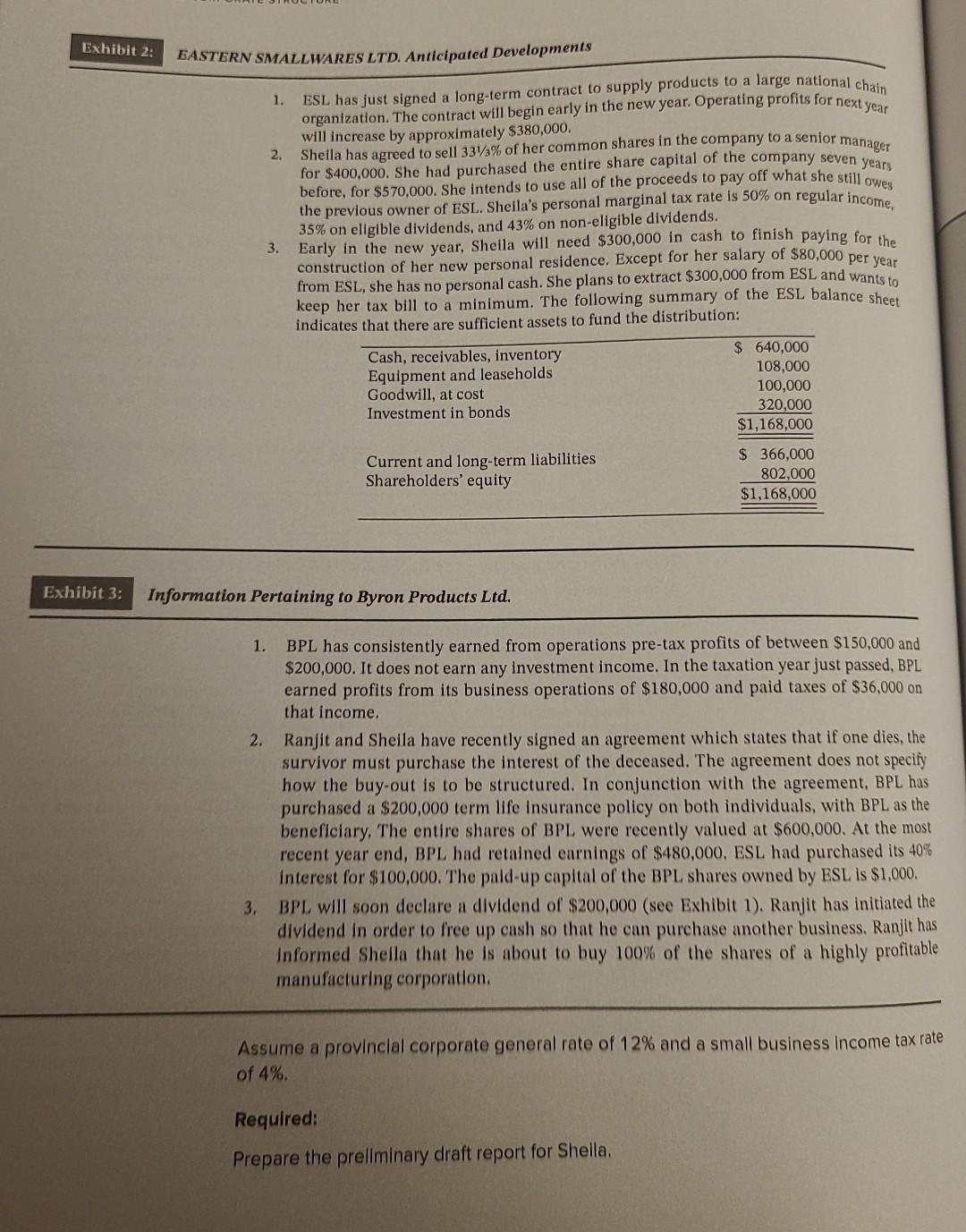

CASE TWO EASTERN SMALLWARES LTD. AND BYRON PRODUCTS LTD. Sheila Stekylo is the sole shareholder of Eastern Smallwares Ltd., a Canadian-controlled private corporation based in southwestern Ontario. The company wholesales smallwares to retail variety stores in eastern Canada. Two years ago, ESL purchased 40% of the common shares of Byron Products Ltd., a company in a similar line of business but operating in western Canada. The remaining 60% of BPL's shares are owned by Ranjit Dhillon. Ranjit is actively involved in managing BPL's operations. It is two months before ESL's year end and Sheila has completed a review of the company's financial information. ESL's operating results, to date, are good. The company's internal accountant has prepared projections to the end of the year (see Exhibit 1). Sheila notices that the projections do not include an estimate of the current year's taxes and tells her internal accountant the following: "We need an estimate of the current year's tax cost for ESL so we can properly plan our cash flows. Also, there are a lot of planned activities that you and I have discussed that are going to have tax consequences and may require some planning. Also, some changes are happening at BPL. For example, BPL has taken out a $200,000 life insurance policy on both me and Ranjit as part of the buy/sell agreement, and I have no idea what the tax implications are if BPL collects on that insurance. And Ranjit is talking about acquiring a separate business in his own name. Prepare as much information as you can, and send it over to our accountants at Carlson and Kominsky (C\&K). Have them estimate this year's tax cost for ESL, and then have them explain to us the tax implications of the various planned events and make any planning suggestions." As a member of C\&K, you have been assigned to report to Sheila. You intend to prepare a preliminary draft report for review based on the information provided in Exhibits 1,2, and 3. Your report will include an estimate of ESL's net income for tax purposes, taxable income, and tax cost for the current year. 1: EASTERN SMALLWARES LTD. Projected Year-End Statement of Income with Supplementary Notes Supplementary Notes: 1. The insurance expense of $7,000 consists of three separate premiums: fire and theft ($2,500), public liability ($1,500), and term life insurance on Sheila that has been pledged to the bank as required collateral for a loan ($3,000). 1. ESL has just signed a long-term contract to supply products to a large national chain organization. The contract will begin early in the new year. Operating profits for next year will increase by approximately $380,000. 2. Sheila has agreed to sell 33131% of her common shares in the company to a senior manager for $400,000. She had purchased the entire share capital of the company seven years before, for $570,000. She intends to use all of the proceeds to pay off what she still owes the previous owner of ESL. Sheila's personal marginal tax rate is 50% on regular income, 35% on eligible dividends, and 43% on non-eligible dividends. 3. Early in the new year, Sheila will need $300,000 in cash to finish paying for the construction of her new personal residence. Except for her salary of $80,000 per year from ESL, she has no personal cash. She plans to extract $300,000 from ESL and wants to keep her tax bill to a minimum. The following summary of the ESL balance sheet indicates that there are sufficient assets to fund the distribution: Exhibit 3: Information Pertaining to Byron Products Ltd. 1. BPL has consistently earned from operations pre-tax profits of between $150,000 and $200,000. It does not earn any investment income. In the taxation year just passed, BPL earned profits from its business operations of $180,000 and paid taxes of $36,000 on that income. 2. Ranjit and Sheila have recently signed an agreement which states that if one dies, the survivor must purchase the interest of the deceased. The agreement does not specify how the buy-out is to be structured. In conjunction with the agreement, BPL has purchased a $200,000 term life Insurance policy on both individuals, with BPL as the beneficiary. The entire shares of BPL were recently valued at $600,000. At the most recent year end, BPL had retained earnings of $480,000. ESL had purchased its 40% interest for $100,000. The pald-up capital of the BPL shares owned by ESL is $1,000. 3. BPL will soon declare a dividend of $200,000 (see Exhibit 1). Ranjit has initiated the dividend in order to free up cash so that he can purchase another business. Ranjit has informed Shella that he is about to buy 100% of the shares of a highly profitable manufacturing corporation. Assume a provinclal corporate general rate of 12% and a small business Income tax rate of 4%. Required: Prepare the preliminary draft report for Shella. 2. Legal and accounting fees include $2,700 for the collection of delinquent accounts recelvable, and $7,000 for preparing a debenture agreement to obtain an expanded line of credit with the bank. The remaining costs relate to annual audit fees. 3. Repairs and maintenance include the following: 4. This year, the company began a new policy of establishing a reserve of 1% of sales for future returns of defective merchandise. This reserve, along with several other minor items, is included as a deduction under "other" expenses. During the year, only $9,000 of defective merchandise was returned. 5. On the first day of the current taxation year, the company rented additional premises under a six-year lease agreement. The agreement includes two three-year renewal options. Improvements costing $28,000 were made to the premises. As an inducement to sign the lease, the landlord paid ESL $25,000 to cover some of these improvements. This amount was credited to contributed surplus on the balance sheet. 6. The undepreciated capital cost of certain assets at the end of the previous year was as follows: There were no acquisitions or sales of equipment during the current year. 7. At the end of the previous year, the following additional tax accounts existed: 8. The net gain on land sales ($15,000) resulted from two transactions. One property was acquired five years ago as a possible site for a warehouse. However, when new leased space became available, ESL sold the land for $40,000 more than it cost. The other property was sold for a loss of $25,000 after being held by ESL for only six months. It had been acquired in the expectation that its value would rise rapidily after a new shopping centre was developed nearby However, the shopping centre project was cancelled, and land yalues in the area declined. 9. Not reflected in the projected income statement is an anticipated dividend from BPL. Ranjit has informed Shelia that BPL. Intends to declare a non-ligible dividend of $200,000. The dividend will be received before the current year end 10. Included in the amount for salaries and wages are estimated bonuses of $30,000 included in the amount for sataries and watil be accrued at year end. The bonuses will be paid in for senior stafi. These three instaiments of $10,000 over the nd the remaining two at 8 and 12 months, be paid four respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts